The Paper Trail: Out of Office

As we head into the 4th of July holiday, I'm guessing I'll receive a decent number of "out of office" replies to this post as people get a head start on their celebrations. I'll be taking an extended weekend myself to celebrate Independence Day with family and friends. (Pro tip: put the phone away during the fireworks display - nobody wants to see your blurry photos anyway.)

Speaking of "out of office", the topic du jour in the investment world these days is commercial real estate (CRE). It was even the topic of my latest piece over on the Savant Wealth blog.

A few months ago, we were worried about the health of the U.S. banking system.

The S&P 500 is now up double digits since that fateful Friday that Silicon Valley Bank met its maker.

Naturally, market bears and prognosticators are looking for the "next shoe to drop" and consensus has coalesced around CRE, and more specifically office properties.

With all the attention being paid to CRE markets today, this month's edition of The Paper Trail is intentionally over-indexed towards real estate related insights. In addition, this month's research roundup features:

- The intangible value factor

- Corporate arbitrage

- GP stakes investing

- Commitment pacing in private equity

- Return attribution for value and quality stocks

- Estimating the odds of a "hard landing"

- Investing beyond U.S. shores

- A buyer's market in fixed income

- Carbon markets

- And much more!

“bps” (reading time < 10 minutes)

Have the excessively negative headlines about U.S. commercial real estate created an attractive entry point in publicly traded REITs?

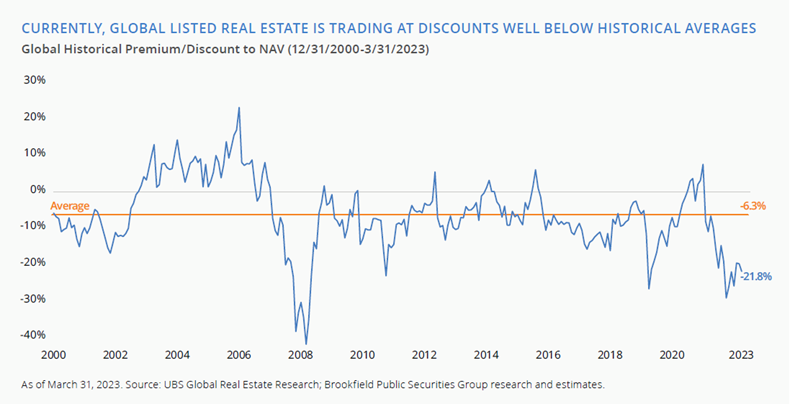

"While fundamentals remain strong and balance sheets have improved, the unprecedented inflation spike and increasing borrowing costs have exerted tremendous downward pressure on real estate securities in recent quarters. As a result, global listed real estate is trading at discounts well below historical averages."

The Opportunity in Listed Commercial Real Estate (Brookfield)

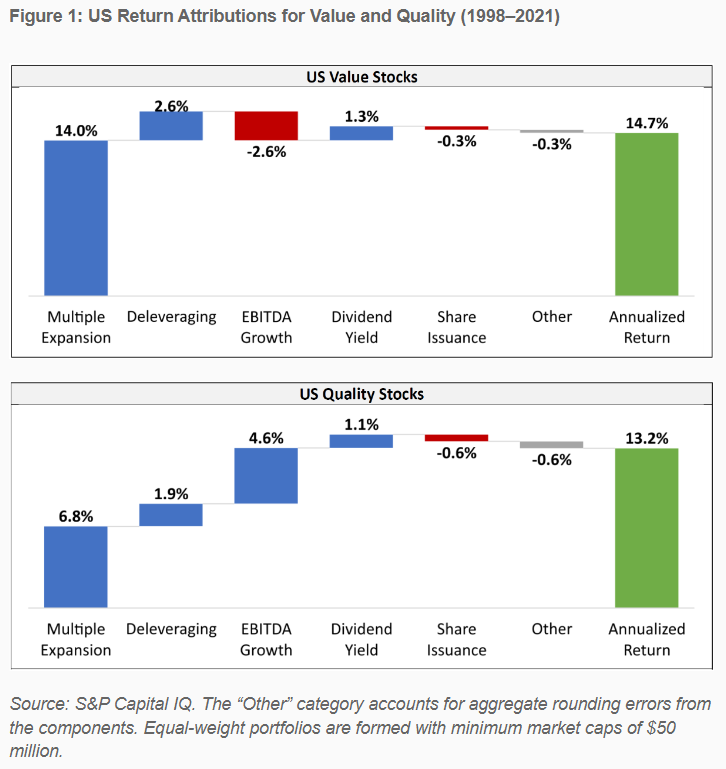

What are the return drivers for value and quality stocks, respectively?

"While quality strategies purchase highly profitable firms at average prices, value strategies purchase average profitability firms at low prices. These two approaches are philosophically similar as they seek to benefit from multiple expansion over time as valuation discounts close in tandem with improved fundamentals."

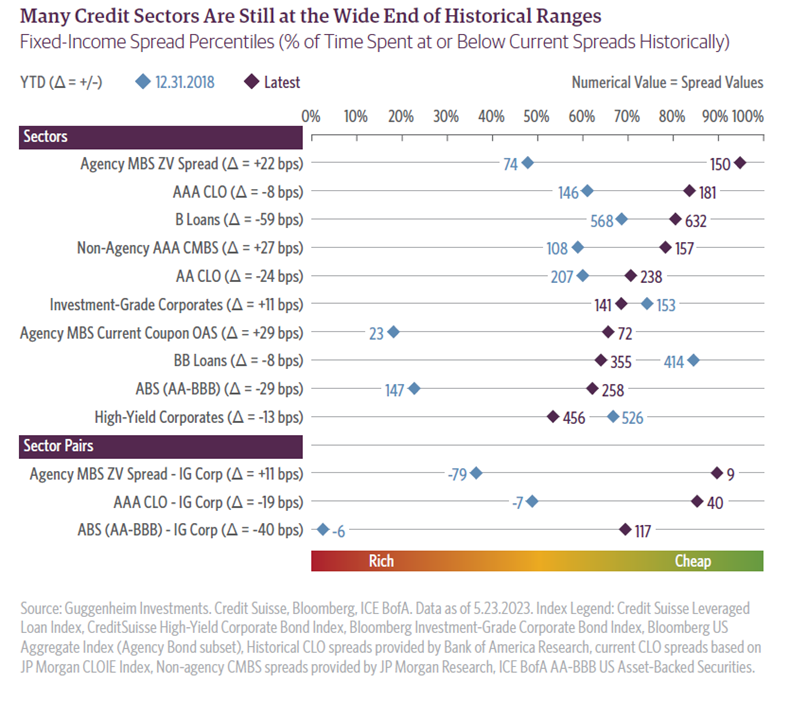

When is the last time bonds looked this attractive?

"The era of low levels of interest rates and borrowing terms favoring shareholders over lenders seems behind us. The subsequent recapturing of economics and negotiating leverage by creditors is just beginning. The shift in this dynamic, combined with wide spreads and higher yields, has dramatically improved the value proposition of credit investments."

Fixed Income Is Now a Buyer’s Market (Guggenheim Investments)

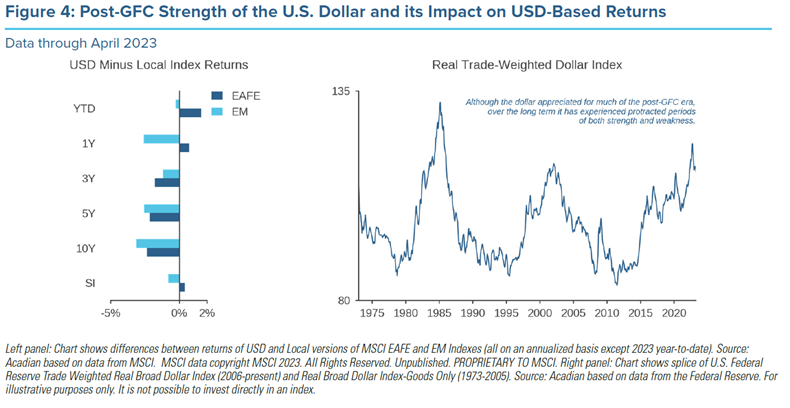

Are international stocks finally going to begin carrying their weight in a portfolio?

"Nevertheless, we caution investors not to chase this past performance in their allocations. In fact, in present context, we believe international equities look comparatively attractive relative to the U.S. on the basis of valuations. Moreover, an era of dollar appreciation, which likely dissuaded U.S. investors from allocating overseas, may be ending."

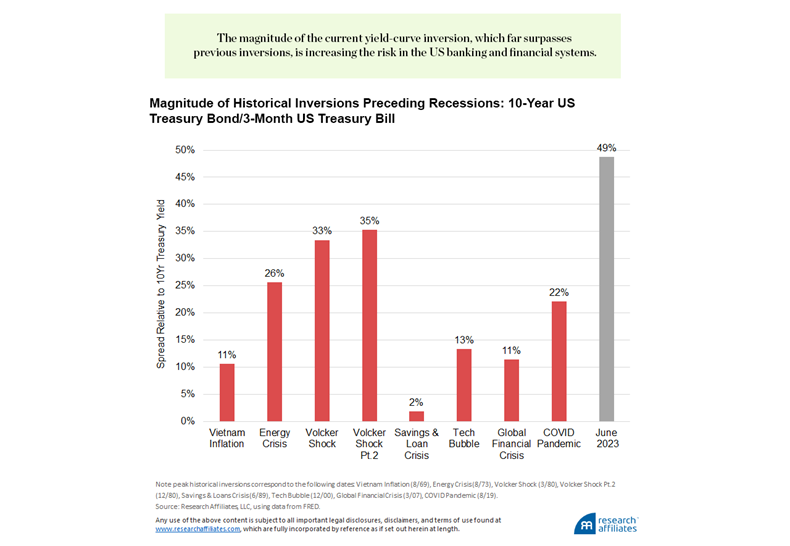

Has the probability of a hard landing increased in recent months?

"Two negatives—the Fed’s mistaken characterization of inflation as transitory, and the Fed’s failure to pause rate hikes in early 2023 amid signs of moderating inflation—do not make a positive. The result is a banking and financial system, as well as a commercial real estate market, under stress. As a result, the odds of a hard landing have increased."

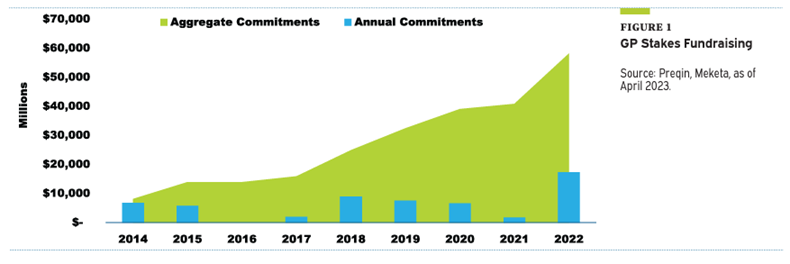

What is GP stakes investing and where does it within the risk-reward spectrum of private markets strategies?

"This is still a relatively nascent segment of the market, with limited competition, and evolving investment strategies that may target specific aspects of the private markets. While primarily considered a minority position in a private market investment firm, the return profile has distinct components, with a significant proportion of projected return coming from the management fee return stream, and upside potential coming from higher returning, more volatile carried interest exposures."

“pieces” (reading time > 10 minutes)

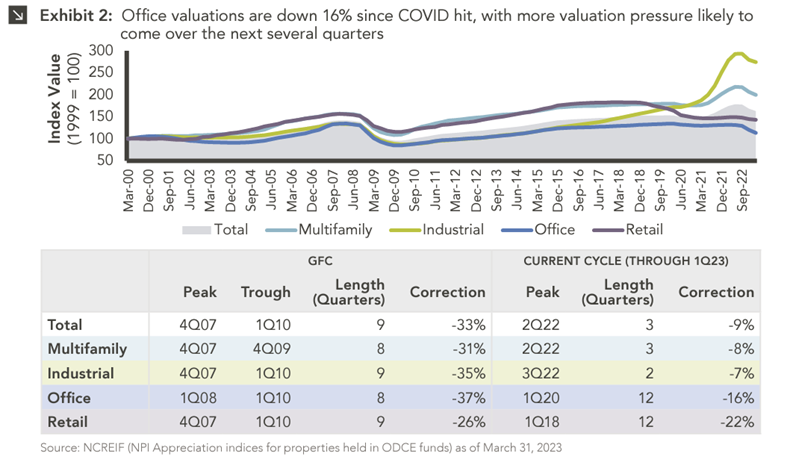

What are the risks and opportunities in commercial real estate (CRE)?

"Fundamental and financing issues are largely concentrated within the office sector — which will likely see a correction over a longer time period but be manageable for most core real estate funds — while other sectors, including industrial and multifamily, are actually set to benefit over the next few years. "

Out of Office: Where Real Estate Markets Stand Today (Marquette Associates)

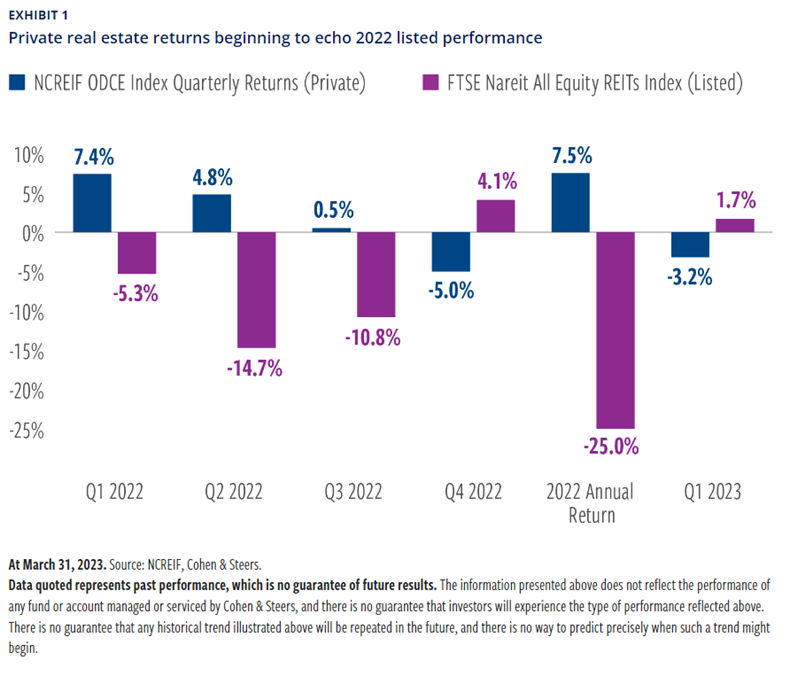

How long will the dislocation between private and public real estate last?

"This repricing warrants a certain amount of caution from investors as we

wait to see what the depth of the challenges will be. However, we believe

this regime shift may create a multi-year period of markdowns and entry

points for the discerning investor."

Private real estate entry points emerging amid selloff (Cohen & Steers)

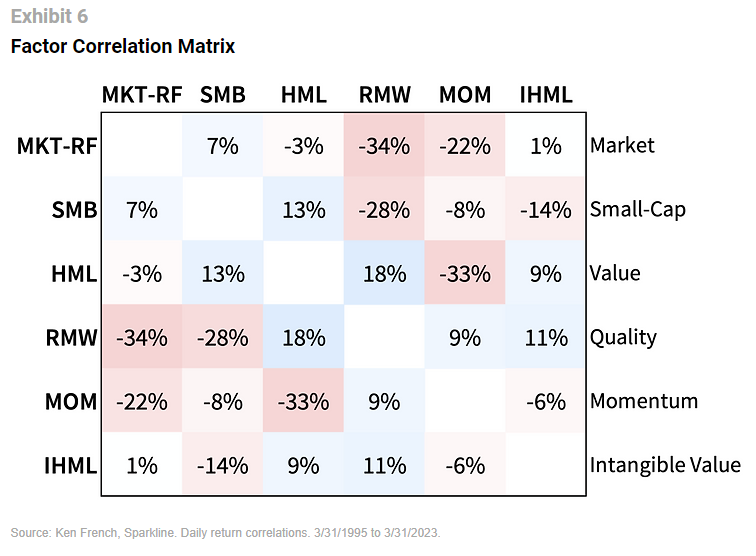

Is the Intangible Value factor complementary to the more established market, size, value, quality, and momentum factors?

"What is the intuition behind Intangible Value as a distinct sixth factor? While ideological twins, Intangible Value and Value focus on opposing parts of the balance sheet. This results in two very different sets of companies. Value favors capital-intensive banks and manufacturers, while Intangible Value prefers asset light tech platforms and brands."

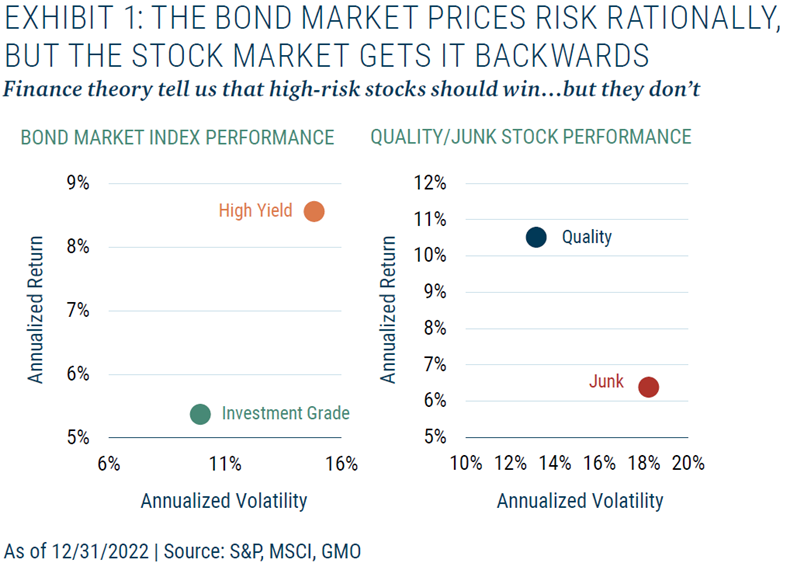

Are Quality stocks uniquely suited for the current market environment?

"The lower market volatility of Quality stocks is a reflection of their more stable fundamentals. This stability allows Quality companies to make strategic investments during times of economic stress, while Junk companies fight for their lives."

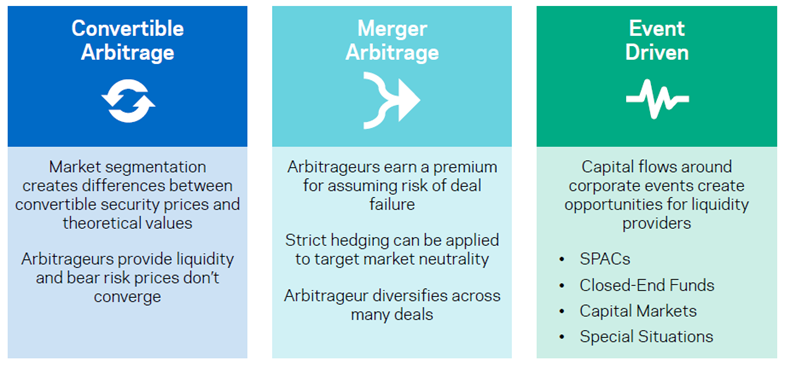

What role do corporate arbitrage strategies play in financial markets?

"Since the real world presents few truly riskless opportunities, arbitrage in practice is more accurately characterized as the deployment of capital to address relative value differences among related assets. Effectively, arbitrageurs are compensated with attractive risk-adjusted returns for the service of making markets more efficient."

Corporate Arbitrage: Overview and Benefits of a Dynamic Multi-Strategy Approach (AQR)

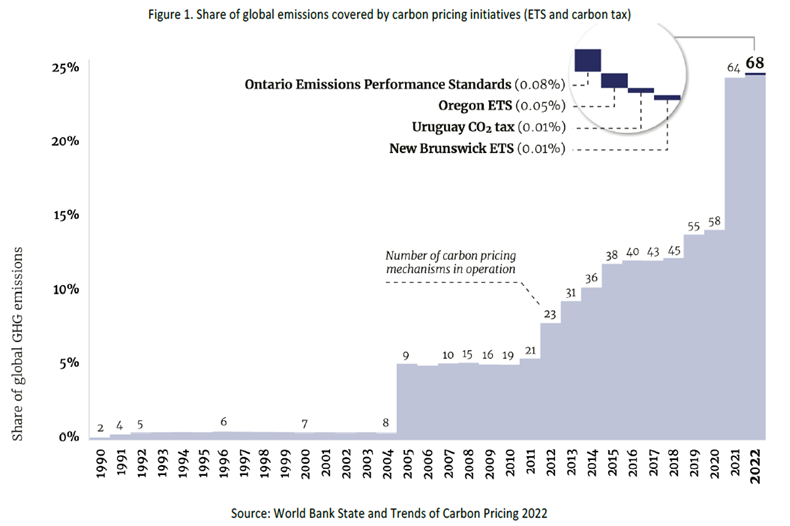

Have carbon markets become an established asset class?

"The concept of pricing carbon was introduced less than twenty years ago, when the first carbon allowance market launched in 2005 in Europe. Today, there are 68 carbon pricing initiatives across the globe, which is more than double of what it was ten years ago."

What’s Driving Unprecedented Growth in Carbon Markets (KraneShares/CLIFI)

How should private market investing think about pacing their capital commitments?

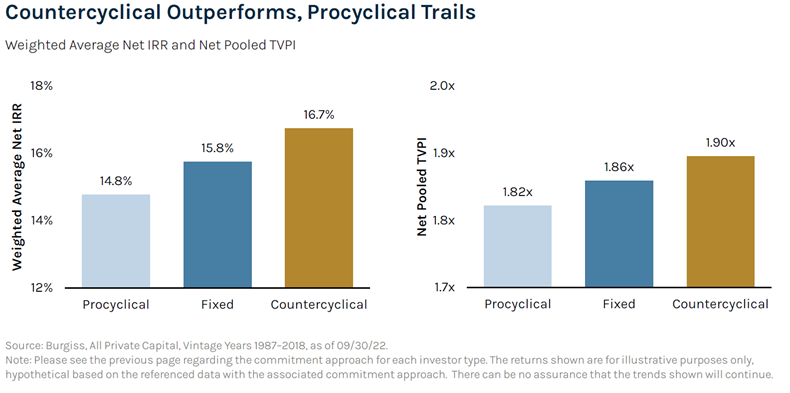

"Between 1987 and 2018, investing in periods of lower aggregate fundraising would have generated an additional 90 basis points of Net IRR over a fixed commitment strategy. Doing the opposite—following the fundraising market and investing more in highly subscribed vintage years—would have eroded 100 basis points from the Net IRR achieved by steady commitment pacing, resulting in the light blue bar."

Unwinding the Market’s Clock: Opportunities in Commitment Timing (Ares)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.