The Paper Trail: Function Over Form

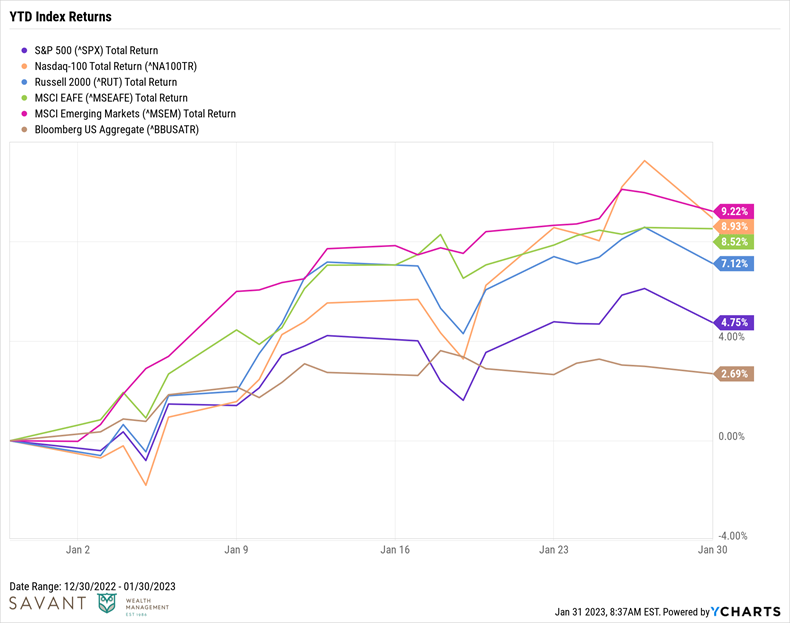

How's 2023 going you ask?

Global stock and bond markets are rallying, good (bad) news is good (bad) news again, and 2022's Bizarro World does not appear (thus far) to have a sequel on the horizon.

While I am not a very superstitious person, I'll go ahead and shut up now so as not to tempt the market gods...

To all my readers, I hope you and yours are having a fabulous start to the year, both personally and professionally.

Now, please enjoy the January 2023 edition of The Paper Trail. This month's research roundup features:

- Proration in semi-liquid alternative funds

- The U.S. Dollar and global asset returns

- Long/short value investing

- Investor identity as a determinant of long-term returns

- Functional asset allocation frameworks

- Cyclical vs. structural bear markets

- The post-pandemic housing market

- And much more!

“bps” (reading time < 10 minutes)

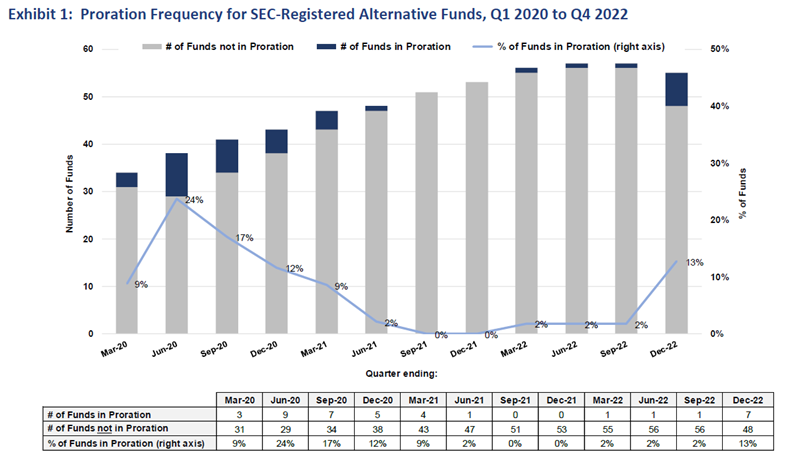

Should investors be concerned about prorated liquidity from semi-liquid alternative funds?

"Our study suggests that investors in alternative funds should have confidence in the availability of quarterly liquidity without the implementation of proration; with exceptions for either prolonged periods of market stress or fund-specific circumstances such as poor performance."

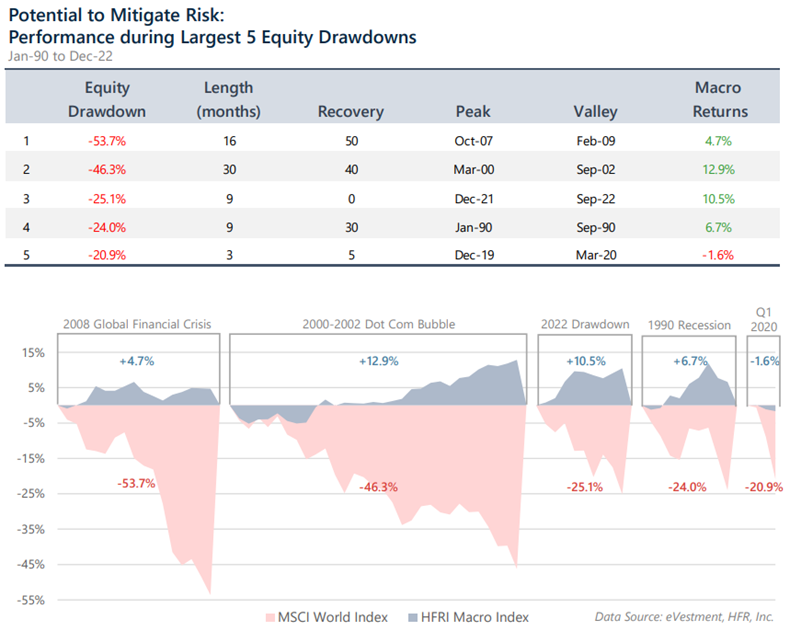

Do global macro strategies deserve a strategic allocation in a diversified portfolio?

"Macro strategies do not have an embedded bias to be long or short any given asset class, including equities. Over the longer term, macro tends to have low correlation to equities, providing the potential to perform well during periods of sustained stress in global equity markets. While macro has historically performed well, on average, during equity sell-offs, positive performance during equity downturns is not guaranteed and macro should not be treated exclusively as a portfolio hedge."

Building Portfolio Resilience at the Macro Level (Graham Capital Management)

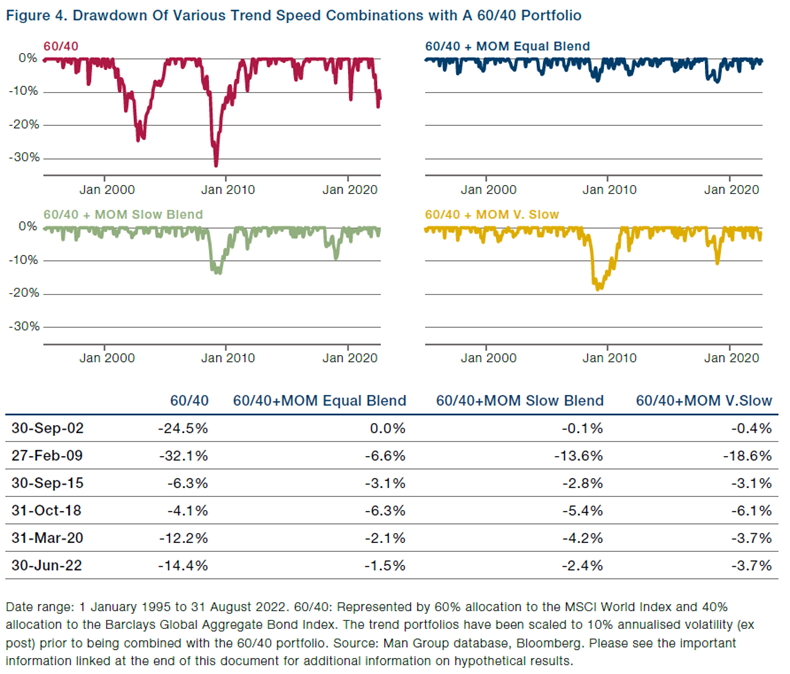

Should investors in trend-following strategies prefer fast or slow trend signals?

"As expected, all combinations with a trend strategy deliver some degree of risk mitigation compared to the traditional portfolio. Moreover, the degree of downside mitigation typically improves with greater allocation to faster speeds."

The Need for Speed in Trend-Following Strategies (Man Group)

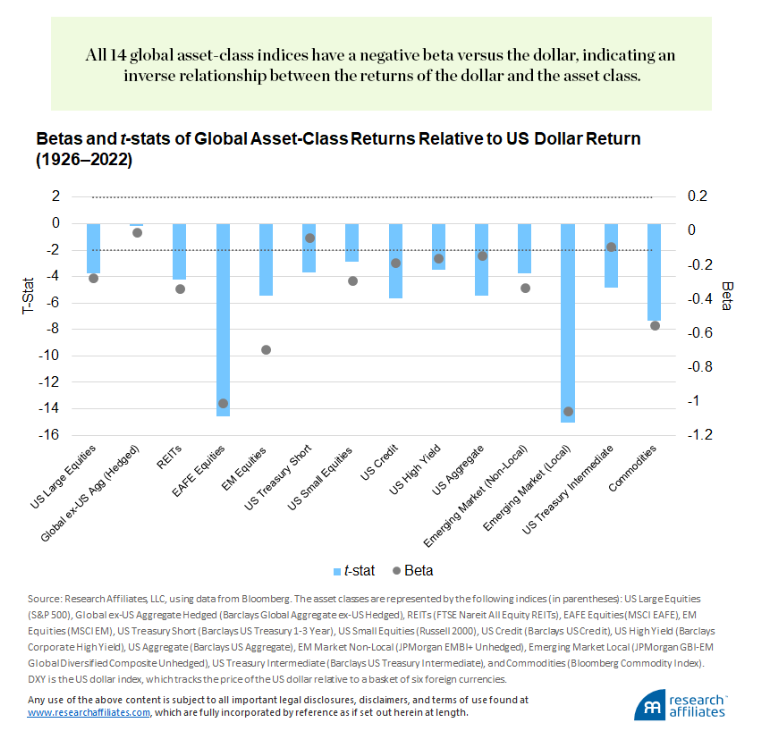

Has the U.S. Dollar peaked? And if so, how might that impact global asset returns?

"In a weakening dollar scenario, unhedged foreign stocks and bonds not only typically outperform, but are the only statistically reliable relative relationship we observe."

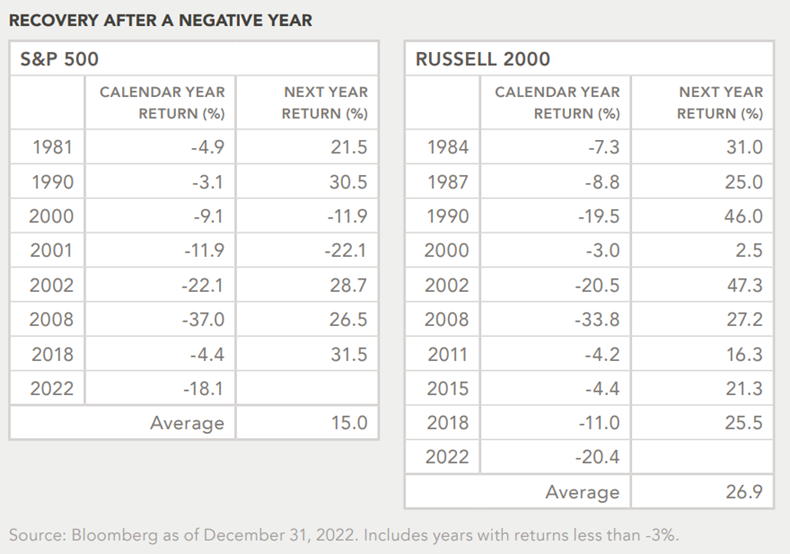

How do markets usually behave in the year following a bad year?

"However, we can point to more focused shorter-term data that provides some meaningful optimism for U.S. equities in 2023. More specifically, if we consider the absolute performance in 2022 coupled with one of the biggest drivers of it — historically high inflation — past data suggests that the next year might look a lot different."

2023 Market Preview: Trail Guide to 2023 Asset Class Performance (Marquette Associates)

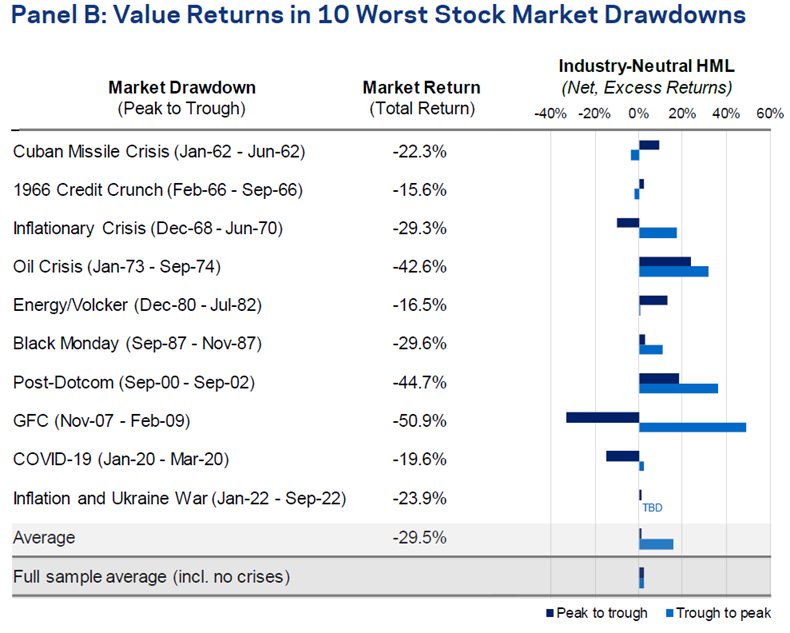

Is long/short the best way to play the value trade?

"We believe the extremely attractive forecast for value is valid irrespective of the future macro environment. Why? Market-neutral, industry-neutral implementations of value have, over the long run, demonstrated low correlations to interest rate changes, recessions/recoveries, and equity market drawdowns/drawups."

Value: Why Now? Capturing the Comeback in Its Early Innings (AQR)

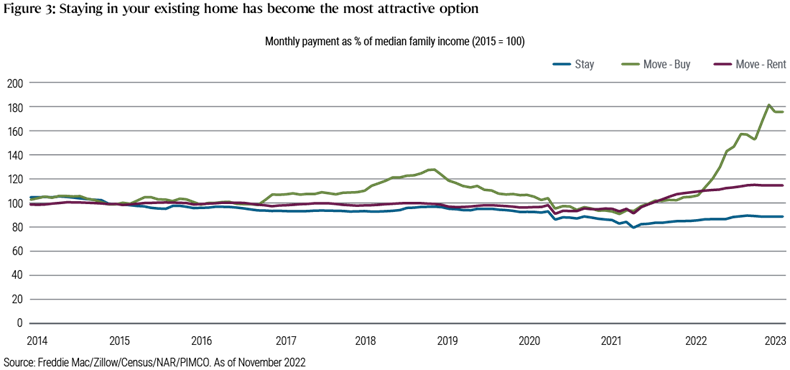

What will the U.S. housing market look like in 2023?

"The current interest rate environment strongly incentivizes homeowners to stay put, as selling would generally bring increased housing costs such as higher mortgage payments (and higher property taxes in states such as California). Although the balance between choosing to rent versus buy has shifted toward renting, that is not an attractive option either, as rents have risen by 26% since 2019. Therefore, staying in place remains the cheapest option."

“pieces” (reading time > 10 minutes)

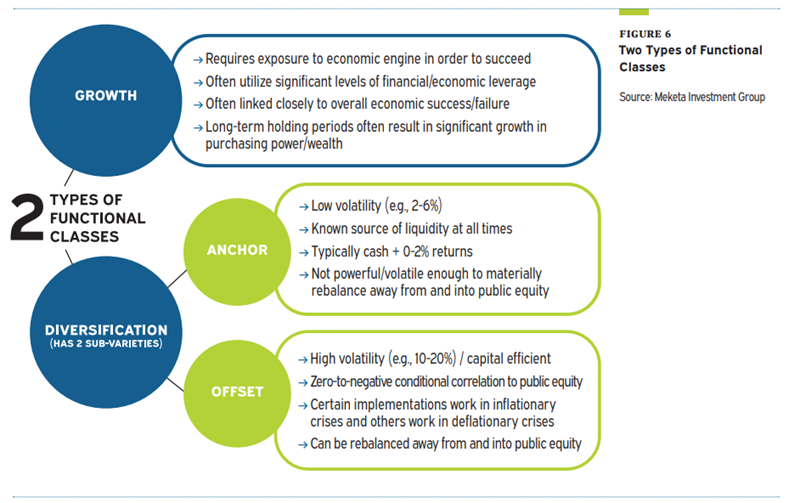

Should allocators organize their portfolios by asset class or by function?

"Functional allocation frameworks tend to align with the notion of “as simple as possible, but as complex as necessary.” By creating an allocation framework with both high-level, strategic classes (for overseeing bodies and/or long-term policy) as well as low-level, implementation classes (for day-to-day management), these frameworks offer the potential to improve portfolio management and oversight. Despite these potential improvements, these frameworks are not silver bullets."

Is 'investor identity' a more important determinant of long-term investment returns than asset allocation?

"The same fundamental ingredients are used by all investors to generate returns, but the individual nature of those ingredients and how they’re combined varies substantially across organizations. These differences amount to specific “recipes” for producing returns, and these recipes are entirely based on the resources available within their identity. Among investors, there are a few famous recipes that have emerged over the years, such as the Canadian Model and the Yale Model. In the same way that the best recipes for cookies are reliable, and lead to happy kids, these famous models have reliably led to high performance for the organizations that pioneered them."

The ‘Investor Identity’: The Ultimate Driver of Returns (Ashby Monk & Dane Rook)

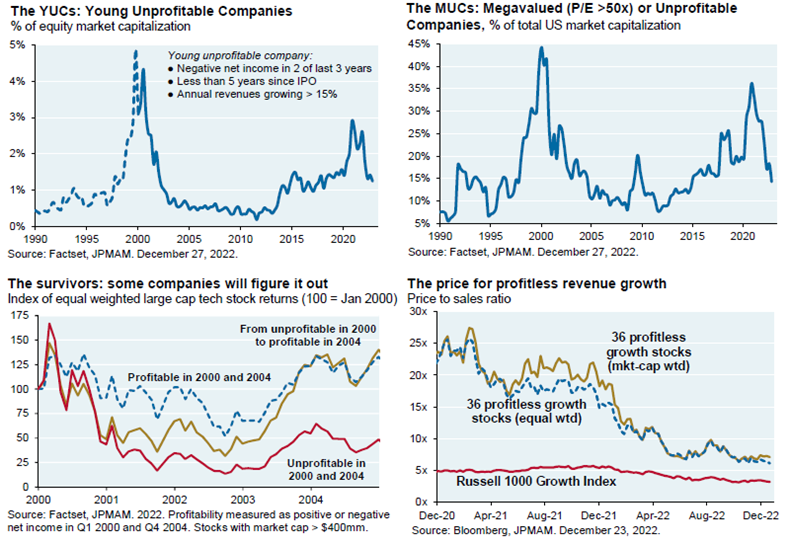

Is the pain in unprofitable tech stocks close to its nadir?

"Many unprofitable companies are in that position since the market did not require them to be profitable. With the benefit of ample pre- and post-IPO capital, they forged ahead with enormous customer acquisition costs in an effort to gain scale. Many cannot do that anymore, but some will figure out how to become profitable in this new era."

Eye On The Market Outlook 2023: The End of the Affair (J.P. Morgan)

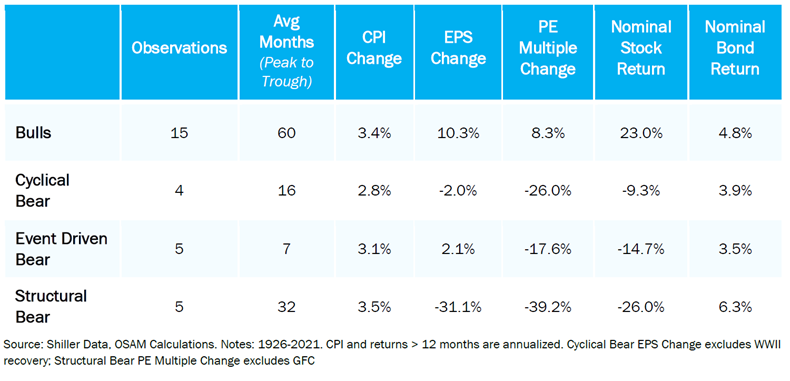

What type of bear market are we in?

"Given the post-GFC run-up in valuations, a marked shift in inflation dynamics, an aggressive Fed, and the strong potential for some form of de-globalization, we are most likely about halfway through a structural bear market that started in late 2021. Though certainly painful from an absolute return perspective, bears help the market clear on a long-term basis and are healthy in setting the stage for future growth. One could plausibly argue that the next true bull market will be generational in nature."

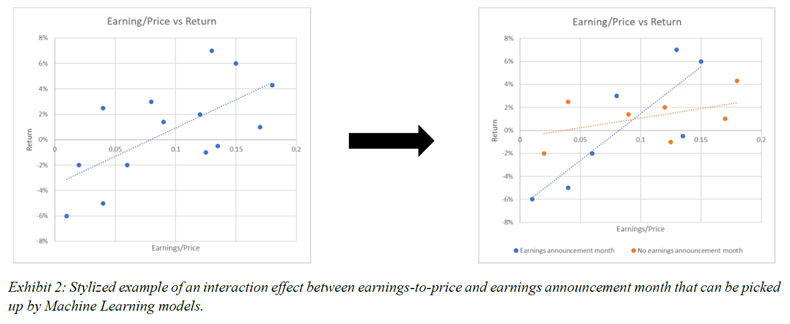

Should quantitative investors embrace machine learning techniques?

"Machine Learning can be at an advantage over classical econometric approaches whenever the focus is on forecasting, especially in the absence of a theoretical model. It is well-equipped to deal with large and complex data sets, and particularly suitable for capturing nonlinearities and interaction effects."

How Can Machine Learning Advance Quantitative Asset Management? (Robeco)

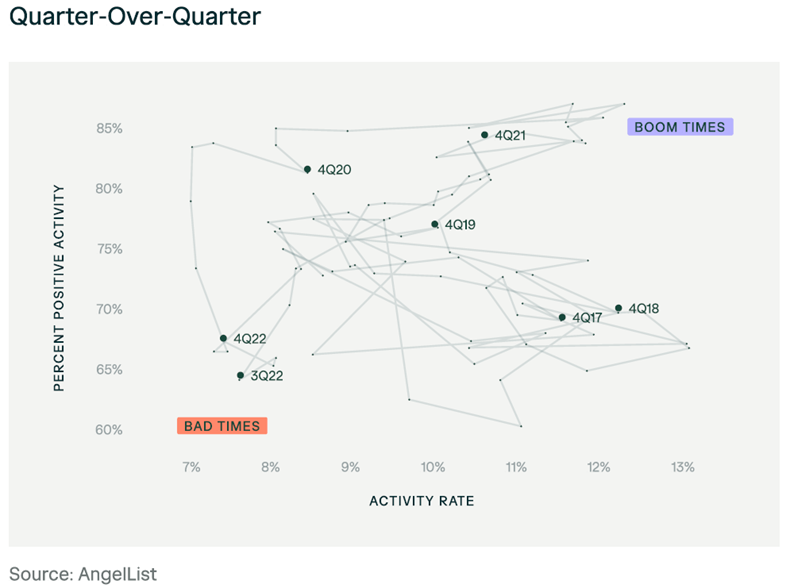

How bleak is the outlook for early-stage venture and startup investing?

"These increasingly less favorable market conditions for startups may be good news for investors. While median and average valuations increased YoY, they showed marked declines in 4Q22, indicating the market is becoming more buyer-friendly."

The State of U.S. Early-Stage Venture & Startups: 2022 (AngelList & Silicon Valley Bank)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.