The Paper Trail: Metaversal Truths

So here we are. Christmas is in the rearview mirror and investors are clamoring for a much-anticipated Santa Claus rally to close out the year. In many ways, 2021 was calmer and less stressful than 2020. In other ways, it was a heck of a lot weirder.

As we continue to navigate yet another variant of Covid, suddenly the prospect of the Metaverse doesn't seem so bad. But while we still inhabit the physical world, it's worth heading into 2022 with eyes wide open for our portfolios.

With that in mind, I present this year's final edition of The Paper Trail!

“bps” (reading time < 10 minutes)

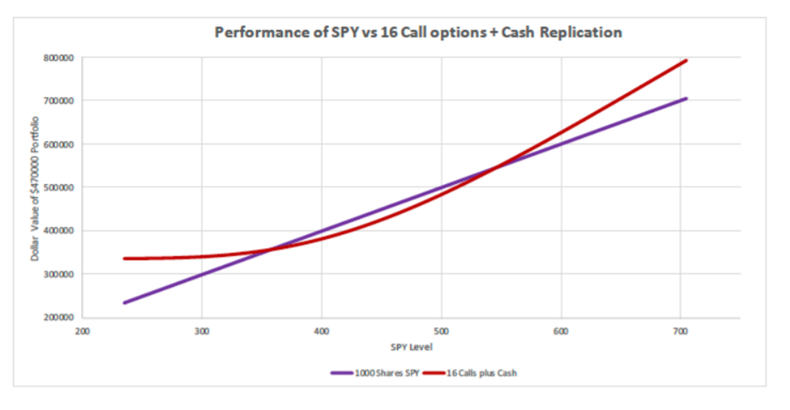

Can the average investor introduce positive convexity into their portfolio?

"It is likely the FED has (temporarily) broken the correlation between interest

rates and inflation. Thus, it is indisputable that Implied Volatility is way too low

since the range of possible outcomes is now much wider. As such, adding

positive Convexity to one’s portfolio should be seriously considered."

Unbalanced Leverage (or Options for Civilians) (The Convexity Maven)

Unbalanced Leverage (or Options for Civilians) (The Convexity Maven)

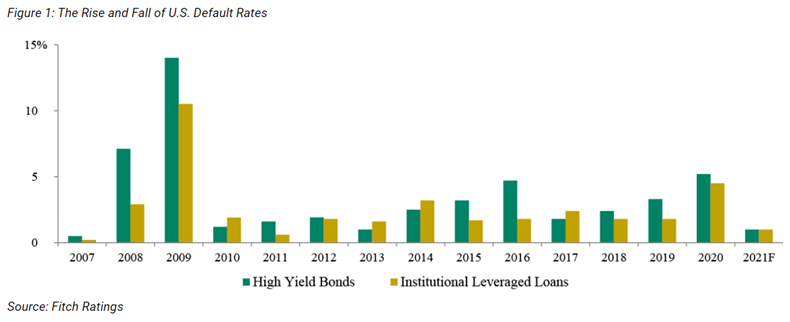

Is distressed investing still a thing?

"Distressed credit has continued to play a significant role in the strategies of many opportunistic investors and will likely continue to do so moving forward, given that sector- and company-specific dislocations occur even when markets are strong and default rates are low overall. But locating these opportunities, tackling them quickly, and avoiding the value-reducing pitfalls common in today’s expensive bankruptcy system is challenging and often requires extensive experience, market relationships and a large capital base."

Global Opportunity Knocks: The Evolution of Distressed Investing (Oaktree Capital)

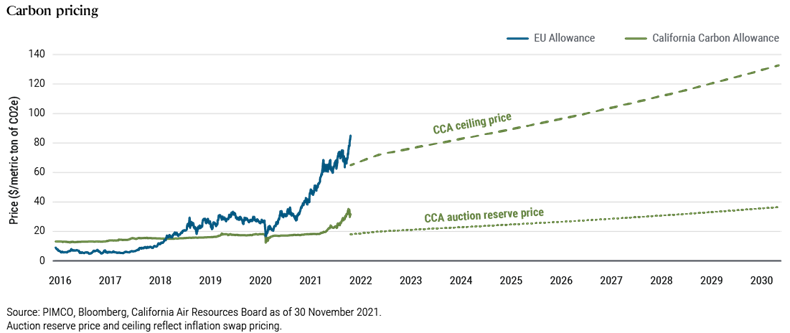

Is there a supply-demand imbalance in the market for California Carbon Allowances (CCAs)?

"As covered entities struggle to find cost-effective ways to reduce emissions, many are expected to opt to keep emitting and purchase more allowances. This continued demand coupled with steadily falling supply is expected to increase the price for allowances and the rising market-based price gives participants an incentive to find the most cost-effective way to reduce emissions."

Carbon Cap‑and‑Trade: We See a Compelling Opportunity (PIMCO)

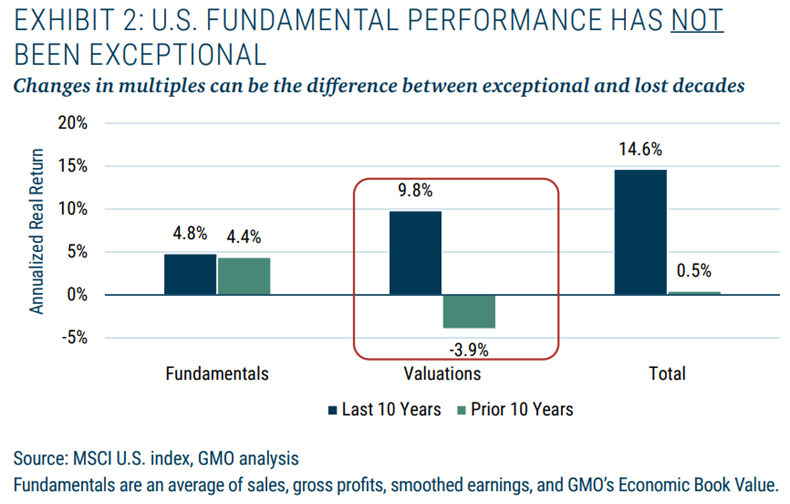

Is now the time to shift away from U.S. equities and towards non-U.S. equity markets?

"No one reading this quarterly will be surprised to see the U.S. equity market as the leading performer over the last decade, but some may be surprised to learn that Japanese companies delivered the best fundamental performance over that same period."

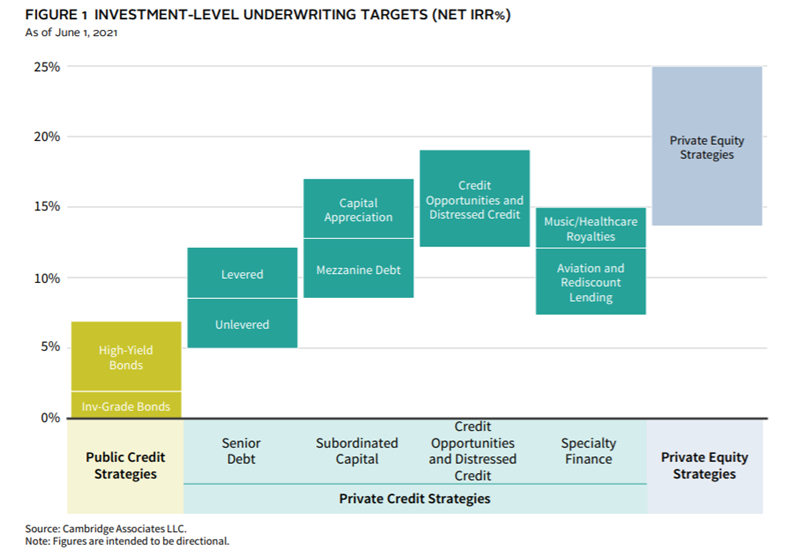

What role should private credit play in a multi-asset portfolio?

"Private credit is not a monolith but rather consists of several different investment strategies. One feature that generally makes these compelling investments in a total portfolio versus, for example, equities, is the contractual return that exists in private credit."

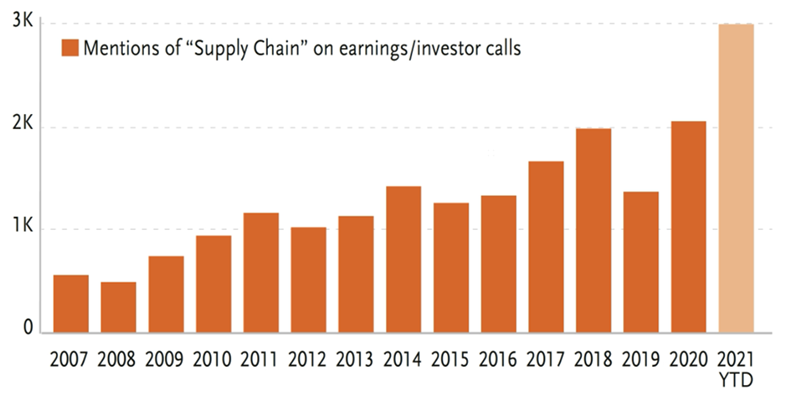

Will the Fed be able to put the inflation "tiger" back in its cage?

"The cautionary tale here is that the reason it took a decade or more to extinguish the U.S. inflation of the 1960s is that once inflation gets started, it becomes its own “cause.” As prices rise, people naturally extrapolate the continuation of those price rises. The perceived future value of the currency falls and cascading distrust in the fiat alters the behaviors of buyers, sellers, and investors. If you expect your money to be worth less tomorrow, you will behave accordingly."

Picasso’s Napkin: Inflation is the Path of Least Resistance (TCW)

“pieces” (reading time > 10 minutes)

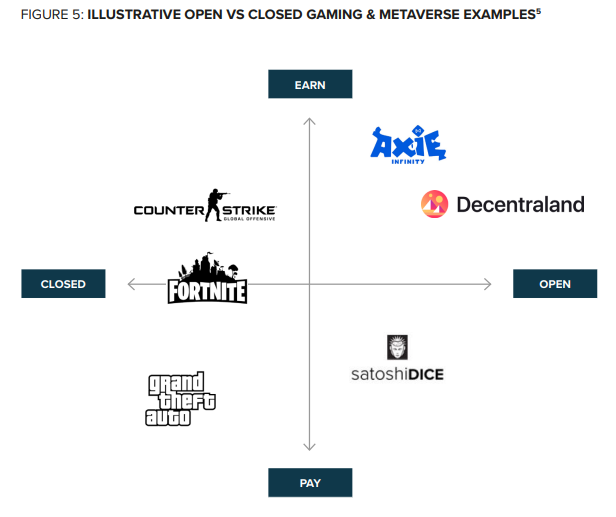

Is the "metaverse" something investors should be paying attention to?

"Gaming is just one of the most immediately addressable segments where

value is already starting to naturally shift to Web 3.0, but the Metaverse

opportunity extends far beyond gaming. The Metaverse is estimated to be a

trillion-dollar revenue opportunity across advertising, social commerce, digital

events, hardware, and developer/creator monetization. "

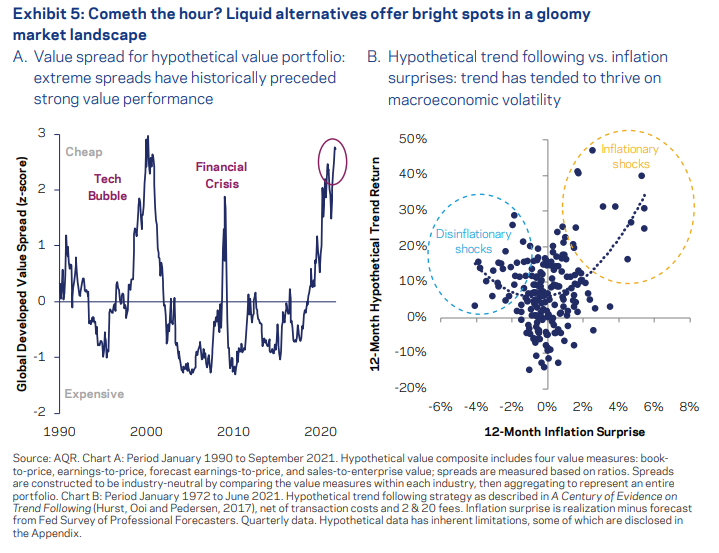

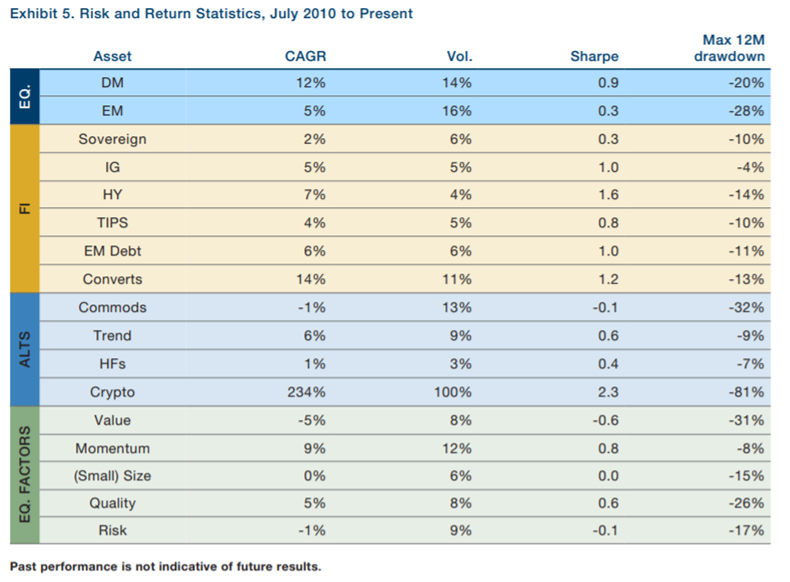

Do liquid alternatives deserve a second look?

"And because they take both long and short positions, many liquid alternatives can both hedge macroeconomic exposures (like inflation risk), and mitigate the pervasive impact of low yields on expected returns. Indeed, some strategies, such as equity value, are looking particularly attractive in late 2021. Others, such as managed futures or trend following, may thrive if the next decade sees greater macroeconomic turmoil than the last."

Has Crypto earned a permanent place in a diversified portfolio?

"So this is the wrinkle. The risk-adjusted return may be attractive but whether investors have the behavioral gumption to hold the line through the drawdowns, thereby achieving those numbers, is far from certain. "

The $64,000 $65,000 $57,000 Question: Bitcoin’s Place in Multi-Asset Portfolios (Man Group)

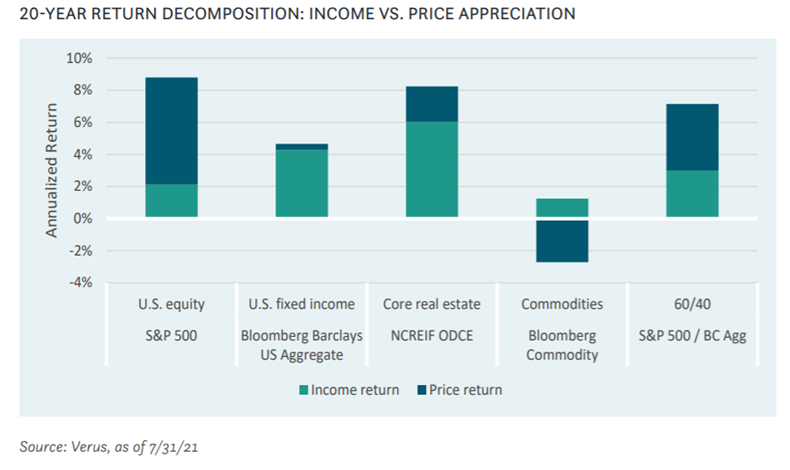

How does the current low-yield dynamic affect of the role of income in a portfolio?

"These dynamics suggest that: 1) overall portfolio returns will likely be lower in the future, 2) investors may need to place greater focus on price appreciation in order to reach their investment objectives, and 3) a greater emphasis on price appreciation may come hand-in-hand with increased portfolio risk and uncertainty due to the less dependable nature of price appreciation as a source of return."

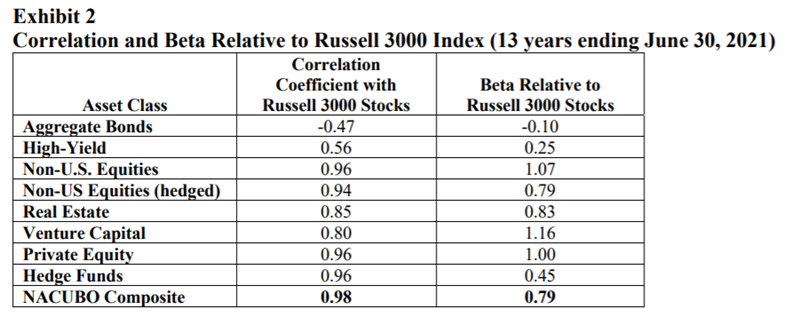

Are "endowment model" returns just the U.S. equity market factor in disguise?

"The overall effect is evident in the statistics for the NACUBO composite itself: It has exhibited a beta of nearly 0.8 with the US stock market over the 13-year period by virtue of its near perfect correlation with it. And thus, the US equity factor reveals itself as the prime driver of endowment returns."

The Modern Endowment Story: A Ubiquitous US Equity Factor (Richard Ennis)

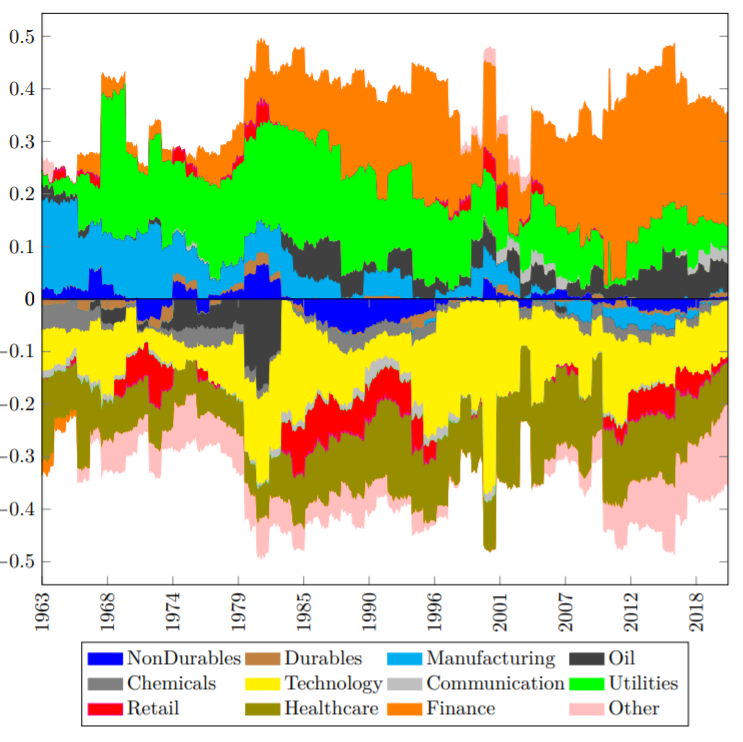

Should long-only and/or long-short factor investors hedge their implicit sector bets?

"We show both analytically and empirically that the long–short investor is more likely to benefit from hedging out sector bets, whereas the long-only investor is more likely to benefit from investing in the factor as it stands. "

Is Sector-neutrality in Factor Investing a Mistake? (Campbell Harvey, Feifei Li, and Sina Ehsani)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.