The Paper Trail: Interesting Times

“May you live in interesting times.”

Yes, we may.

While February is the shortest month of the year, it can often feel like the longest (especially living in Chicago).

Thankfully both the weather and markets have been milder than expected this year.

Whether that continues in anyone's guess. But either way, things will no doubt remain interesting.

Now, onto February's edition of The Paper Trail. This month's research roundup features:

- Expected returns for private credit

- A deep dive into emerging market debt

- An improved outlook for the 60/40 portfolio

- Opportunities and risks in the U.S. real estate market

- The relationship between drawdowns and recoveries

- Return smoothing and the overstated diversification benefits of private equity

- The thawing of crypto winter

- And much more!

“bps” (reading time < 10 minutes)

Is private credit poised to outperform private equity?

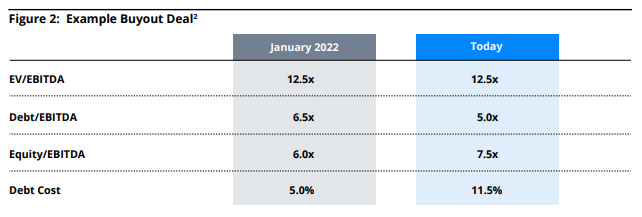

"Over the past year or so, private credit has shed its reputation as private equity’s boring sibling. Because for perhaps the first time, returns for private credit could rival the median return produced by the buyout industry."

Will Private Credit Returns Surpass Private Equity, Even as Risk Declines? (Adams Street)

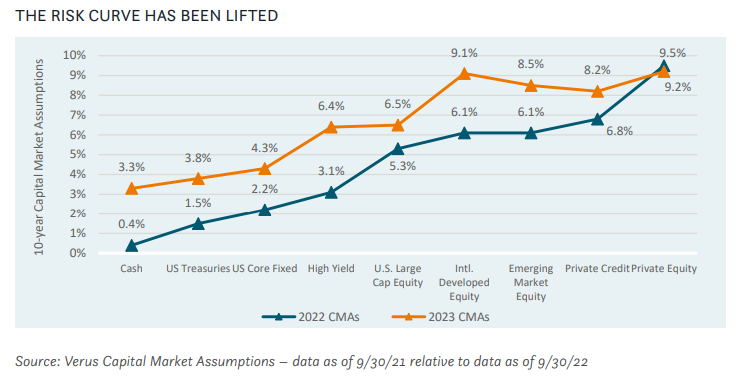

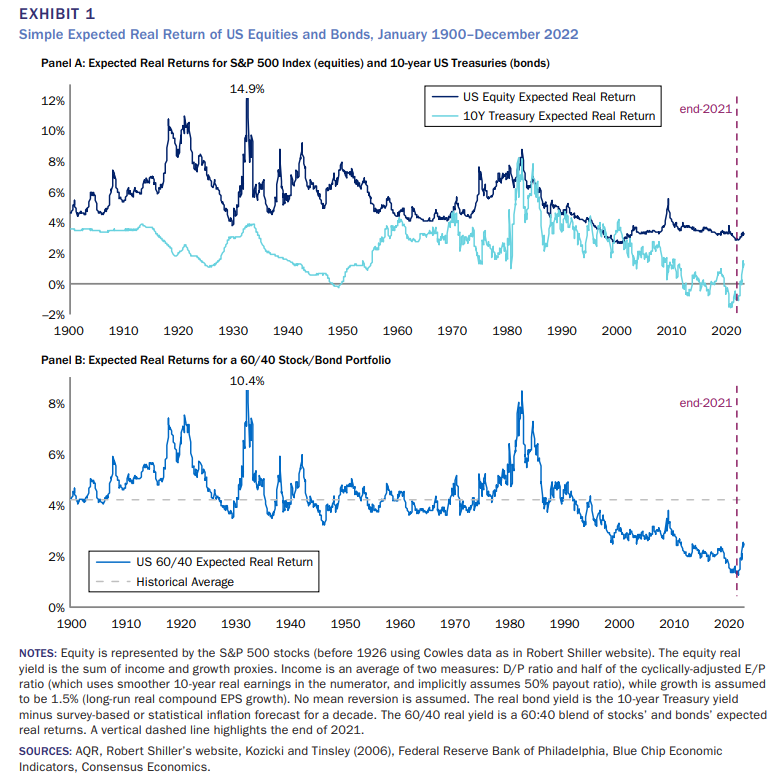

Can investors take less risk today to meet their return objectives?

"The COVID-19 pandemic and subsequent global ultra-low interest policies resulted in a collapse of expected returns across all asset classes. This effect is shown by the blue line below. In that environment, bonds and diversifying assets offered such low returns that many investors were pressured to reach for yield, moving their funds away from safer assets towards riskier exposures that would better contribute to portfolio return objectives. The market reversal of 2022 alleviated much of this pressure, as demonstrated by the orange line."

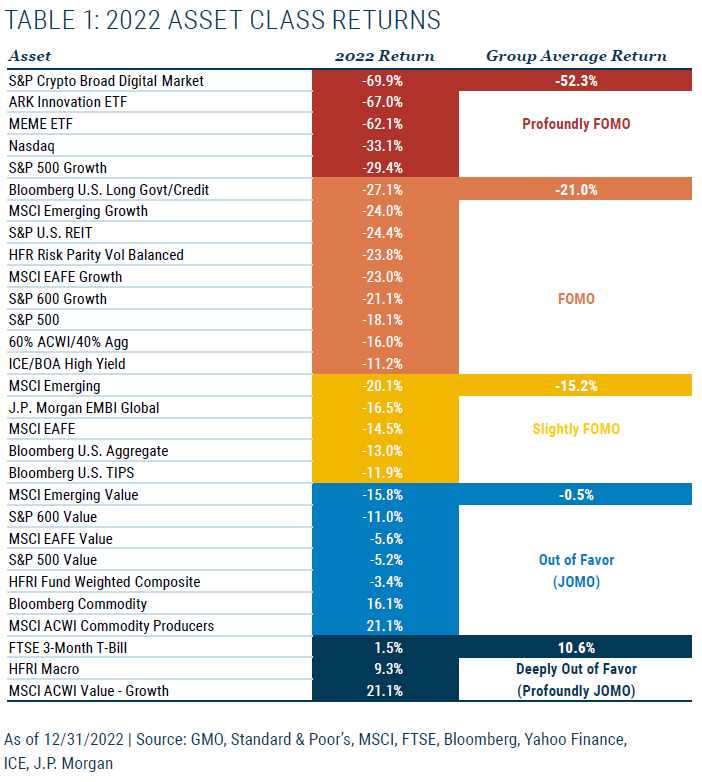

What asset classes look attractive after the bloodbath of 2022?

"Far from being a FOMO market, 2022 was arguably the first JOMO (Joy of Missing Out) market in at least a half century. As we look ahead to 2023, the good news after last year’s sharp declines is that pretty much every traditional asset is meaningfully cheaper than it was a year ago, and it is suddenly possible to put together portfolios of assets that are fair value or better, even if taking maximum advantage of today’s opportunity set requires accepting some real career risk."

2022: The Joy of Missing Out - A Bad Year in Markets Brings Better Opportunities (GMO)

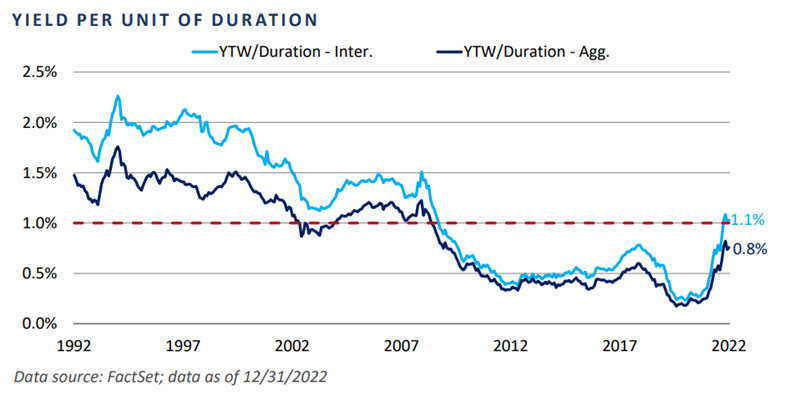

Where do bonds go from here?

"The uptick in interest rate volatility witnessed throughout 2022 suggests ambiguity in consensus among market participants. On one hand, the 2-year/10 year Treasury curve moved deeply into inverted territory in mid-2022, indicating the bond market believes the Federal Reserve has already overextended its interest rate hiking cycle and should reverse course. On the other hand, the Federal Reserve is ignoring the yield curve inversion and has pushed forward with its hawkish rhetoric."

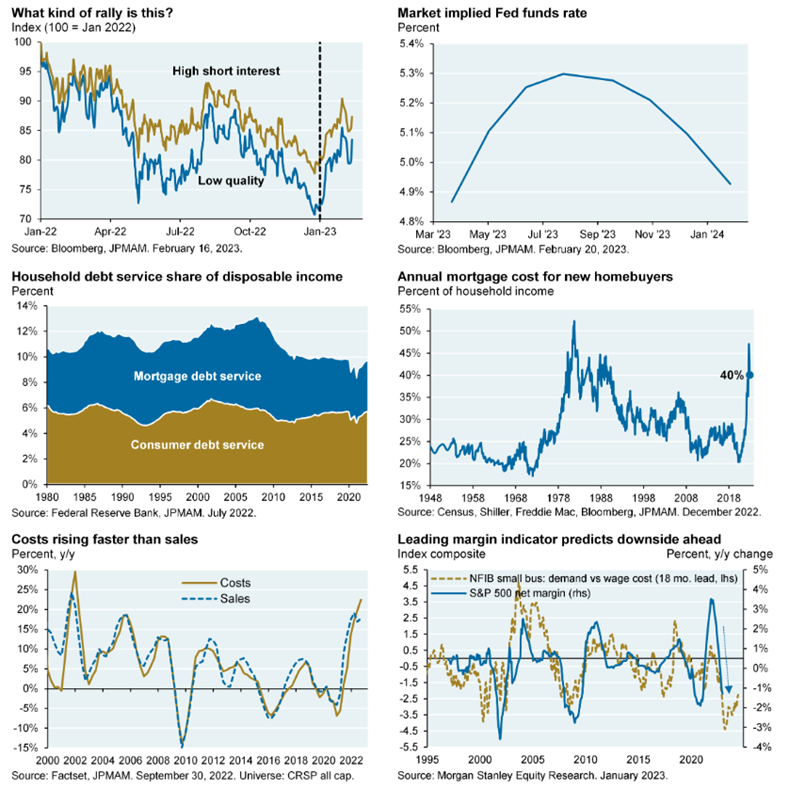

Is the early stock market rally of 2023 already running out of steam?

"It’s positive that the global economy is not imploding as some suggested it might. But I think there are still shoes to drop once lagged effect of higher US interest rates kick in."

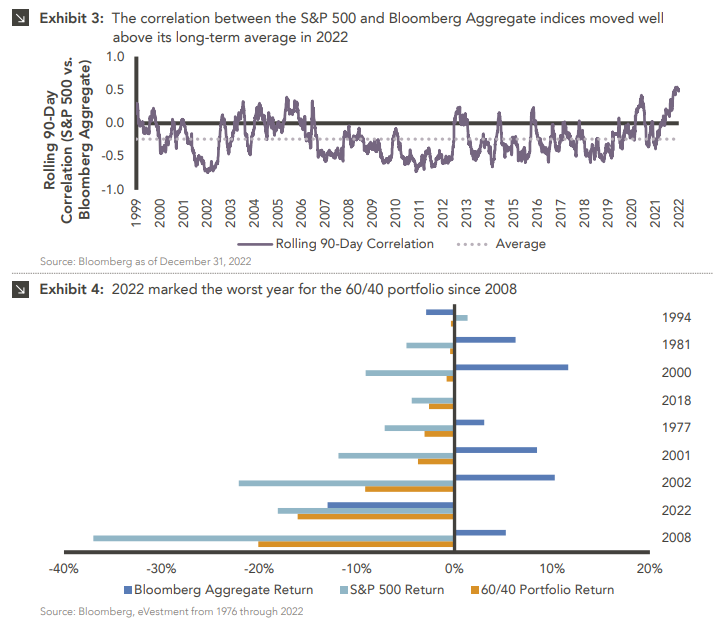

Are there reasons to be optimistic about the 60/40 portfolio again?

"While the near-term outlook for equity market performance is somewhat less clear, a reversion to the mean in correlations between equities and bonds would at a minimum improve the diversification benefits of the traditional model. Should headwinds come to pass, it may be said that reports of the death of the 60/40 portfolio were greatly exaggerated."

The 60/40 Portfolio Revisited: Back from the Dead? (Marquette Associates)

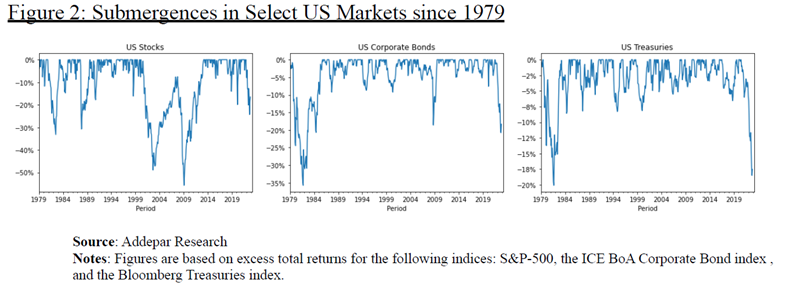

What is the relationship between drawdowns and eventual recoveries?

"For this reason, drawdowns and recoveries mutually define each other; a recovery starts when a drawdown ends, but whether or not a recovery has started is something that can only be known with certainty after the recovery ends. This uncertainty can often pose a challenge for investors in managing drawdowns."

Submergence = Drawdown + Recovery (Dane Rook, Dan Golosovker, Ashby Monk)

“pieces” (reading time > 10 minutes)

What changed in 2022 and what remains the same?

"With the macro volatility genie out of the bottle, 2022 was a great year for trend and macro strategies. If central bankers struggle to again suppress macro volatility, and the challenging environment for investors’ core portfolios persists, these strategies may continue to be particularly helpful."

What is the outlook for U.S. real estate?

"This will be a more interesting investing environment for cycle-resilient segments, given the backdrop of valuation volatility, increased relevance among large investors, and fundamentals that are historically solid in nominal terms but are declining relative to prior highs. Ultimately, we believe the lack of alternatives to these sectors (especially at scale) will be a decisive factor in keeping them both relevant and worthwhile."

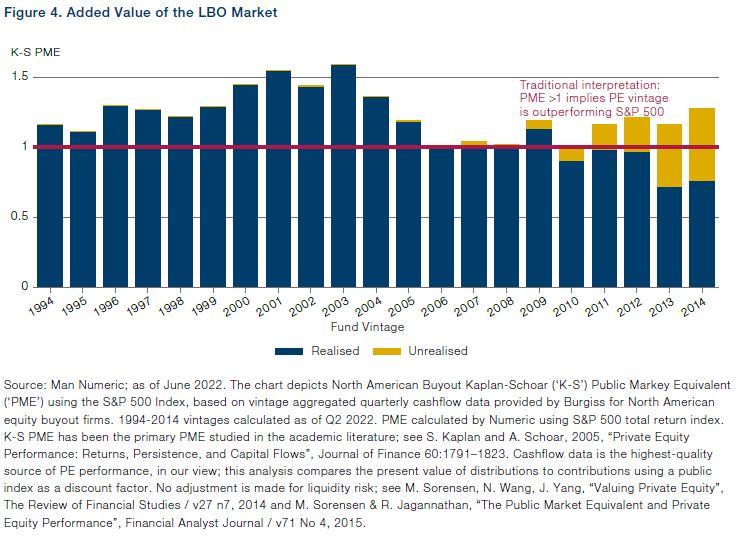

Are the return smoothing benefits of private equity worth the premium fees investors have to pay?

"Helped immensely by smoothed numbers during downturns, PE’s reported returns are less volatile than those of most public equity portfolios and thus PE’s risk-adjusted returns may look quite attractive to many investors at first glance. It does not take a deep look beneath the surface, however, to see that smoothing artificially depresses the volatility of these reported numbers."

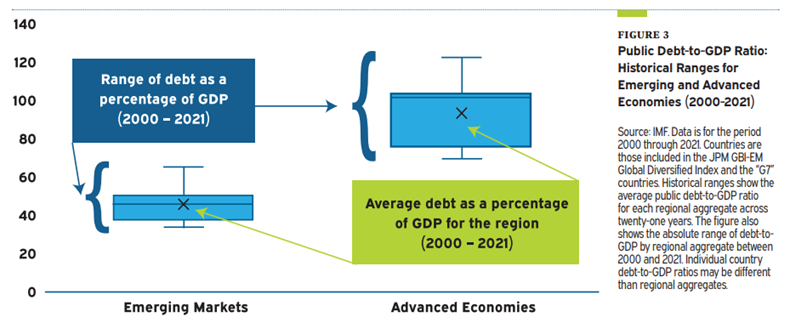

Has Emerging Market Debt matured enough as an asset class to deserve a strategic allocation in a diversified portfolio?

"We recommend that investors with large, well-diversified portfolios allocate up to 5% of total assets to emerging market debt. Increasing levels above this amount may be warranted in some cases, but we believe this level is prudent given the likely increase in currency risk this allocation will introduce at the portfolio level. The allocation should be considered within the context of the rest of the portfolio, including exposure to emerging markets in other asset classes. "

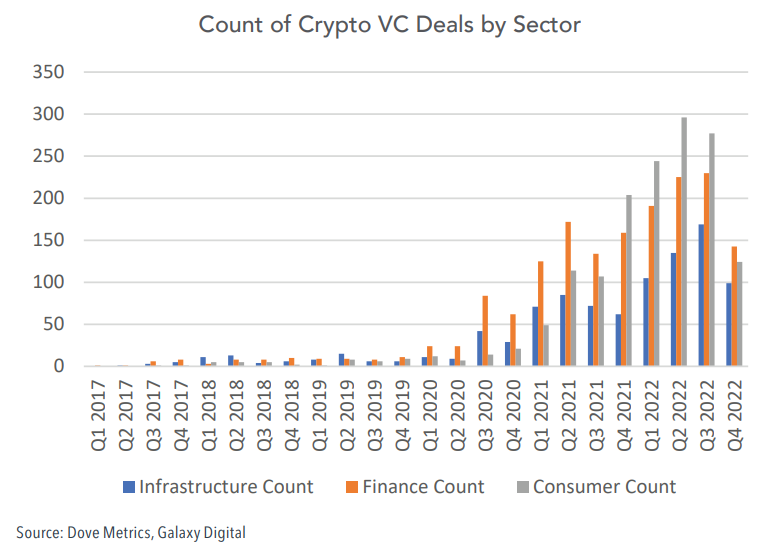

Can crypto bounce back from the damage done in 2022?

"The euphoria of the bull market gave a false sense that everything at the infrastructure layer was working flawlessly. While strong user adoption of a few breakout applications demonstrated a degree of scaling success, the industry is realizing that more infrastructure development is needed to make blockchain a seamless technology for mainstream users."

What Happens Now That the [Latest] Crypto Bull Market Is Over? (Evanston Capital)

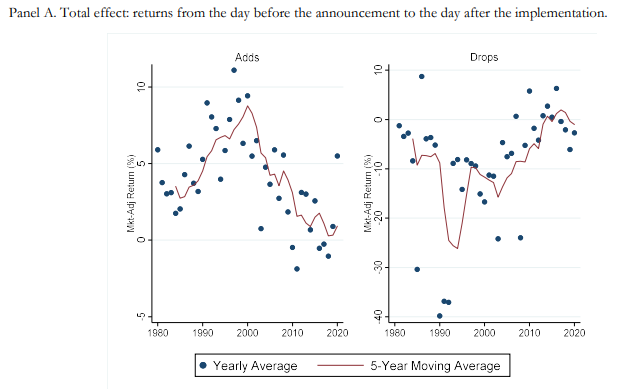

What happened to the index effect of abnormal returns for additions and deletions?

"Overall, the findings suggest an account along the following lines. In the 1980s, index changes were unanticipated, index funds were small, and there was mispricing in the market. As index funds grew larger, the mispricing deepened and turned into an opportunity. As a result, the market adjusted to take advantage of this opportunity, in part by better anticipating inclusions, and in part by creating arrangements where other institutions stood ready to sell to indexers upon inclusions, and companies sold their own stock into these events. This worked to eliminate the anomaly on average, despite demand shocks that continued to grow in magnitude over the 2000s and 2010s"

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.