The Paper Trail: Future Proof Portfolios

Investors have had a lot to be thankful for in 2021. But as we awoke on Black Friday to media concerns over Omicron, a new Covid variant, the markets reminded us just how fragile this recovery is and just how quickly the narrative can shift. Stocks went on to have their worst day of the year.

The last 18 months have been a rising tide lifting all most boats, and diversification and risk management have felt like an afterthought. A bad day like Friday barely makes a dent in a year of bountiful gains.

The violent price action might continue this week and beyond. Or it might be just another blip on the radar that we have all forgotten about three months from now. Your guess is as good as mine. As Yogi Berra said, “It's tough to make predictions, especially about the future.”

While we cant predict, we can prepare. And we can prepare by building resilient and durable portfolios built to withstand a litany of possible future outcomes.

With that in mind, I present the November edition of The Paper Trail!

“bps” (reading time < 10 minutes)

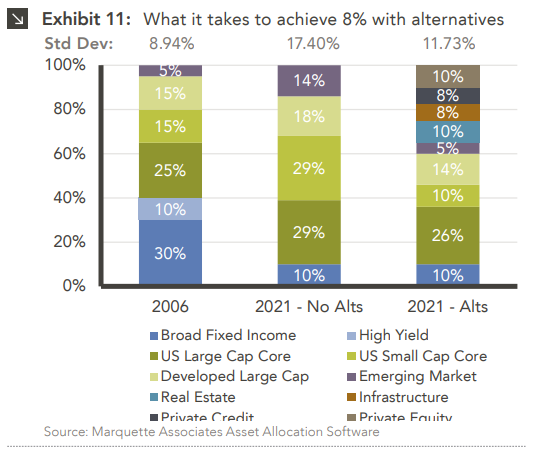

Is there any hope for the 60/40 portfolio over the next ten years?

"Barring any massive interest rate rises — which would re-calibrate expected bond returns — at this point it seems safe to conclude that the 60/40 portfolio is a thing of the past for organizations pursuing target rates of return north of 7%. Assuming little flexibility with investment return goals, investors are faced with choosing a more volatile and concentrated portfolio of mostly equities or bettering their return potential with alternative investments."

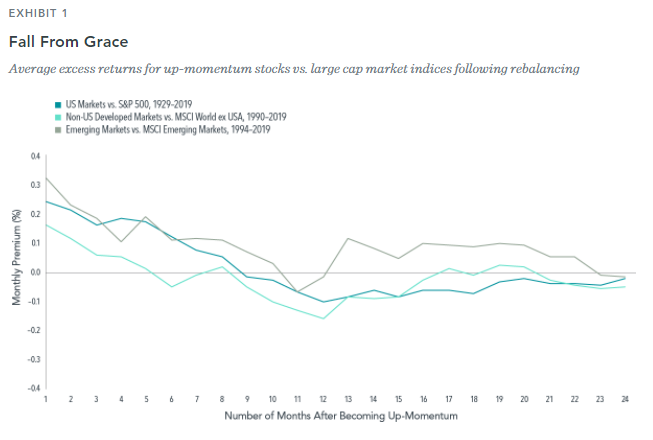

Can the excess returns of momentum survive real-world implementation?

"As with many things in life, the truth is somewhere between the extremes: While both simulated and real-world data suggest momentum may not be suitable as a driver of long-term asset allocations, we believe momentum considerations can be integrated in a cost-effective way to help inform daily portfolio management decisions."

Myth-Busting with Momentum: How to Pursue the Premium (Dimensional Fund Advisors)

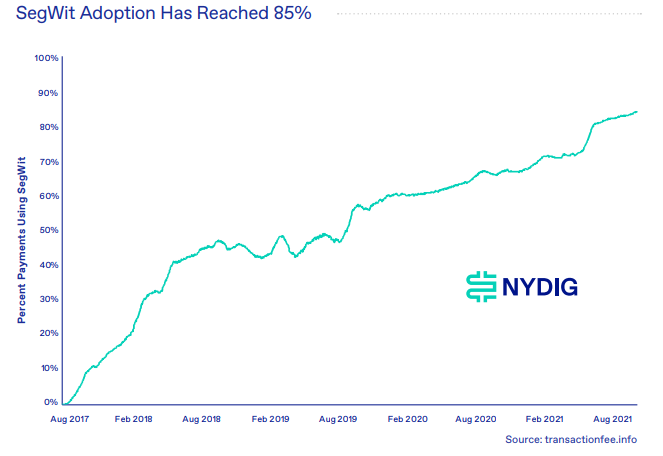

What does the Taproot upgrade mean for Bitcoin?

"The two innovations encompassed by Taproot, MAST and Schnorr signatures, act in somewhat separate and sometimes interlinking ways to accomplish the joint goal of improving security and privacy while reducing space taken on the blockchain and thus fees. Both concepts have been long contemplated in the Bitcoin community, and unlike the previous major update, SegWit, were much less controversial."

Taproot: Explaining Bitcoin’s Biggest Upgrade in Four Years (NYDIG)

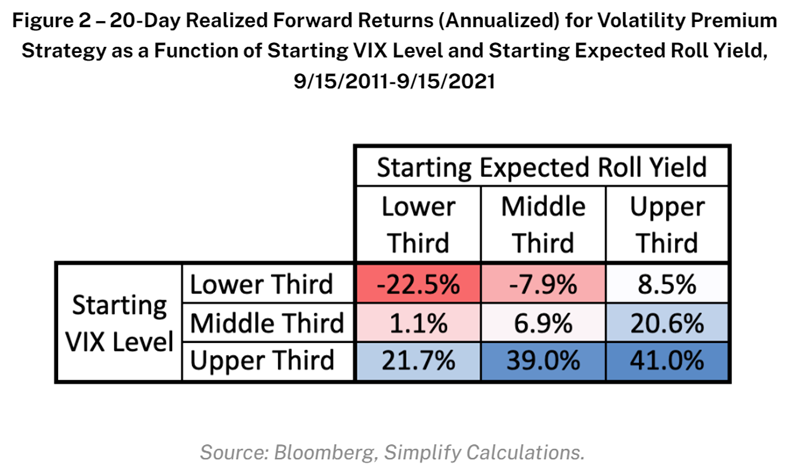

Can the equity volatility premium be harvested tactically?

"After adjusting for both volatility and tail risks, we have seen that the equity volatility premium presents a compelling risk-adjusted income stream for strategic asset allocators. We have also shown that volatility premium harvesting can be intelligently managed tactically based on starting VIX levels and starting expected roll yields."

Enhancing Portfolio Income With the Equity Volatility Premium (Simplify)

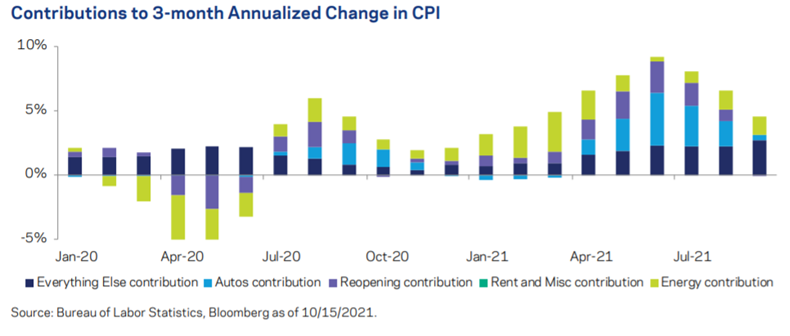

Will high inflation prove to be "transitory" or something more structural?

"While there is good reason to believe that recent high inflation rates will subside to some extent, there are also a number of factors suggesting a return to low and stable ~2% headline CPI readings is unlikely in the near term"

Inflation Outlook: the Macro, the Micro, the Transitory (AQR)

“pieces” (reading time > 10 minutes)

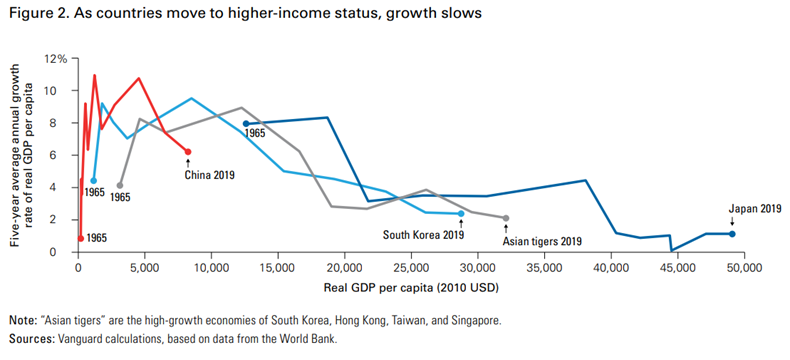

What is the long-term trajectory for China's economy and financial markets?

"China’s future as the world’s largest economy is not a foregone conclusion, with the country on the precipice of significant domestic and international challenges. To avoid the middle-income trap, China must change in two interrelated areas: alleviating structural risks, such as imbalances, inefficiencies, and inequality; and encouraging technological innovation and industrial upgrading."

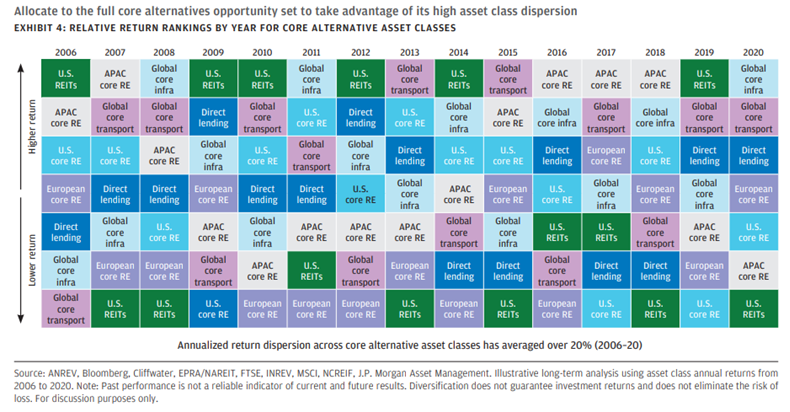

What are the prerequisites for successfully investing in alternatives?

"Determining a strategic alternatives allocation depends largely on factors specific to the investor, including risk-return objectives, liquidity constraints, level of access to alternatives and the ability to execute. Variation in these and other parameters can be significant across investors, with implications for choosing portfolio construction approaches."

Alternative investments: The essential buyer’s guide (J.P.Morgan)

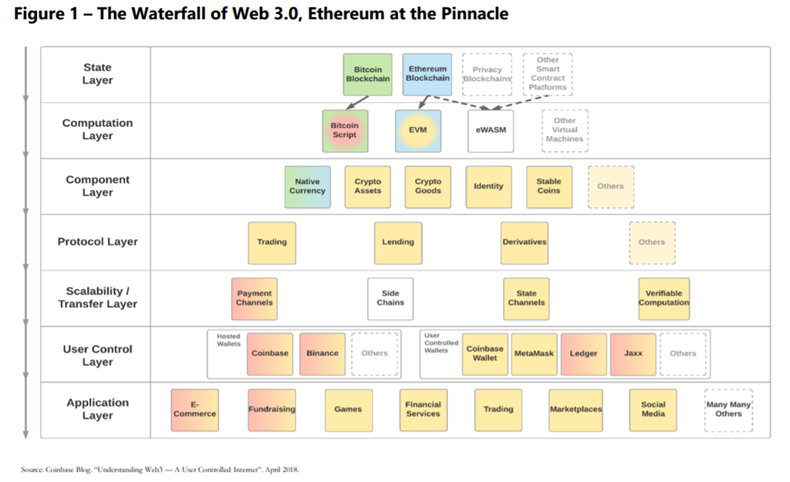

What does the future hold for Ethereum?

"Just as the deepening in the store-of-value network is defining Bitcoin, developer involvement in Ethereum will be the ultimate arbiter for its protocol. Of the 3,000 active monthly developers in digital protocols, 2,400 are linked to Ethereum. It is winning."

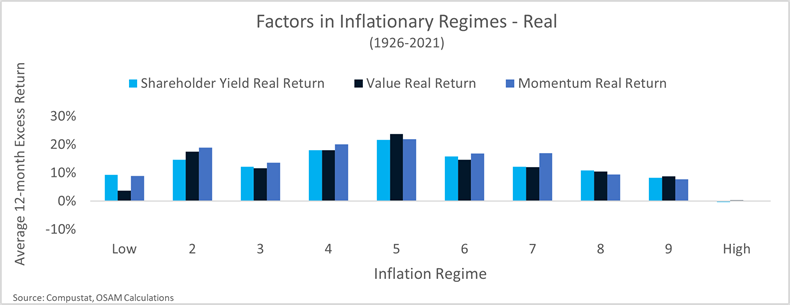

How should investors think about stock returns in the face of higher inflation?

"Our analysis suggests that while investors are right to pay attention to inflation, comparisons with the 1970s may be overblown. Equities, as a whole, may not welcome high rates of inflation, but certain stock selection factors have shown more resilience than others in periods of rising prices."

The Great Inflation, Factors, and Stock Returns (O'Shaughnessy Asset Management)

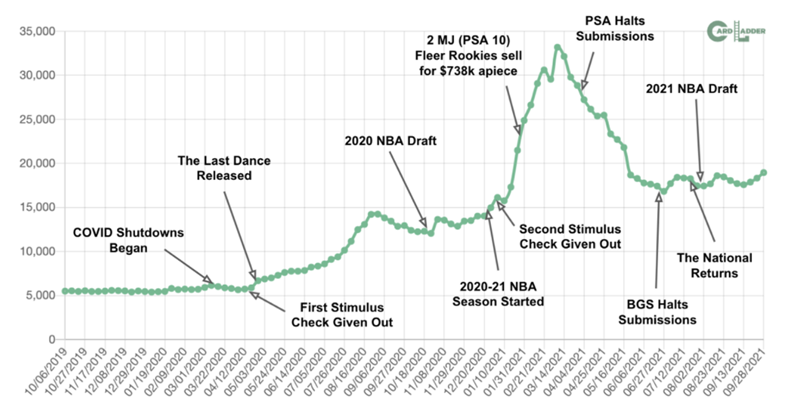

Are trading cards a bona-fide asset class?

"Trading cards are the rare product - perhaps the unicorn product - that is equal parts four industries: culture, commerce, finance and gaming."

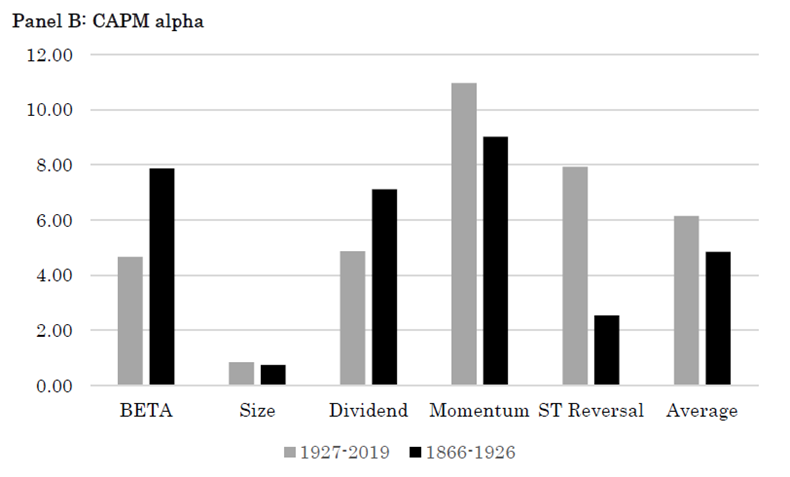

What does the cross-section of stock returns look like over the REALLY long-term?

"This pre-CRSP period extends the CRSP sample with 61 years of additional and independent data, allowing us to examine the cross-section of U.S. stock returns out-of-sample in a robust and rigorous way. Results over this ‘pre-CRSP’ era reveal a flat relation between market beta and returns, an insignificant size premium, and significant momentum, dividend yield (as proxy for value) and low-risk factor premiums."

The Cross-Section of Stock Returns before 1926 (And Beyond) (Robeco)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.