The Paper Trail – February 2021

Welcome to the latest edition of The Paper Trail, a monthly compilation of the most interesting, thought-provoking and informative investment research I can find.

Housekeeping items:

- Each piece will be introduced with the primary question the authors aim to explore and/or answer.

- I’ll also include a memorable quote and visual from each one.

- Lastly, they are bucketed into two categories, sorted by estimated reading time – “bps” for the shorter ones and “pieces” for the longer ones.

Enjoy!

“bps” (reading time < 10 minutes)

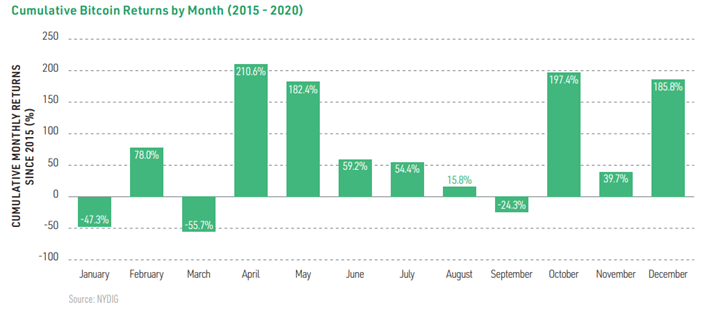

Does seasonality impact Bitcoin returns?

“If we are to describe it best in words, it is that historically on average the first quarter has shown monthly returns that oscillate back and forth, returns in spring have started off strong and waned as the summer months went on, and the year has finished with an outstanding fourth quarter.”

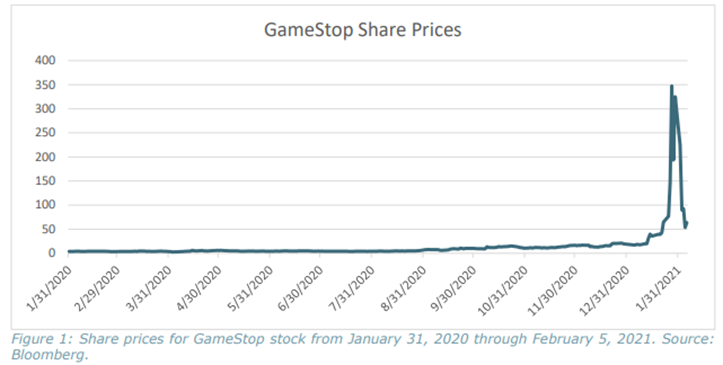

Can the Adaptive Markets Hypothesis (AMH) explain the GameStop situation?

“The AMH is an alternative approach to understanding market dynamics. According to the AMH, markets behave like an ecosystem. Success or failure is governed by the principles of evolutionary biology.”

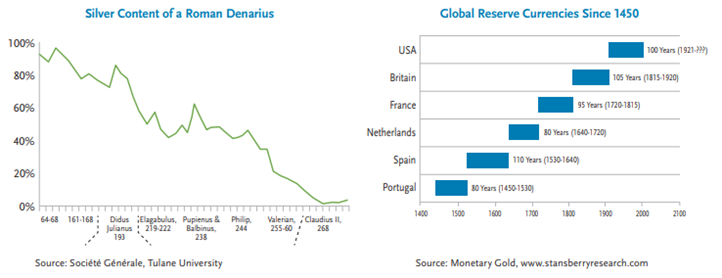

Are market forces helpless in a war against policy?

“For the moment, the answer is easy: the Fed has no reason to step aside, as the perceived cost of artificially supporting an economy unable to pull its own weight is perceived as negligible.”

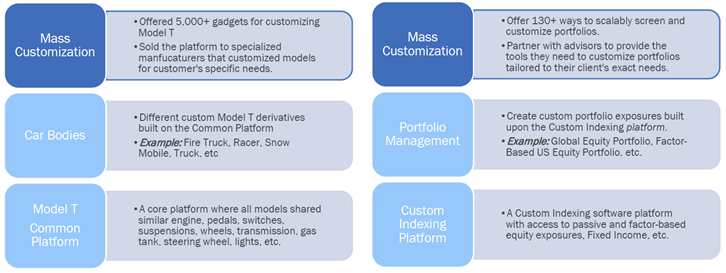

Is mass customization made possible by common platforms?

“History demonstrates that commoditization tends to increase demand for customization.”

History, Platforms & Mass Customization (O’Shaughnessy Asset Management)

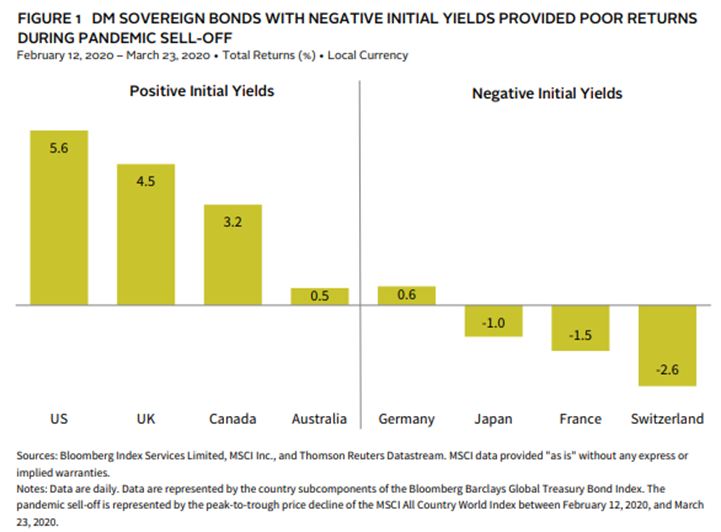

What are the alternatives to developed markets (DM) sovereign bonds to play “defense” in a portfolio?

“In our view, it is better to prepare for a variety of environments given the difficulty associated with correctly predicting macro outcomes.”

Playing Defense in a Low-Rate Environment (Cambridge Associates)

“pieces” (reading time > 10 minutes)

What’s the best way for small- and medium-sized institutions to build private equity programs?

“Given the illiquid nature of private market investments and the potentially limited amount of capital that smaller-scale investors may have to deploy, investing in private market funds at a small scale poses unique considerations.”

Building a private markets program at smaller scale (Meketa)

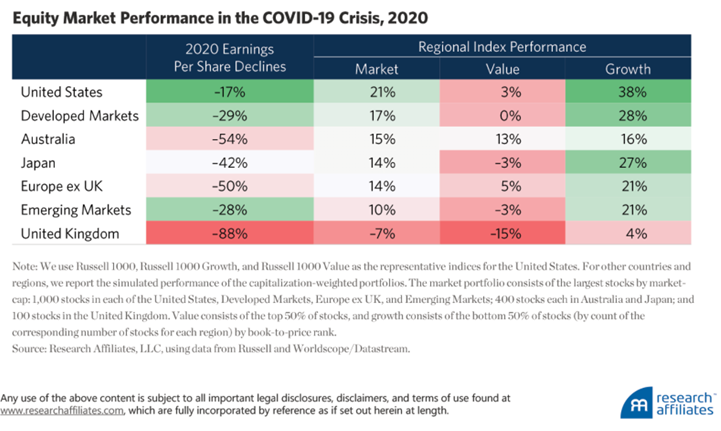

Are U.K. equities poised to be the trade of the decade?

“In late 2020, a new kid emerged on the bargain-of-the-decade block. As Brexit negotiations broke down again and again, and a more virulent form of COVID emerged in the United Kingdom, UK stocks, and notably UK value, reached implausibly cheap levels relative to justifiably “fair” values of stocks in other developed economies.”

How COVID-19 Vaccines and Brexit Create the Trade of the 2020s (Research Affiliates)

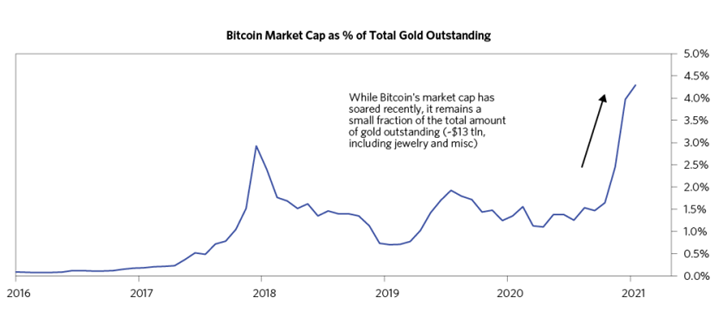

What does Ray Dalio think of Bitcoin?

“I believe Bitcoin is one hell of an invention. To have invented a new type of money via a system that is programmed into a computer and that has worked for around 10 years and is rapidly gaining popularity as both a type of money and a storehold of wealth is an amazing accomplishment.”

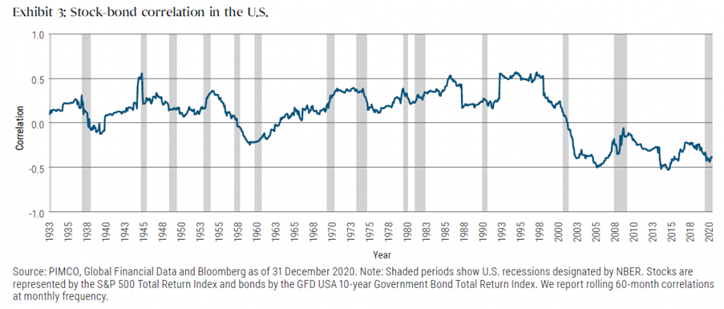

Are low yields causing investors to underestimate the value of bonds in a portfolio?

“Throughout the past three decades, most of the fundamentals – weak demographic and productivity growth, lower risk premia, rising inequality, market anxiety, easy money, benign inflation and robust central bank and hedging demand for fixed income – drove real yields one way: down. And although the world is one of considerable entropy, none of the factors listed above appears to be reaching an obvious inflection point in the immediate future.”

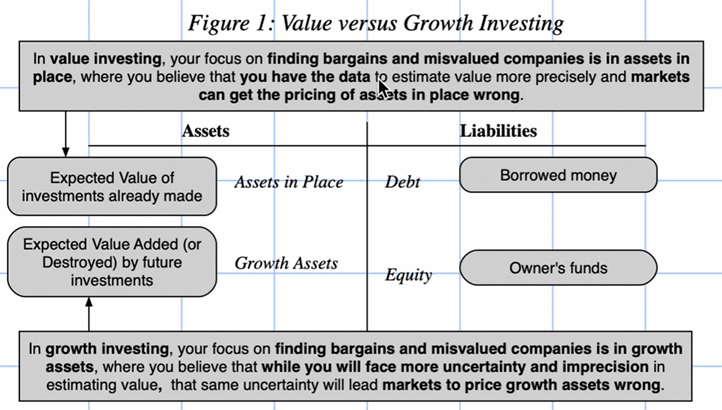

Has value investing as we know it outlived its usefulness?

“To rediscover itself, value investing needs to get over its discomfort with uncertainty and be more willing to define value broadly, to include not just countable and physical assets in place but also investments in intangible and growth assets.”

Value Investing: Requiem, Rebirth or Reincarnation? (Aswath Damodaran & Bradford Cornell)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.