The Paper Trail – November 2020

Welcome to the latest edition of The Paper Trail, a monthly compilation of the most interesting, thought-provoking and informative investment research I can find.

Housekeeping items:

- Each piece will be introduced with the primary question the authors aim to explore and/or answer.

- I’ll also include a memorable quote and visual from each one.

- Lastly, they are bucketed into two categories, sorted by estimated reading time – “bps” for the shorter ones and “pieces” for the longer ones.

Enjoy!

“bps” (reading time < 10 minutes)

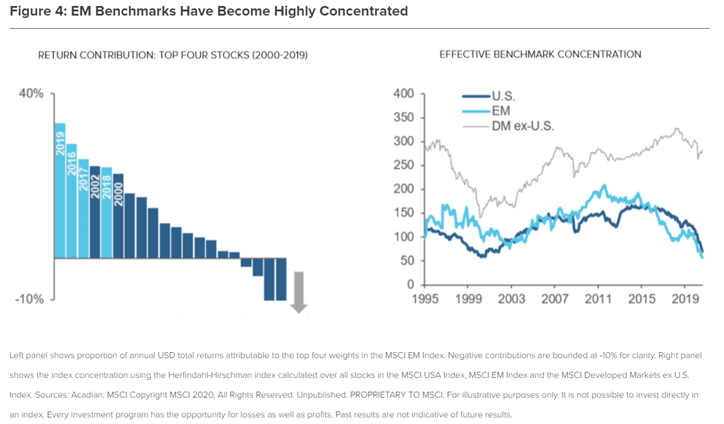

Are Emerging Markets indices too top-heavy?

“While it is tempting for investors to chase the past performance of large-cap growth, looking forward we would advocate recommitment to EM strategies that are well diversified.”

Reassessing Emerging Markets Equities (Acadian Asset Management)

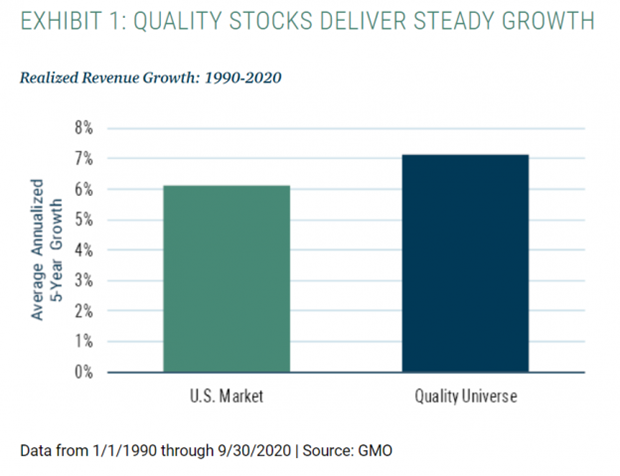

Is the Quality style/factor a viable third choice in the Value vs. Growth debate?

“By providing a third dimension on which to select stocks, a Quality strategy can protect investors from the extremes of both styles by allowing them to own a portfolio that has delivered higher growth than the overall market.”

Quality: The Real McCoy (GMO)

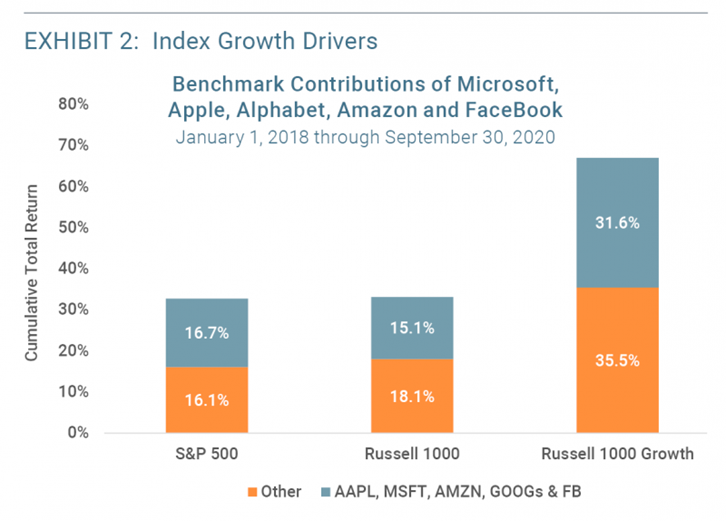

Are we on the verge of a cyclical shift that will reduce the dominance of today’s market leaders?

“The concentration and ever-increasing climb in mega-cap growth stock prices is not supported by rational valuation measures. Investors favoring these largest growth stocks must have extremely optimistic future expectations during the current health and economic crises. This ongoing trend should concern investors, especially those who have flocked to these equities recently.”

What The Future Holds: Will Today’s Mega Cap Growth Leaders Become Tomorrow’s Laggards? (Glenmede)

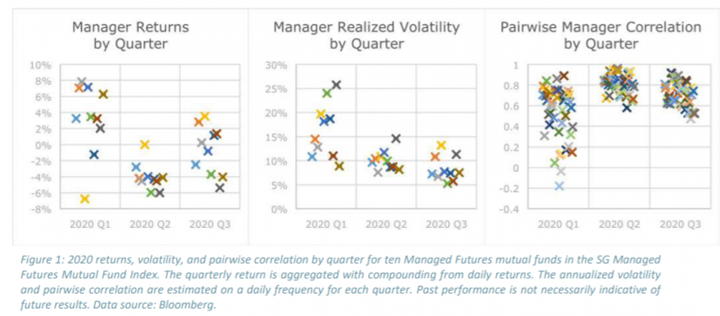

What are the drivers of return dispersion across Managed Futures funds?

“In practice, measurement windows, signal speeds, risk allocation, and overall risk targeting methodologies can vary greatly, leading to potential return dispersion. To put this simply, the trends are the same but how you capture them can vary substantially.”

Managed Futures Return Dispersion: A Review (AlphaSimplex Group)

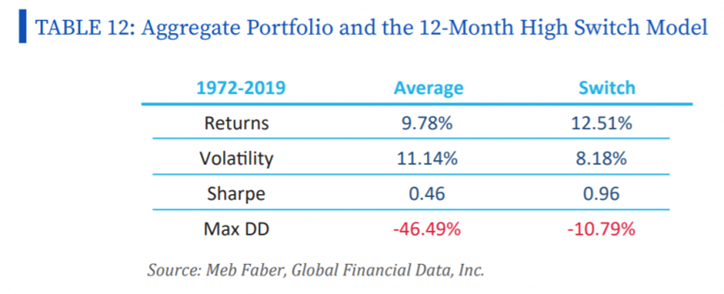

Investors are hesitant to invest money in stocks at all-time highs. Should they be?

“Many investors fear buying at recent or all-time highs.

This is understandable. It can feel like you’re chasing performance or showing up at the party just a few minutes before the hosts kick everyone out.

But if we go strictly by the numbers, they paint a different picture. Buying at highs is often aligning your capital with strength, rather than exposing it to weakness.”

All Time Highs: A Good Time to Invest? No. A Great Time. (Cambria Investments)

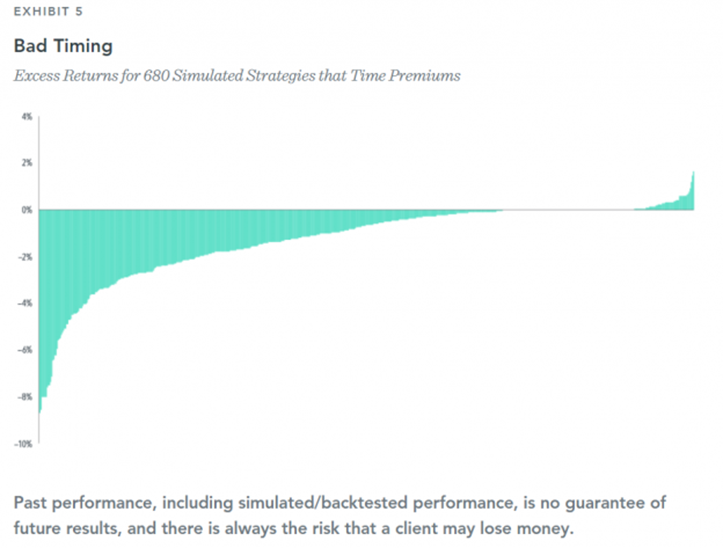

How much noise exists within impressive backtest results?

“If all these decades of poking and prodding the data have proved anything, it’s that you can’t prove something with data alone. The endless combinations available to researchers and the noise inherent in stock return data imply historical return comparisons should be evaluated with a heaping spoon of salt.”

The Right Thing, Not the Easy Thing (Dimensional Fund Advisors)

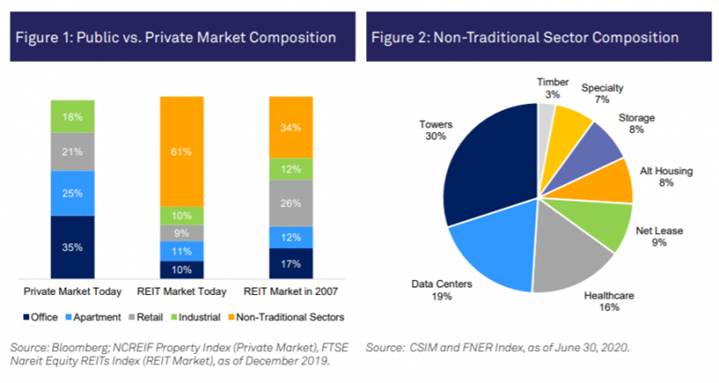

Are REITs better positioned than Private Real Estate to capture the transition to alternative property types?

“The rationale to invest in the REIT market has expanded, and now provides investors with an opportunity to reposition portfolios by accessing alternative growth sectors.”

“pieces” (reading time > 10 minutes)

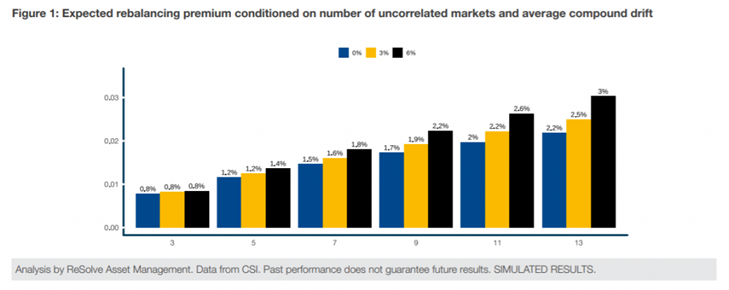

How valuable is the rebalancing premium in risk parity portfolios?

“Importantly, the rebalancing premium is not a property of markets per se. Rather, it emerges directly from entropy – the unleashed potential of randomness itself.”

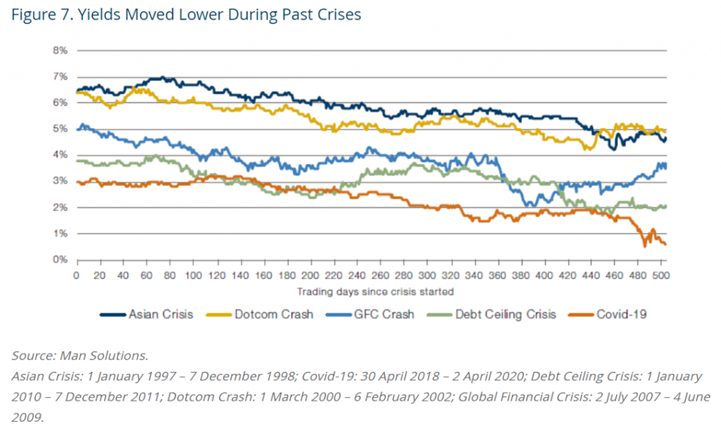

With yields so low, should investors question the logic of hedging historically expensive equities with historically expensive bonds?

“For years, investors have benefitted from the simplicity of the 60/40 portfolio. This may result in futility.”

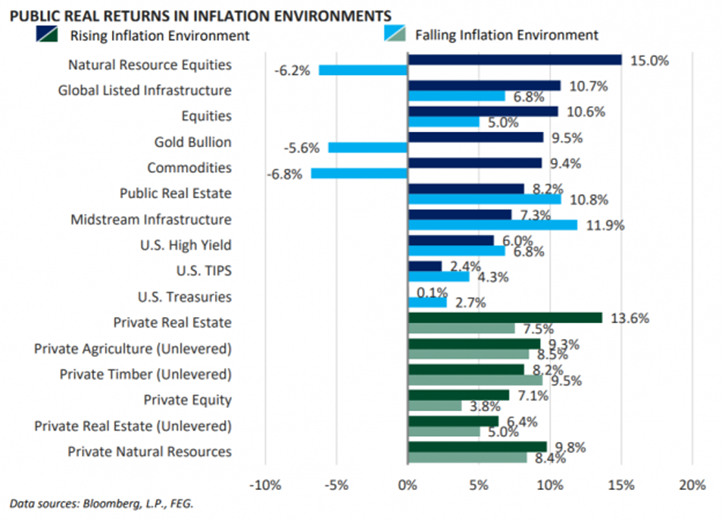

How should investors balance the tradeoffs between inflation protection and total return?

“Creating a successful portfolio that is mindful of inflation risks is more than selecting assets with attractive inflation hedging qualities.”

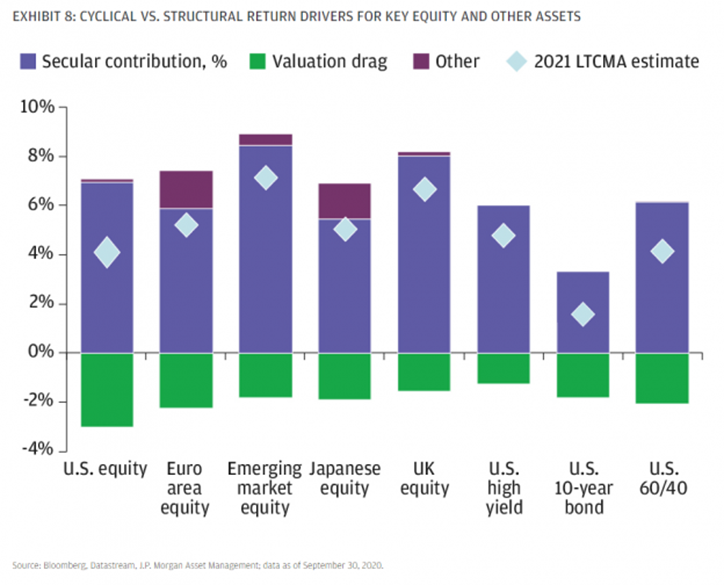

How should investors think about long-term assumptions and portfolio construction in the aftermath of the COVID-19 crisis?

“As we move further into the 2020s, we will need to adopt a new portfolio for the new decade. With expanded opportunity sets and acceptance that truly safe assets no longer offer income, investors can more fully exploit the specific trade-offs that a portfolio can tolerate in order to harvest returns.”

2021 Long-Term Capital Market Assumptions (J.P. Morgan Asset Management)

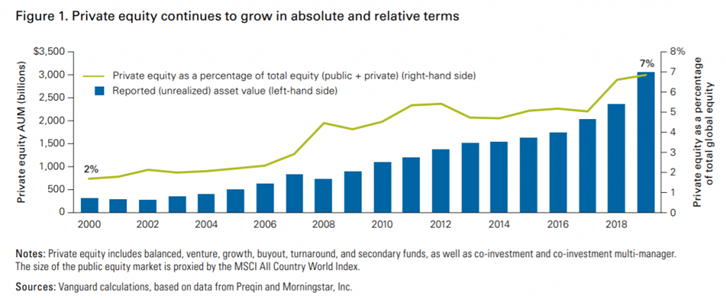

How should long-term investors consider the use of private equity in their strategic asset allocation?

“While private equity and public equity share a number of sources of risk and return, there are structural differences that create a unique set of risks and challenges for investors considering private equity for a diversified portfolio. The main differences are constraints on the ability to rebalance, inflexible and uncertain timing and size of cash inflows and outflows when owned through a fund structure, and a valuation adjustment for the illiquid assets in the portfolio.”

The Role of Private Equity in Strategic Portfolios (Vanguard)

Happy Thanksgiving everyone!

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.