The Paper Trail: Regime Change Resilience

Halloween is right around the corner, and I find myself faced with the difficult decision of which costume to wear this year: Roaring Kitty or Shiba Inu?

As we inch closer towards the end of 2021, investors have largely been rewarded with treats rather than tricks. That said, the risk that markets get spooked remains ever-present, as does the need to remain disciplined and seek portfolio resiliency in the absence of a crystal ball. With that in mind, I present the October edition of The Paper Trail!

“bps” (reading time < 10 minutes)

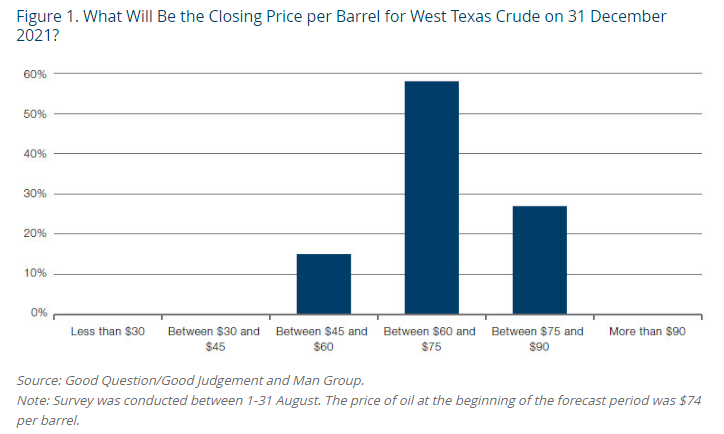

Can oil prices continue to grind higher?

"Substitution is clearly happening, but with around 1.5 billion vehicles in the global car park (versus only around 8.5 million electric vehicles), and no existing non-carbon solutions for shipping or aviation yet, that process will not be fast. The release valve over the short-to-medium term, absent a recession, will likely be price."

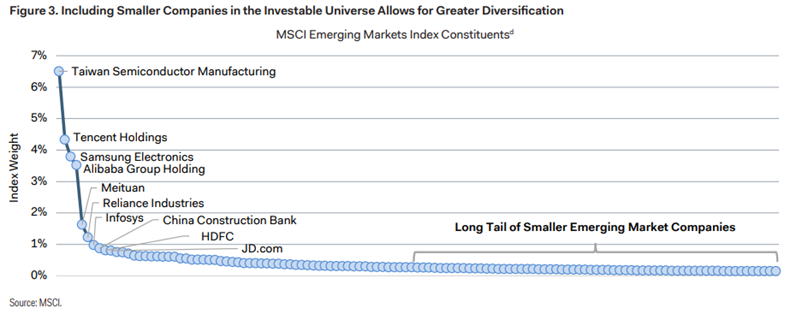

Where do the opportunities lie in emerging market stocks?

"Since large-cap emerging market companies are mostly concentrated in the Information Technology and Financials sectors, investors need to be willing to invest in small- and mid-cap companies to achieve broad diversification in emerging markets."

Emerging Market Stocks: A Wealth of Opportunities (Dodge & Cox)

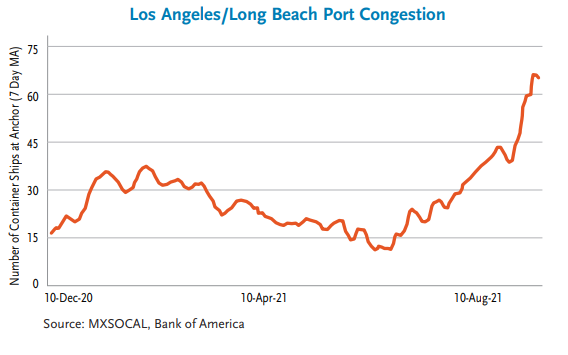

Are widespread shortages here to stay?

"Historically, supply constrictions have occurred owing to bad harvests, labor strikes, political disruptions, or trade embargoes. But reductions in supply should jack up prices thereby restraining demand and, eventually calling forth new sources of production. But here we are, closing in on the two year “anniversary” of the pandemic, and the shortages remain. Indeed, using the proxy in the form of shipping congestion, these shortages may be worsening."

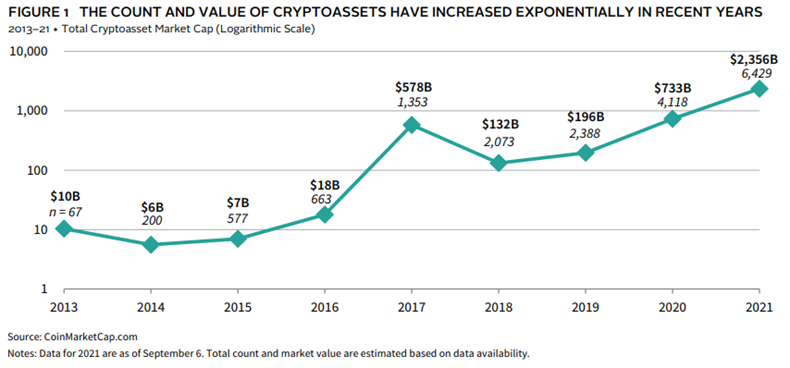

What issues should investors consider when evaluating what role, if any, cryptoassets play in their portfolios?

"Much like the early internet or early-stage venture, there will be a high failure rate. For many of these crypto tokens in this increasingly saturated market, the question is not “when,” but “if,” these technologies will ever work as intended. There are projects that are working as intended, but we have yet to see which ones will be the “winners” and generate mainstream adoption. For this reason, investors looking to enter the space are more likely to realize gains by focusing on diversified baskets of cryptoassets, rather than individual offerings."

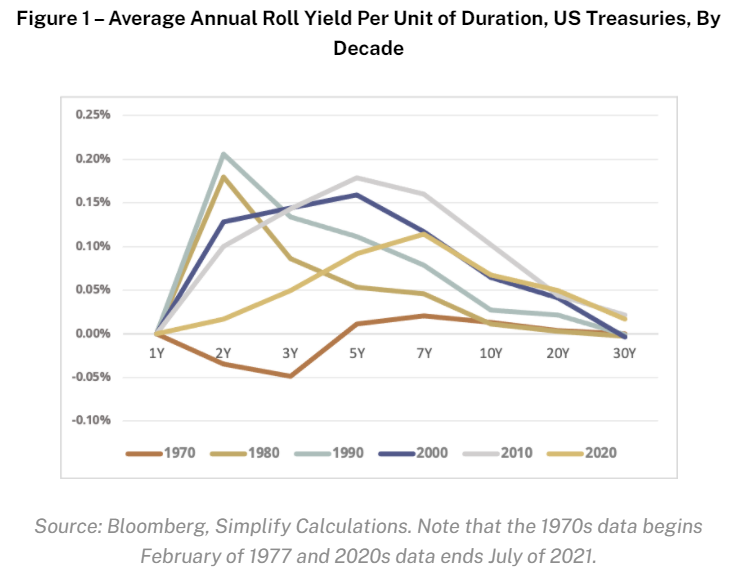

Is there a more efficient way to obtain long duration exposure than simply buying long-dated Treasuries?

"With roll yields and coupon yields (per unit of duration) highest toward the front end of the curve, we have demonstrated the potential benefits of gaining long duration exposure by levering up a short-to-intermediate tenor Treasury."

“pieces” (reading time > 10 minutes)

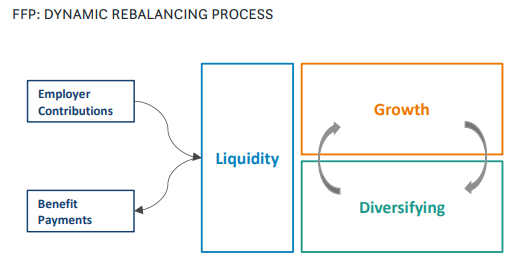

How can we build Functionally Focused Portfolios (FFP) using an ensemble of equity risk mitigation approaches?

"Relative to traditional approaches to asset allocation, FFP places liquidity at the center of the process and builds in growth and diversification once that core liquidity function has been satisfied. The core liquidity pool is continuously replenished from contributions and investment income. The growth and diversifying portfolios are periodically rebalanced, based on market movements."

Establishment of Risk Mitigation Buckets (Verus Investments)

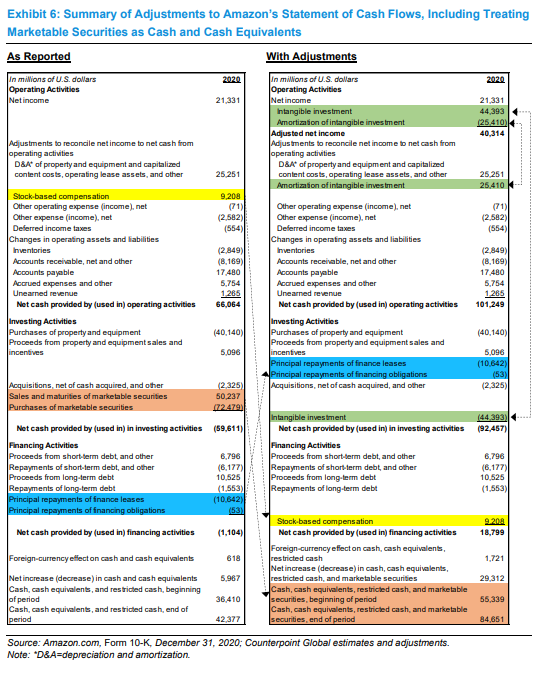

Can the cash flow statement be improved upon?

"A clearer understanding of the cash in, cash out, and financing activities provides relevance and predictive value beyond the current standards. This analysis is important because an accurate measure of the magnitude of investment and profitability is essential to understanding the business."

Categorizing for Clarity: Cash Flow Statement Adjustments to Improve Insight (Counterpoint Global)

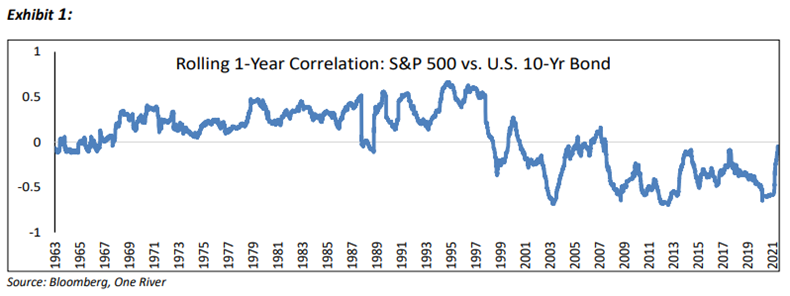

How reliable are historical cross-asset correlations?

"We believe that the success experienced by allocators who have leaned heavily on transitory correlations over the last few decades is less likely to persist through significant economic change without sources of structural correlation in their portfolios."

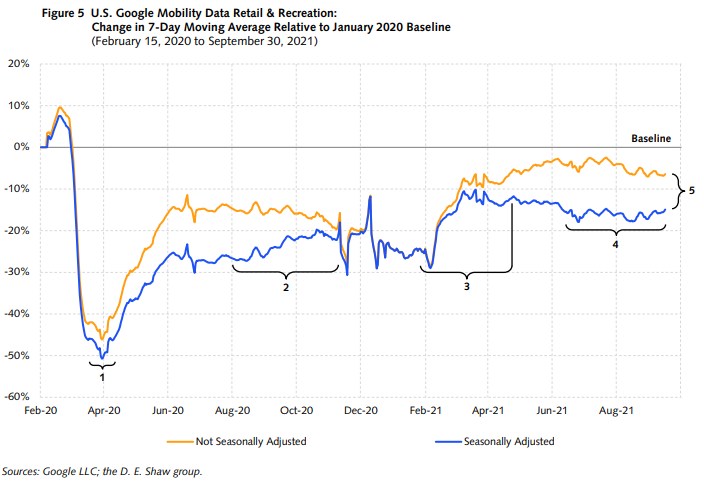

Should alternative data sources like Google's mobility data be taken at face value?

"According to our analysis, in which we account for that seasonal variation in the United States, the overall recovery of U.S. mobility following the massive lockdown-induced decline in early 2020 has been more muted than the raw data suggest, and - notably - the more recent perceived mobility recovery since April 2021 has been essentially nonexistent."

Fair Weather Trends: Seasonality and Google Mobility Data (D. E. Shaw)

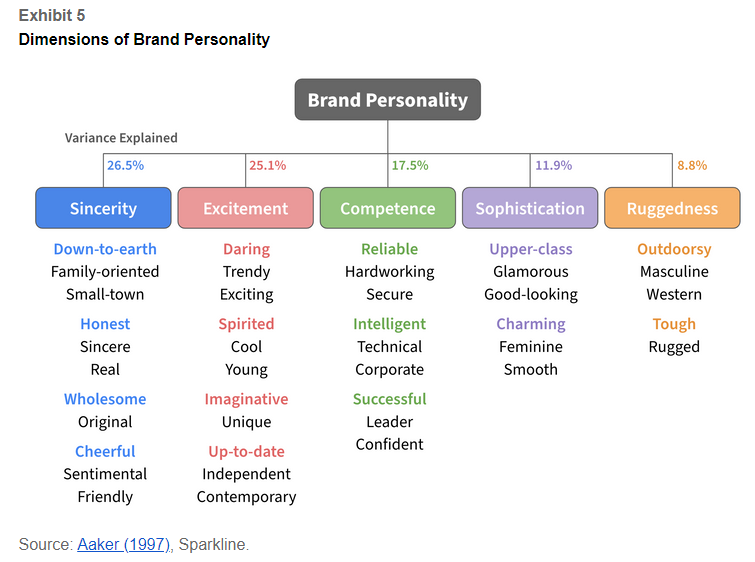

Is it possible to measure the actual value of a brand?

"Fortunately, in the influencer era, the nexus of consumer power has migrated online. It has moved to the very domain that is the most fertile ground for NLP and other modern data analysis techniques."

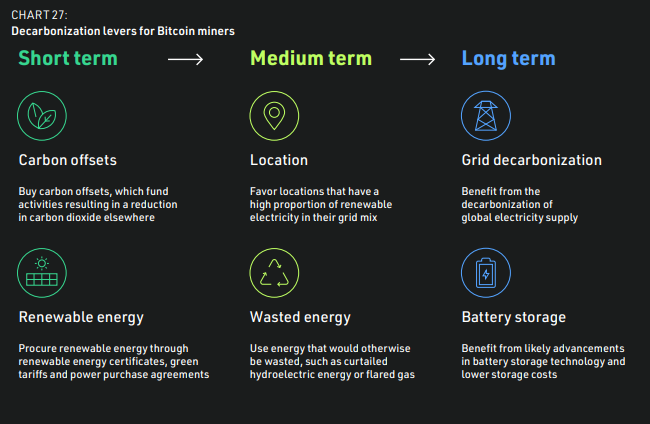

Can Bitcoin chart a path towards more sustainable energy consumption?

"The current energy consumption of Bitcoin miners can be inferred relatively easily, but projecting Bitcoin’s future emissions intensity requires various assumptions. These relate to Bitcoin’s price trajectory, miners’ energy mixes and geographies, miners’ economics, the off-grid share of mining activity, the average price of electricity available to miners, and the volume of transaction fees."

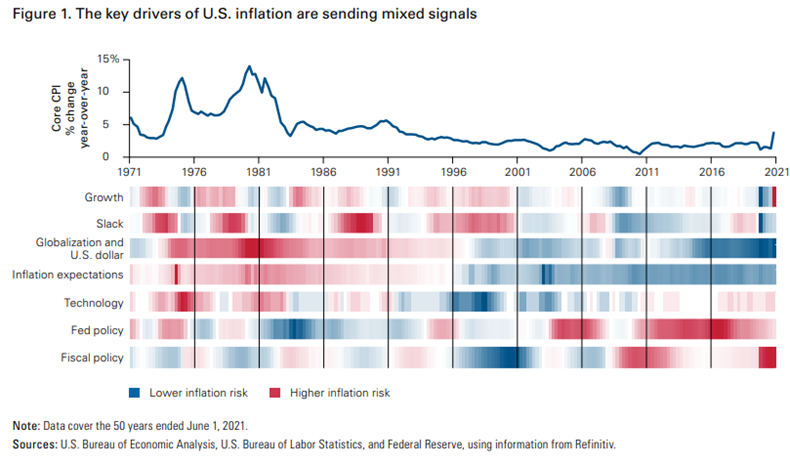

Are the stronger than expected inflation rates of late likely to persist into 2022 and beyond?

"The longer that today’s inflationary spike lasts, the greater the risk that expectations become dislodged, which could raise the medium- and long-term inflation outlook. As our model shows, inflation is highly responsive to changes in inflation expectations."

The Inflation Machine: How it Works and Where it's Going (Vanguard)

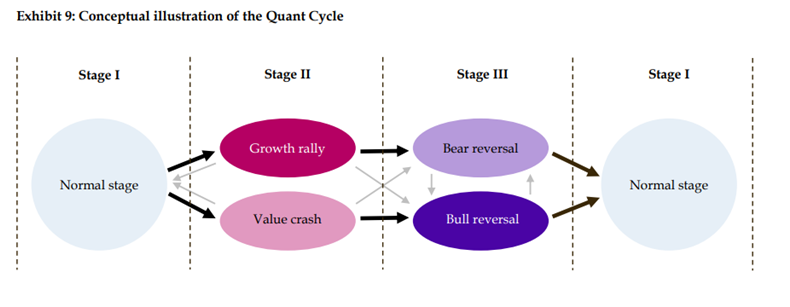

Do factor returns follow the traditional business cycle, or an entirely different cycle unto themselves?

"In line with previous studies we find that traditional business cycle indicators do not capture much of the cyclical variation in factor premiums. We argue that this is not surprising if, rather than being a reward for macroeconomic risks, factor premiums are a behavioral phenomenon at heart."

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.