The Paper Trail: Rear-View Mirror

As another year comes to a close, I want to thank all my readers for continuing to support this blog. I hope your holiday season has been filled with quality family time, as well as some quiet time for rest and reflection as the new year approaches.

For yours truly, 2024 is shaping up to be a year of profound change. On the personal front, my wife and I are expecting our second child in mid-February. We can't wait to welcome this baby into the world and complete our little family.

Professionally, I have a very exciting update to share. I'll tell you more about it next year! (Sorry, couldn't resist the dad joke)

But seriously, stay tuned...

***

Please enjoy the December 2023 edition of The Paper Trail. This month's research roundup features:

- Expected returns for U.S. equities

- The convergence of high yield bonds and leveraged loans

- Multi-manager hedge funds

- Portfolio liquidity decisions

- Small buyout funds

- Rising debt costs and corporate earnings

- Retail real estate fundamentals

- The quality anomaly

- Diversification in direct lending

- GP Seeding

- And much more!

“bps” (reading time < 10 minutes)

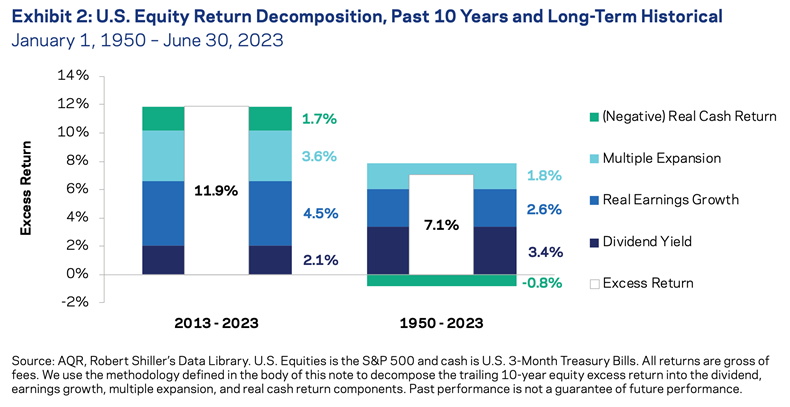

Is it possible for U.S. equities to repeat their performance of the last 10 years?

"Here is the rub: to forecast a repeat performance from equity markets, you

must forecast earnings growth at levels unprecedented in a non-recession economy and the market to trade at its richest level ever at the end of the decade. While it’s impossible to rule out this scenario, it is an implausible baseline assumption."

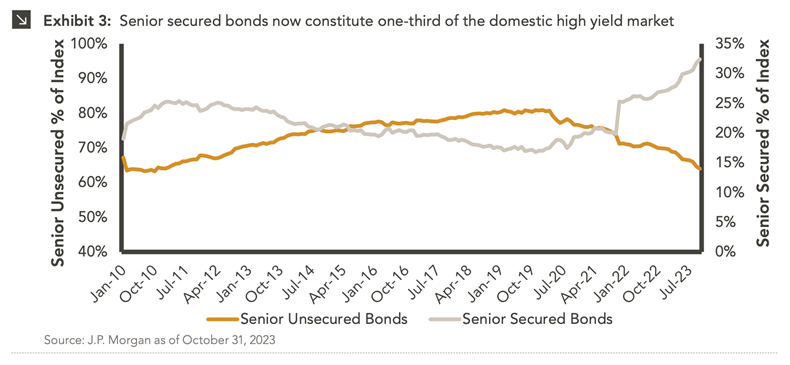

Are there major risk-reward differences between high yield bonds and leveraged loans?

"Senior secured bonds have always been a constituent of the high yield market. However, over the past few years, their share of the overall index has increased dramatically and is now at a record level of the market. While the coupon structure is different, senior secured bonds are “secured” by the assets of the borrower, much like leveraged loans. This recent development — the growth of senior secured bonds as an overall percentage of the high yield market — blurs the lines between these markets and may lead to increasingly similar behavior between the markets."

We’re Not So Different, High Yield Bonds and Leveraged Loans (Marquette Associates)

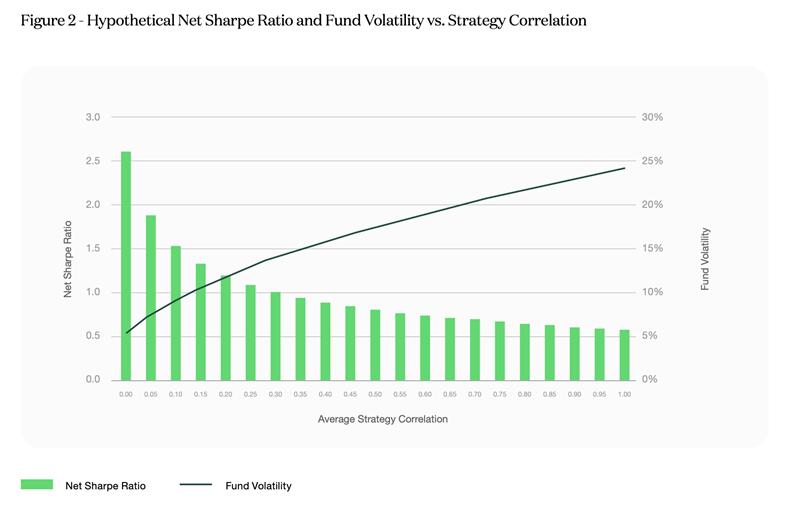

Why have multi-manager hedge funds been so successful in recent years relative to the broader hedge fund universe?

"Yet we believe the special sauce in multi-manager fund portfolios is driven by the portfolio construction math - finding and allocating to enough lowly correlated strategies and implementing them

in a cash efficient manner."

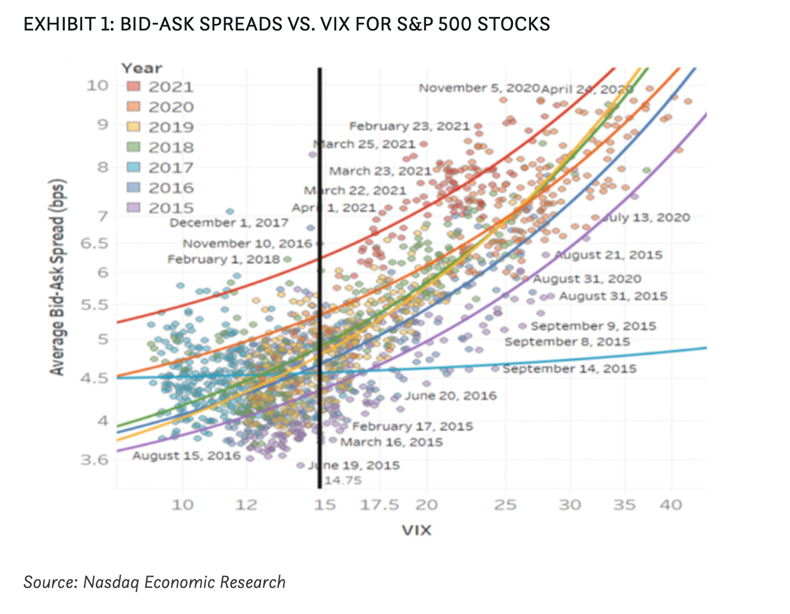

Why are portfolio liquidity decisions so important for investors to consider?

"Investors must consider portfolio liquidity because they never want to be in a position where they are forced to sell their higher-returning assets that have just gone down in value in order to cover cash obligations or capital calls— effectively locking in market losses."

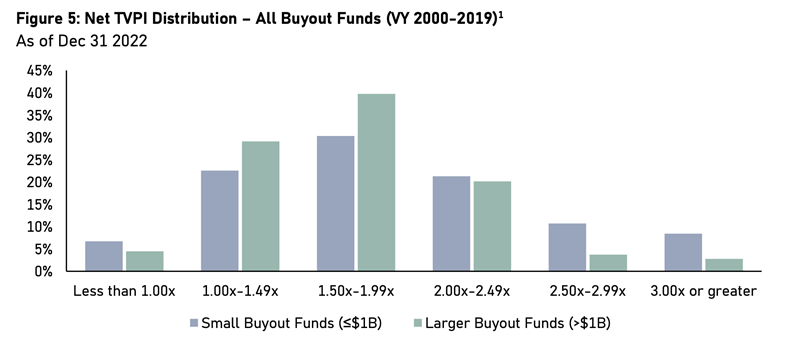

Have small buyouts earned a premium over large buyouts in private equity?

"When a small buyout manager is successful in scaling a smaller business into a more institutional or sizeable entity, the sale multiple is likely to increase as a new buyer can value the strategically more important asset with more stability and fewer risks."

Do Small Buyout Funds Still Belong in a Diversified Private Equity Portfolio? (Abbott Capital)

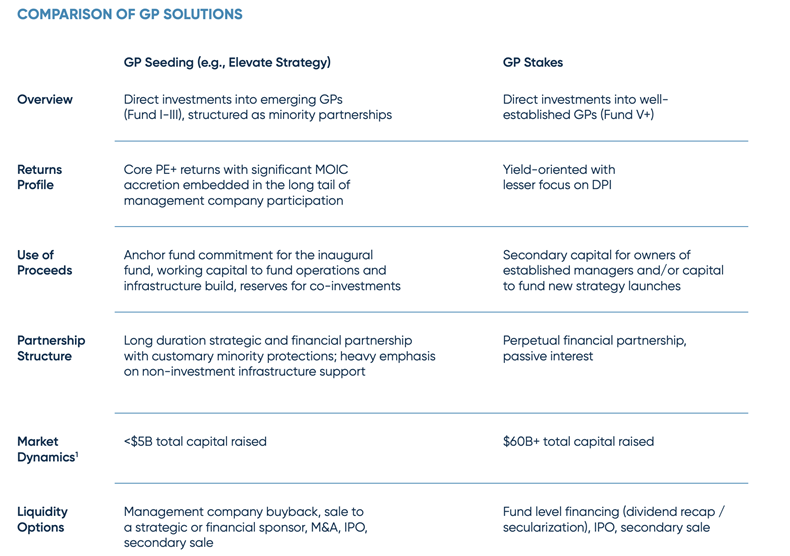

How does GP Seeding compare and contrast with GP Stakes in the private markets ecosystem?

"GP seeding is often mentioned alongside GP stakes investing. While both entail acquiring minority interests in the management companies of asset managers, stakes investing generally refers to a focus on more established firms (Fund IV+), with an established base of $2+ billion in AUM. In addition, seeding and staking are different in material respects including duration, return profile, use of proceeds, and opportunity set, among other key criteria."

The Rise of GP Seeding as an Institutional Asset Class (GCM Grosvenor)

“pieces” (reading time > 10 minutes)

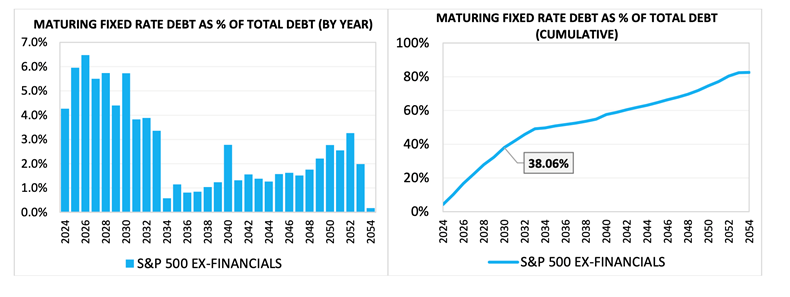

What is the potential impact of rising debt costs on U.S. corporate earnings?

"Right now, the corporate sector is temporarily insulated from the immediate effects of interest rate increases by the fact that it issued substantial amounts of medium and long-term debt under the low interest rate conditions of the last decade."

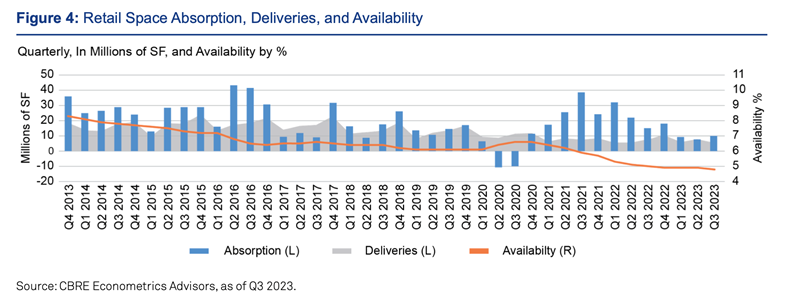

Has the death of brick-and-mortar retail real estate been greatly exaggerated?

"As a result of these externalities, the retail sector finds itself in an unanticipated golden era of fundamentals, boasting record low vacancy rates, record high rental rates, and twelve quarters of positive absorption."

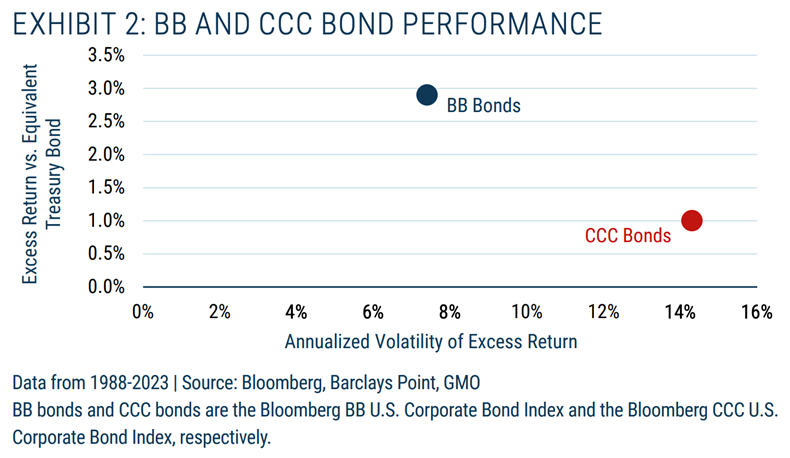

Why does the quality factor persist in equity and high yield credit investing?

"This is the part of the essay where I’d normally try to summarize my views on why the anomaly in question exists. But in this case, I have trouble coming up with anything at all plausible that doesn’t come down to “investors are weirdly stupid.” Financial markets are not supposed to work backward, and when one is looking at asset classes, they generally don’t."

The Quality Anomaly: The Weirdest Market Inefficiency in the World (GMO)

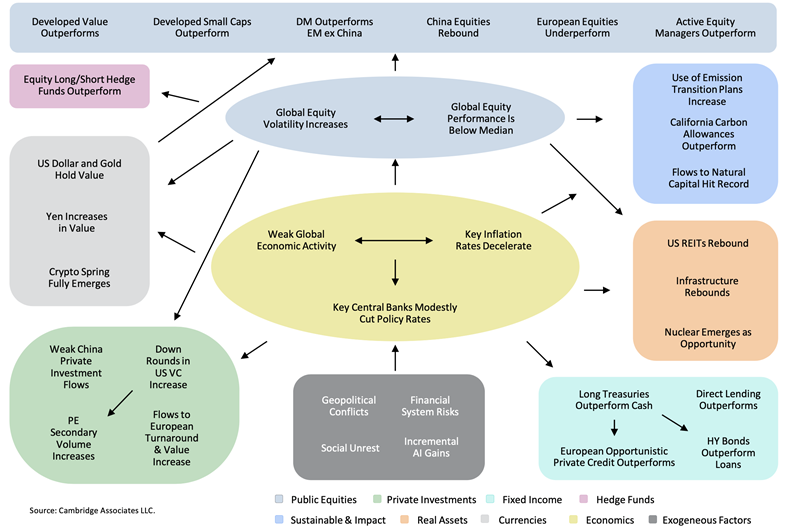

What is the economic outlook for 2024 and how might that manifest in asset class returns?

"Weakness in global aggregate demand will help those inflation rates that experienced pandemic-related surges continue to decelerate. We expect this will allow most key central banks to modestly cut policy rates before the end of 2024."

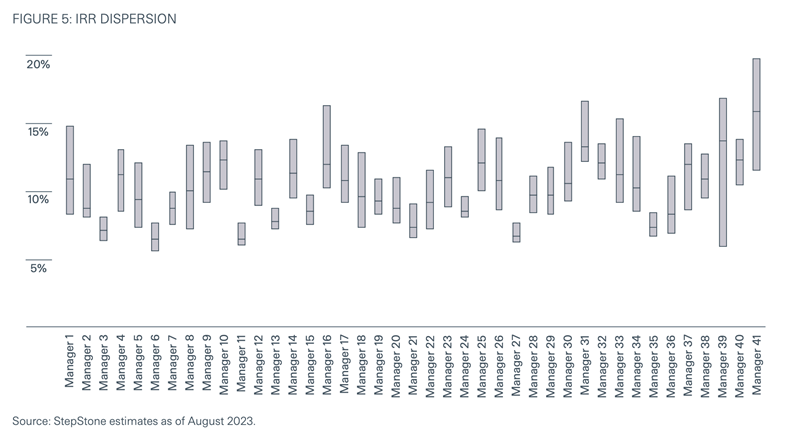

Does it make sense to diversify by manager within a direct lending portfolio?

"Because direct lending GPs tend to specialize in specific niches of the direct lending space—such as particular market segments—being overly reliant on a single GP can render a portfolio susceptible to idiosyncratic shocks, thereby negatively affecting returns or the efficient deployment of capital."

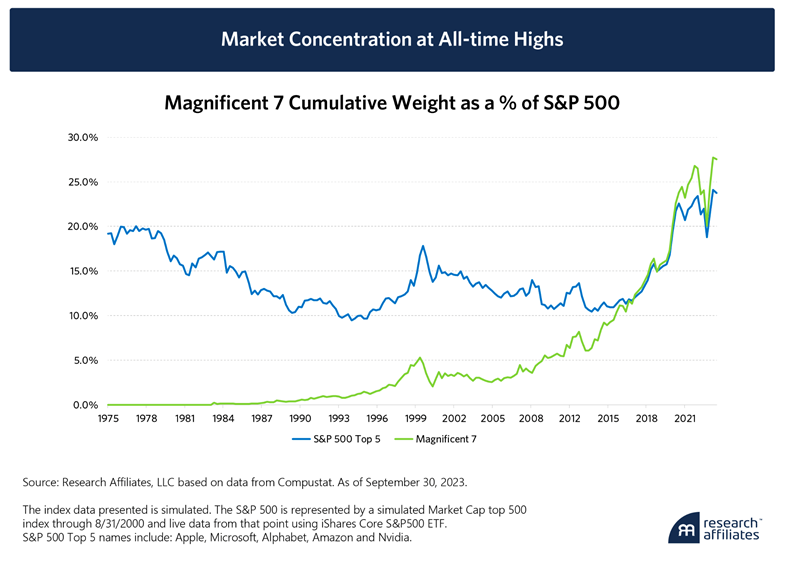

Should investors be concerned about the high degree of concentration in the U.S. stock market?

"Indeed, the outsized influence of these companies on market averages magnifies the scrutiny of their fundamentals, leading some investors to worry that any blemishes could be a harbinger of more difficult times ahead. For such investors, alternatives to capitalization weighted indexes would provide better equity diversification."

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.