The Paper Trail – March 2021

Welcome to the latest edition of The Paper Trail, a monthly compilation of the most interesting, thought-provoking and informative investment research I can find.

Housekeeping items:

- Each piece will be introduced with the primary question the authors aim to explore and/or answer.

- I’ll also include a memorable quote and visual from each one.

- Lastly, they are bucketed into two categories, sorted by estimated reading time – “bps” for the shorter ones and “pieces” for the longer ones.

Enjoy!

“bps” (reading time < 10 minutes)

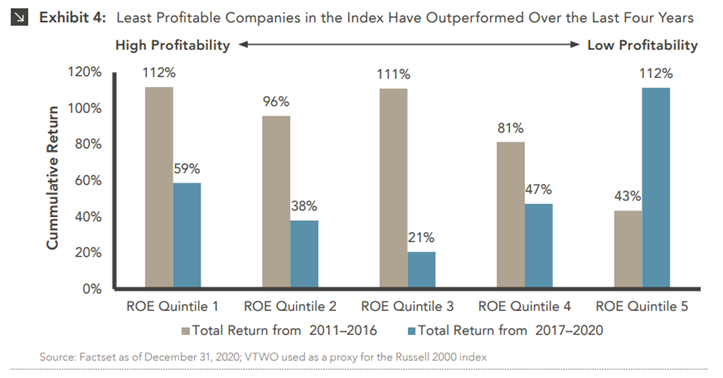

Why is quality so important when investing in small-cap stocks?

“It is difficult to say when this speculative period in the small-cap market will simmer. As of year-end, more than 30% of the Russell 2000 index is comprised of non-earning companies.”

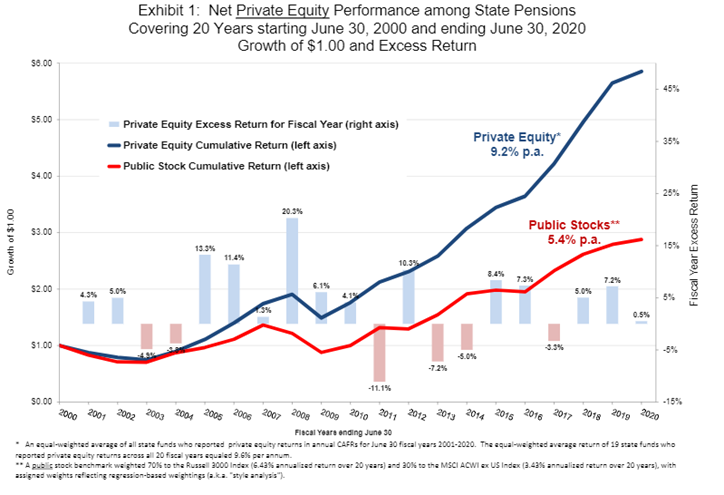

Does the long-term performance of private equity justify its higher fees and illiquidity?

“A familiar narrative is that private equity returns are failing to deliver the excess return over public stocks compared to years past. Our study finds no such evidence.”

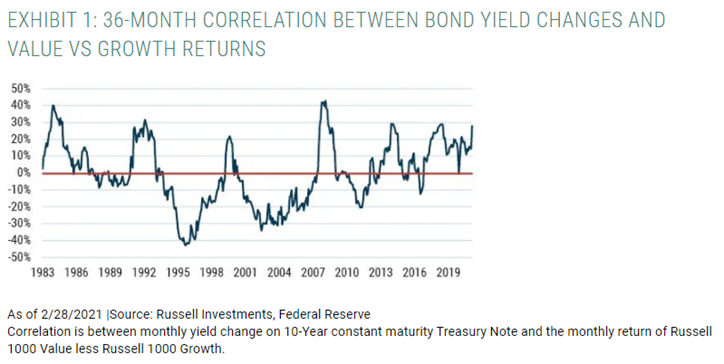

What is the impact of interest rate fluctuations on value and growth stocks, respectively?

“Neither value nor growth indices hold a constant set of securities through time, and this inherent turnover (“rebalancing”) has profound effects on the returns they deliver over time. This turnover pulls the effective duration of value and growth stocks quite close together.”

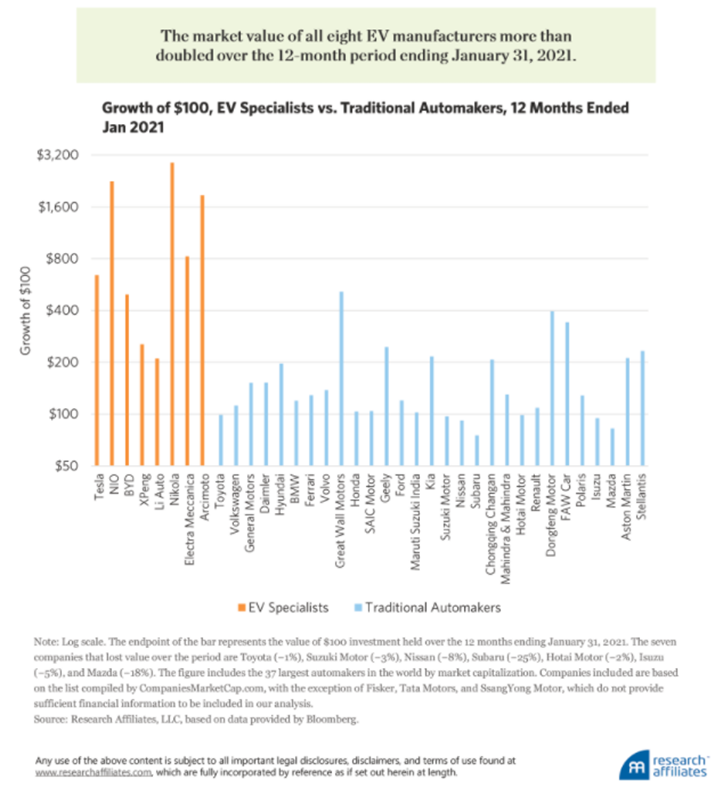

Are investors in Electric Vehicle stocks suffering from delusion?

“The simple fact, as Warren Buffett so cleverly stated, is that technology does not translate into great fortunes for investors unless it is associated with barriers to entry that allow a company to earn returns significantly in excess of the cost of capital for an extended period. Of course, Apple, Google, and Facebook are well-known examples of such technological success, but they are the exception rather than the rule.”

Big Market Delusion: Electric Vehicles (Research Affiliates)

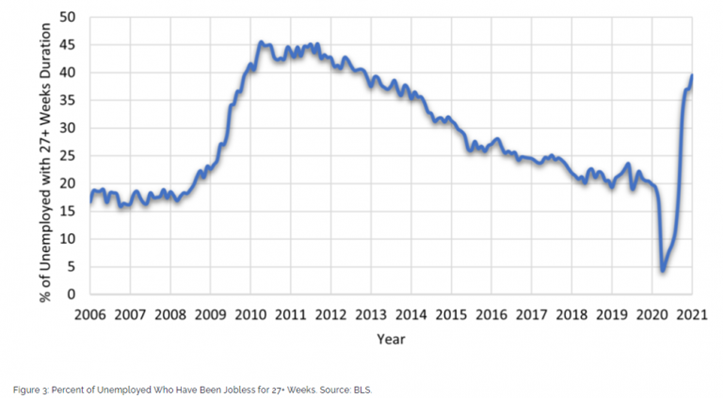

What are the implications of the economic recovery for small-to-midsized businesses?

“The economy is poised for a short-run boost to consumer demand and economic growth at the same time that it is vulnerable to considerable medium-term uncertainty regarding the pace of recovery in the labor market and among the smallest of small businesses that will determine the degree of long-run scarring.”

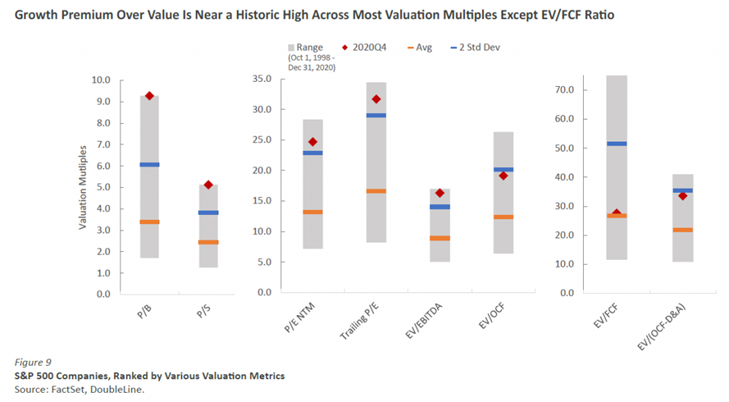

Are proclamations of value investing’s demise predicated on unfounded misconceptions?

“To paraphrase Mark Twain, the reports surrounding the death of value investing have been greatly exaggerated. Indeed, value stocks have rarely, if ever, appeared so attractive relative to growth stocks.”

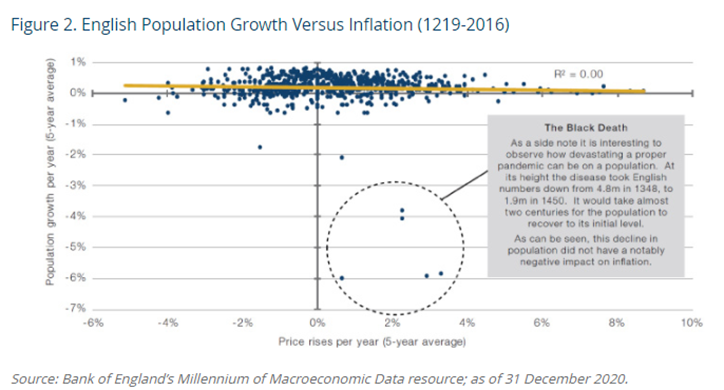

What are the inflation ramifications of aging populations?

“The effect of demographics is simply felt far slower. To be fair, in our experience, even proponents of ‘demographics is destiny’ admit that there are policy choices that could create inflation in any demographic environment.”

“pieces” (reading time > 10 minutes)

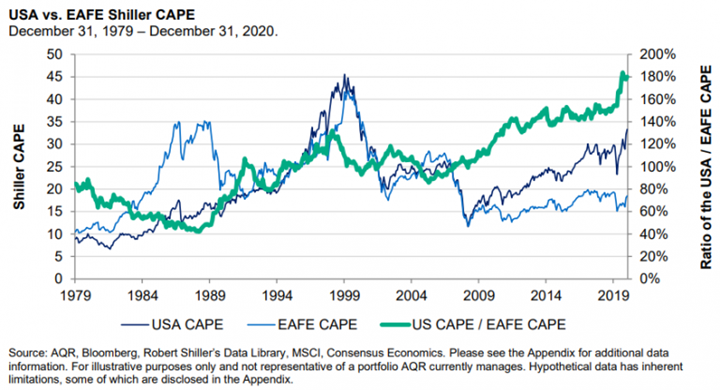

How influential are valuation changes when estimating long-term expected returns?

“So, when we adjust for the change in relative valuation, the return differential shrinks from an economically (if not statistically) significant 2.1% per annum to an insignificant (both ways) forty basis points. The victory of the USA over EAFE for the last forty years is almost entirely coming from it getting relatively more expensive.”

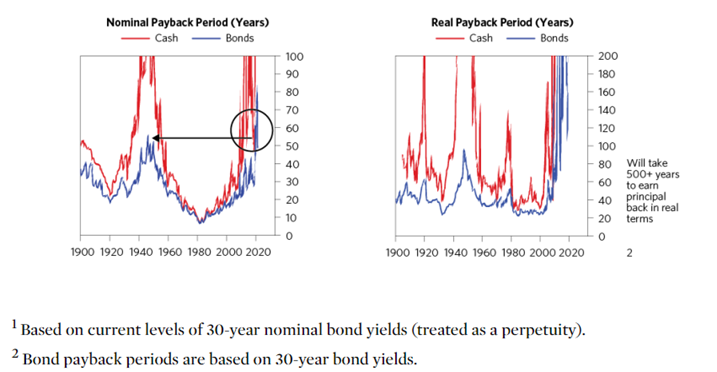

Is there a strong case for owning bonds in today’s environment?

“If bond prices fall significantly that will produce significant losses for holders of them, which could encourage more selling. Bonds have been in a 40-year bull market that has rewarded those who were long and penalized those who were short, so the bull market has produced a large number of comfortable longs who haven’t gotten seriously stung by a price decline.”

Why in the World Would You Own Bonds When… (Bridgewater Associates)

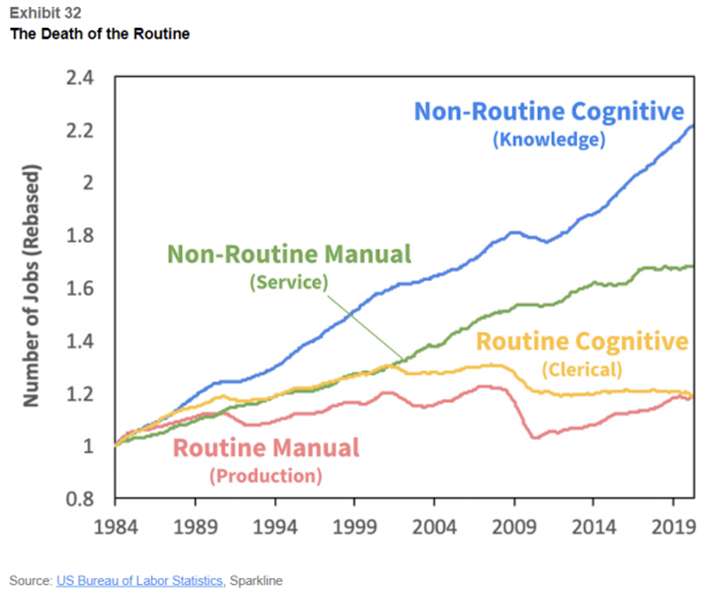

Should investors incorporate intangible human capital assets when evaluating stocks?

“As the growth of human knowledge accelerates, the fortunes of companies will increasingly depend on making continual investments in highly skilled and adaptable workforces.”

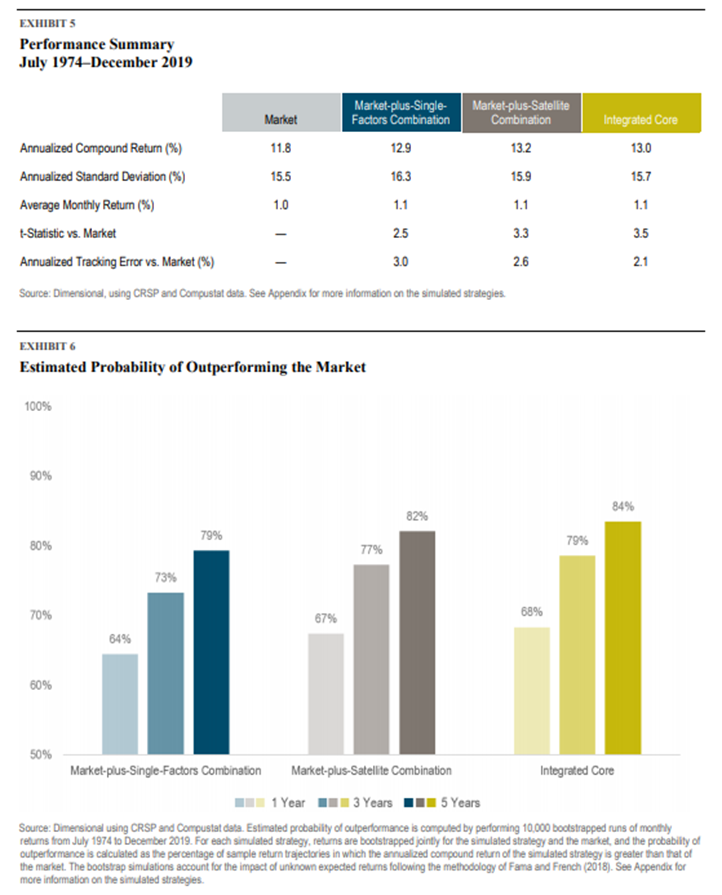

What is the most efficient way to pursue multi-factor portfolios?

“Size, value, and profitability premiums do not exist in a vacuum—a sort on one variable tends to produce simultaneous dispersion in the other characteristics. For example, smaller cap and deeper value firms tend to have lower profitability, so a sort on market capitalization or relative price also results in differences in profitability. Overlooking interactions between premiums may lead to an offsetting emphasis on the premiums and suboptimal portfolio construction.”

Pursuing Multiple Premiums: Combination vs. Integration (Dimensional Fund Advisors)

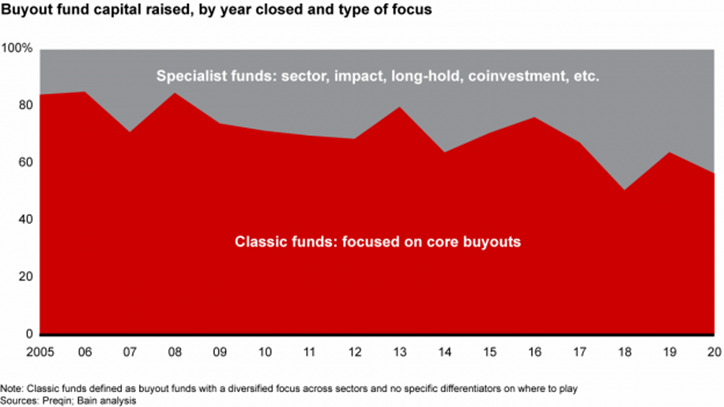

What does the future hold for the classic private equity buyout fund?

“It’s not that there’s a need for more capital. What the market is craving are clever new ways to find and create value.”

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.