The Paper Trail: Hard to Concentrate

"Hustle, bustle and so much muscle, oh

Cells about to separate

And I find it hard to concentrate, and

Temporary this cash and carry

I'm stepping up to indicate

The time has come to deviate" - Red Hot Chili Peppers

I spent the past week up in Mackinac Island and Traverse City with my family. I'm not sure what it is about northern Michigan, but any time we drive up there my wife and I like to listen to the Chili Peppers album Stadium Arcadium on repeat.

The reason I bring all this up is that I found the above lyrics from the song "Hard to Concentrate" particularly apropos for the current moment The Magnificent Seven™ are having in the stock market and the resulting index concentration it has led to. Perhaps the time has come to deviate...

With that in mind, please enjoy the September 2023 edition The Paper Trail! This month's research roundup features:

- Stock market concentration across the globe

- Profitability of value stocks in Europe and Japan

- The dismal performance of the clean energy sector

- Secondary markets in private real estate

- Interest rates and the equity risk premium

- The tradeoffs between avoiding losers and going for winners

- GDP growth and Emerging Market equity returns

- AI/NVIDIA: breakthrough or bubble?

- Onshoring and industrial real estate

- And much more

“bps” (reading time < 10 minutes)

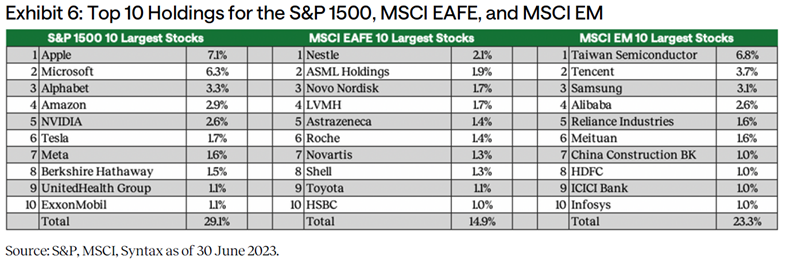

How concentrated are foreign stock markets relative to the U.S.?

"The S&P 1500 and MSCI EM indices have a relatively high concentration risk with their top ten holdings accounting for 29.1% and 23.3% of their total weights, respectively. In contrast, the top ten holdings of the MSCI EAFE make up only 14.9% of the index."

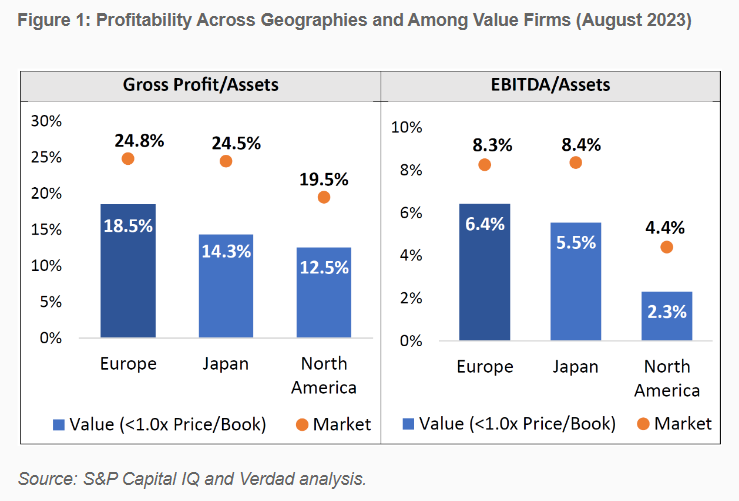

Are profitable stocks on sale in Europe and Japan?

"Value stocks everywhere are less profitable than the broader market. But we see that European and Japanese value stocks are significantly more profitable than North American value stocks. Indeed, because the North American market has a long tail of unprofitable biotech and venture-backed firms, the median return on assets is higher in international markets at 8% EBITDA/Assets in Europe and Japan versus 4% in North America."

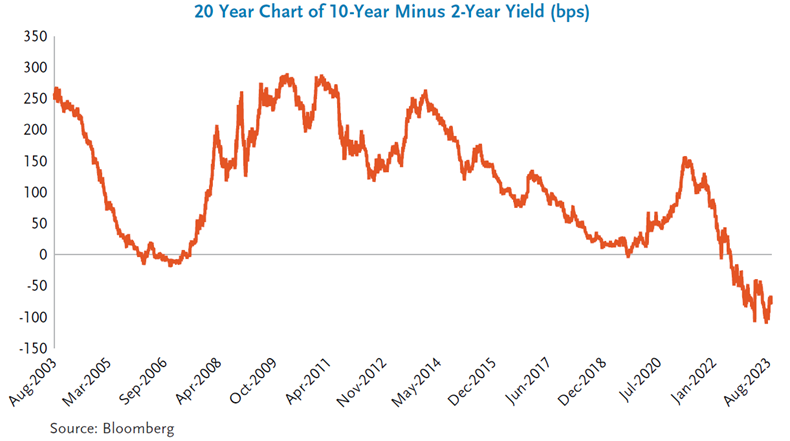

Have investors become too optimistic about the prospect of a "soft landing"?

"There are increasing signs that pandemic-related savings have been worked off (lower checking and savings balances, rising credit card and auto loan delinquencies) and that businesses, pressured by higher expenses, are being forced to cut back on labor (layoff announcements are increasing while job openings are decreasing). Companies with low coupon debt will face their day of refinance reckoning as that wall of maturities (particularly for rate sensitive high yield borrowers) comes closer. Bank lending standards are tightening as profits are being squeezed by the inverted yield curve and lower net interest margins. The recession IS coming, the voice from the cornfield is telling us, we just don’t know exactly when. Our best guess would be sometime in the first half of 2024."

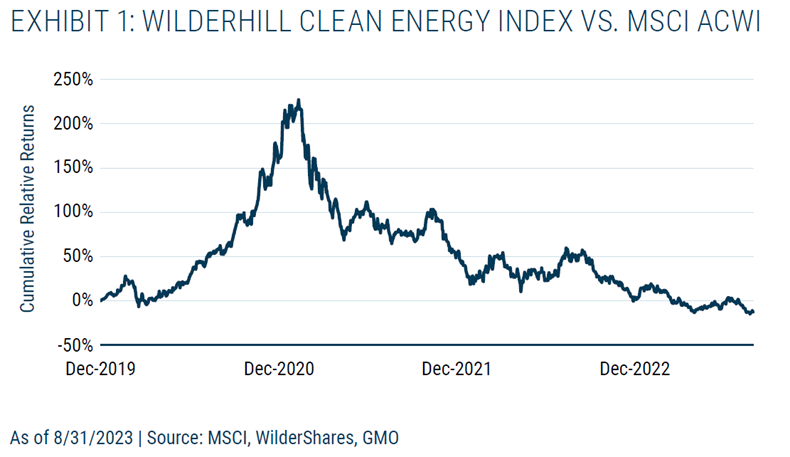

Why have clean energy stocks done so poorly over the past few years?

"Clean energy is a beaten-down sector that is growing rapidly, is increasingly profitable, and now has unprecedented, massive public policy support. While performance in clean energy has been painful the last two and a half years, that’s nothing new for a sector with a long history of wild swings. Any nascent industry is going to experience bumps along the road, but the long-term trajectory for clean energy continues to rise, and the valuations on offer are remarkably low for companies poised to generate strong long-term growth."

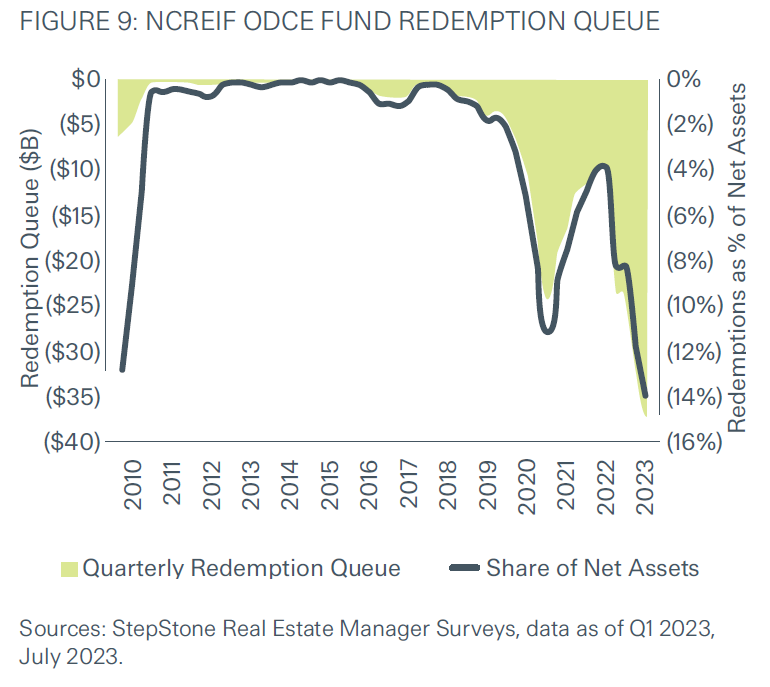

How attractive are secondary markets in private real estate today?

"The recent spike in interest rates has caused property values and therefore property sales activity to decline, resulting in declining distributions to LPs that they had counted on to fund their other investment commitments and their institutional obligations. These factors should drive a rich opportunity for secondary investors to provide the capital to solve GPs’ and LPs’ liquidity issues."

Have bond valuations reached a point where they can resume their normal role in a multi-asset portfolio?

"We find that bond valuations are more attractive than they have been in a decade. Receding inflation risk also means that bonds will once again provide diversification benefits for investors."

“pieces” (reading time > 10 minutes)

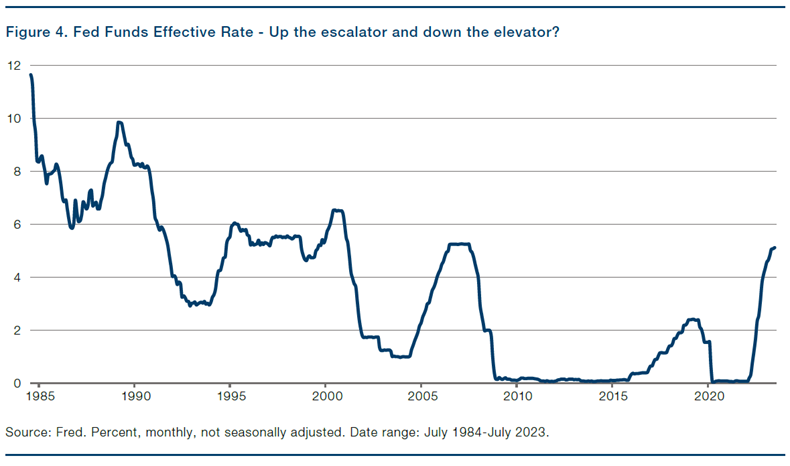

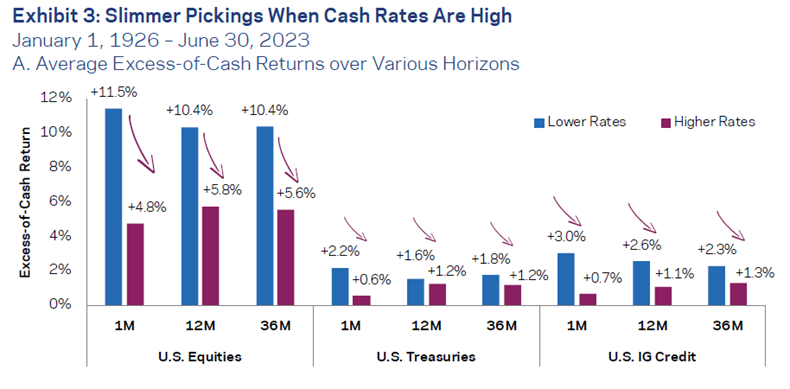

How do higher interest rates affect the equity risk premium?

"For all three asset classes and at all horizons—and most dramatically for equities—risk premia have been smaller when starting cash rates are higher."

Honey, the Fed Shrunk the Equity Premium: Asset Allocation in a Higher-Rate World (AQR)

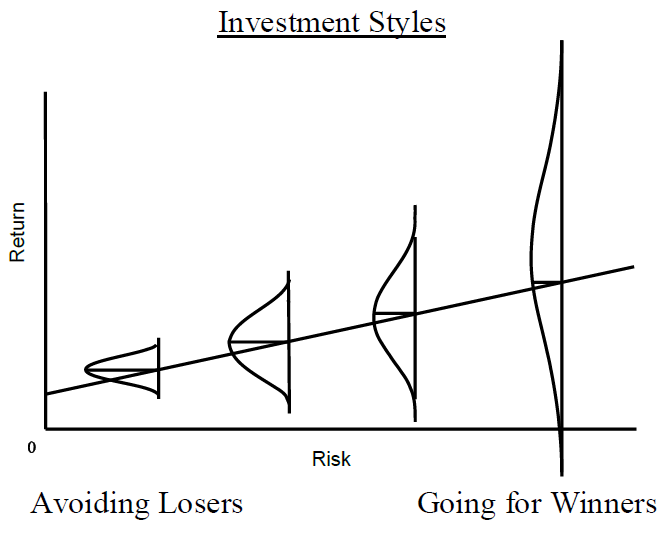

Is investment success more predicated on avoiding losers or identifying winners?

"The proper choice between the two approaches – fewer losers or more winners – depends on each investor’s skill, return aspiration, and risk tolerance. As with many of the things I discuss, there’s no right answer here. Just a choice."

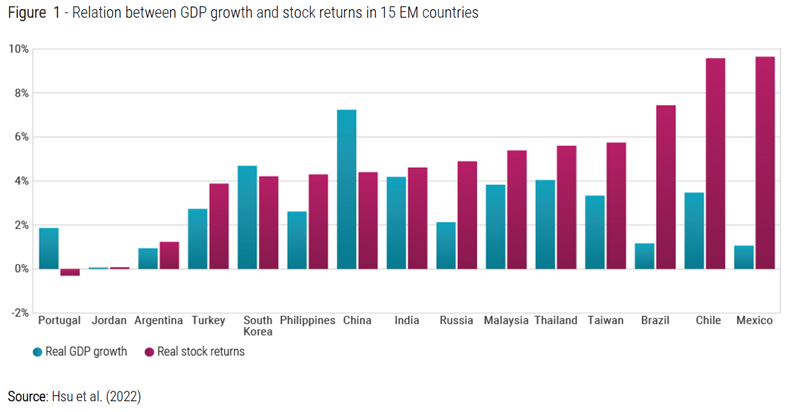

Does GDP growth matter for equity returns in Emerging Markets?

"Investors do tend to overestimate the relevance of economic growth. Dimson, Marsh, and Staunton (2002) and Ritter (2012) find that the long-term correlation between GDP growth and stock returns across countries is zero, or even negative. Perhaps the benefits of economic growth accrue primarily to consumers and workers instead of shareholders, or to the shareholders of privately held firms. It may also be that corporate managers pursue growth too aggressively, at the expense of profitability. More recently, Hsu, Ritter, Wool, and Zhao (2022) confirm that GDP growth and stock market returns are effectively unrelated, but they also find a significant relation between stock market returns and earnings growth of listed companies. So growth does matter, but only earnings growth, and although this might seem closely related to GDP growth, it really is not."

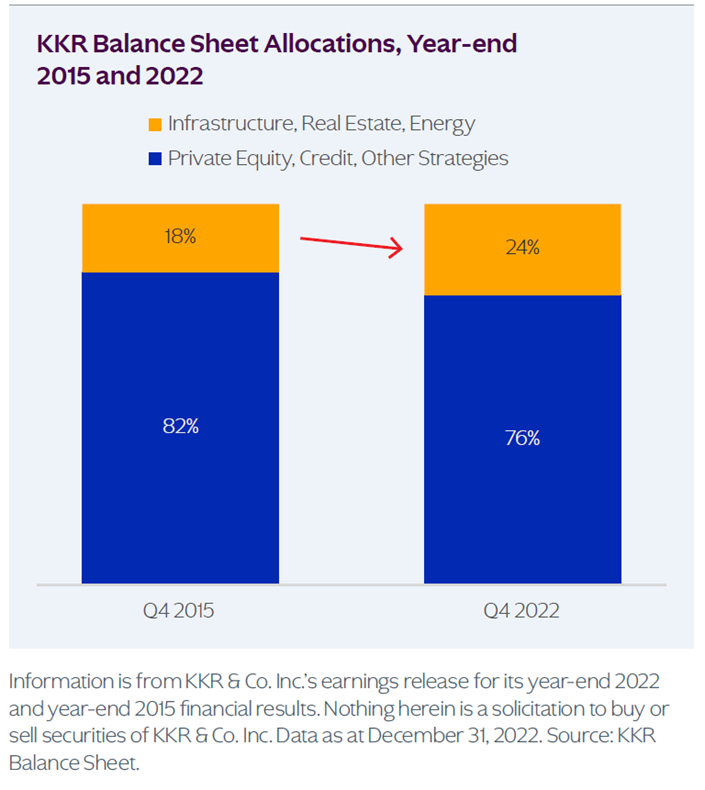

Can Private Real Assets enhance a traditional portfolio in an environment with a "higher resting heart rate" for inflation?

"As such, we continue to favor Real Assets with defendable margins and upfront recurring yields as a potential substitute to traditional fixed income across many types of portfolios. Importantly, not all Real Assets are created equal, and many of the more ‘traditional’ inflation hedges are not performing as expected. Therefore, we believe that an investor must look beyond REITs, TIPS, and Gold towards more collateral-based cash flows linked to nominal GDP, including a mix of Asset-Based Finance, Infrastructure, and select parts of Real Estate Credit and Equities."

Regime Change: The Changing Role of Private Real Assets in the ‘Traditional’ Portfolio (KKR)

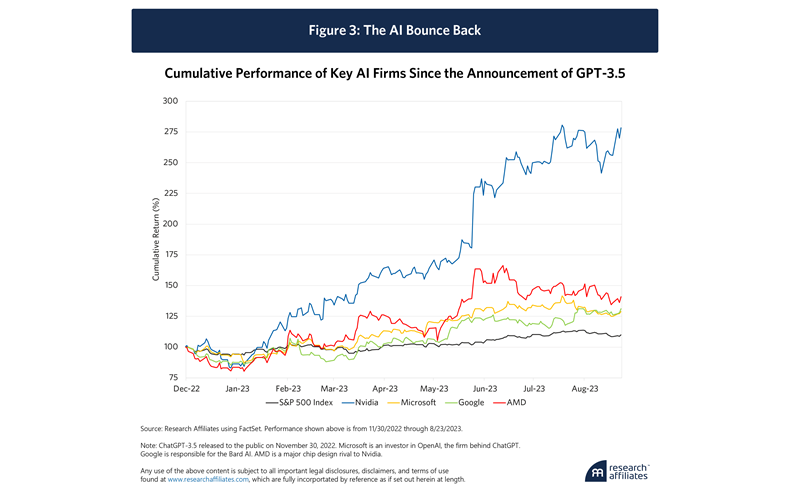

Is NVIDIA's stock price in a bubble?

"Overconfident markets paradoxically transform brilliant future business prospects into even more brilliant current stock price levels. Nvidia is today’s exemplar of that genre: a great company priced beyond perfection."

The NVIDIA/AI Singularity: Breakthrough, Bubble, or Both (Research Affiliates)

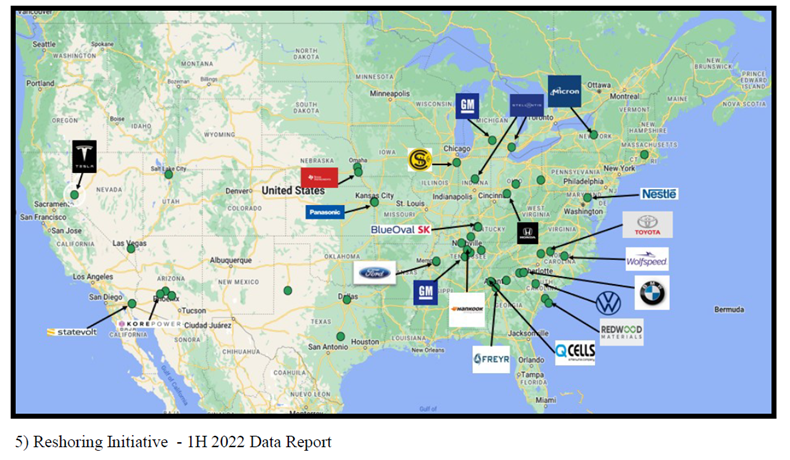

Is U.S. Industrial Real Estate poised to benefit from the shift towards onshoring manufacturing operations?

"Lastly, we believe this onshoring trend is another secular trend, similar to e-commerce growth, that should allow the industrial sector to sustain growth in tenant demand over the foreseeable future. We believe this growth in manufacturing operations domestically will contribute to sustaining positive supply and demand fundamentals and healthy leasing performance for the sector over a long-term investment horizon."

Onshoring: A Growing Demand Driver for the Industrial Sector (ElmTree Funds)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.