The Paper Trail: Rate Expectations

There's no sugar coating it - it's been a brutal start to the year for bonds. The Bloomberg U.S. Aggregate Bond Index is down nearly 7 percent year-to-date.

The conventional wisdom of building a balanced portfolio is being challenged before our very eyes. If there was ever an environment to demonstrate the value of diversifying your diversifiers, this is it.

In this month's installment of The Paper Trail, we'll examine:

- Interest rate forecasting

- Personalized portfolios

- Turbulence in Trend Following

- The role of illiquidity

- Evolving global stock markets

- And much, much more!

Enjoy!

“bps” (reading time < 10 minutes)

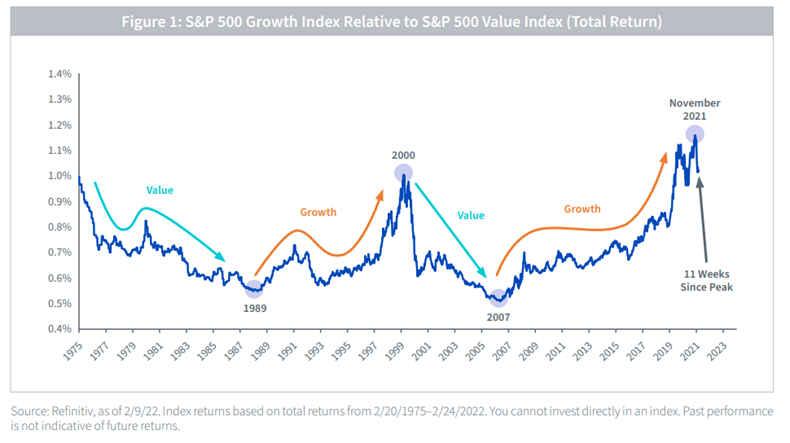

Why should investors consider tilting towards value stocks and away from growth?

"Growth stocks have a problem: they don’t appear to be growing."

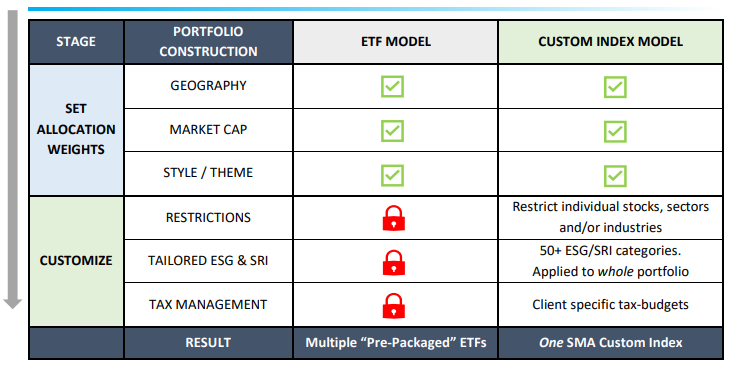

Is there any stopping the trend towards customized and personalized portfolios?

"In every other facet of life we crave personalization over commodification. Choosing between a tailored dress/suit and mass-produced off-the-rack option, most prefer the tailored – especially when priced equally. Investing will be no different."

Paradigm Shifts: Commodification to Personalization (O'Shaughnessy Asset Management)

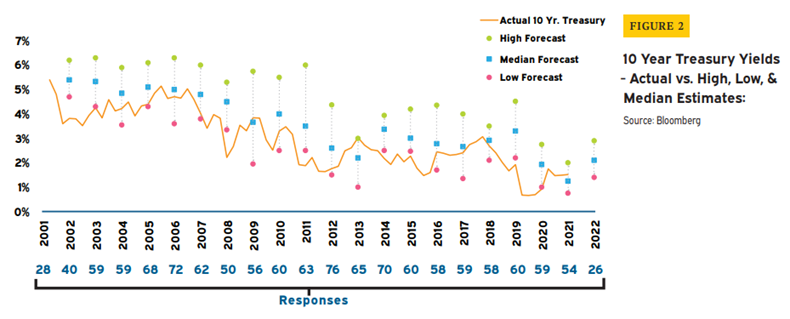

Are economists any good at predicting interest rate movements?

"There are no shortages of opinions on forecasting future yields, and economists are among those who have traditionally taken on this responsibility and whose predictions are recorded for posterity. In reviewing their predictions over the past two decades, we see underwhelming results."

Interest rate volatility part I: considerations in predicting interest rates (Meketa)

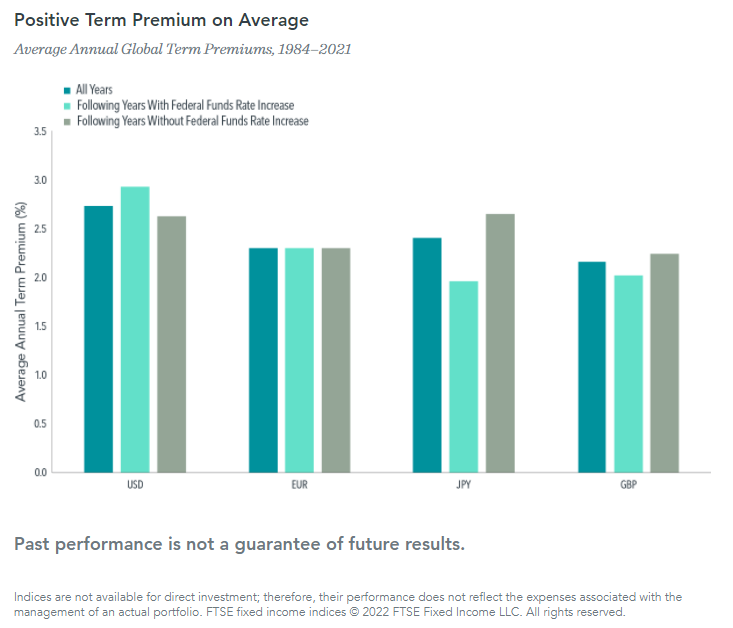

Is there a relationship between past changes to the Fed funds rate and future term premiums?

"Bond prices and yields reflect the aggregate expectations of all market participants, including opinions on how and when the Fed will act in response to macroeconomic conditions. Even if the timing and direction of federal funds rate changes could be predicted perfectly, we would still not know for certain how other interest rates would react."

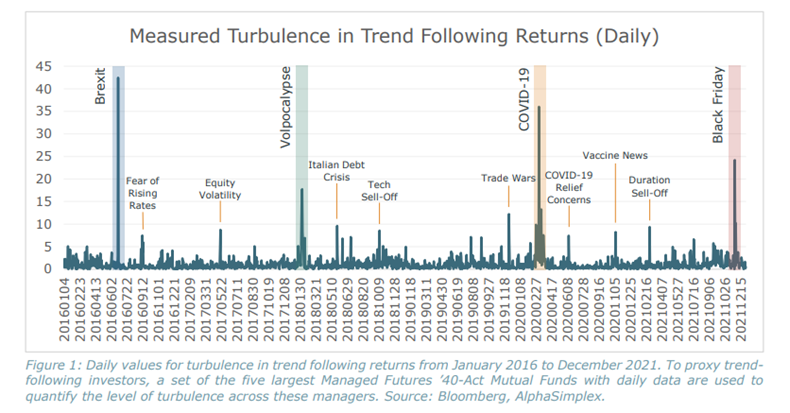

How frequent are periods of "turbulence" within trend following strategies?

"On a daily basis, we find that there are occasionally extremely turbulent days in trend-following returns and these days are often driven by magnitude surprises. Not only are these extreme days rare but they are also very negative for trend following; however, they do not persist and they are often followed by positive trend-following returns in the following week or month. This highlights the episodic nature of market shocks, which unfortunately plague all investments equities and trend following alike."

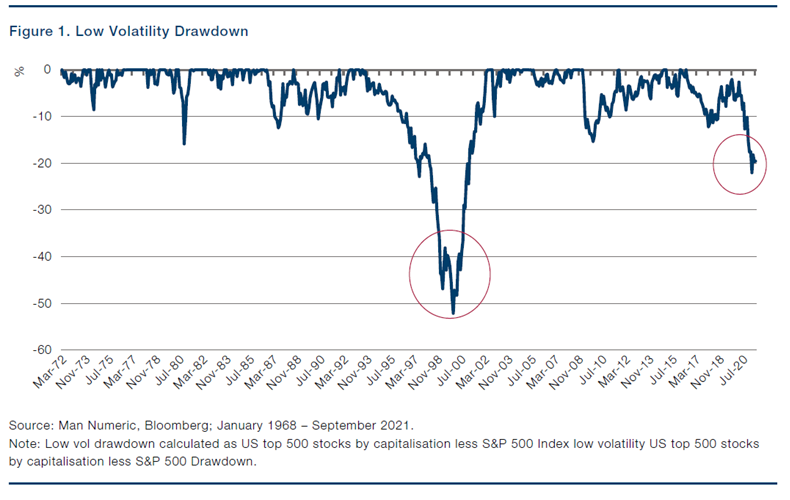

Is the low volatility factor poised for a comeback?

"In our view, this backdrop bodes well for the low vol concept in the coming quarters. Low vol’s defensive tilt is intentionally designed to withstand uncertain environments. As a bonus, low vol stocks have not fallen prey to incredibly stretched valuations to the same extent as the broader market, augmenting the concept’s current value proposition and potentially positioning it for outperformance in the coming quarters."

“pieces” (reading time > 10 minutes)

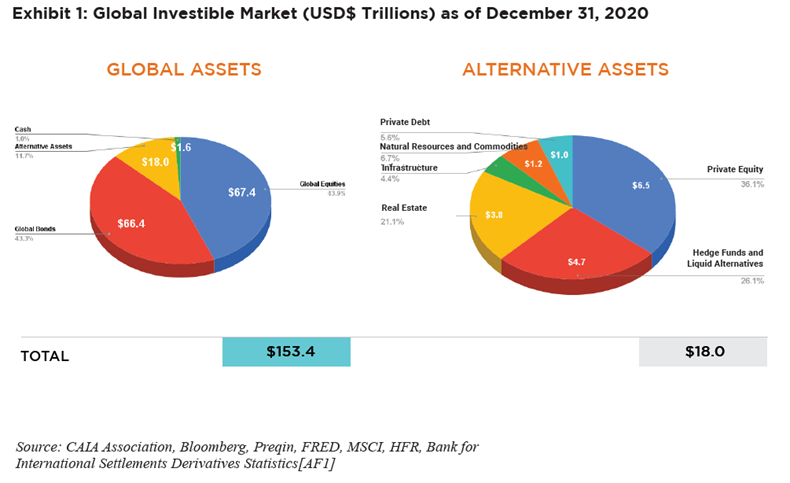

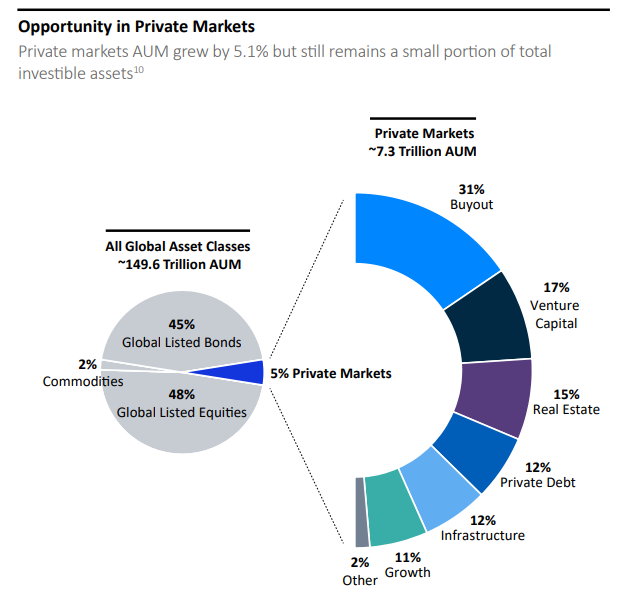

What role will illiquidity play in the portfolios of the future?

"Liquidity is no longer considered a benefit or drawback, but merely a feature. The blurring of private and public capital is an important trend that we believe will continue for years to come."

How can investment organizations harness feedback more effectively to improve processes?

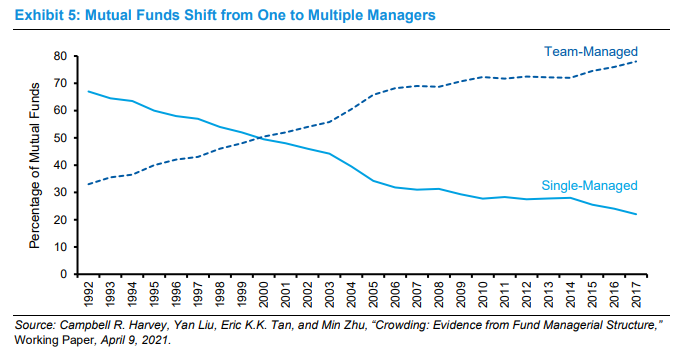

"One of the most profound changes in the investment management industry has been the shift from single- to team-managed funds. About 65 percent of funds had a single manager 30 years ago and about 20 percent do today (see exhibit 5). Team-run funds have generated higher excess returns than have single-managed funds, and they have done so with a lower standard deviation."

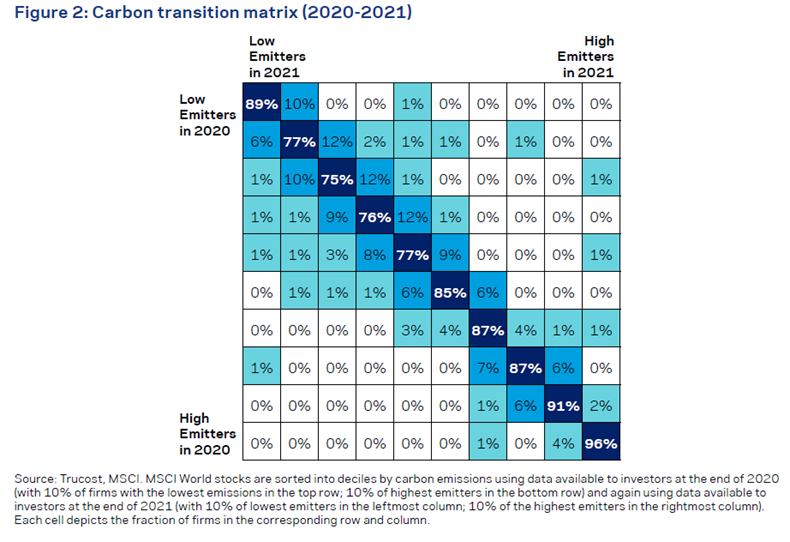

Is the relative "greenness" of companies stable over time?

"Not surprisingly perhaps, companies that were historically green (or brown) remain green (or brown) today and for a number of years into the future, overall and compared to same-sector peers. Second, and more surprisingly, we show that portfolio carbon footprint measured using historical data is remarkably informative about the current portfolio carbon footprint (using current, or same fiscal-year emissions that the portfolio finances)."

What does the future hold for private markets?

"This trend of “private for longer” shows no signs of abating and indicates a clear migration of value creation from public markets to private. PwC expects private markets to grow by $4.9 trillion between 2021 and 2025 to just under $15 trillion, which would see the sector’s share of global assets under management (AUM) doubling to 10% – a level that implies considerable runway for growth."

Private Markets Insights: Optimism in an Age of Change (Adams Street)

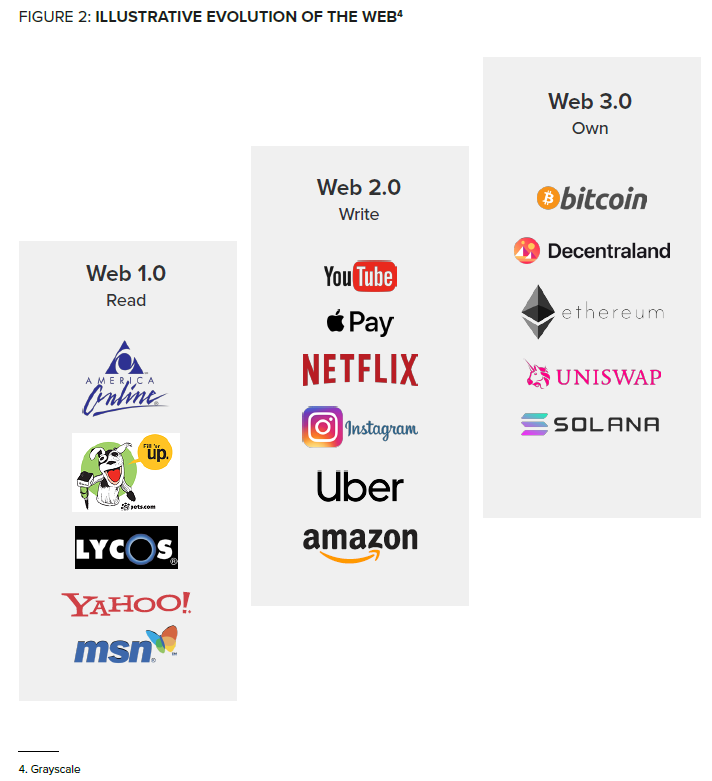

What is the investment thesis for allocating to crypto?

"Crypto assets blend the dynamics of investing in emerging markets, the

technology sector, and venture capital to provide exposure to the next wave

of the internet – Web 3.0 Cloud Economies (Figure 2). Crypto assets enable

investors and users to have direct ownership and control over internet

economies."

The Postmodern Portfolio Crypto Allocation Thesis (Grayscale)

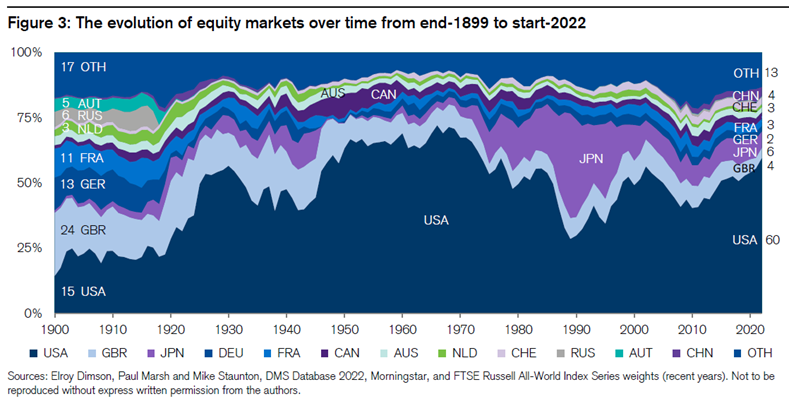

How have global equity markets evolved over time?

"At its peak, at start-1989, Japan accounted for 40% of the world index, versus 29% for the USA. Subsequently, Japan’s weighting has fallen to just 6%, reflecting its poor relative stock-market performance. The USA has regained its dominance and today comprises 60% of total world capitalization."

Credit Suisse Global Investment Returns Yearbook 2022 (Credit Suisse)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.