The Paper Trail: Private Party

2021 was a banner year for private equity: new records in deal value and exits, the second-best fund-raising year ever, and a continuation of the strong returns that have outpaced other asset classes.

But can the party in private markets continue in 2022 and beyond? It's definitely a question worth examining with private markets likely to play a more substantial role in the portfolios of high-net-worth investors in the years to come.

In addition to private equity, this month's installment of The Paper Trail digs into:

- Litigation Finance

- Value in Japanese Equities

- The Upward Migration of ESG Ratings

- Information in Municipal Bond Yields

- The Momentum Factor's Woes

- And much, much more!

Enjoy!

“bps” (reading time < 10 minutes)

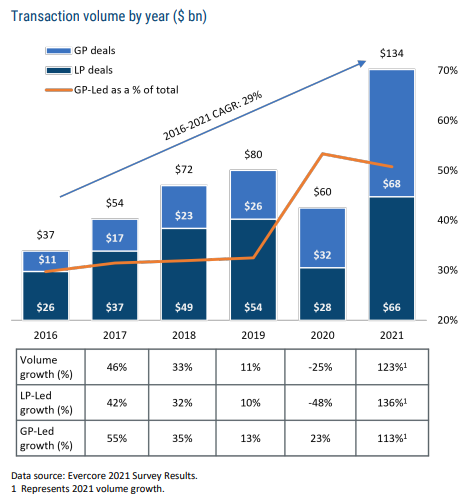

What's behind the rise of GP-led private equity secondary market transactions?

"The trend of utilizing GP-led deals as a viable liquidity alternative was amplified by the COVID-19 pandemic. Early in the pandemic, sponsors recognized that conditions and valuations weren’t optimal for full exits given the uncertainty in the economy. Sponsors were receptive to options that would allow them to provide partial liquidity to investors, while also enabling them to wait for the optimal exit environment."

Capitalizing on the Growing GP-Led Secondary Market (GCM Grosvenor)

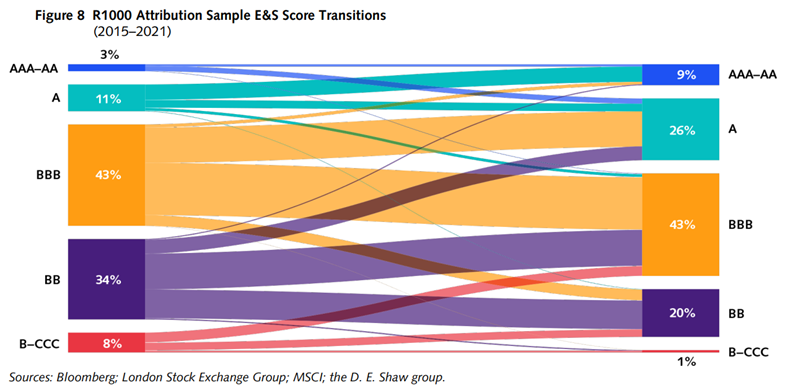

Have corporate ESG ratings been increasing over time?

"After conducting an attribution analysis of Russell 1000 constituents and adjusting for three structural factors, we find that U.S. equities still experienced a meaningful increase in ESG ratings."

Keep the Change: Analyzing the Increase in ESG Ratings for U.S. Equities (D E Shaw & Co)

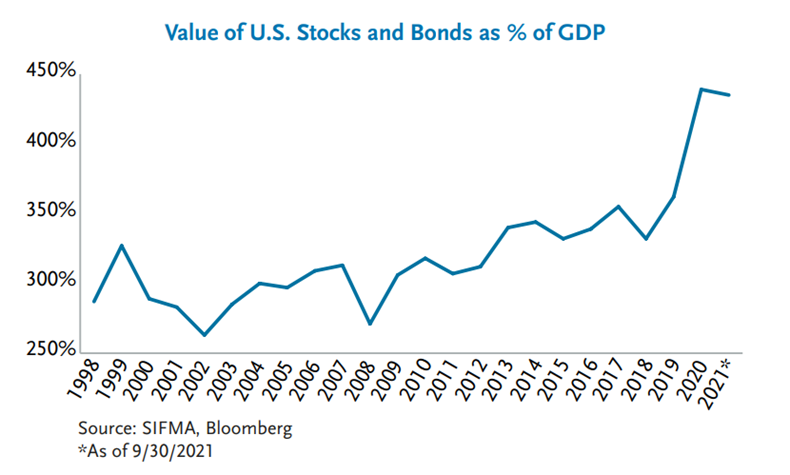

Does the economy drive financial market performance, or vice versa?

"In today’s world, not only do financial markets reflect investors’ aggregate predictions of the future, but the movement of asset prices themselves will more than ever influence the economic future by impacting wealth and spending. To spell it out... higher inflation → higher interest rates → lower assets prices → lower demand for goods/services → slower growth and less upward price pressure."

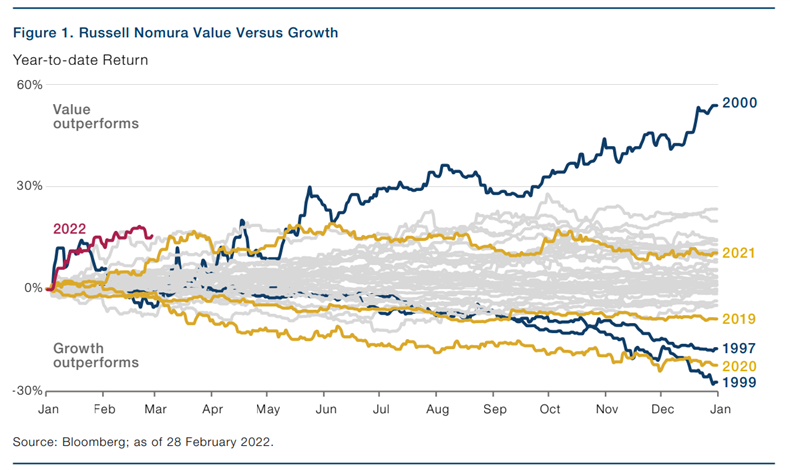

Where is the real value in the Japanese stock market?

" Returns for each type of Value stock can be very different: while rising rates tend to reduce multiples such as price-to-earnings and price-to-book ratios (therefore making quality Value stocks more attractive on a relative basis), they raise the cost of capital. This can sound the death knell for some ‘deep’ Value stocks, which are often reliant on cheap debt to continue operating."

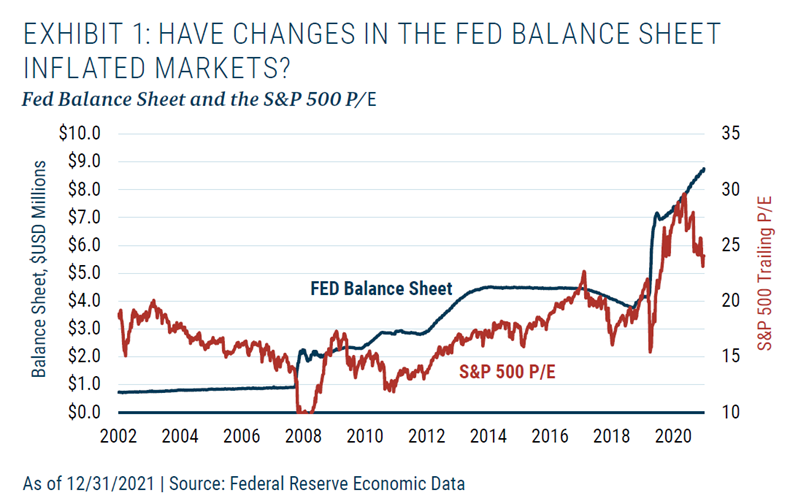

What impact do changes in the Fed's balance sheet have on equity and bond markets?

"For long-only investors, what central banks do with their balance sheets is very important. At a time when there seems to be a multitude of issues for asset prices, this adds yet another concerning matter."

Watch Out for the Balance Sheet: Finding Shelter From the Storm (GMO)

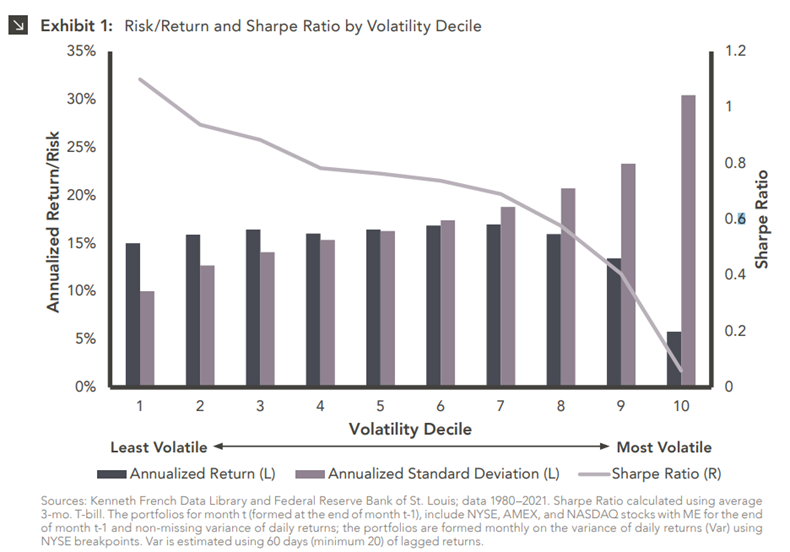

What are the future prospects for the low volatility style?

"As 2022 unfolds, many expect continued market fluctuation amid monetary tightening and geopolitical uncertainty in various parts of the world. Additionally, the recent yield curve inversion, combined with the souring of various leading economic indicators, has escalated concerns of a recession in the coming years. These dynamics could serve as a relative performance tailwind for low volatility equity strategies, which have historically provided diversification and helped insulate portfolios from broad market turbulence, while still offering upside participation."

“pieces” (reading time > 10 minutes)

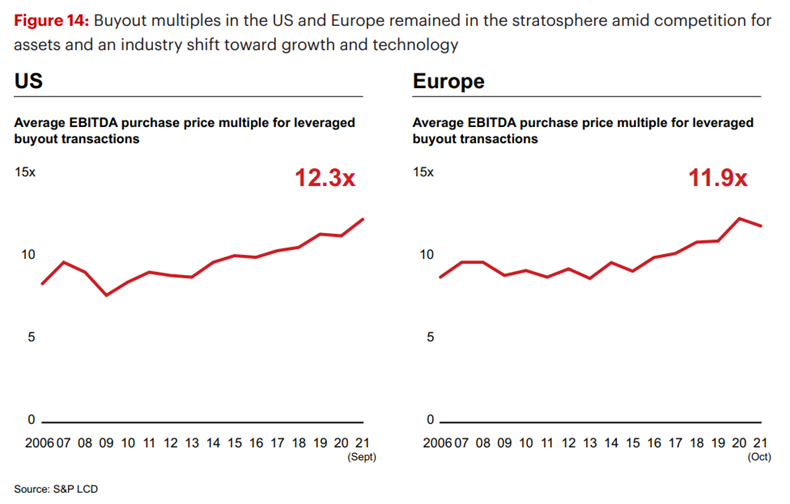

How long can the party in private equity keep going?

"Well before the pandemic, the mountain of unspent capital was already putting pressure on GPs to put money to work in ever larger deals. Then the trillions in Covid-related stimulus added oxygen to the mix. The combination created a burst of activity in sectors across the board, but especially in technology and tech enabled industries, where deal valuations tend to be higher."

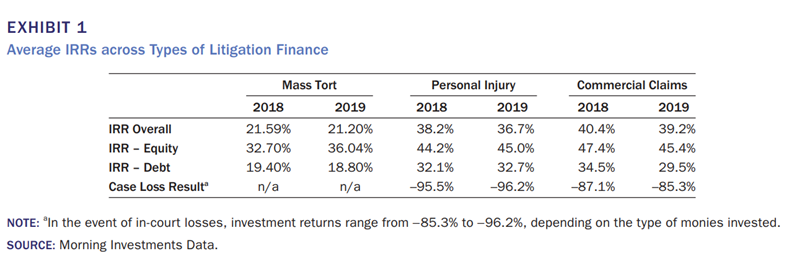

Should litigation finance warrant consideration as an alternative investment?

"A key issue for litigation finance in the future will be how it is perceived from an ESG standpoint. If litigation finance is perceived as a form of alternative lending, similar to payday loans, it may struggle to attract greater acceptance. But if it is perceived as providing access to capital in an underserved market, similar to online funding portals, it may gain much greater traction."

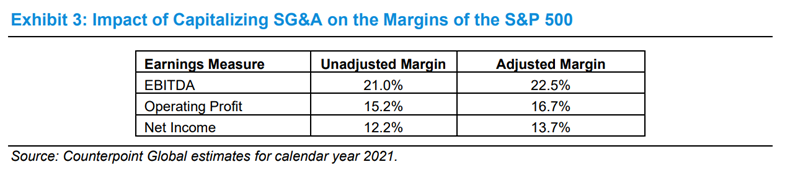

What is the impact on earnings if intangible investments are capitalized?

"Given the assumptions we use, the capitalization of intangible investments would lead to net income for the S&P 500 that is about 12 percent higher than what is reported. These figures suggest great caution in comparing earnings or multiples over time. "

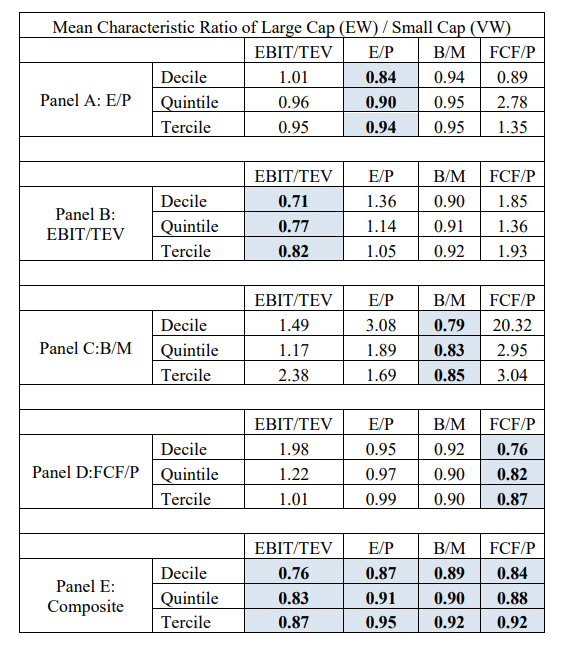

Does size matter when it comes to value investing?

"We find that equal-weight large-cap Value portfolios and small-cap Value portfolios (both market-cap-weighted and equal-weighted) are statistically similar from a returns perspective. Not only are the returns similar, but the equal-weight large-cap Value portfolio also has vastly superior liquidity characteristics relative to the small-cap equivalent"

Long-Only Value Investing: Does Size Matter? (Alpha Architect)

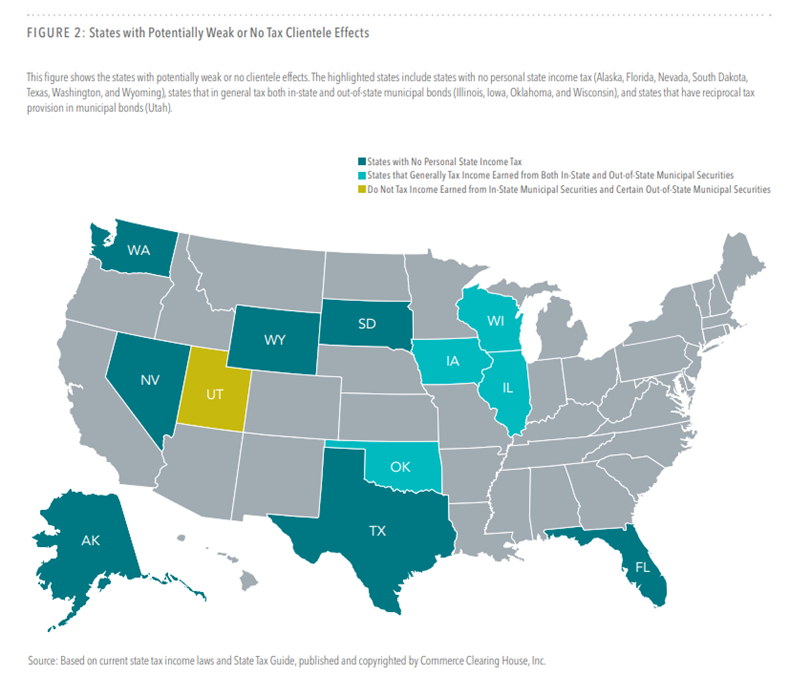

What information is contained in municipal bond yields?

"Municipal bonds issued by states with weak or no tax clientele effects have higher yields and average returns than those issued by states with strong clientele effects. There is also a reliable relation between current term spreads and future term premiums, and between current credit spreads and future credit premiums."

The Cross-Section of Municipal Bond Returns (Dimensional Fund Advisors)

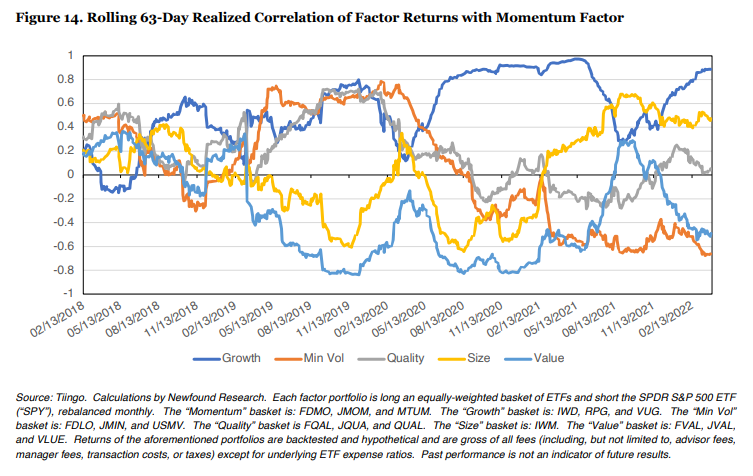

What's going on with the momentum factor?

"For momentum to work, there needs to be a continuation of trends. The last two years have seen just the opposite, with significant factor volatility and strong reversals while markets tried to navigate recessionary fears, stimulus impacts, a technology-enabled work-from-home environment, COVID-19’s impact on the digital economy versus brick-and-mortar, global re-opening and reflation, and finally fears of inflation and quantitative tightening. With relative performance cycles lasting just 6-to-9 months at a time, by the time momentum was transitioning into the new trend, the opposite trend was taking off."

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.