The Paper Trail: Perpetual Motion

Welcome to the first installment of The Paper Trail of the new year, and the first from my new perch as Head of Portfolio Solutions at Cliffwater!

That's right. As I hinted at in December's post, I had a professional change on the horizon. I am now at the end of the first month in my new role and can happily report I am loving every minute of it.

And the good news for my readers is that despite the change of scenery, the Bps & Pieces blog will indeed live on!

At the risk of being labeled a homer for my new employer, the January 2024 edition of The Paper Trail highlights a trio of recent pieces our team has recently published on the topics of private equity excess returns, vintage timing/diversification, and perpetual investment vehicles.

In addition to the above topics, this month's research roundup also features:

- Multi-strategy liquid alternatives

- Japanese deep value stocks

- Natural capital investments

- Superstar brands

- Overlay strategies and long-term compounding

- U.S. real estate outlook for 2024

- Asset-based specialty finance

- And much more!

“bps” (reading time < 10 minutes)

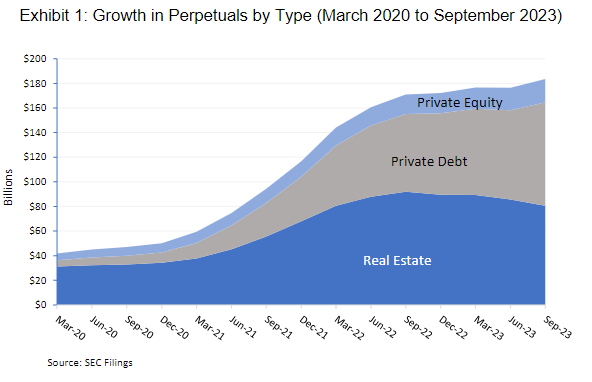

Why are perpetual alternative investment vehicles growing in popularity?

"Alternative investments are fast-growing among wealth management, and vehicles that are perpetual by design are quickly replacing traditional private funds due to their enhanced investor protections, administrative convenience, immediate investment, and enhanced liquidity. These perpetuals include SEC-registered private BDCs, private REITs, interval funds, and tender funds, each with important differences, but collectively offering high-net worth investors a more convenient path to accessing alternative investments."

Perpetuals Gaining Traction Again, Despite Real Estate Headwinds (Cliffwater)

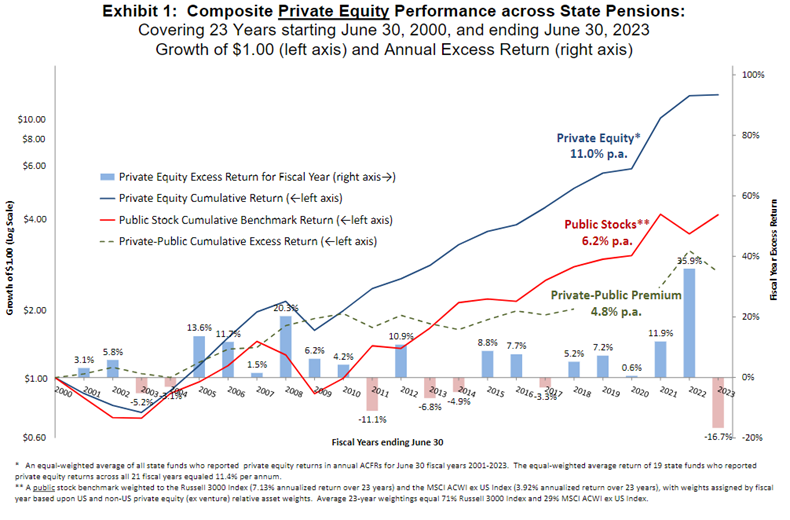

Have the excess returns of private equity over public equity diminished over time?

"Not too long ago, a familiar narrative was that private equity returns were failing to deliver the excess return over public stocks compared to years past. Our study finds no such evidence."

Long-Term Private Equity Performance: 2000 to 2023 (Cliffwater)

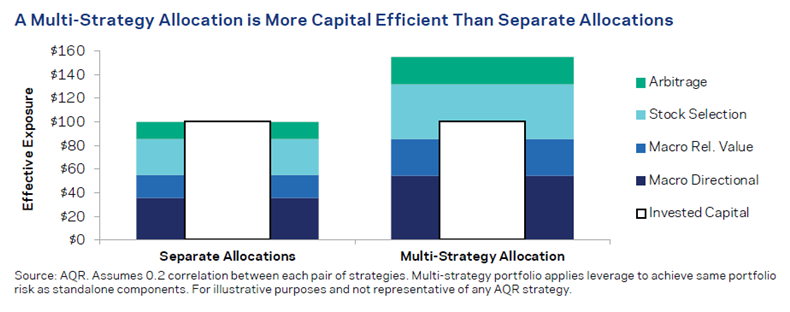

Do multi-strategy liquid alternative fund offer a structural advantage over a blend of single-strategy funds?

"Multi-strategy hedge funds provide a natural one-stop shop for liquid diversifying returns, with the potential to deliver a smoother ride thanks to their broad internal diversification. While ‘pick n mix’ hedge fund portfolios are sometimes seen as offering anemic aggregate returns, a multi-strategy manager can use prudent leverage to monetize internal diversification—delivering greater capital efficiency and higher expected returns."

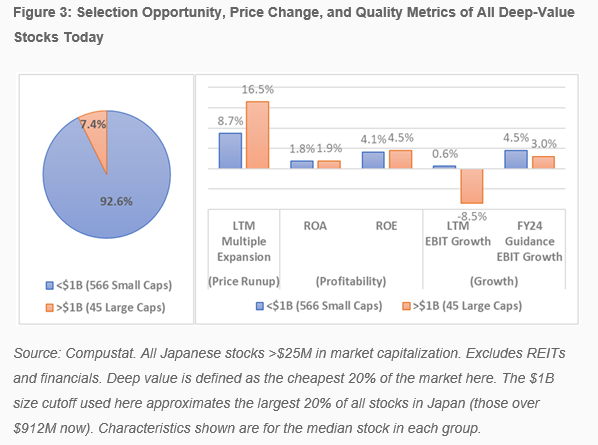

Which Japanese stocks stand to benefit the most from corporate reform initiatives?

"There are only 45 stocks over $1B today that are deep value, versus 566 smaller stocks at equivalent prices. After prices ran up twice as quickly for these large caps last year, the remaining stocks look a bit like the liquid leftovers within Japanese deep value stocks, in our opinion."

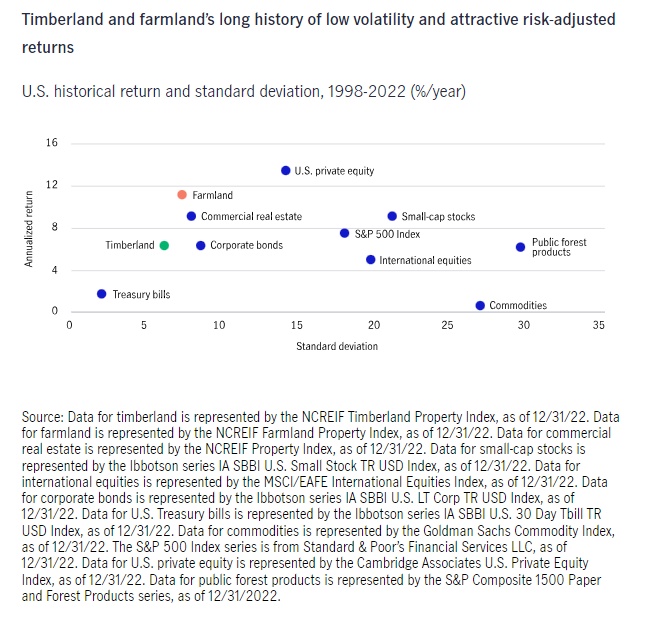

What is "natural capital" and does it belong in your portfolio?

"The investment case for timberland and farmland as traditional natural capital investments has long benefited from strong demand fundamentals and diversification potential alongside returns that have consistently hedged against inflation. High-quality carbon credits now offer a growing store of value, while sustainable management practices that support biodiversity, conserve water, and deliver climate benefits provide investors with further opportunities to enhance diversification, yield, and profitability while meeting their climate and nature commitments."

Investing in the power of nature (Manulife Investment Management)

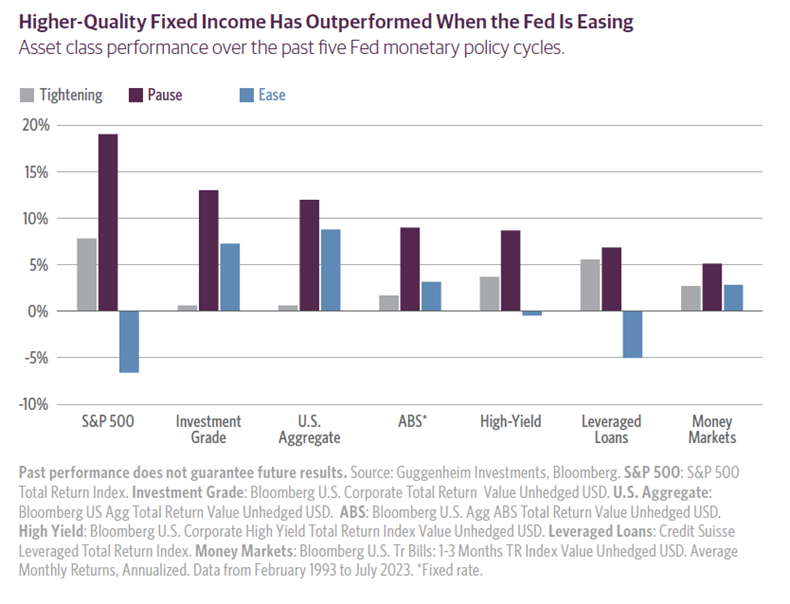

Should investors consider moving out of money markets and into high-quality core fixed income?

"Historically, the Bloomberg U.S. Aggregate Bond Index (the Agg) outperformed money market instruments over the last three months of the Fed pause and through the easing cycle by a cumulative 5 percentage points on average."

Learning from Turning Points in Monetary Policy (Guggenheim)

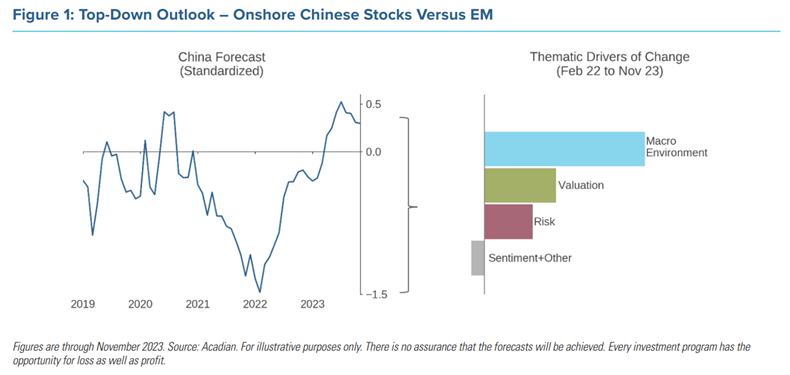

Do the opportunities in Chinese stocks now outweigh the risks?

"A steady drumbeat of negative news flow about China’s economy and its geostrategic tensions with the U.S. has weighed on investor sentiment towards the country for quite some time. Despite these unresolved concerns, our top down forecast for Chinese equities has improved relative to other emerging markets (EM) over the past year, and fundamentally oriented stock selection has been rewarded in the country’s markets. "

“pieces” (reading time > 10 minutes)

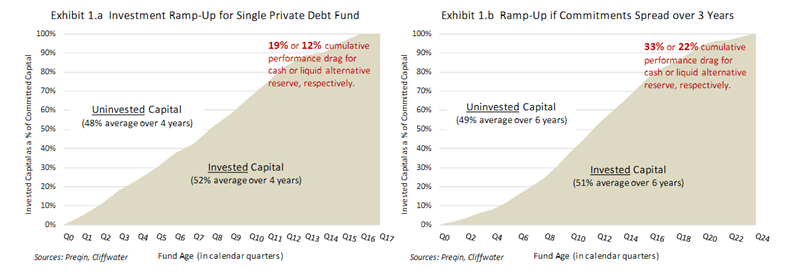

Is opportunistic vintage timing a worthwhile exercise for private market investors?

"The failure of vintage year management in traditional allocation models is acute for private debt, where vintage years have little differentiation and opportunity costs for unfunded commitments are high and immediate. Investors are better served by newer portfolio solutions that attach less importance to vintage and, instead, get and keep capital invested in an expedited and diversified fashion."

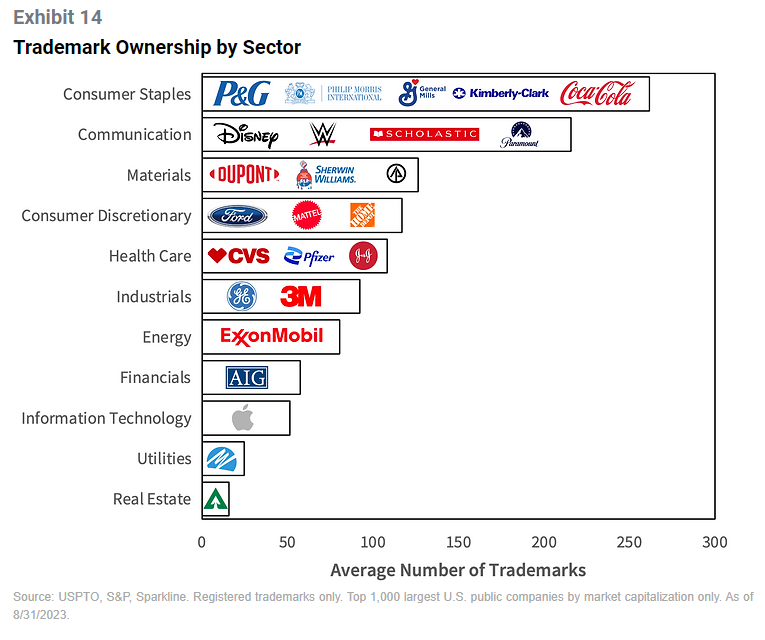

Are companies with "superstar brands" undervalued by the market?

"If the customer is king, we want to invest in the companies making the stuff he desires. Trademarks can help us identify not only fast-growing product categories but also firms benefiting from these burgeoning product markets."

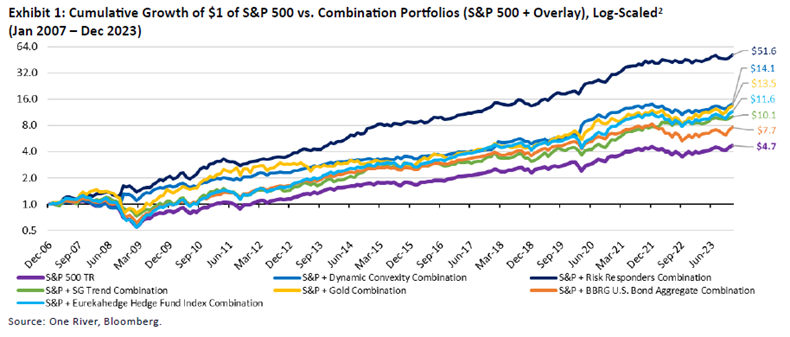

Can capital efficient overlay strategies lead to greater long-term compounding of total portfolio values?

"Our conclusion is that negatively correlated and positively convex returns, especially when rebalanced alongside equity beta, produce a substantially higher compounding benefit per unit of risk (volatility) and risk-adjusted return (information ratio) than do more highly correlated / non-convex returns. In fact, the more negatively correlated / positively convex the returns are, the less those return sources need to exhibit high returns in order to be beneficial to the total portfolio."

Convexity, Correlation, and Compounding (One River Asset Management)

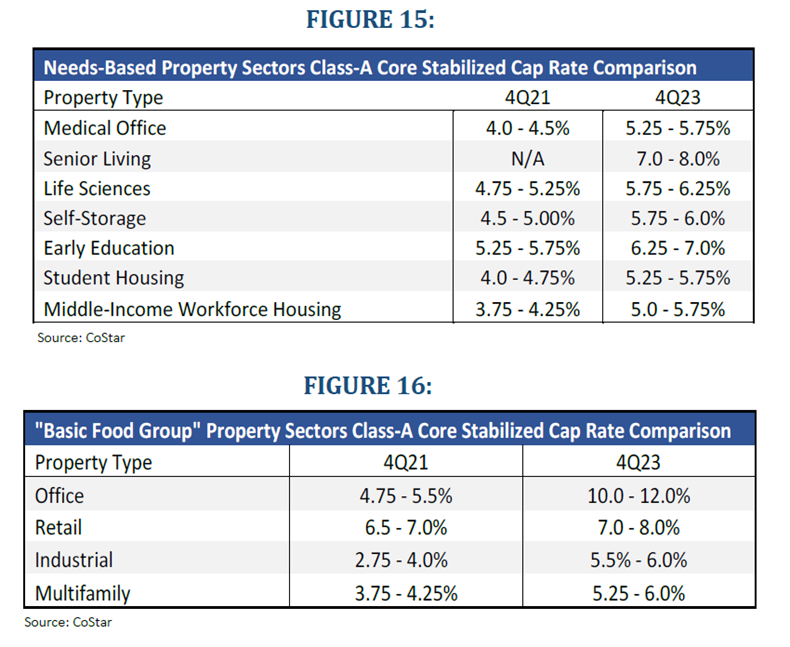

What is the outlook for U.S. Real Estate in 2024?

"The coming year will likely be one of the most exciting years in U.S. CRE which will be talked about for years to come, and there will probably be a Harvard Business School case study on capital market cycles, Black Swan events, and economic volatility describing the unprecedented 2020 - 2024 period. The year 2024 will likely start a new bull run in CRE, but it will not be uniform. Although performance will start aligning more in 2024 than the whipsaw environment of the last several years, the market will remain highly divergent in performance across property sectors, markets, and even submarkets."

U.S. Real Estate Outlook 2024 & 2023 Year in Review (Virtus Real Estate Capital)

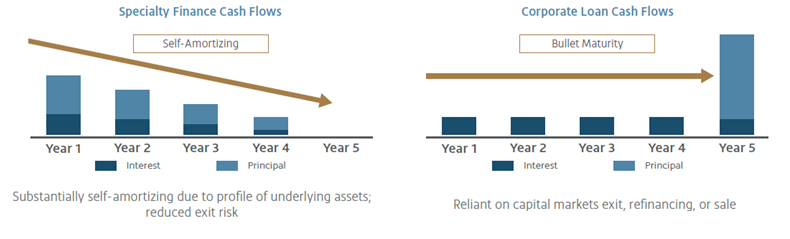

Are Private ABS strategies a misunderstood asset class?

"Consumer and commercial credit assets generally feature amortizing cash flow streams, which means principal (along with interest) is repaid throughout the life of the loan. This acts as on-going risk reduction as the principal shrinks over time, versus a typical corporate loan’s bullet maturity."

Choose Your Own Adventure - Private ABS Edition (Atalaya Capital Management)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.