The Paper Trail: Quality Time

Like many of you, this past week for me was one full of quality time with my family (and a bit too much to eat and drink).

As we collectively look to burn off the excess calories consumed over Thanksgiving week, we yearn for the days of having excess returns in our portfolios.

Despite the red that continues to permeate our 2022 account statements, investors - perhaps surprisingly - still have much to be thankful for:

- Higher Yields and Better Valuations: The most common investor complaints pre-2022 were that stocks were too expensive and interest rates were too low. While it has taken some pain to get here, those objections are no longer accurate. This is a great long-term development for savers and investors.

- A Third Leg of the Diversification Stool: Despite more attractive entry points relative to twelve months ago, investors are no longer limited to stocks and bonds alone to build portfolios with. An array of valuable and diversifying alternatives are available to augment traditional portfolios. Some, like Managed Futures, have thrived in this market environment. These non-traditional asset classes and strategies exist across the liquidity spectrum and provide investors additional arrows in their quivers to achieve their most important financial goals.

- Control Over Our Actions (or Inactions): To quote Morgan Housel, "A lot of financial debates are just people with different time horizons talking over each other." It's quite likely that your time horizon is longer than much of the noise you are consuming in the financial media. There's nothing wrong with paying attention to what is happening in the world and it is perfectly normal to have concerns about the risks that exist. But there is no requirement for those worries to manifest as portfolio churn. What is interesting is rarely actionable.

***

I am incredibly thankful for everyone who follows the blog and receives value from The Paper Trail. I truly enjoy compiling it each and every month and have no plans to stop any time soon. That said, I welcome any feedback readers have on how to make it better - feel free to drop me a line or slide into the DMs on Twitter if you have any suggestions!

Now, onto this month's research roundup, featuring:

- Quality in Small-Caps

- Value vs. Growth Regimes

- Sports Teams as Real Assets

- Inverted Yield Curves and Future Bond Returns

- Political Influence and Stock Returns

- Benchmark Bias in Institutional Portfolios

- The Outlook for Credit Markets

- Global Data Centers

- And much more!

“bps” (reading time < 10 minutes)

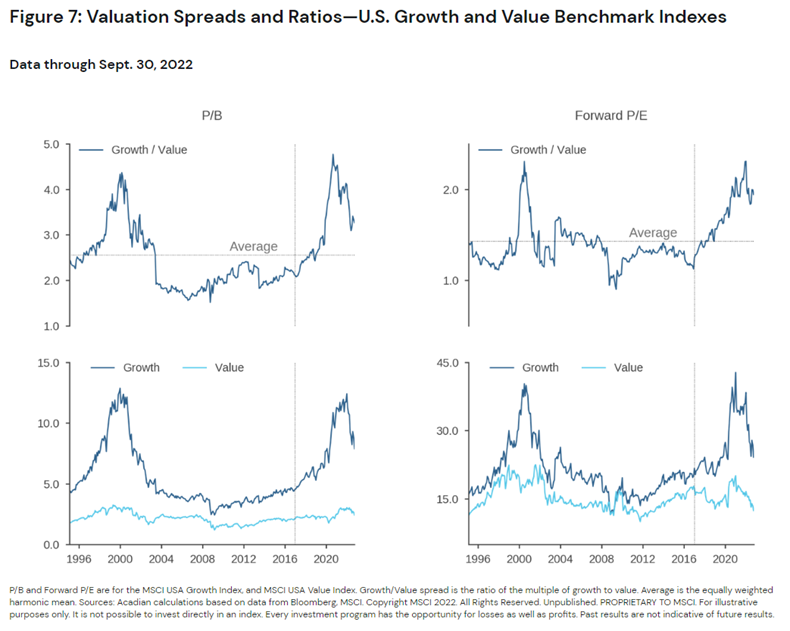

Has a new era for value investing officially begun?

"The speculative excess that we saw over the past several years presented a daunting headwind for any value investing approach, exacerbating mispricings over a protracted period. That headwind may now have subsided with a change in the economic conditions that gave rise to it, benefiting value."

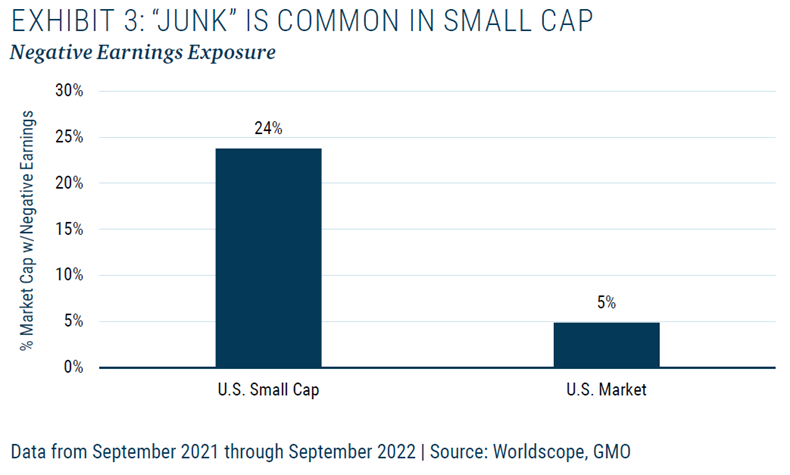

Is successful small-cap investing as simple as avoiding "junk"?

"The small cap universe is full of speculative stocks offering more promise than profit and burdened with challenged financials. Chronically underperforming junk companies represent far more of small cap indices than they do of large cap indices."

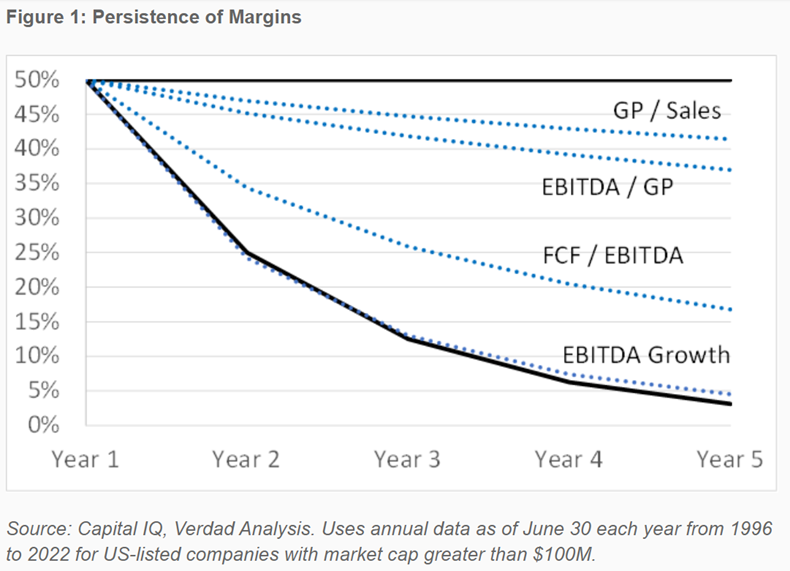

Should profit margins be expected to persist?

"The message to the analyst modeling company financials is somewhat heartening. While we’ve been adamant that growth is not persistent and that high growth rates should not be carried out for many years, margins and returns on assets are relatively sticky. Very high margins and returns on capital do mean revert, but slowly. While growth may be ephemeral, profitability is not."

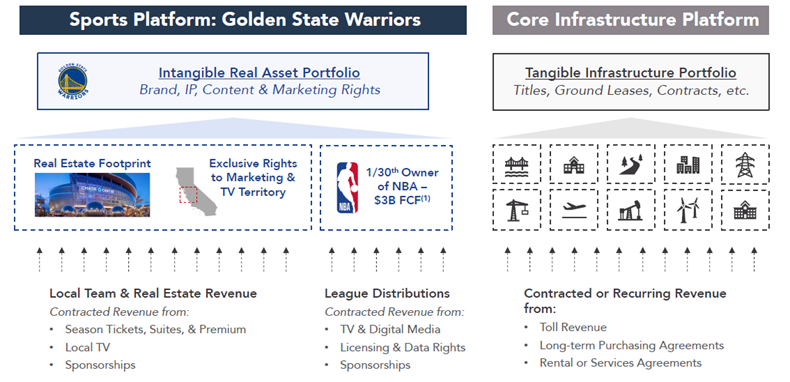

Are professional sports franchises a novel "real asset" category?

"Sports franchises own intangible, intellectual property (IP) that generates recurring revenues from licensing, just as a core infrastructure platform owns tangible property that generates recurring revenues from rent, tolls, or long-term contracts. All tangible assets are backed by intangibles, namely enforceable contracts, zoning rules, or developer reputation."

Sports Are Real Assets: The Case for Inclusion (Arctos Sports Partners)

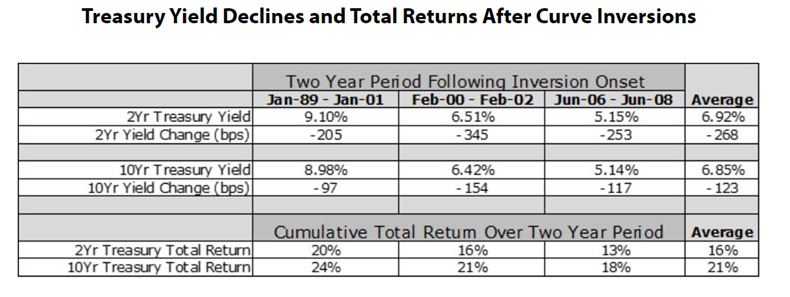

Should fixed income investors consider moving out on the yield curve?

"To consider the opportunity for investors, we looked at where two-year and 10-year Treasury yields were at the beginning of each inversion period and where they were two years later and asked how one would have fared had they invested in the 10-year maturity segment instead of the two-year. Not surprisingly, what we found is that yields on both curve segments fell sharply, producing very positive total returns for investors. Two-year and 10-year yields fell by an average of 268 basis points and 123 basis points, respectively. The cumulative total return for each over the two-year timeframe was 16% and 21%."

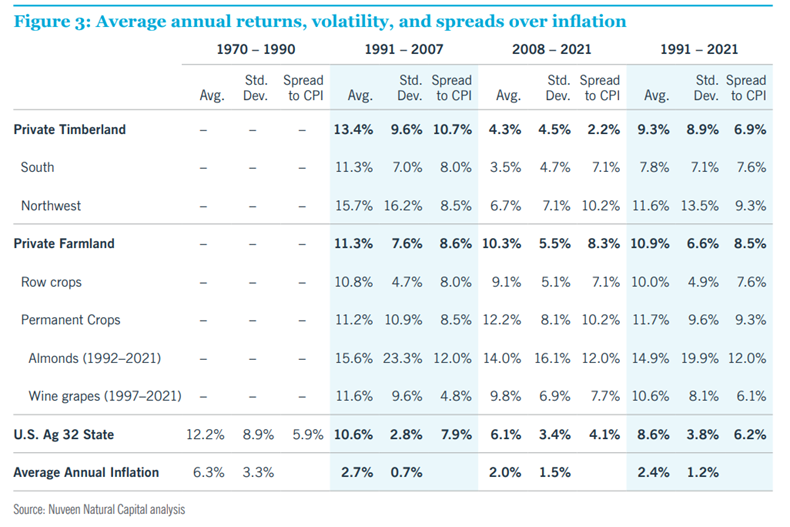

Do Farmland and Timberland offer a hedge against inflation?

"Results show that farmland and timberland investments continue to serve as a hedge against inflation and provide tools for investors to build inflation-resilient portfolios. Both asset classes offer investors a compelling alternative to protect the purchasing power of investment portfolios supported by returns that have historically outpaced inflation rates, a strong positive correlation between returns and inflation, and where increases in inflation are associated with more than equivalent increases in returns."

Inflation Hedging Ability of Natural Capital Investments (Nuveen)

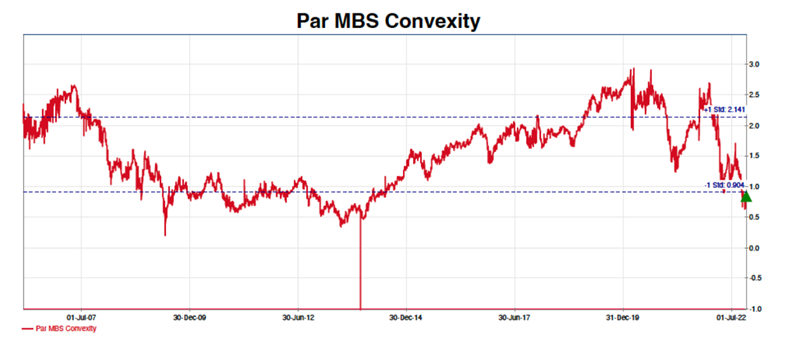

Is there value in the mortgage bond market?

"At this point, we must be sniffing a bottom for MBS versus UST rates. Almost

every risk vector is near its peak, and one is earning 60bps (OAS) on top of that."

“pieces” (reading time > 10 minutes)

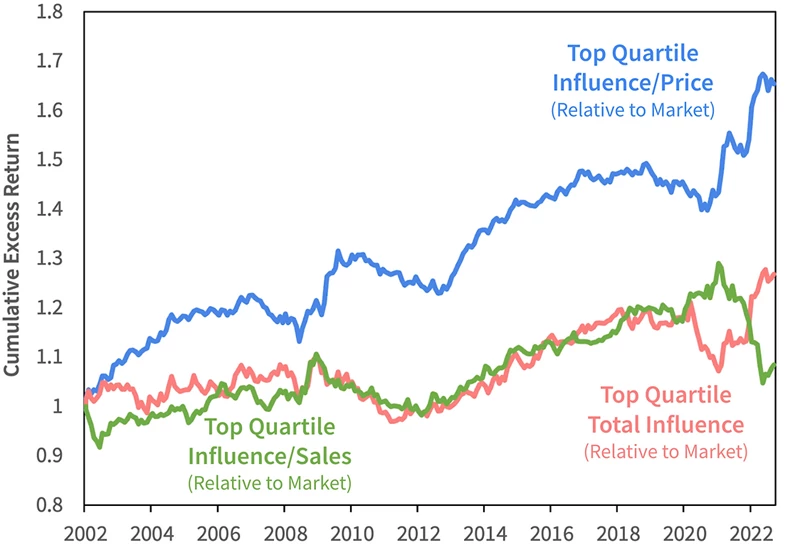

How influential are corporate lobbying and campaign contributions on individual stock returns?

"Merely recognizing that political capital has value is insufficient for profiting in the stock market if this information is already priced in. Influence is only worth buying if it can be obtained at a good price."

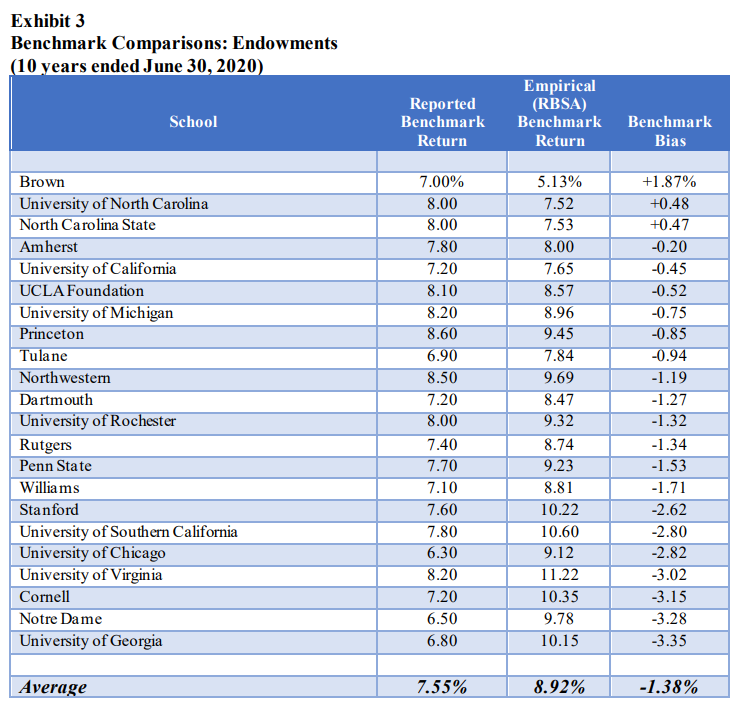

Are institutional investors relying too heavily on biased benchmarks?

"As a result of benchmark bias, the majority of funds give the impression they are performing favorably compared to passive management when, in fact, they are underperforming by a wide margin. Benchmark bias masks serious agency problems in the management of institutional funds. Investment trustees must step up and take control of benchmarking and performance reporting."

Lies, Damn Lies and Benchmarks: An Injunction for Trustees (Richard Ennis)

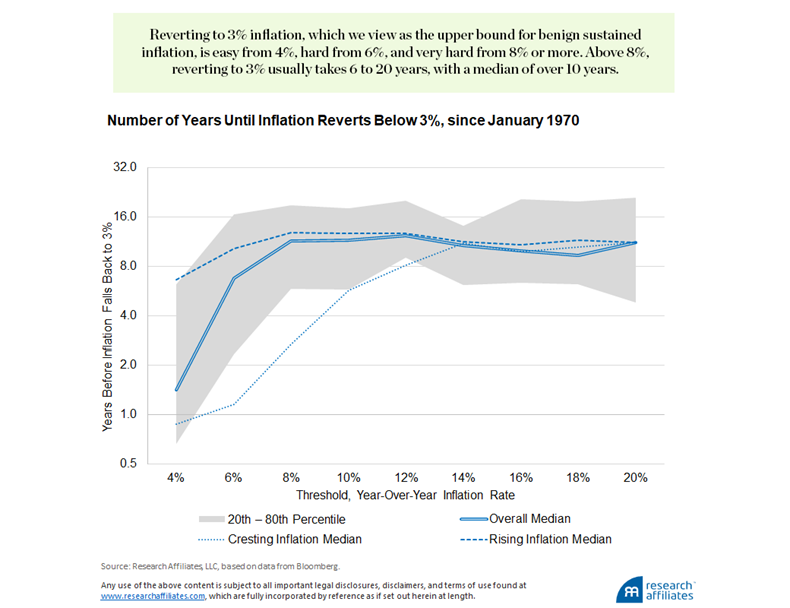

How long will it take for inflation to revert back to more "normal" levels?

"Those who expect inflation to fall rapidly in the coming year may well be correct. But, history suggests that’s a “best quintile” outcome. Few acknowledge the “worst quintile” possibility, in which inflation remains elevated for a decade. Our work suggests that both tails are equally likely, at about 20% odds for each."

History Lessons: How “Transitory” Is Inflation? (Research Affiliates)

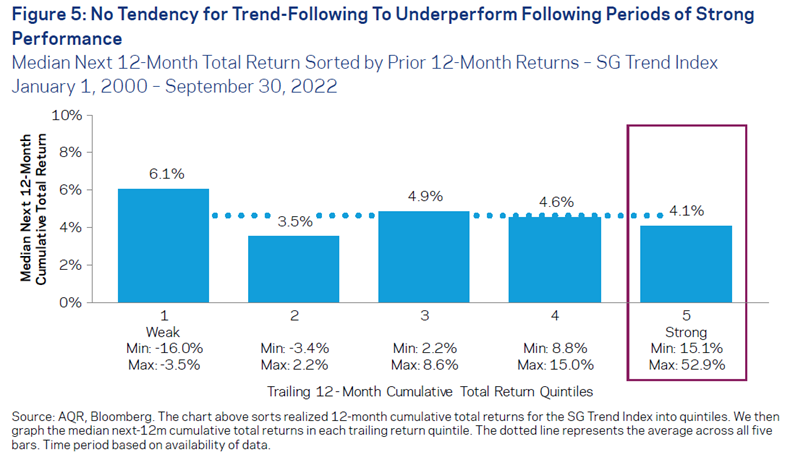

Is it too late to explore an allocation to trend-following strategies?

"After a strong period of performance for trend-following, many are worried that they will be “late to the trade” and recent performance will reverse. Based on the likelihood for macro volatility to persist and the current economic backdrop supporting the persistence of large market moves, we think there is a reasonable chance that strong trend-following returns continue."

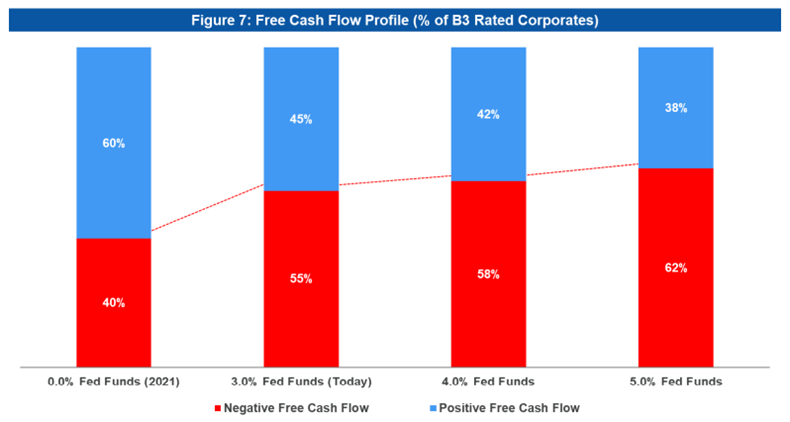

How vulnerable are credit markets at this stage of the cycle?

"Rising interest rates and weaker corporate earnings will pressure the ability of companies to generate adequate free cash flow after debt service. Cash-burn will be most pronounced for lower-rated leveraged loan issuers, particularly given the migration of high-risk issuers to the loan market over the past several years."

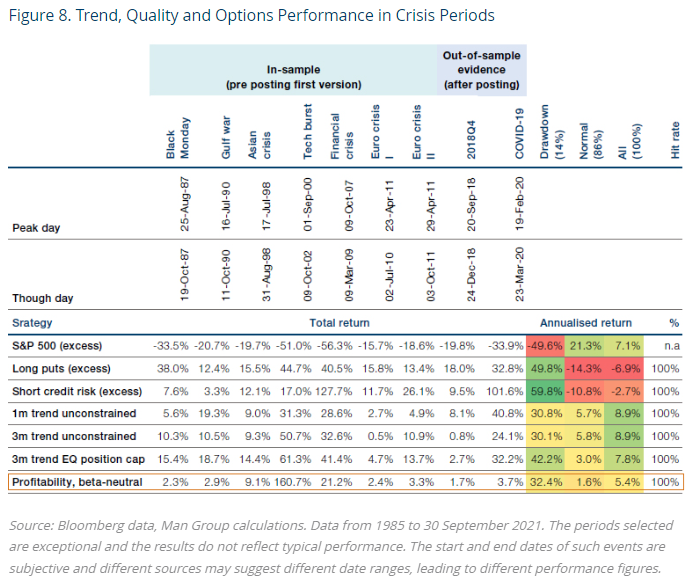

What choices do investors have to introduce convexity into their portfolios?

"Building on our previous research into the optimal strategies for market crises, including trend-following and the equity quality factor, we have found that sophisticated systematic overlays, combined with a small allocation to tail hedge options, can deliver an almost identical convexity profile at an improved rate of average monthly returns."

Creating Portfolio Convexity: Trend Versus Options (Man Group)

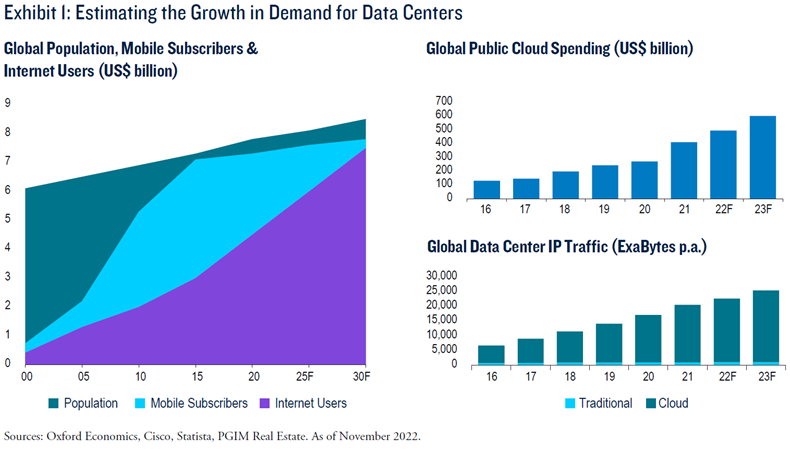

Does the demand for data centers show any signs of slowing down?

"There are challenges to be sure. We see returns in 2022 softening in line with a fall in investment volume as global economic uncertainty impacts the markets, while at the same time concerns about energy usage and its impact on the environment are growing, forcing the industry to take stock and look for ways to meet sustainability goals. But it is hard to ignore the sheer speed at which technology and the need for data centers is being adopted."

Global Data Centers: The Resilience of Digitalization (PGIM Real Estate)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.