The Paper Trail: Hidden in Plain Sight

My friend Corey Hoffstein of Newfound Research is fond of saying “risk cannot be destroyed, only transformed.”

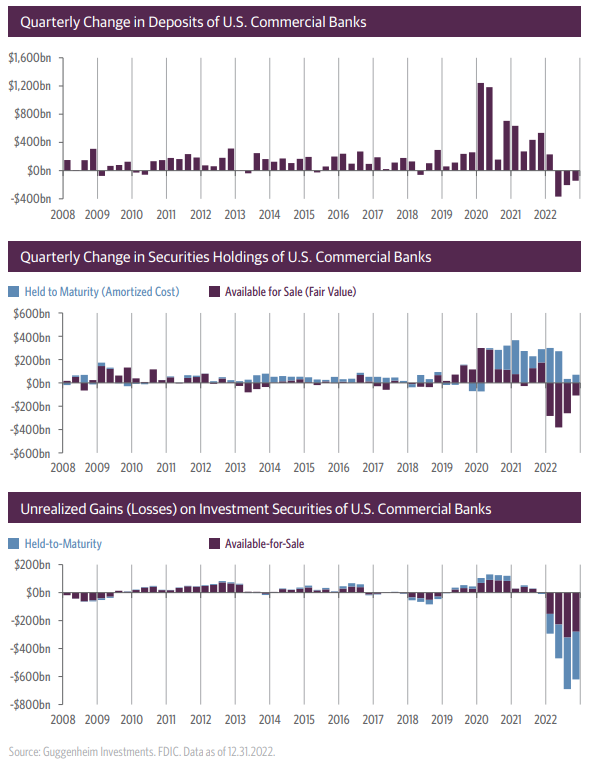

It now appears that the credit risk that was extinguished from the banking system following the Global Financial Crisis was transformed, at least in part, to interest rate risk.

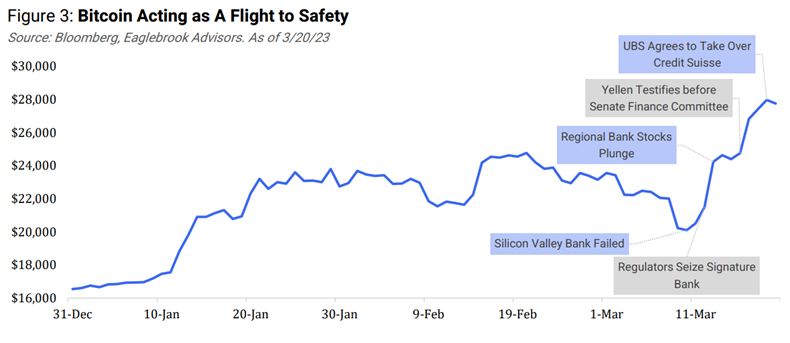

Few people, if any, had "banking crisis" on their 2023 market bingo card, and yet here we are following the demise of SVB, Signature Bank, and Credit Suisse.

Many have stated ex-post that the unrealized losses on bank balance sheets were a risk hidden in plain sight. But everything is hidden in plain sight when you have the benefit of hindsight.

The risks of broader contagion (for now) seem contained, but the pain for regional banks over the past month has been brutal and the future highly uncertain.

If there is a lesson to be learned from this year's "Ides of March" - which incidentally was a deadline for settling debts in ancient Rome) - it's that the macro backdrop and prevailing market narrative can shift at a moment's notice.

Now, onto the March edition of The Paper Trail. This month's research roundup features:

- Duration mismatches in the U.S. banking system

- The digitization of "old economy" corporations

- Merger arbitrage as a diversifier

- A framework for investing in Risk-Mitigating Strategies (RMS)

- The future of quant investing

- Japanese value stocks

- Infrastructure investing

- Private equity in times of crisis

- And much more!

“bps” (reading time < 10 minutes)

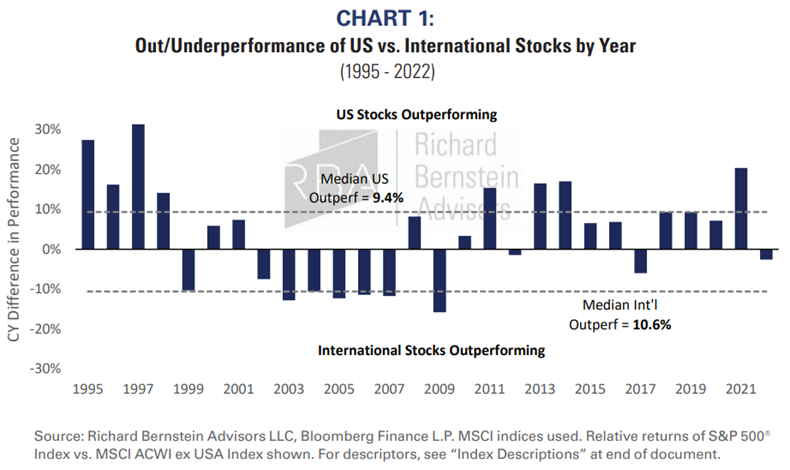

Are international stocks finally ready to grab the baton and outperform U.S. stocks?

"The rising tide that drove stellar US performance last decade may now be going out. International markets’ cheaper valuations and relatively more accommodative liquidity suggests that investors with US-heavy portfolios may want to consider diversifying with opportunities outside the US."

A sea change in international markets (Richard Bernstein Advisors)

Is Bitcoin acting as a safe-haven asset in this current banking crisis?

"After experiencing high correlation with risk assets over the last few years, bitcoin is demonstrating a recent 'decoupling.' "

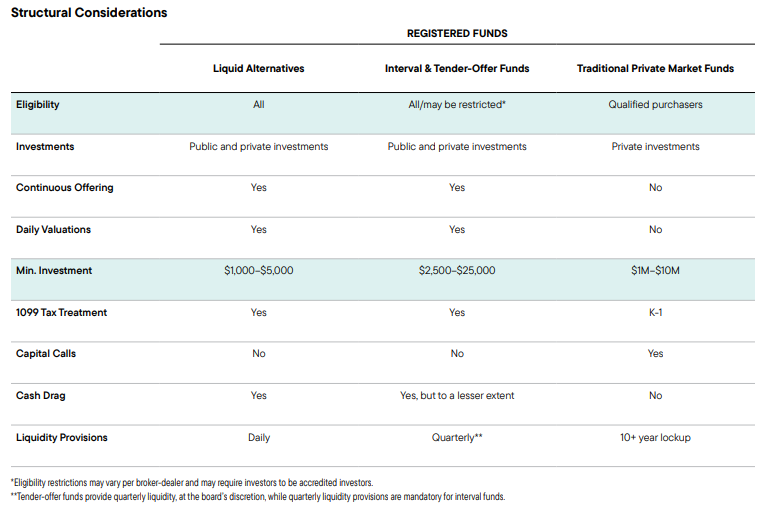

Is there a cost to having too much liquidity in a portfolio?

"With the proliferation of registered funds, geared toward HNW investors, they can now access the private markets at lower minimums and more flexible features. While interval funds and tender-offer funds offer more flexible liquidity provisions than the first-generation of fund structures, they should be viewed as long-term investments to potentially capture the illiquidity premium noted above. There may be a cost for offering greater liquidity—a “cash drag”—the give up for holding more liquid assets to meet periodic redemptions."

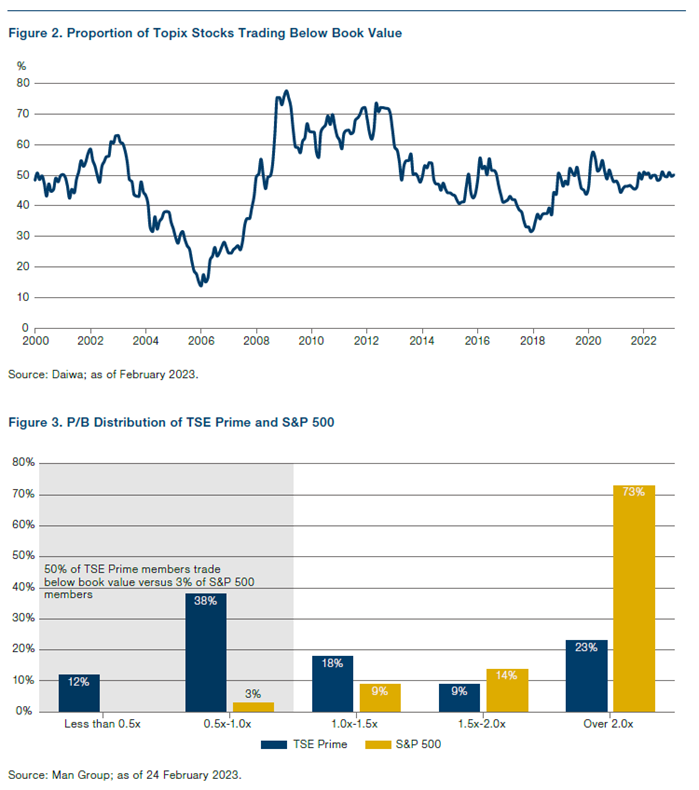

Why do so many Japanese stocks trade below book value and is there a catalyst for that to change any time soon?

"The directive by the Japanese bourse for companies trading below book value to come up with capital improvement plans has huge implications for Japanese stocks – specifically Japanese Value – especially considering that almost half of stocks on the Tokyo Stock Exchange trade below book."

This Time Is Different: Japan Value and Corporate Governance (Man Group)

Were the problems in the U.S. banking system hidden in plain sight?

"While it’s true that SVB was an outlier in terms of the mismatch between its highly run-prone funding base and longer-duration asset composition—and therefore its troubles were idiosyncratic—a close look at trends among FDIC insured banks over the past 15 years shows that what happened at SVB is indicative of a system-wide phenomenon."

A Not-So-Funny Thing Happened on the Way to the Terminal Rate (Guggenheim Investments)

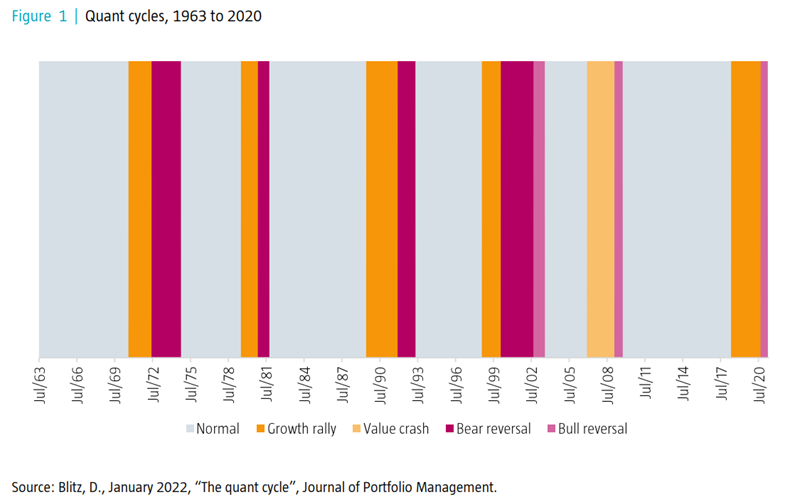

What does the future hold for quantitative investing?

"For returns, the likelihood of successfully exploiting non-standard patterns should increase as return databases expand. Next-generation quant strategies can also be designed to target sources of alpha orthogonal to existing factors, such as short-term signals that are uncorrelated with traditional Fama-French factors. Regarding risk, by spotting complex patterns machine learning algorithms can be used to predict which firms potentially face financial distress, especially since risk is often nonlinear."

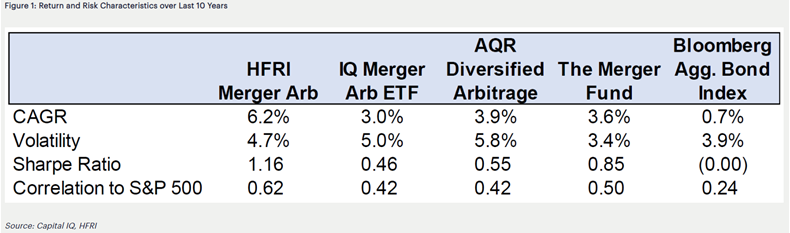

Is Merger Arbitrage still a valuable diversification strategy?

"Betting on mergers is a classic hedge fund arbitrage strategy. For a variety of reasons, we believe the stock price of acquisition targets usually trades slightly below the offer price and, given that about 90% of deals go through, we believe there’s a small premium to be earned. The bet, however, is negatively skewed, given the maximum that the arbitrageur can make is the spread, while the downside if the deal breaks can be large."

“pieces” (reading time > 10 minutes)

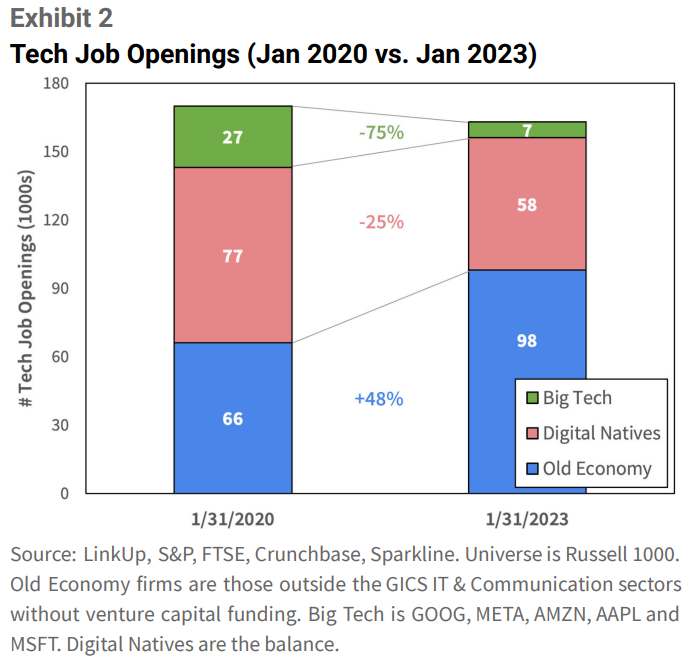

Are "Old Economy" firms finally embracing digitization?

" For decades, Big Tech has hoarded top tech talent, starving Old Economy firms of the technical skills required to meet their digitization goals. Now, as Big Tech relaxes its grip on the labor market, legacy firms see a golden opportunity. "

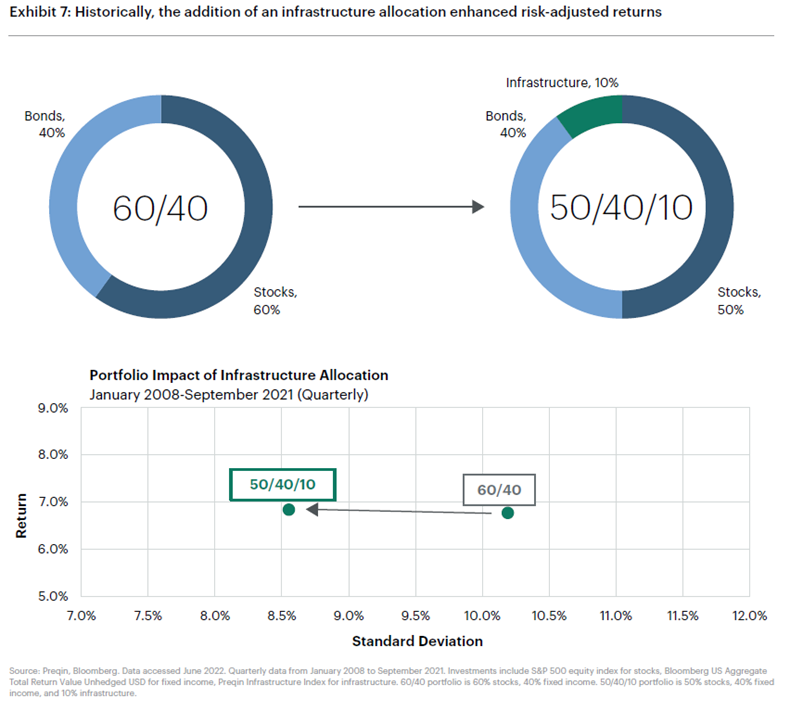

Is infrastructure investing tailor-made for the current macro environment?

"We believe that a nuanced infrastructure investment strategy with a disciplined, price-conscious investing mindset—purchase price matters—is more crucial than ever. We see the middle-market as the most fertile ground for opportunity, especially at a time when the large capitalization space is awash in capital."

Infrastructure Investing: Embracing Complexity in Times of Structural Change (Apollo)

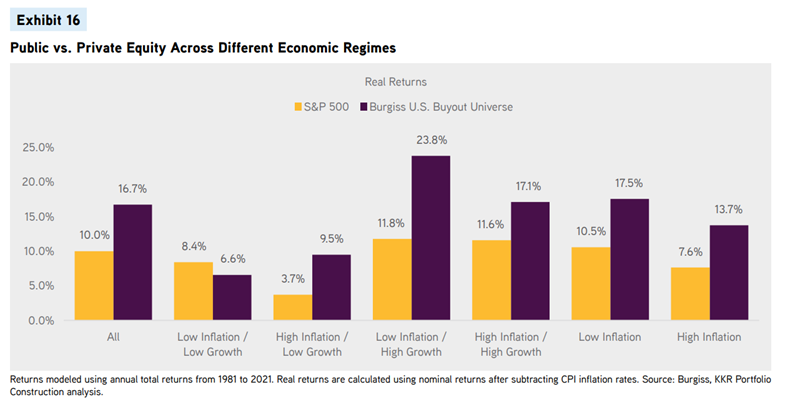

How does private equity performance compare to public equities in different economic regimes?

"It’s important to note that Private Equity is a much younger asset class than Public Equities (starting in the late 1970s/early 1980s), and as such, it does not have the same amount of historic data available to assess its behavior. That said, with the data we do have, we find that in real terms Private Equity typically outperforms Public Equities in all environments except the ‘low inflation/ low growth‘ environment, which is a period where significant multiple expansion in the Public Markets often can outweigh the benefits of operational improvements in Private Equity. "

Regime Change: The Role of Private Equity in the ‘Traditional’ Portfolio (KKR)

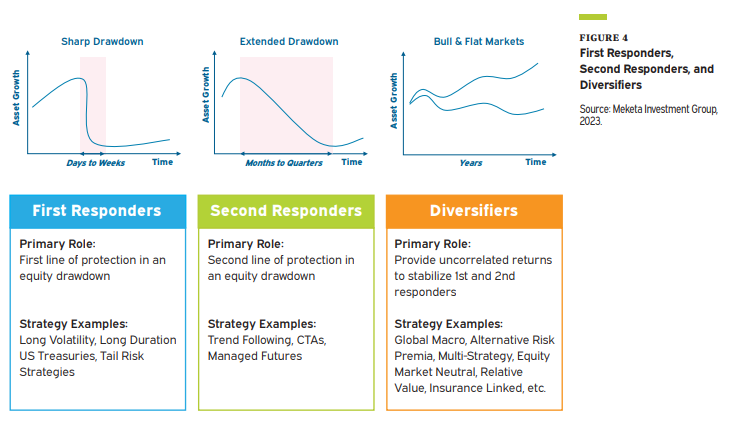

What types of investment strategies are expected to behave in a way that is complementary to equity risk?

"An RMS framework may allow investors to consider allocating across three functional groups: first responders, second responders, and diversifiers. Structuring each group to achieve functional outcomes rather than investing in a more non-descript category such as “hedge funds” may produce more effective and balanced solutions. In addition, this may allow for increased flexibility to adapt as markets evolve. As each functional group has its merits and limitations, a balanced approach would likely improve the probability of investors achieving their desired outcomes."

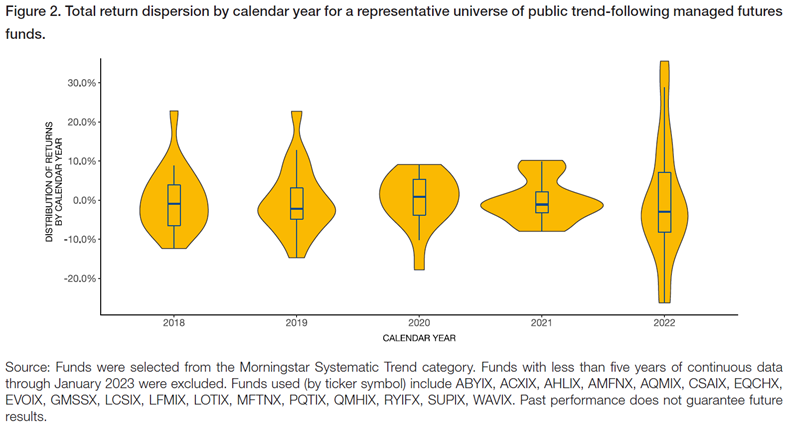

How much performance dispersion is there across the universe of Managed Futures funds?

"Rather, most investors choose to allocate to just one fund or perhaps a small sample of funds. This may be problematic for those seeking category-like returns most years. That’s because there is a great deal of variation in how funds express a trend-following strategy. Funds may choose different universes of markets to trade, utilize different trend lengths and definitions, apply different weighting schemes, use different risk management techniques and stop-losses, or include exposures to other systematic factors like carry."

Peering Around Corners: How to Replicate Trend Following Managed Futures (ReSolve Asset Management)

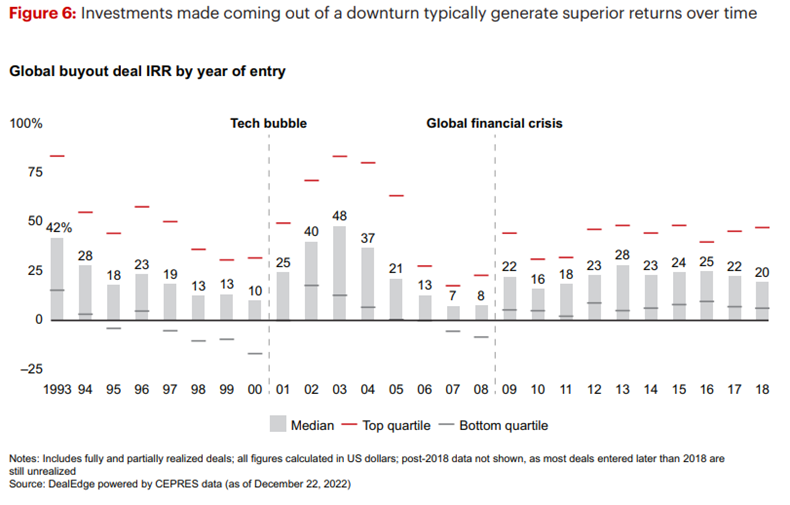

Are crisis periods the best time to commit capital to private equity funds?

"If a deal targets a good asset at a good price, it may be worth getting it done with more equity or a higher price on the debt than you’d like. You can always fix the balance sheet when conditions improve, but waiting risks losing a valuable opportunity to profit from the rebound. "

Global Private Equity Report 2023: Navigating a Shifting Tide (Bain & Company)

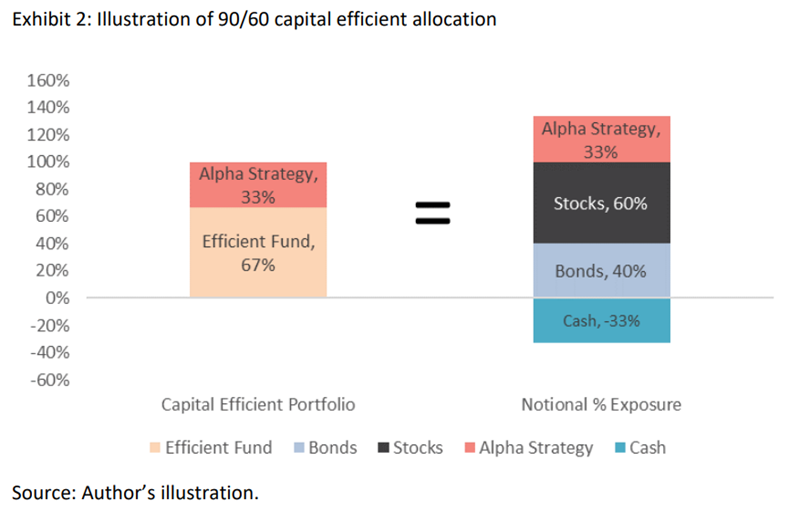

Are 'capital efficient' funds a viable solution for individual investors?

"Many financial advisors and investors will find the investment case for 90/60 capital efficient strategies intuitive and appealing. However, the leap from theoretical promise to realized results always comes down to frictions that that typically don’t find their way into the academic analysis."

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.