The Paper Trail – July 2021

Welcome to the latest edition of The Paper Trail, a monthly compilation of the most interesting, thought-provoking and informative investment research I can find.

Housekeeping items:

- Each piece will be introduced with the primary question the authors aim to explore and/or answer.

- I’ll also include a memorable quote and visual from each one.

- Lastly, they are bucketed into two categories, sorted by estimated reading time – “bps” for the shorter ones and “pieces” for the longer ones.

Enjoy!

“bps” (reading time < 10 minutes)

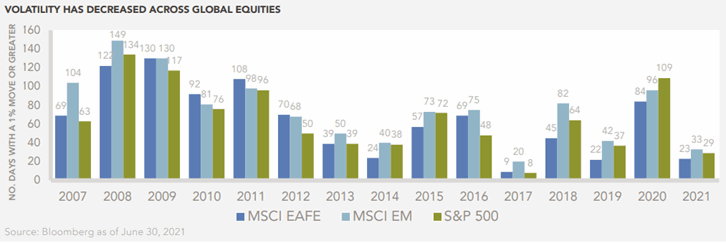

Should we expect an increase in volatility for the second half of 2021?

“While it would be imprudent of us to predict a market drawdown, there are a number of factors that have the potential to push volatility and trigger a possible market correction: mean reversion, the Delta variant, unexpected interest rate movements, and sustained inflation, among others. These dynamics have all been pretty quiet as of late, but don’t be surprised to hear more out of them — or one of their yet to identified brethren — in the coming months. Markets don’t stay quiet forever.”

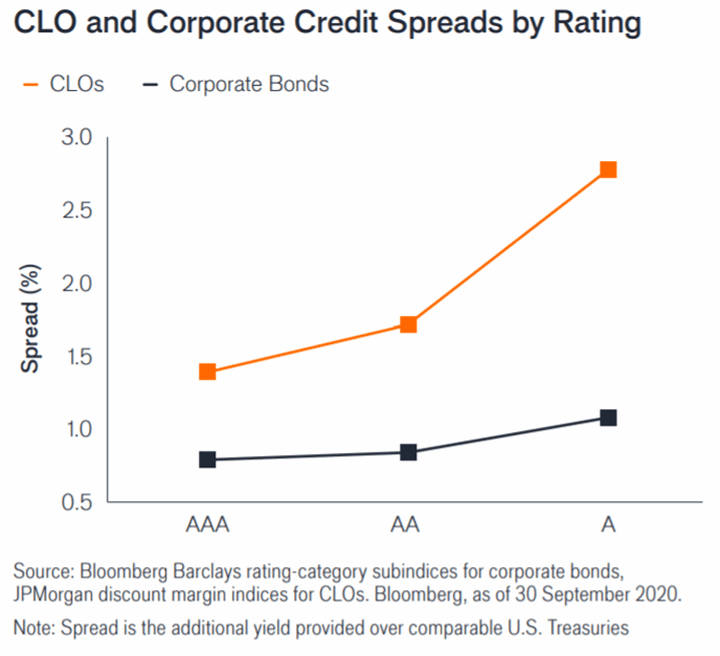

Do CLOs deserve a spot in a diversified portfolio?

“According to Moody’s, of the more than 5,000 CLO tranches outstanding in the nearly 20 years surrounding the GFC, only 1.1% were “impaired” in some way. And, no senior tranches – those rated Aa or Aaa – suffered any losses.”

The Case for Collateralized Loan Obligations (Janus Henderson)

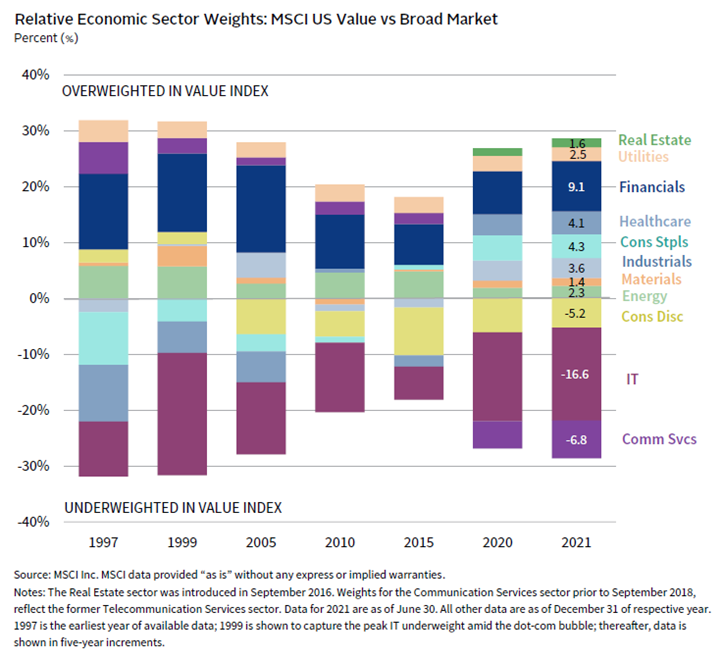

Will the recovery in value maintain its momentum?

“We expect the current rally in value equities will likely hold through at least this year, as global economic activity helps value-leaning cyclicals outperform. Beyond this year, the outlook is unclear and dependent on sustained higher levels of economic growth that would be supported by improvement in productivity, which would drive wages and demand higher. Such conditions could also help improve profitability among a broader range of companies than the dominant US large growth companies, encouraging mean reversion.”

VantagePoint: Can Value Outperformance Endure? (Cambridge Associates)

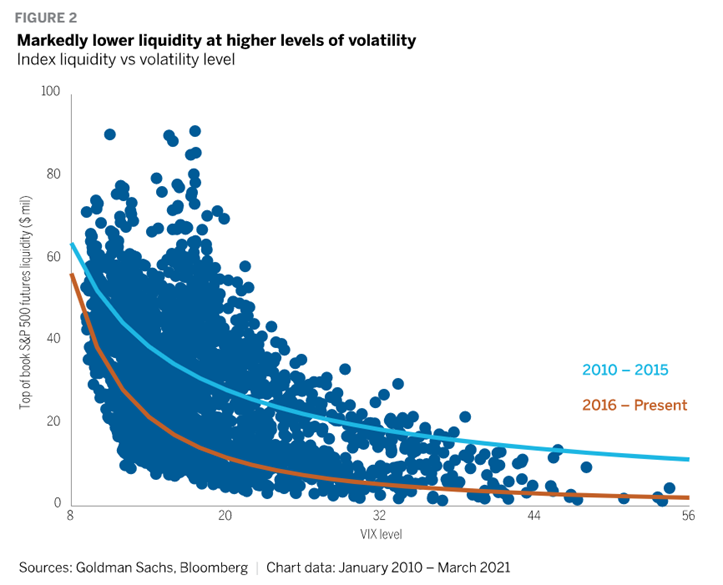

Are severe, liquidity-driven price dislocations going to be a fixture of markets for the indefinite future?

“Given the fragile liquidity equilibrium, we expect the market to be prone to moving dramatically from low volatility to high volatility, with the potential for that volatility to then de-escalate quickly once systematic strategies have reduced equity exposure.”

Why fragility is the new reality for the stock market (Wellington Management)

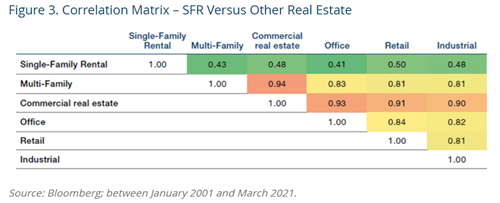

How does Single Family Rental (“SFR”) housing fit into a portfolio?

“It is worth stating that coronavirus is not the only reason for this appreciation: long before the pandemic, the growing cohort of millennials provided a demographic tailwind to the asset class. Some 67.5 million Americans are between 20-34 years old, an age group which are likely to buy or rent SFR as they look to get married and have children.”

Diversifying With Picket Fences: Single Family Rental Investments (Man Group)

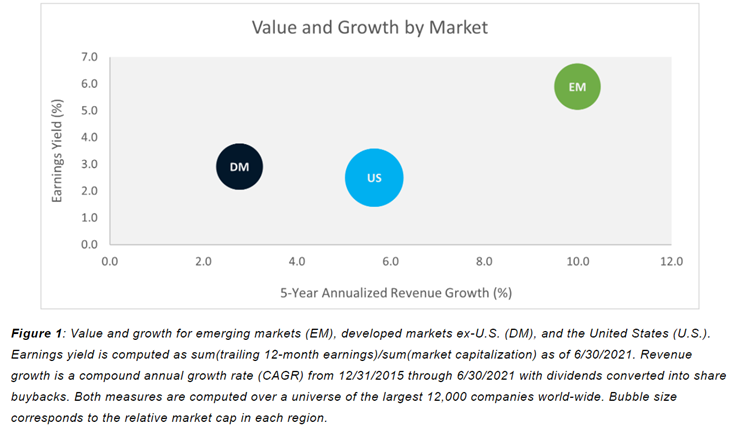

Is there still a compelling case or investing in Emerging Markets?

“EM companies are not cheap for lack of fundamental earning power either. In fact, they have higher growth and profit margins than both the U.S. and developed international regions. Valuations may be suppressed for other reasons, such as policy and ESG concerns, but if (or when) they revert to long-term fundamentals, the returns could be lucrative.”

Emerging Markets – The Growing Opportunity (O’Shaughnessy Asset Management)

“pieces” (reading time > 10 minutes)

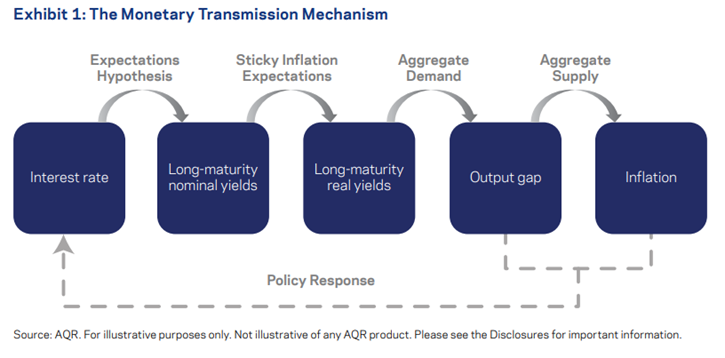

Do we really understand what makes bond yields tick?

“Despite “noise” to the contrary, and despite the exceptionally low yield environments we have witnessed, fundamentals continue to drive bond markets.”

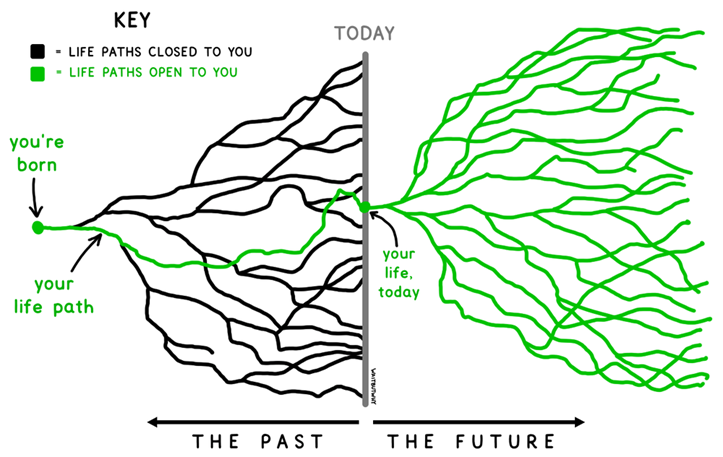

Can greater awareness in the present help inform better investing decisions in the future?

“By cultivating awareness, trying to slow down time, and finding the right questions to ask (e.g., working backward, what won’t change, pre-mortem analysis) we can attempt to create a landscape for decision making that allows us to see good fortune when it comes knocking and take the next incremental step toward a better future.”

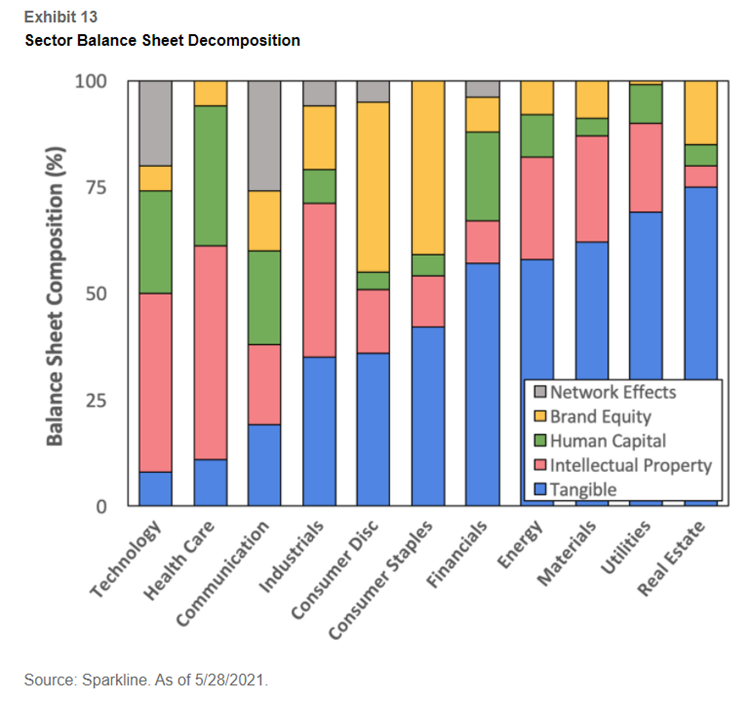

Can intangible value be measured?

“We believe that investors have a third option, which avoids having to make this false choice between “growth” and “value”. A more holistic definition of intrinsic value should produce an acceptable framework for both factions. This should allow investors to incorporate the intangibles that drive growth in the present day, while still keeping an eye on valuations. By giving companies credit for their intangible assets, we believe investors can own high-quality, modern portfolios without abandoning the value paradigm.”

Intangible Value (Sparkline Capital)

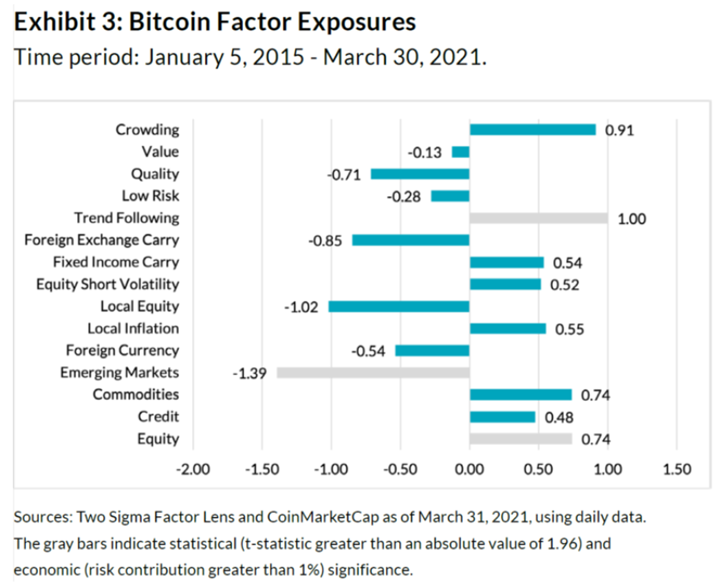

Can investors properly assess the risks of crypto assets in the context of a diversified portfolio?

“That being said, Bitcoin was not entirely orthogonal to the factor set–there did appear to be some meaningful relationships with existing risk factors, such as positive correlations with the global equity market and the tendency for BTC to behave like an inflation sensitive asset.”

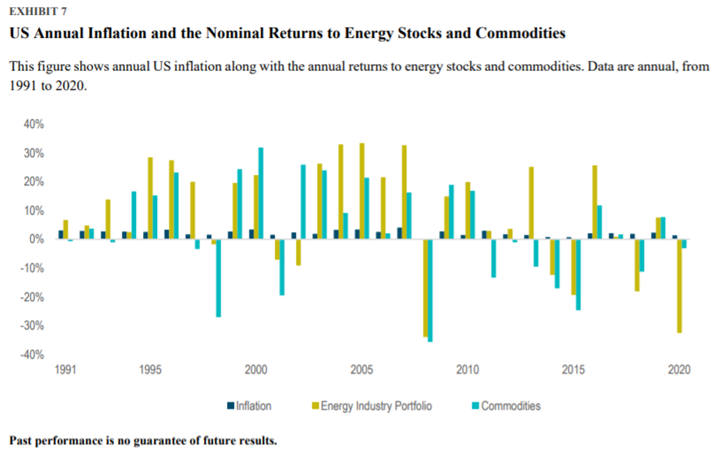

What does the empirical evidence tell us about the relationship between inflation and asset class returns?

“We find mostly weak correlations over time between nominal returns and inflation, including contemporaneous, lagged, expected, and unexpected inflation. In the few cases where the correlations were reliably positive, such as for energy stocks and commodities over 1991–2020, the assets’ returns were around 20 times as volatile as inflation and more than half of their nominal return variance was unexplained by inflation.”

US Inflation and Global Asset Returns (Dimensional Fund Advisors)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.