The Paper Trail: Navigating the Hype

The dog days of summer are in full force. And as we all look for ways to navigate the heat, investors are left to navigate a delicate balance of hype and hysteria.

I hope you're all finding time for some rest and relaxation this summer. And what better way to get some R&R than to kick back, pop open a cold beverage, and enjoy some of the finest investment research from the month of July!

Please enjoy the latest edition of The Paper Trial, featuring:

- Decomposing yields in private debt

- S&P 500 valuation and concentration

- Design choices for risk-mitigating portfolios

- Protecting against "Minsky Moments"

- Parallels between the current AI hype cycle and the Dot Com bubble

- Life before index funds

- Best practices for writing investment memos

- Dynamic factor timing

- Looking back at the wild ride of IPOs/SPACs from 2020/21

- And much more!

“bps” (reading time < 10 minutes)

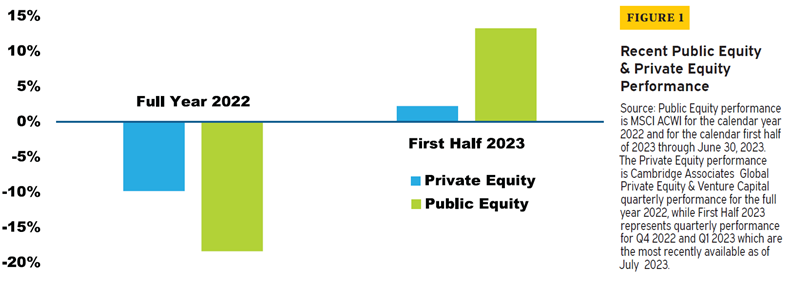

How should investors expect private equity to perform relative to public market stocks?

"While in some ways, equity is equity, whether private or public, there are some important distinctions between public and private. The observed volatility for private equity appears to be less than public equity. Driving this is that unless there is a significant event, private equity portfolio company valuation models tend to result in much more stable values than those determined in daily priced public markets."

Lag effect in Private Equity, or “Where are my returns?” (Meketa)

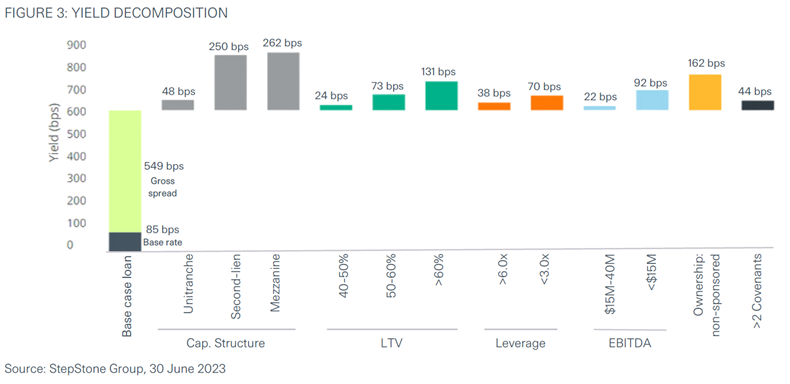

What are the sources of return in private debt?

"The attractive returns that direct lending can provide, compared to public debt, are commonly broken down into a combination of illiquidity premium and complexity premium. We find this framework to be a bit wanting."

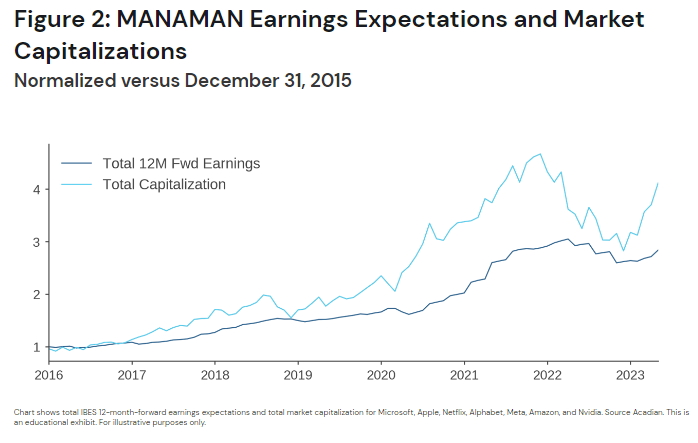

Have U.S. equities gone too far, too fast?

"While the U.S. large-cap growth runup has a basis in economics and fundamentals, we provide evidence that valuations have become stretched. Based on that view, we believe that U.S. large-cap growth has again become expensive and, by extension, that other markets and market segments look relatively attractive"

U.S. Equities: Back to the Future? (Acadian Asset Management)

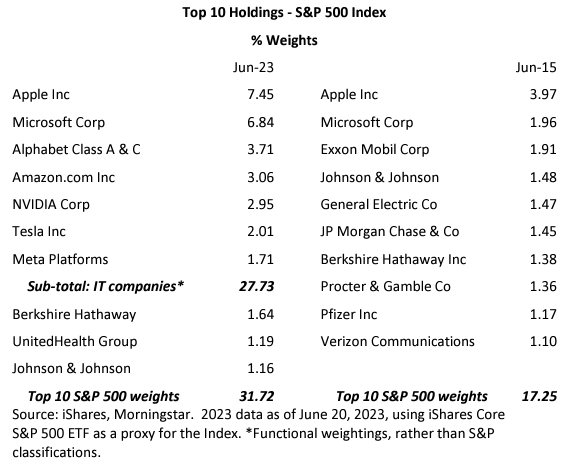

Has the S&P 500 become too concentrated?

"So, the S&P 500 is in something of a bind. If the technology giants—whose index weight is far higher than is represented by the current sector classifications—continue to grow, the S&P 500 will indeed cease to be useful as an index. If the opposite happens, the index will embody a massive concentration of risk because there is no valuation margin of safety in the event of declining profits."

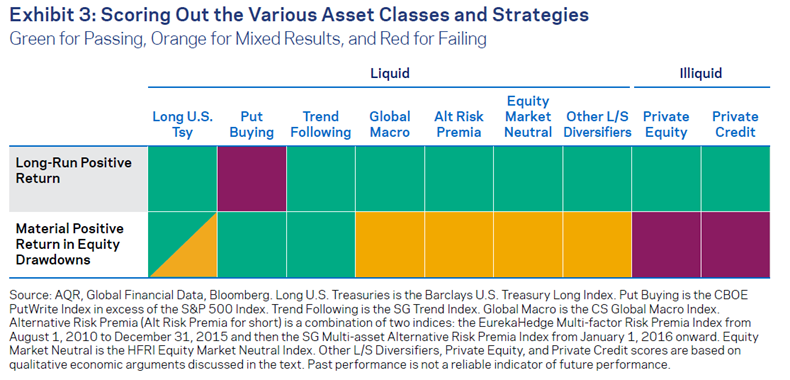

What are the key design choices for successfully implementing a risk-mitigating portfolio?

"Our criteria for selecting risk-mitigating strategies are straightforward. First, the strategy should deliver a long-run positive expected return—mandate number one. Secondly, the strategy should earn a material, positive expected return during both growth and inflation-driven equity drawdowns — mandate number two."

Key Design Choices When Building a Risk-Mitigating Portfolio (AQR)

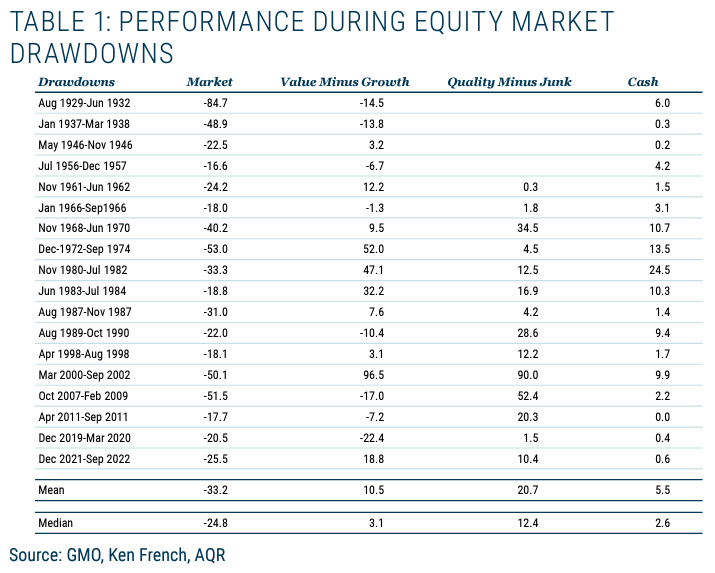

What are the best strategies to protect investors against systemic vulnerabilities, or "Minsky moments"?

"Value versus Growth generally does pretty well during equity drawdown events (especially if Financials are excluded). It isn’t as good a hedge as quality versus junk, but the valuation differential suggests it has good long-term store of value potential. To me this offers the best way of dealing with the timing uncertainty created by the prevalence of slow burn Minsky moments."

“pieces” (reading time > 10 minutes)

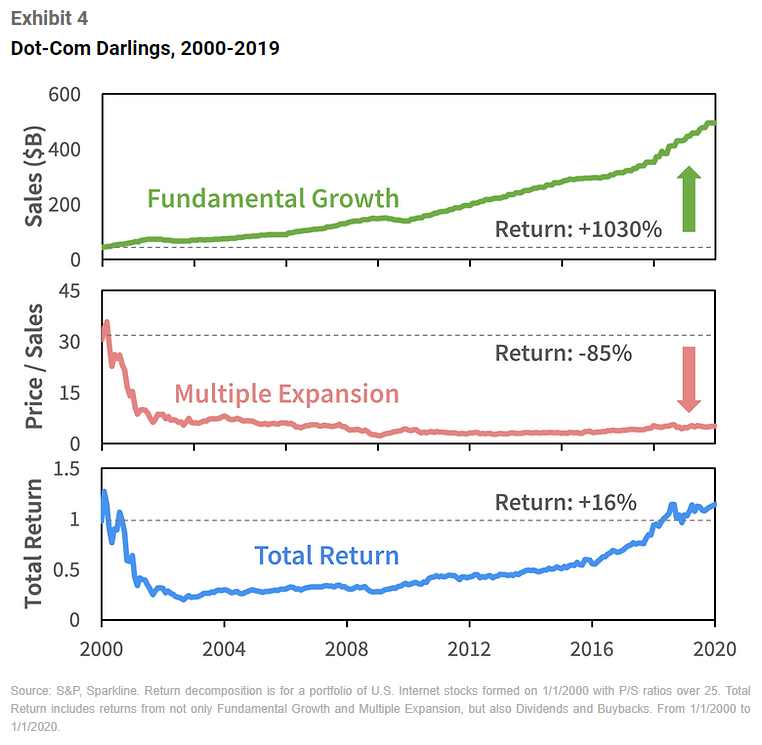

Is the AI hype cycle going to rhyme with the history of the dot com bubble?

"As the Age of AI dawns, investors will be presented with many exciting opportunities. However, based on studies of past technological revolutions, investors must remain wary of the runaway hype that accompanies innovation."

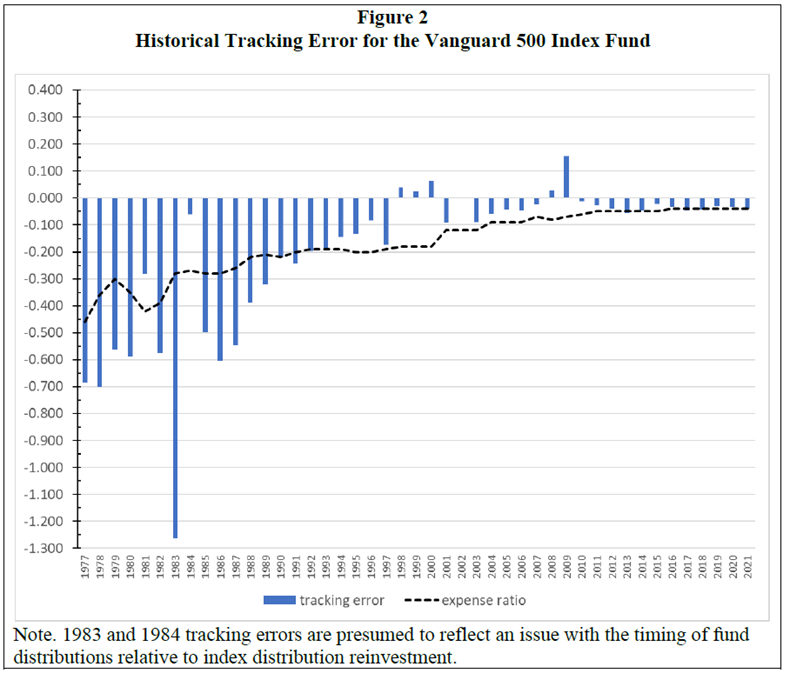

Could investors from prior generations have actually earned market returns?

"Investors in earlier decades might only have received 90% of the market return if they had to deduct a combined 100 bp annually of management fees and trading expenses; or as little as 80%, if all-in costs totaled 200 bp (Bogle 2005, 2016). Collectively, fund investors could not have received anywhere close to the market return, after subtracting expenses and trading costs, plus manager errors in security selection or investment timing (Sharpe 2013). Compounded over decades, wealth accumulation in fact must have been measurably lower relative to the no-cost values tabled in a publication like the Stocks, Bonds, Bills & Inflation yearbook."

Before Index Funds: How Much of the Market Return Could Investors Have Got? (Edward F. McQuarrie)

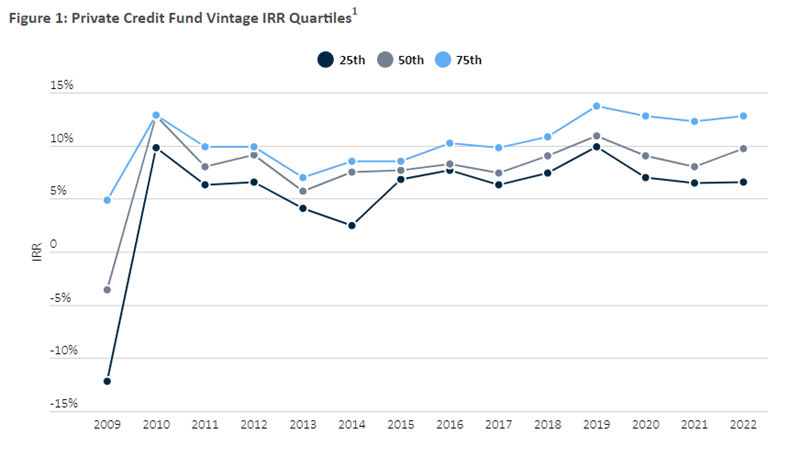

How important is manager selection within private credit?

"We believe a private credit manager must have three key characteristics to avoid losses and produce alpha – a proven approach to underwriting, a differentiated approach to originating and winning deals, and a capital base that matches their opportunity set."

In Private Credit Manager Selection, the Devil is in the Diligence (Adams Street Partners)

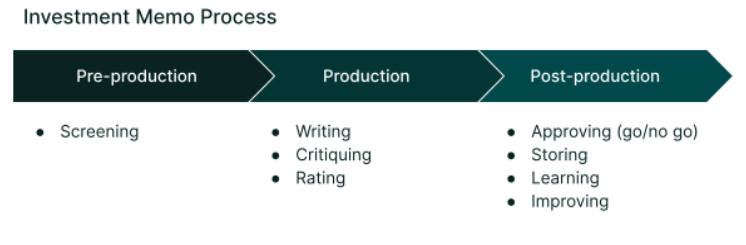

What makes for a good investment memo?

"The professional investors we studied are all strong performers among their peer groups. Although investment memos aren’t the sole ingredient to their success, it’s safe to assume that solid memos — and the processes for crafting them — are clear enablers of that success."

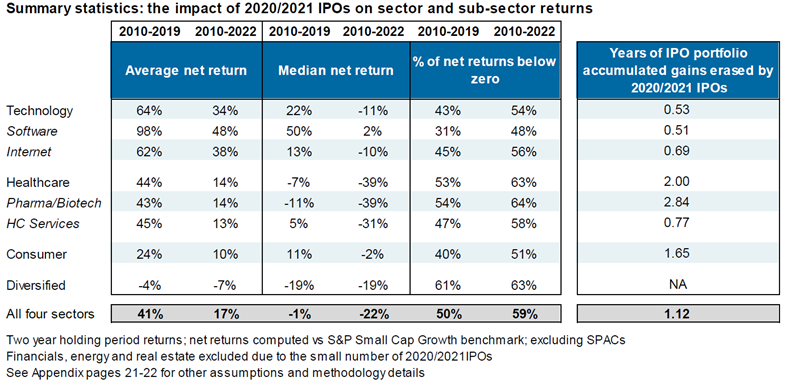

How bad of a train wreck were the 2020/20201 IPO vintages?

"The table compares IPO returns over the 2010-2019 period with the 2010-2022 period in order to assess the impact of 2020/2021 IPOs. The poor relative performance of IPOs during these two vintage years drove down average and median net returns sharply, and across most sectors. For example: average healthcare net returns were 44% for 2010 - 2019, but after including 2020/2021 IPOs net returns fall to 14% for the 2010-2022 period."

Mr. Toad’s Wild Ride: The impact of underperforming 2020 and 2021 US IPOs (J.P. Morgan)

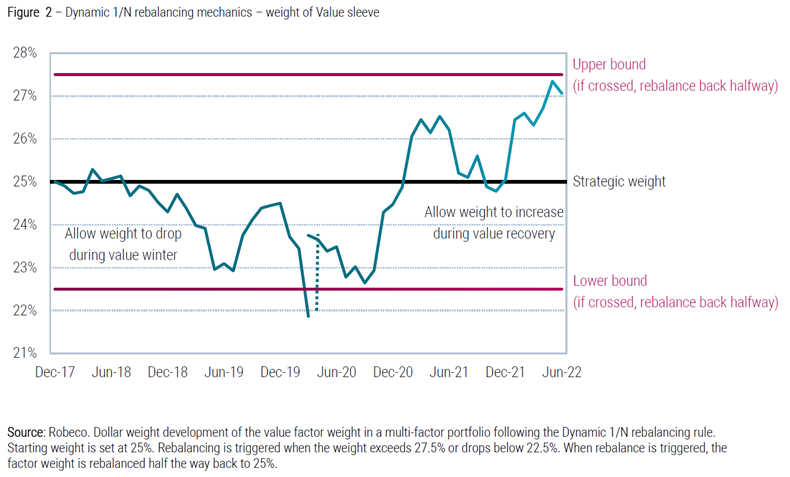

Is it possible to time factor tilts?

"Notwithstanding, factor momentum brings about high strategy turnover. As a consequence, one has to thoughtfully trade-off the associated transaction costs (which are for certain) versus the expected factor momentum alpha (which is noisy). Instead, we advocate a prudent factor timing strategy that benefits from short-term factor momentum effects while reducing turnover and transaction costs and maintaining proper factor diversification."

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.