The Paper Trail – June 2021

Welcome to the latest edition of The Paper Trail, a monthly compilation of the most interesting, thought-provoking and informative investment research I can find.

Housekeeping items:

- Each piece will be introduced with the primary question the authors aim to explore and/or answer.

- I’ll also include a memorable quote and visual from each one.

- Lastly, they are bucketed into two categories, sorted by estimated reading time – “bps” for the shorter ones and “pieces” for the longer ones.

Enjoy!

“bps” (reading time < 10 minutes)

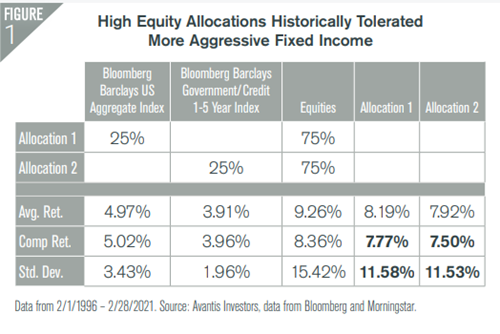

Should your equity allocation impact the composition of your bond allocation?

“While many investors have balanced allocations (some mix of equities and fixed income), if they are constructed in isolation it is more akin to having two portfolios—one that is 100% equity and one that is 100% fixed income.”

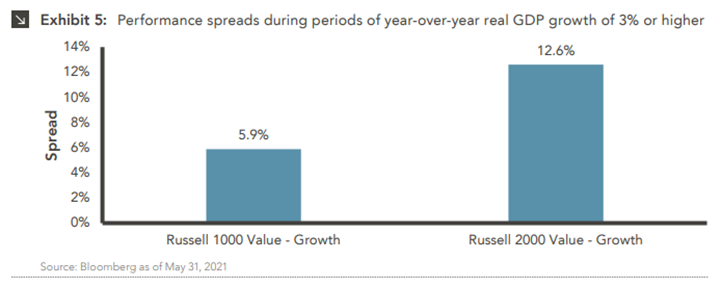

Is the recent outperformance from value stocks sustainable?

“Though style performance trends are notoriously difficult to predict, the current climate appears to be conducive to the continued strong performance of value-oriented equities due to attractive relative valuations and the prospects of sustained economic growth.”

Value vs. Growth: Where Do We Go from Here? (Marquette Associates)

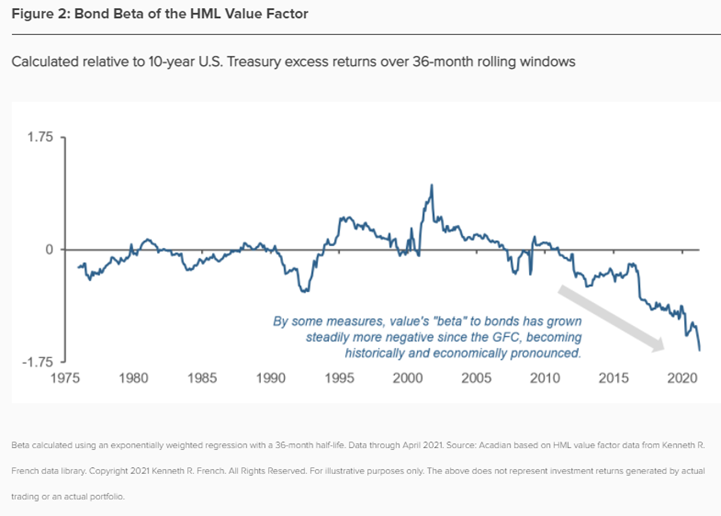

How tight is the relationship between interest rates and the value premium?

“Recent academic research has cast doubt on the significance of the duration effect, finding that cash flows of growth stocks do not actually grow meaningfully faster than those of value stocks (Chen 2017). Moreover, we believe that any causal relationship is often overwhelmed by forces that separately influence interest rates and value returns, including the state of the economy, the policy environment, and market sentiment.”

Value and Interest Rates: Don’t Believe (All) the Hype (Acadian Asset Management)

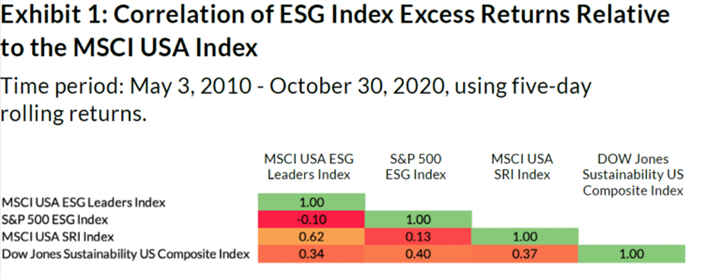

Why is it so challenging to define ESG?

“To provide a hypothetical example of why E, S, and G shouldn’t be grouped together as one single factor, consider an electric car company. On the surface at least, the company’s product might be great for the environment long-term. But upon closer examination, the company’s international labor standards may be deficient, and a single shareholder possesses enough voting rights to singlehandedly make key corporate decisions. Depending on how one weights the components, the stock could rate average or even poorly on ESG in aggregate.”

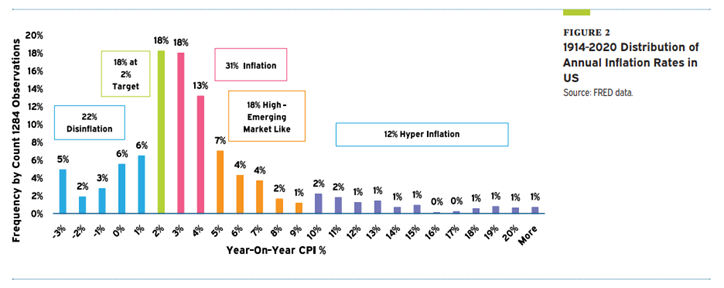

Should inflation stay or should it go now?

“If the inflation beast has been seemingly tamed, why are we worried about it today? The primary reason is that this time, there is unprecedented non-war time fiscal stimulus accompanying the monetary stimulus. And much of the planned spending is set to take effect at a time when the economy will have likely already mostly, if not fully, recovered from the effects of the pandemic. What we do not know is exactly how much additional spending will take place. Likewise, we do not know how the Fed will respond if inflation ticks up.”

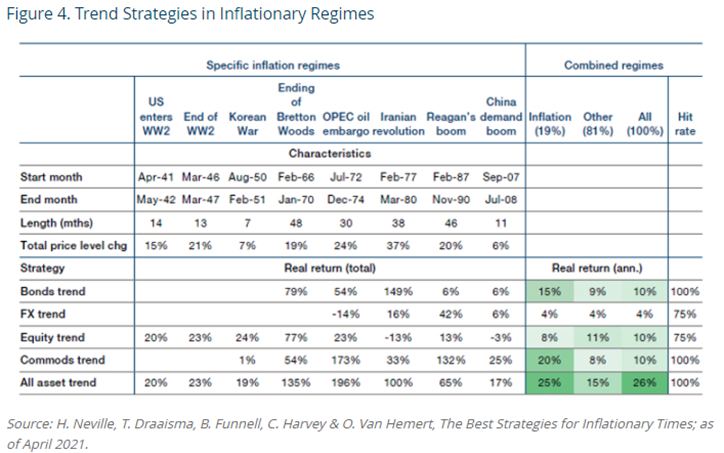

Can trend-following be an arrow in your portfolio’s quiver if we enter a sustained inflationary regime?

“The large moves posted by assets in inflationary times seem particularly well suited for a trend-following approach to capture.”

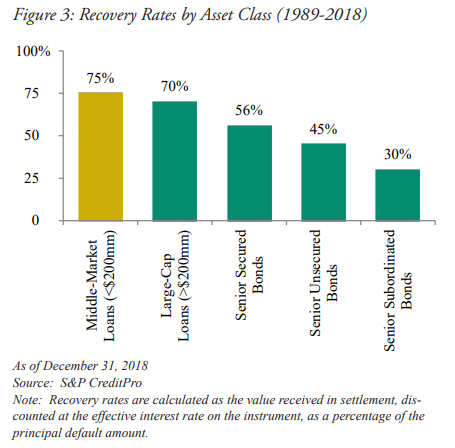

Is there a compelling case for Direct Lending as a strategic allocation within a diversified portfolio?

“Direct lending portfolios, if structured properly, have the potential to generate returns similar to or higher than those of other credit investments such as BSLs, but with less risk. Additionally, an allocation to direct lending enables investors to gain exposure to private-equity-sponsored deals without assuming the same level of risk as equity investors.”

Direct Lending: Benefits, Risks and Opportunities (Oaktree Capital)

“pieces” (reading time > 10 minutes)

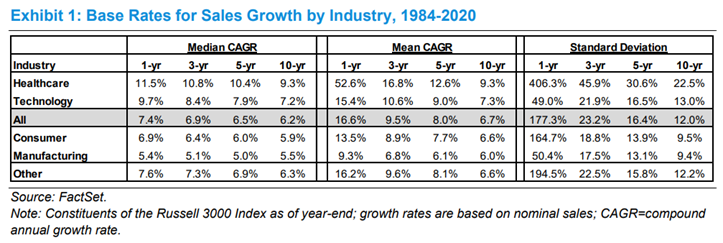

Are historical base rates still a relevant way to establish forecasts in today’s world?

“One important point to bear in mind is that outcomes of a proper reference class can change over time. That Amazon’s sales growth is on pace to be greater than anything we have seen in the past 70 years proves the point. That means that base rates can be very instructive but are not the final word. Indeed, there is reason to believe that some measures of corporate performance are shifting because the nature of business has changed.”

The Impact of Intangibles on Base Rates (Counterpoint Global)

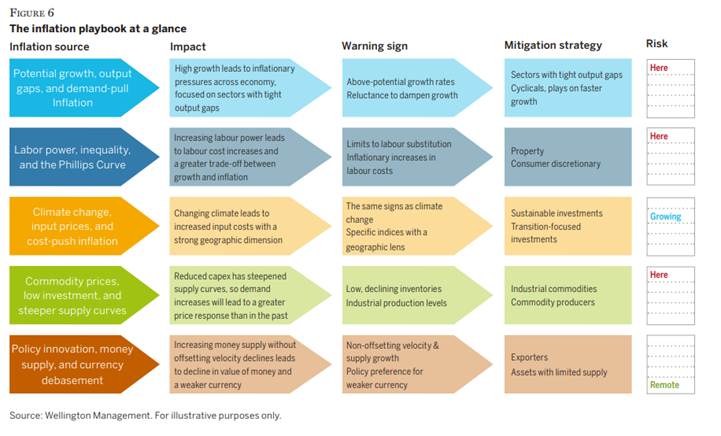

How important is the source of inflation in determining the appropriate “playbook” to manage its risk?

“Where the inflation is coming from plays a critically important role in determining its impact on a portfolio, what “red flags” (warning signs) to look for in each case, and suitable mitigation strategies to employ in defense of the portfolio.”

A Source-Based Approach to Managing Inflation Risk (Wellington Management)

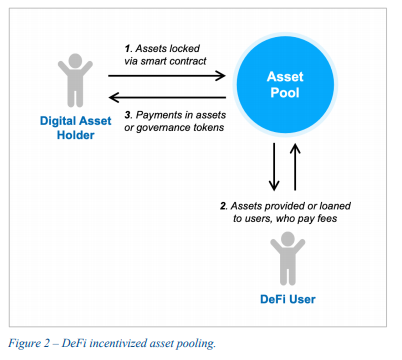

What is Decentralized Finance, or “DeFi”, and why should I care?

“Like blockchain technology more generally, DeFi has an enthusiastic base of evangelists, who promote its potential for efficiency, transparency, innovation, and financial inclusion. It also has its critics, risks, and unknowns.”

DeFi Beyond the Hype: The Emerging World of Decentralized Finance (Wharton)

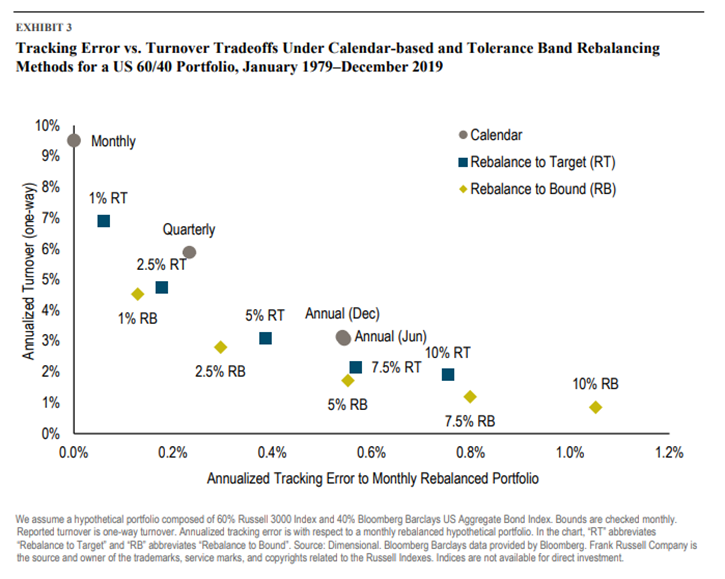

Is there an optimal way to rebalance a portfolio?

“We identify a clear tradeoff between tracking error—performance differences relative to the target asset allocation—and turnover—a proxy for rebalancing costs. This tradeoff can help guide investor choices when deciding between rebalancing approaches. Rigid calendar-based approaches can lead to less efficient rebalancing tradeoffs—lower turnover for a given level of tracking error and vice versa—compared to deviation-based approaches.”

Portfolio Rebalancing: Tradeoffs and Decisions (Dimensional Fund Advisors)

Sign up to receive the latest insights from Phil Huber

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.