The Paper Trail: Phoenix Rising

The kids are all back in school and a three-day weekend is right around the corner. Summer may be over, but now is the perfect time to catch up on all the investment research you've been meaning to get to!

Please enjoy the August edition of The Paper Trail! This month's research roundup includes:

- A resurgence in currency alpha

- Relative value in the bond market

- The impact of dividends on total returns

- A primer on emerging market debt (EMD)

- Best practices for evaluating systematic fund managers

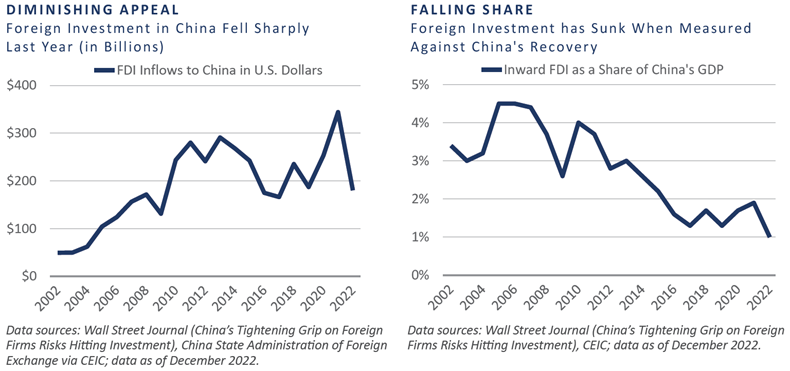

- Pros and cons of investing in China

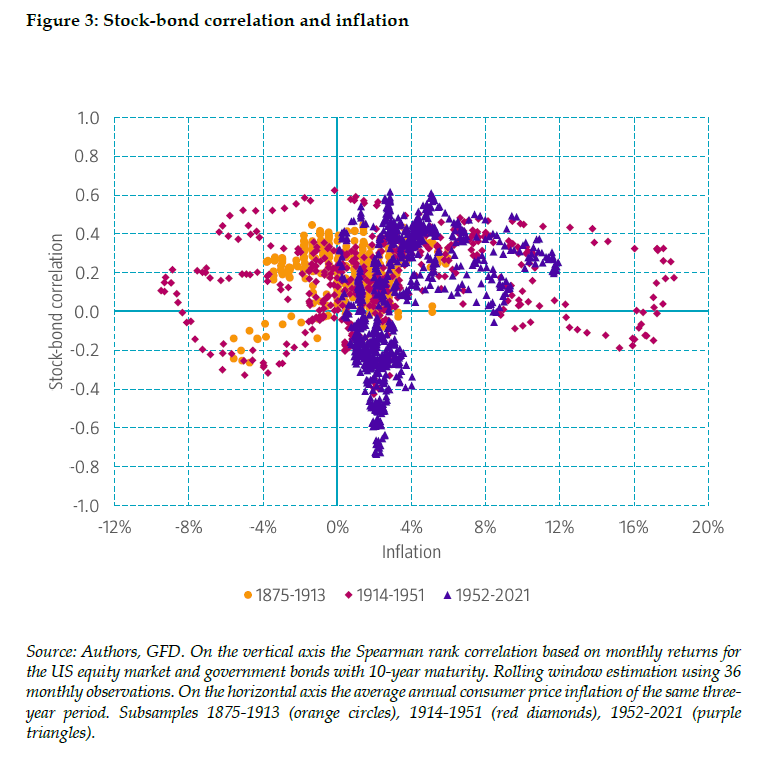

- Variables influencing the stock-bond correlation

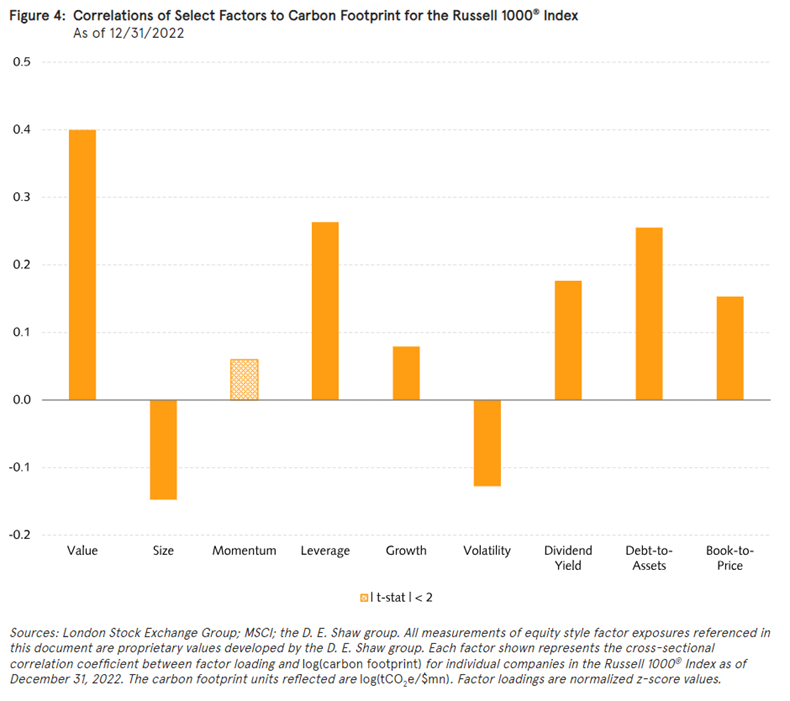

- The relationship between carbon emissions and equity style factors

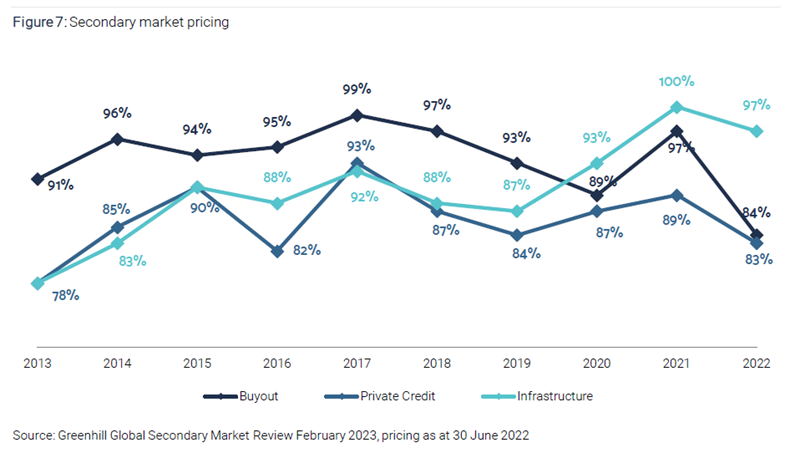

- Favorable conditions for private market secondaries

- And much more!

“bps” (reading time < 10 minutes)

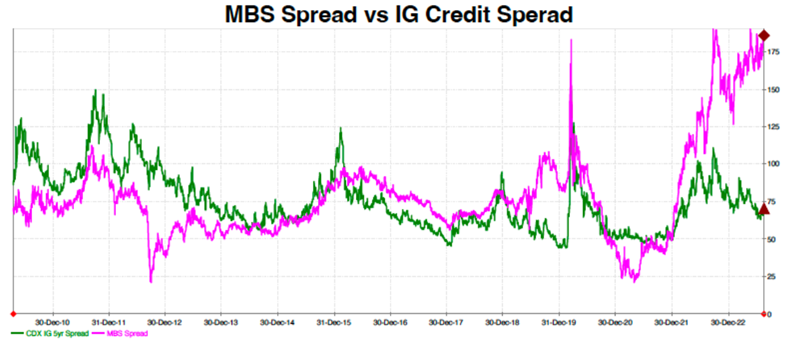

Where is the relative value in the bond markets?

"MBS, with dollar prices just below 100 (par), are the cheapest asset in the bond market because the embedded option in these bonds is so richly valued – I want to sell this Big Option. Not only is one well compensated for market volatility, but also when the Yield Curve steepens, such MBS will do exceedingly well."

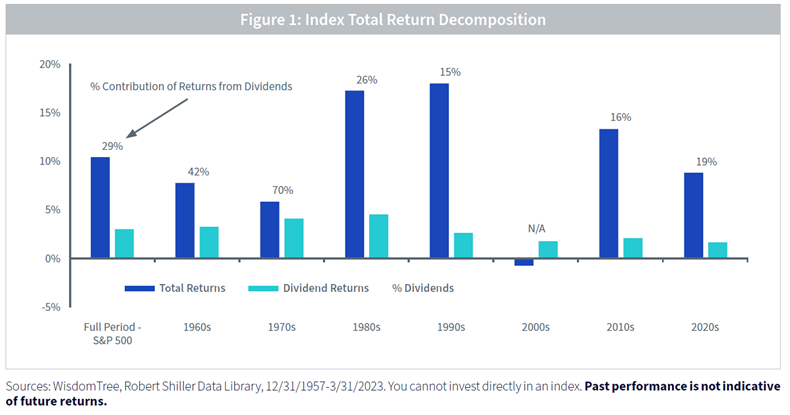

How much do dividends contribute to the total return of stocks?

"Dividends contributed nearly 30% to the 10.4% annual total returns of the S&P 500 over the long run."

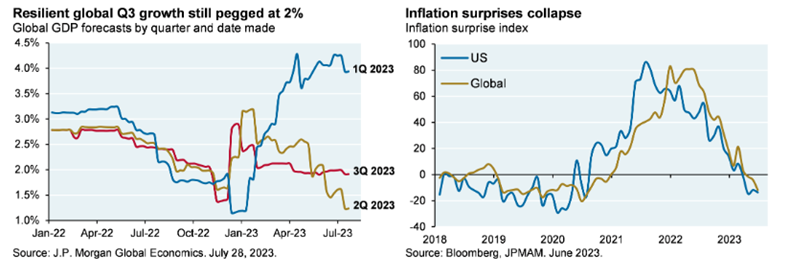

Why has the global economy remained resilient in the face of the fastest rate hiking cycle on record?

"The bottom line: risk appetite is back, courtesy of immaculate disinflation and plenty of liquidity"

The Rasputin Effect: Global resilience to higher rates (J.P. Morgan's Eye on the Market)

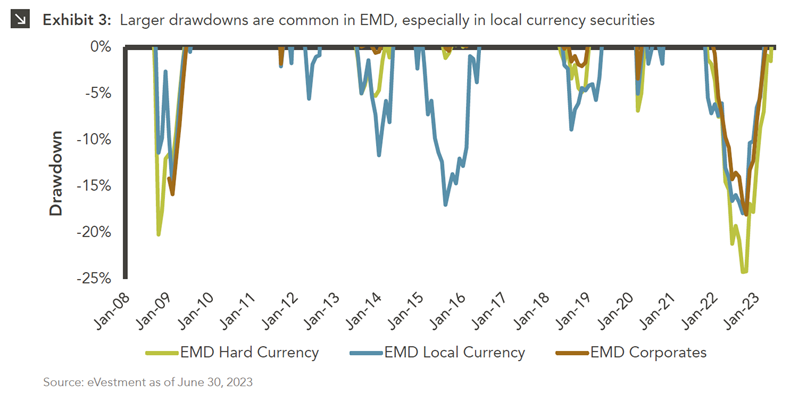

Is the juice worth the squeeze in Emerging Market Debt (EMD)?

"Emerging market debt is a large, complex asset class with a mixed track record. While 2022 was a challenging year, there are opportunities present that have already led to better performance in 2023 and may continue to drive the asset class higher from here."

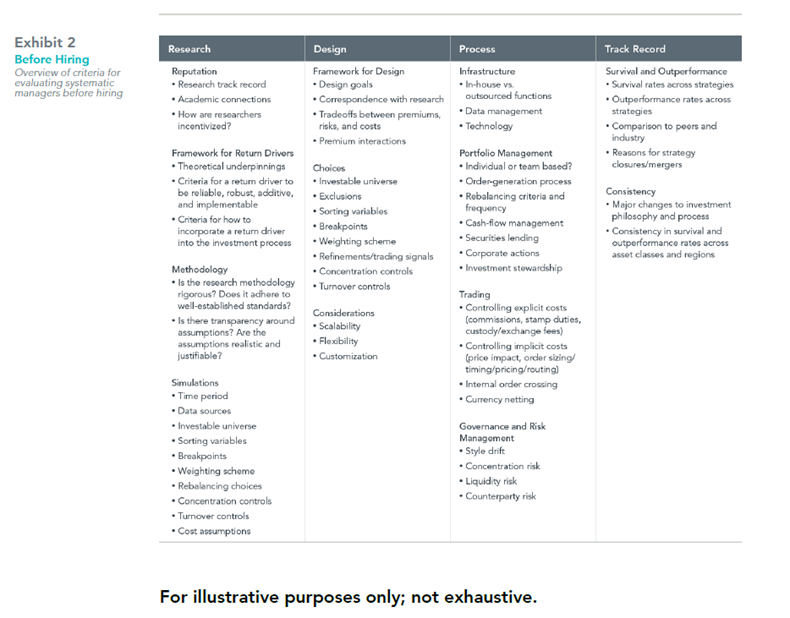

What are best practices for evaluating and selecting systematic asset managers?

"Investors should evaluate a systematic manager’s research, design, process, and track record before hiring."

Systematically Evaluating Systematic Managers (Dimensional Fund Advisors)

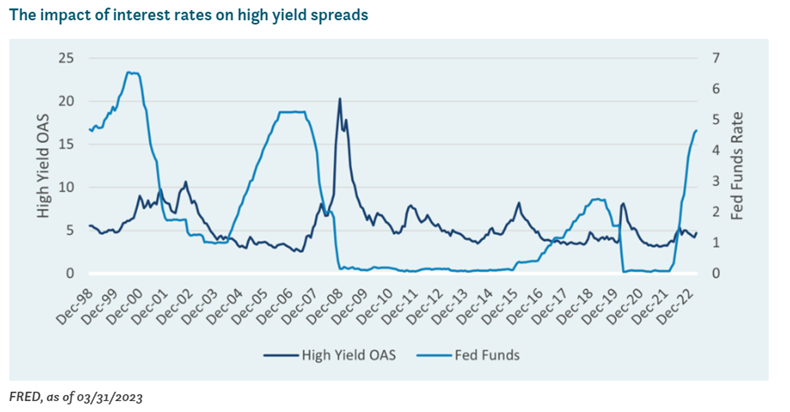

Have we entered a new regime for credit markets?

"Rising interest rates have historically been a headwind for credit. Not surprisingly, corporate bond issuance fell dramatically because of liquidity being removed from the market and because of rising borrowing costs."

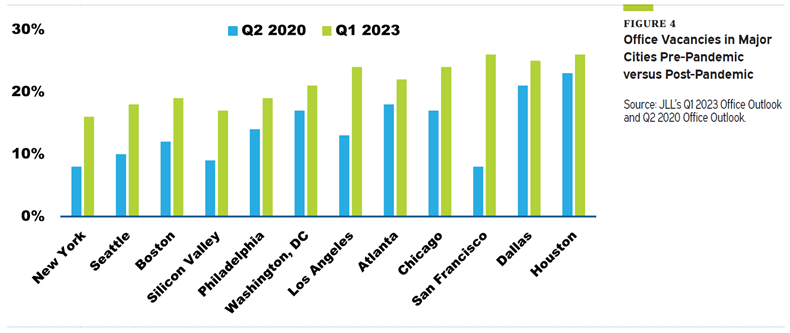

What does the shift to hybrid work schedules mean for the future of the office market?

"As companies navigate this new environment, office vacancy rates are still above pre-pandemic levels, especially in major US hubs like New York City and \ Silicon Valley. Leasing activity has somewhat recovered from the COVID-19 drop off, though not back its to pre-pandemic rate. Given economic uncertainty, higher costs of capital, and high construction costs, new development in the office space has declined, thus limiting the new supply coming to market."

“pieces” (reading time > 10 minutes)

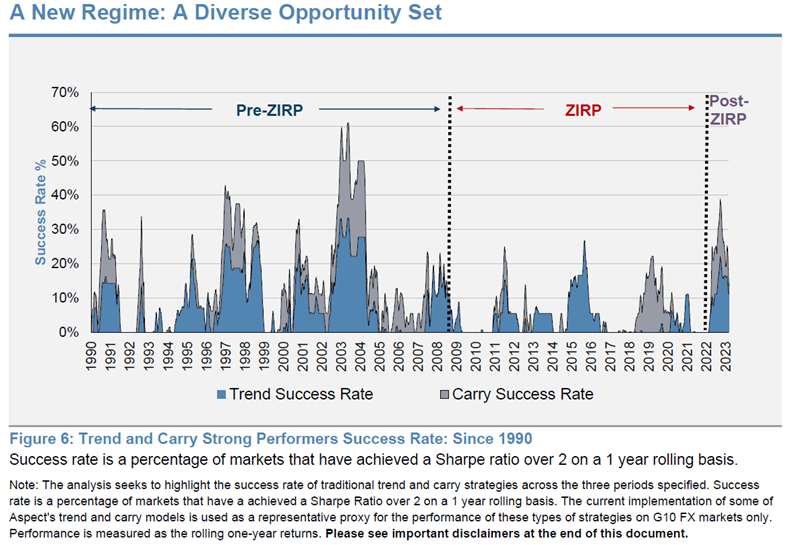

Are there alpha opportunities in currency markets once again?

"The foreign exchange market, which is the largest and most liquid financial market in the world with trillions of dollars traded every day, has witnessed a reinvigoration of two underpinning strategies of currency alpha: momentum and carry."

The Currency Phoenix has Risen from the Ashes (Aspect Capital)

Is China still investable?

"Although China-U.S. relations are strained at present, they have evolved over the years and will continue to evolve. FEG is hopeful that cooler heads will ultimately prevail to avoid any major confrontations. As with any fluid situation, investors will need to stay informed and agile."

Which variables most impact the correlation relationship between stocks and bonds?

"Since the 1950s and the introduction of contracyclical monetary policies, we find remarkably similar patterns across developed markets: the stock bond correlation tends to be high during periods when inflation and real returns on short-term bonds, and the uncertainty surrounding them, are high."

What is the relationship between carbon emissions and style factors in equity portfolios?

"In most cases, the relationships are statistically significant. These correlations indicate that investors seeking to target a reduction in an equity portfolio’s carbon footprint could inadvertently introduce negative tilts to a host of style factors in addition to value, as well as positive tilts to size and volatility."

Factored In: Carbon Reduction and Active Exposure in U.S. Equity Portfolios (D. E. Shaw & Co.)

How favorable are conditions today for secondaries in private markets?

"Given the high volume of secondary deal flow and relative lack of capital, coupled with the more uncertain macro environment that has an obvious implication for valuations in the current market, we are now seeing more deals being done at discounts that are significantly higher than in recent times."

Are we in a golden age for private market secondaries? (Pantheon)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.