The Paper Trail: Don't Say The "S" Word

I'll be honest, it feels a bit weird to share an investment research compilation amid the ongoing events in Ukraine. Talking markets feels so trivial when you turn on the TV and see videos of missile strikes or a father saying goodbye to his wife and children as he prepares to go off and fight.

Sure, our portfolios and investment results "matter" to a degree, at least to the future versions of ourselves and our families, but this week has been a harsh reminder of what really matters.

It was also a reminder of how humbling markets can be. I don't think anyone went to bed Wednesday night after seeing the alerts on their phones about Russia's invasion and Dow futures being down ~800 points and thought stocks would finish in positive territory by Thursday's close. Nor did they think it would be followed by a strong rally on Friday going into the weekend. Investing is hard.

An investment strategy predicated on predictions and activity is almost certain to fall short over time to one based on preparation and temperament. And that is what The Paper Trail is all about - sharing valuable third-party insights with investors to help them prepare and improve their odds of long-term investment success.

With that in mind, I hope you enjoy this month's installment.

“bps” (reading time < 10 minutes)

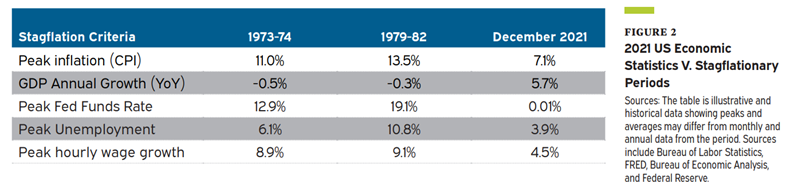

How likely is it that stagflation is on the horizon for the U.S.?

"While we acknowledge that inflation in the US is a concern, we do not yet see conditions that would indicate that stagflation is imminent. As long as unemployment remains low and growth above potential, we believe that comparisons to stagflation in the 1970s and 1980s are premature."

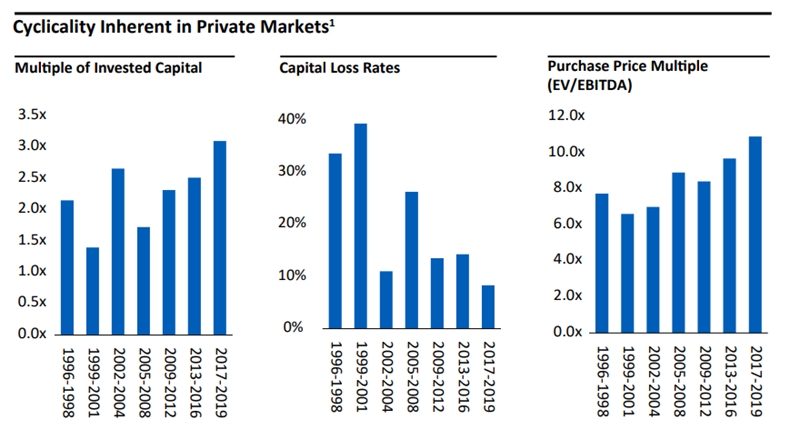

What factors contribute to the success or failure of a private markets co-investment portfolio?

"While there are several topics outlined in the objectives that govern every portfolio, time diversification, company concentration, end market exposure, and lead investor considerations are routinely highlighted as critical metrics to measure. Actively managing each of these elements has the ability to improve the distribution of expected returns without compromising the bottom-up asset selection process."

Portfolio Construction in the Context of a Global Private Markets Platform (Adams Street Partners)

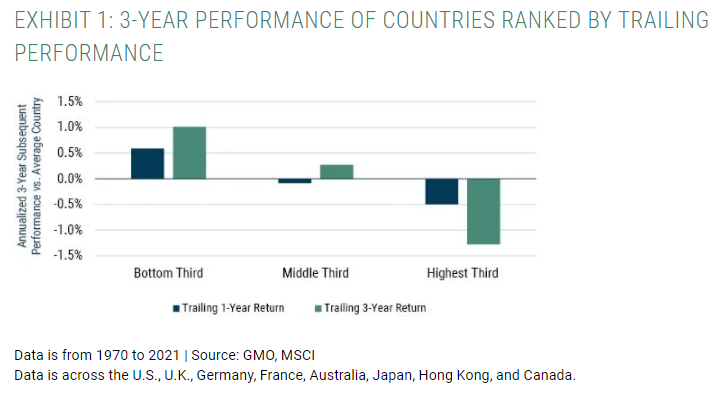

What potential missteps are investors being tempted to make in today's environment?

"Whether we are looking at trailing 1- or 3-year performance, the former laggard countries wind up being the winners, and the previous high-fliers underperform. The U.S. may feel like the safer bet given its strong performance, but history suggests otherwise."

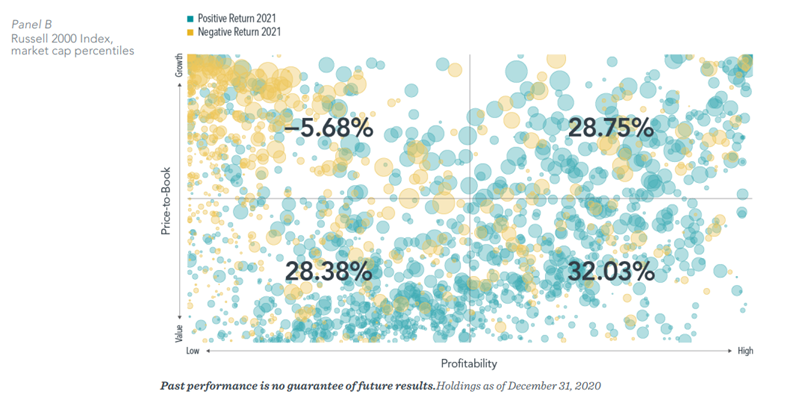

Does it make a difference which types of small cap stocks you own?

"However, looking broadly across decades of returns in global markets, we observe that small cap growth stocks with low profitability tend to underperform over the long run. And for good reason. From a valuation perspective, paying a lot for a company that earns little profit is a good sign of a very low discount rate, and therefore a low expected investor return. Research has shown that when examining stocks by their size, price-to-book, and profitability characteristics, small cap stocks with the lowest profitability and highest relative price have experienced the lowest historical returns."

The Small Caps That May Be Holding Back Your Portfolio’s Returns (Dimensional Fund Advisors)

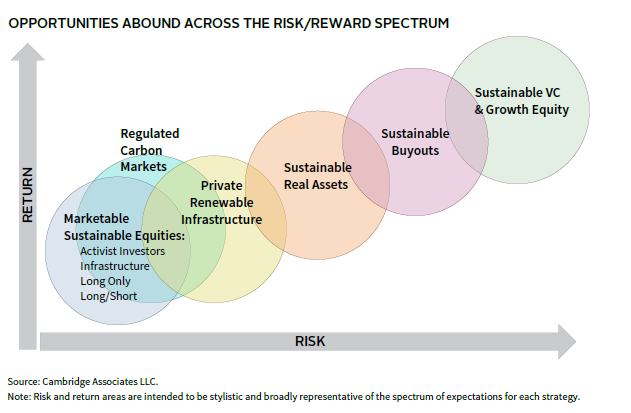

Will any compelling investment opportunities be presented by the transition to clean and sustainable energy?

"Among available opportunities, clean tech stands out, while evolving regulated carbon markets offer attractive return prospects and diversification characteristics."

VantagePoint: Jumpstarting the Energy Transition (Cambridge Associates)

“pieces” (reading time > 10 minutes)

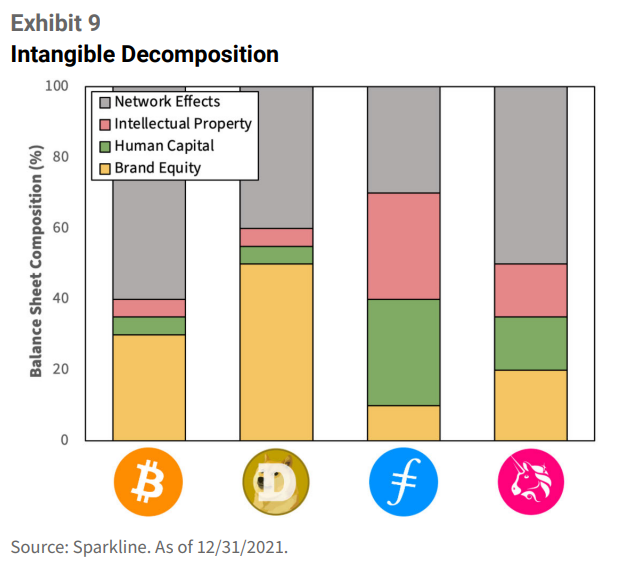

Can value investing principles be applied to crypto?

"The value of Web3 projects can be analyzed using the four intangible pillars. Exhibit 9 decomposes the value of four well-known coins. Memecoins such as Dogecoin are driven by brand, while infrastructure projects like Filecoin rely more on IP and human capital. Network effects are very important for all cryptocurrencies."

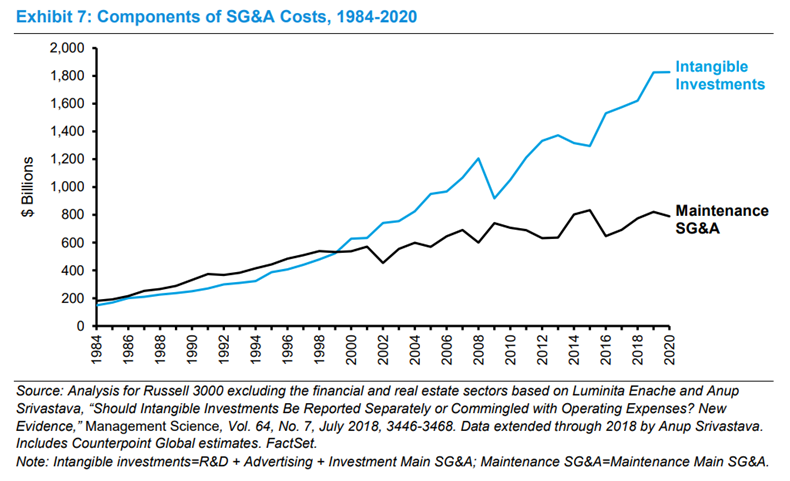

Is it possible to estimate the amount of capital expenditures a company will spend on maintenance versus growth?

"Intangible investment has been up sharply in recent decades. The maintenance component of intangible investment has risen as well. For example, you should deem a reasonable percentage of R&D spending for large technology companies to be maintenance spending. But on balance more intangible investment is funding growth."

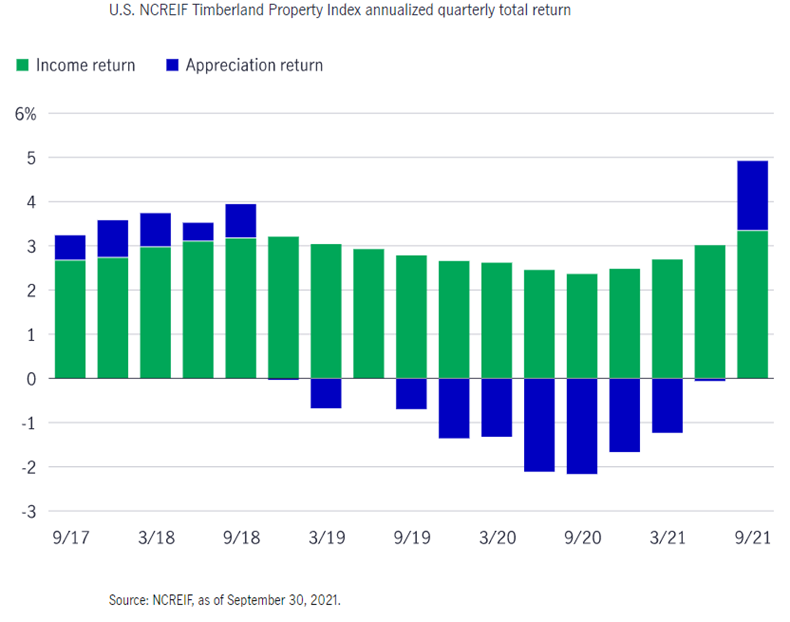

Are timberland investments poised for a resurgence?

"The capital appreciation component of the NCREIF Timberland Property Index moved strongly into positive territory, rising by a 1.6% year-over-year rate as of third quarter 2021. This was the first quarterly annualized increase in NCREIF timberland capital appreciation after 10 consecutive quarters of near-zero or negative annual performance."

U.S. timberland investment prospects have taken a positive turn (Manulife Investment Management)

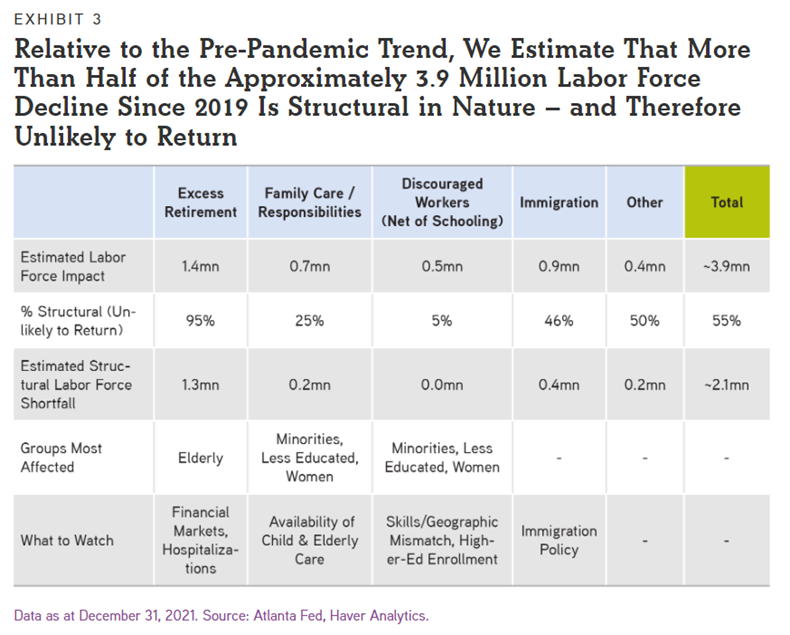

What does the current tightness in the labor market mean for future wages and inflation?

"Indeed, we do not view the current labor shortage as an aberration. Rather, we believe that ongoing tightness in the labor market will lead to higher wages across multiple industries on a sustained basis. If we are right, then we believe that not only will corporate margins be adversely impacted but also inflation could settle at a higher resting ‘heart rate’ in the United States, particularly relative to past cyclesֿ."

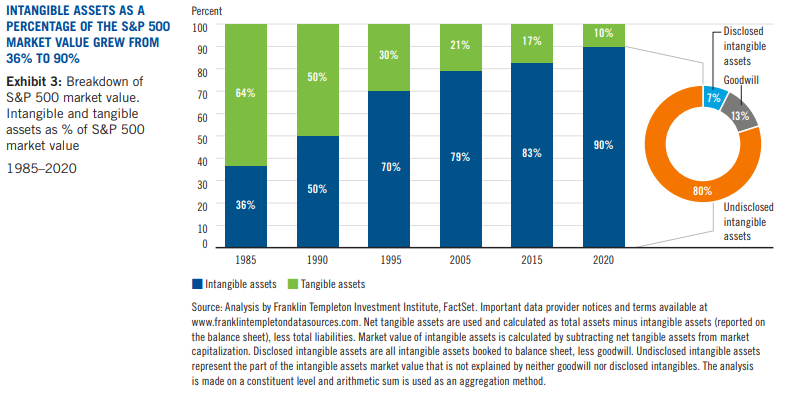

How much has the definition of 'assets' changed over time?

"In the 20th century, machines, factories, and transportation were the assets on a company’s balance sheet. Today, value is dominated by intangibles. Brands, technologies, patents, copyrights, synergies, and business models determine the lion’s share of company worth."

Deep Waves: The Quiet Undertow of Intangible Assets (Franklin Templeton)

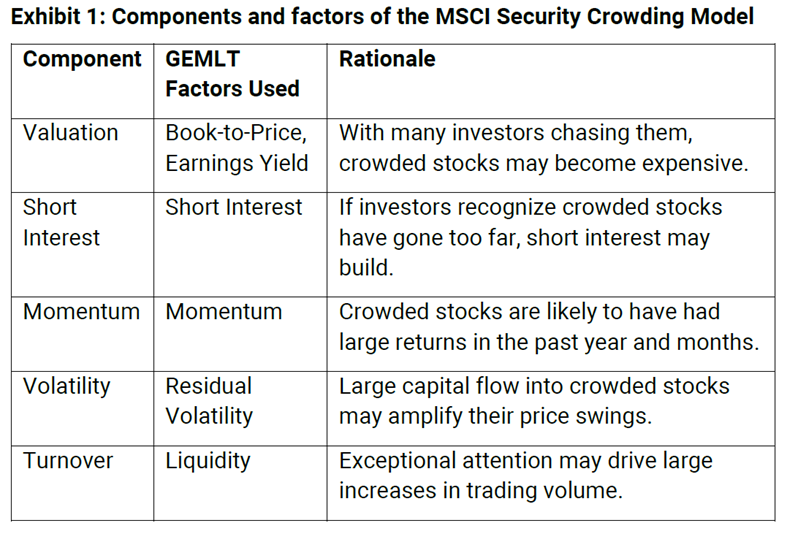

Is it possible to estimate the crowdedness or bubbliness of individual stocks?

"Crowding has been an important issue for investors for years. The rise of retail investors as a new driver for crowding has heightened its importance even more. Regardless of the sources of crowding — retail investors, hedge funds or other institutions — we believe the behavior and characteristics of crowded stocks remain the same. Crowded stocks were likely to exhibit unusual and large price gains, valuations, trading volume, volatility and short interest."

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.