The Paper Trail: Predictably Bad Investments

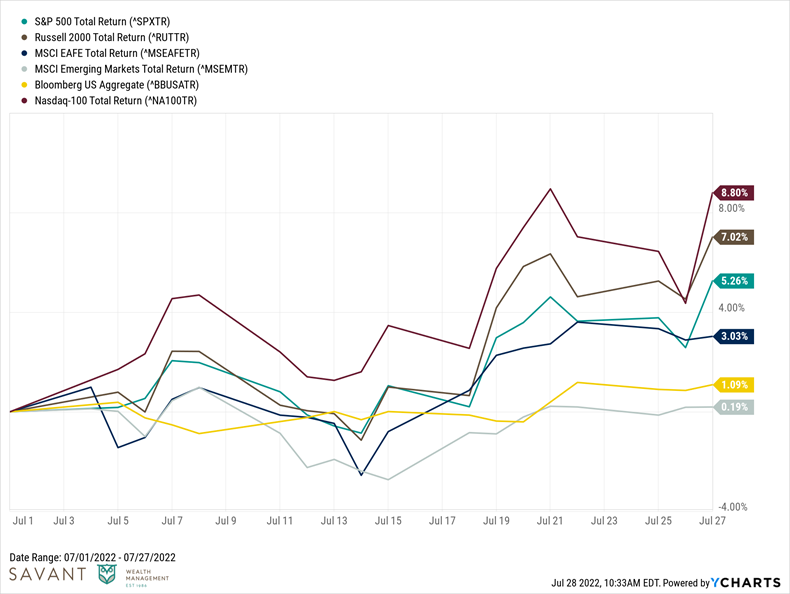

Doth my eyes deceive me? Could it be? Stocks AND bonds up in the same month?

Did we take a time machine back to 2021??? 😂

All kidding aside, let's hope that "as goes July, so goes the rest of the year"!

Please enjoy this month's installment of The Paper Trail, featuring:

- Predictably bad investments in VC-backed startups

- Long-term private equity returns

- Crypto regulation

- The "overnight effect" anomaly in equity markets

- Liquidity holes in financial markets

- The impacts of supply and demand on inflation

- And much, much more!

“bps” (reading time < 10 minutes)

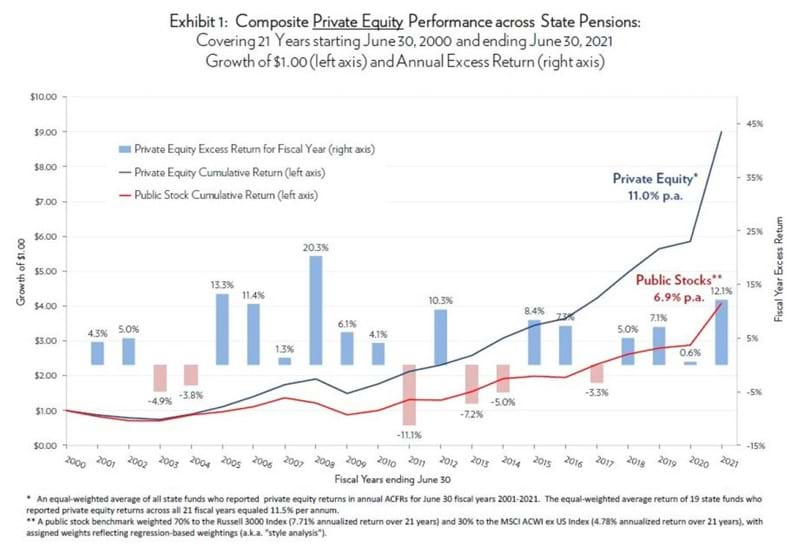

Does Private Equity truly deliver higher risk-adjusted returns than public markets?

"The study finds that private equity produced a significant 4.1% annualized excess return over public equity. We test for any diminution of excess return over time and find no evidence of private equity and public stock return convergence."

Long-Term Private Equity Performance: 2000 to 2021 (Cliffwater)

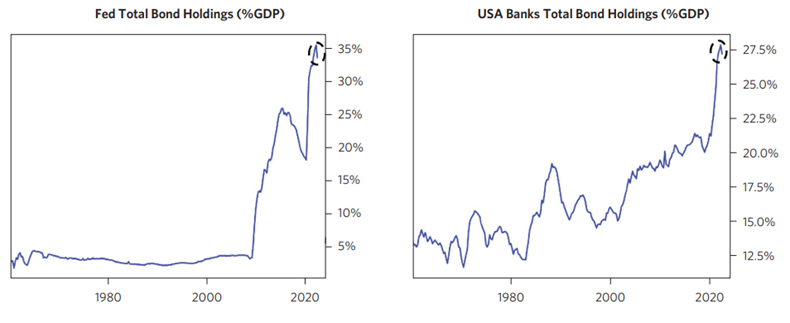

Is the Fed's withdrawal of liquidity from financial markets going to push the U.S. economy into a recession?

"The liquidity hole is expanding rapidly at the same time as interest rates are rising, creating a double whammy for financial assets."

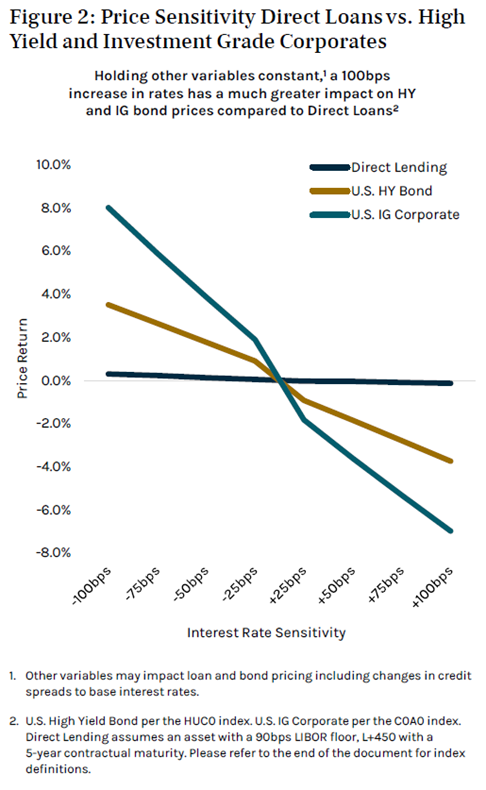

Can private credit offer protection is rising rate environments?

"One appealing feature of direct loans is that their cash coupons reset higher every 30 to 90 days as base interest rates increase. In addition, direct loans often have shorter contractual maturities of 5-7 years with a weighted average life of approximately 3-4 years compared to long-dated corporate bonds. This short duration, floating rate feature, combined with capital structure seniority and covenant protections, enable direct lending assets to be strong performing assets during periods of rising interest rates and the subsequent economic dislocation that often follows a Fed tightening cycle."

Private Credit: Differentiated Performance in the Midst of Rising Interest Rates (Ares)

Are all losses created equal?

"Capitalizing intangible investments and amortizing them makes the economic picture clearer. It allows investors to sort companies losing money for the right reasons and improves the relevance of earnings. Core concepts are communicated more clearly."

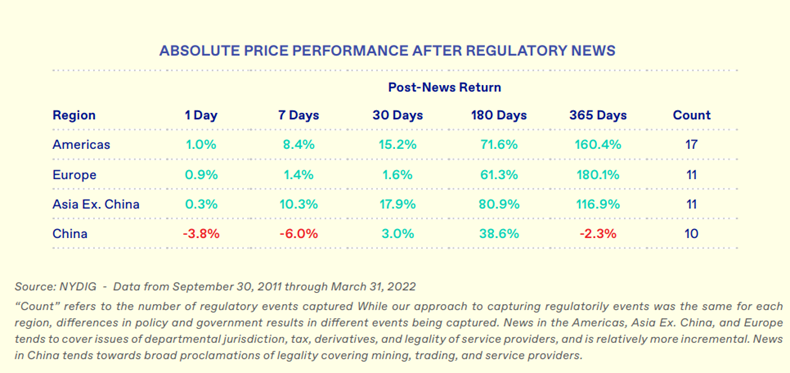

Will increased regulation support or threaten mainstream adoption of crypto assets?

"Given that it is increasingly clear that most countries around the world, including the US, appear to be taking an approach that we categorize as “supportive but with guardrails,” this analysis furthers our belief that increasing regulatory clarity will be beneficial to price and adoption. And given that there is a lot of regulatory clarity left on the table, this could provide a tailwind to bitcoin prices going forward."

“pieces” (reading time > 10 minutes)

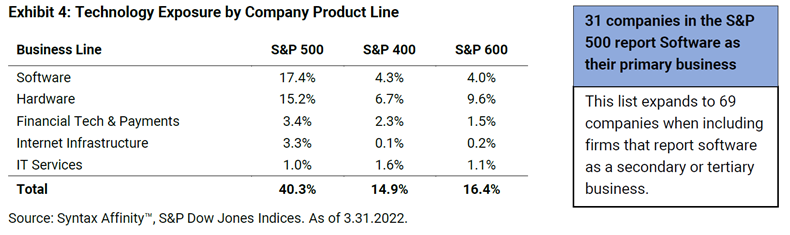

Do investors truly understand the related business risks in the U.S. stock market?

"Moving beyond sector allocations and analyzing exposure to themes at companies' product line levels gives investors a better understanding of not only what they own, but also of the related business risks in a portfolio. Using our Technology theme, the S&P 500’s 40% exposure to tech is well in excess of the 27% weight to the Information Technology sector using GICS."

Know What You Own: Understanding the U.S. Equity Market (Syntax)

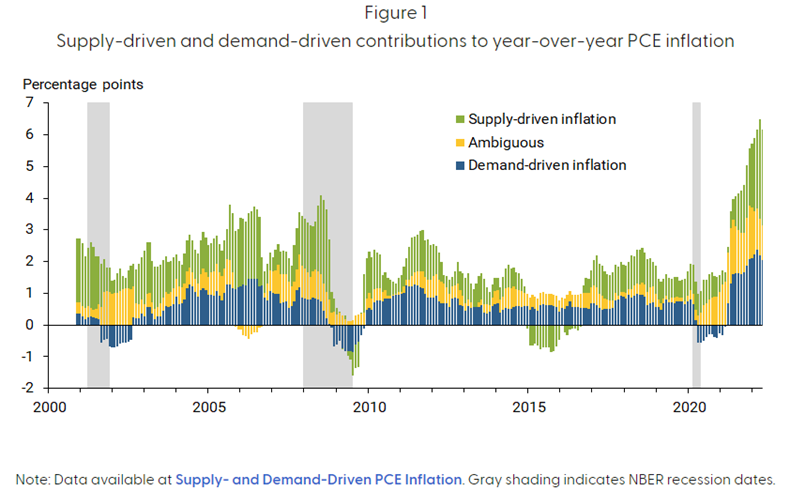

What has a bigger impact on inflation - supply or demand?

"The large impact of supply factors implies that inflationary pressures will not completely subside until labor shortages, production constraints, and shipping delays are resolved. Although supply disruptions are widely expected to ease this year, this outcome is highly uncertain."

How Much Do Supply and Demand Drive Inflation? (Federal Reserve Bank of San Francisco)

What steps can investors take to help close the return gap?

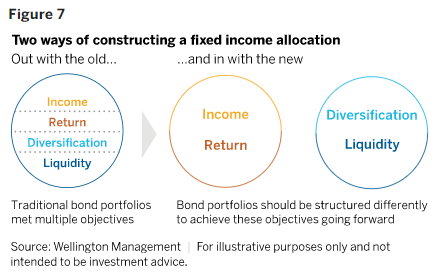

"Historically, it might have been enough to hold a single fixed income portfolio in order to pursue income, a healthy return, diversification, and liquidity. But today I think there is a strong case for using two buckets — one for income and return and the other for diversification and liquidity"

Closing the return gap: A new set of “stepping stone” ideas (Wellington Management)

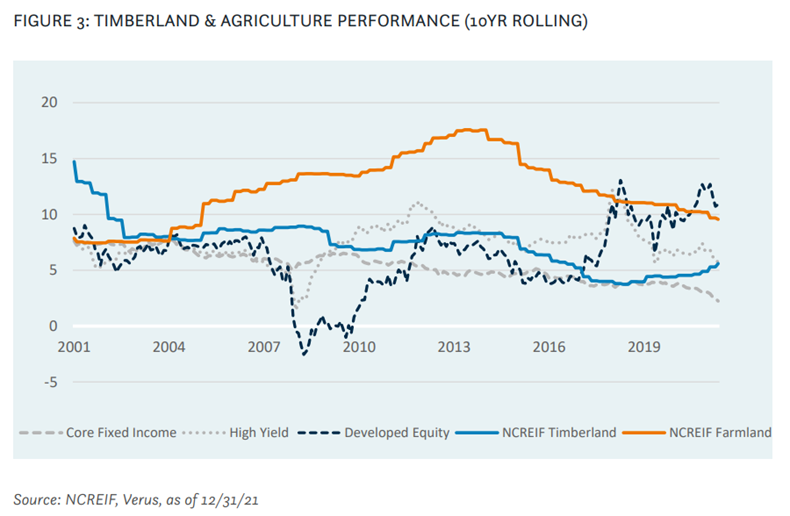

Do Farmland and Timberland deserve a spot in your portfolio?

"During the early 2000s, institutional investment in timberland and agriculture grew substantially as attractive investment returns drew capital to the sector. In the last decade, interest has notably ebbed and flowed as returns softened and opportunities in other ‘real asset’ segments competed for investor capital. Investors remain drawn to both timberland and agriculture due to their low or uncorrelated private market asset exposure that can complement a broader diversified portfolio. "

What are the drivers of the "overnight effect" anomaly that has been observed in equity markets?

"Our research on the overnight effect in single name stocks suggests that the hypothesis of retail trading likely goes a long way toward explaining the phenomenon at both the level of the overall stock market, and that of individual stocks. There is likely some additional interplay with other market participants, along with balance sheet, risk and funding charges that also account for some of the observed effect."

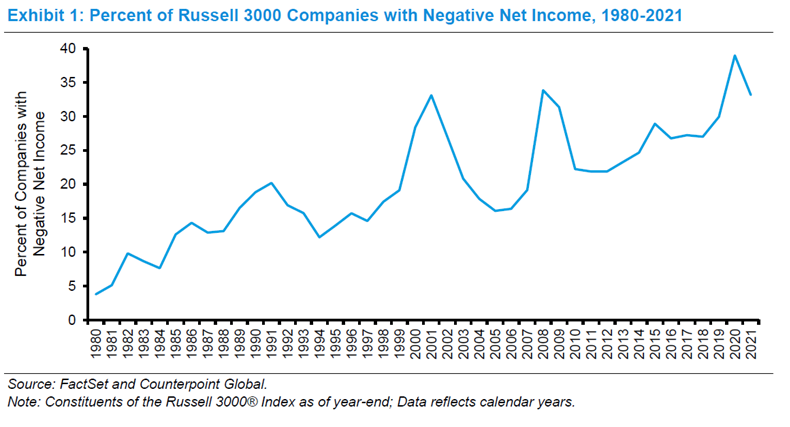

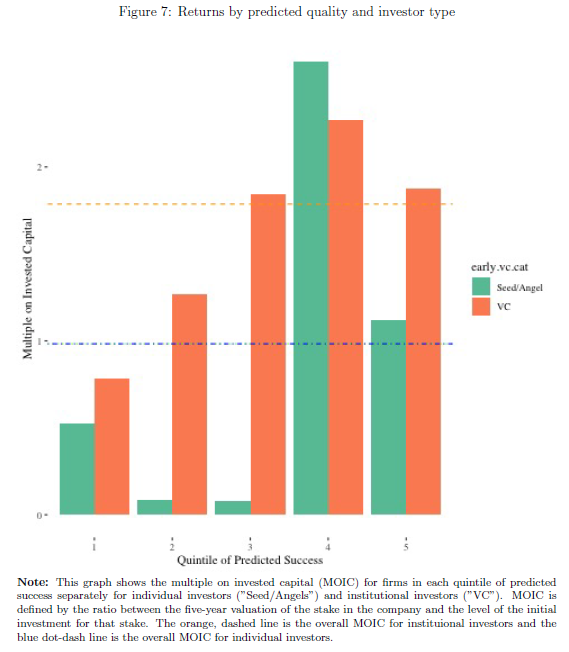

Can startup investors systematically identify bad outcomes ahead of time?

"I find that despite the fact VCs outperform the market on average, the returns are driven by the top half of the predicted quality distribution. By dropping the bottom half of investments and instead investing in the market, returns would have increased by 7 to 41 percentage points. This qualitative finding is robust to a set of outside options (stock market or bond market). Together the results suggest that there is significant room to improve how venture capitalists select into investments."

Predictably Bad Investments: Evidence from Venture Capitalists (Diag Davenport, Chicago Booth)

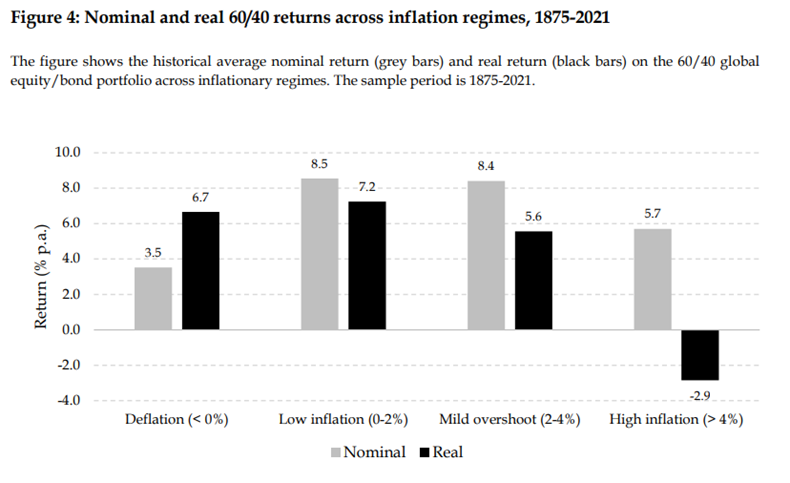

How do asset class returns and factor premiums vary across different inflation regimes?

"Our findings show asset class premiums vary significantly across these inflationary regimes in both nominal and real terms. Equities and bonds on average yield lower nominal returns during periods of high inflation, causing negative real returns. Further, equity returns tend to be relatively low in nominal terms in periods of deflation, but average in real terms."

Investing in deflation, inflation, and stagflation regimes (Robeco)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.