The Paper Trail: Rolling with the Punches

It's that time of year again.

April is coming to a close. Spring has sprung. And the inevitable chorus of "sell in May and go away" will once again rear its ugly head.

It's one of those market aphorisms that people often assume to be true just because it rhymes.

And while stock market performance tends to be weaker in summer months than in winter months, it is just that - a tendency. Not an absolute rule that one should follow blindly.

But if you do insist on selling in May and going away, at least take some great investment research with you!

With that in mind, please enjoy the April edition of The Paper Trail. This month's research roundup features:

- Trend following performance following major reversals

- Intangible assets as an input to quality strategies

- The "re-emerging" case for emerging markets

- A primer on alternative risk premia

- Private equity valuations

- Adding gold to a multi-asset portfolio

- Price-to-book compared to other valuation metrics

- Global reserve currency status of the U.S. Dollar

- And much more!

“bps” (reading time < 10 minutes)

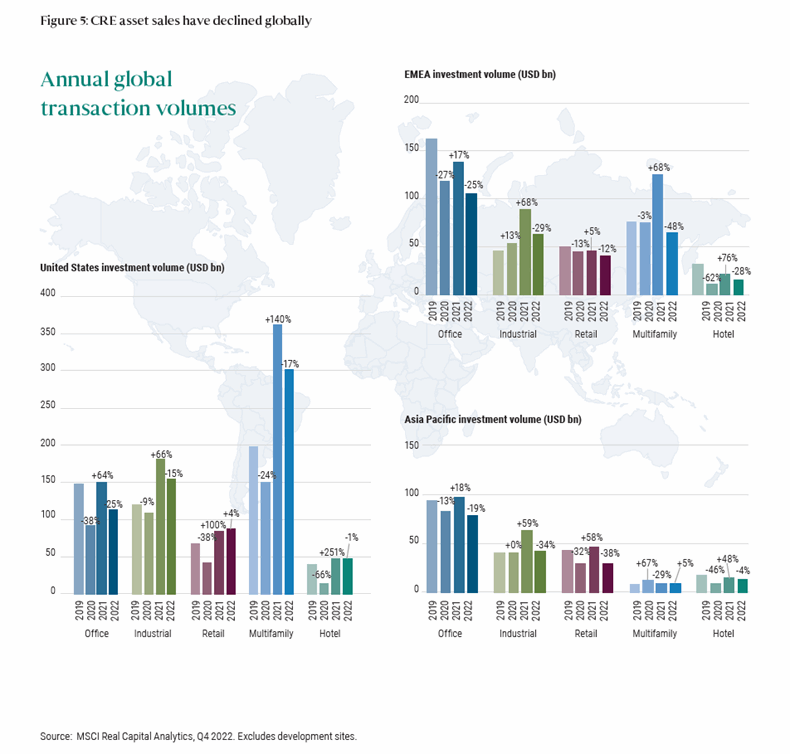

Are there silver linings in the cloudy commercial real estate market?

"We expect asset sales, now stalled, to accelerate in 2023, driven by a combination of investor liquidity and balance sheet pressures, financing challenges, and those simply looking to sell ahead of potential further price declines. We see investment opportunities in this new real estate landscape, and anticipate more may arise as the landscape evolves."

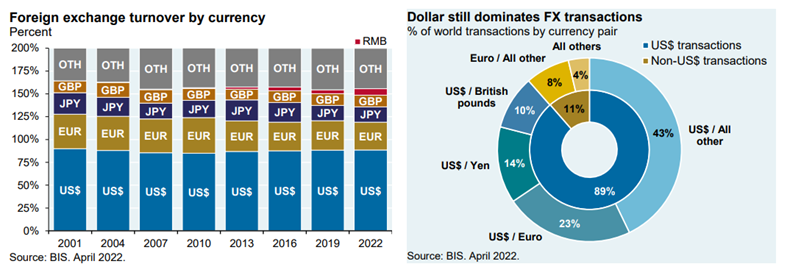

Are concerns over the U.S. Dollar's status as the global reserve currency warranted?

"The dollar’s role in foreign exchange markets is mostly unchanged over the last 20+ years; in 2022 the dollar accounted for ~89% of all FX transactions. In other words, the dollar was involved on one side or the other in 89% of all global transactions. The dollar’s average turnover per day was $6.6 trillion in 2022, up 14% from $5.8 trillion in 2019 and in line with the change in total turnover. In addition to dominating the spot market, the dollar also dominates 85% of currency forward and swap markets. The RMB share has grown but is still not large enough for the label to fit in the red segment in the bar chart"

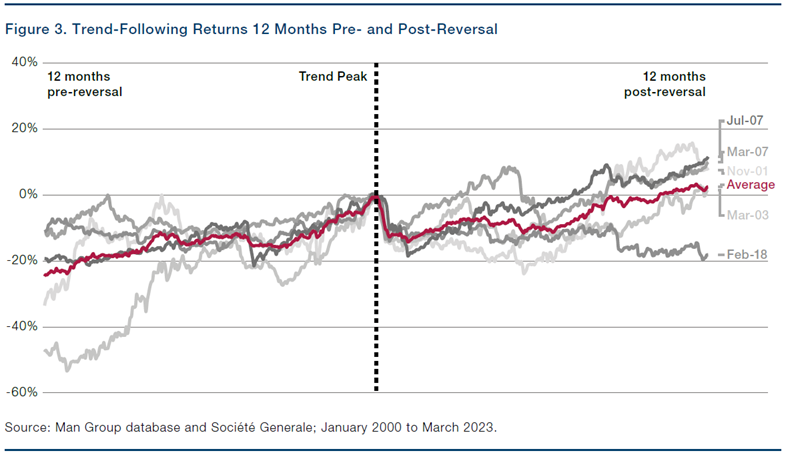

How do trend following strategies typically perform in the periods following a major trend reversal?

"The notable takeaways are two-fold; firstly, on average, trend-following is profitable in the twelve months leading up to a reversal. This is intuitive; by definition, a significant reversal must happen after a sustained trend. Secondly, in the twelve months that follow, on average performance supersedes the high water mark which was set at the peak immediately before the reversal."

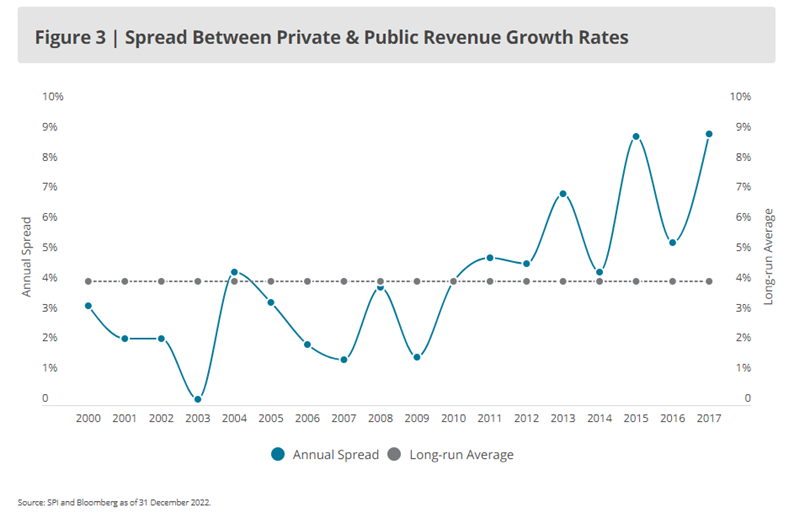

Are concerns of elevated private equity valuations overblown?

"Based on our analysis, private equity outperformance has been attributable to things other than multiple expansion (e.g., revenue growth and margin expansion). So it is reasonable to conclude that even if public valuations are more favorable today, existing private equity investments may outperform the public markets going forward."

Are rising interest rates a tailwind or a headwind for private debt investors?

"We believe that right now, the investment opportunity for private debt is as good as it’s been in a very long time. We view the current vintage of new loans as representing an extremely attractive risk/reward profile. We also believe that the recent sharp rise in base interest rates will result in tighter interest coverage ratios and greater refinancing risk for many borrowers. These two phenomena can be true at the same time, and both provide the best managers with an opportunity to significantly outperform their peers. "

Private Debt Market Outlook: The Opportunity of a Lifetime? (Benefit Street Partners)

“pieces” (reading time > 10 minutes)

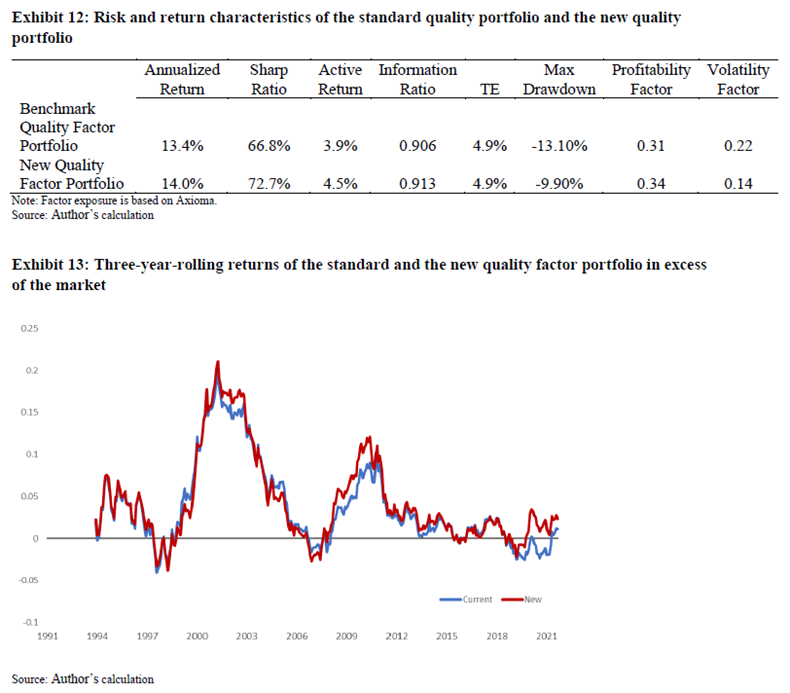

Does accounting for intangible asset intensity (IAI) improve the quality factor?

"By incorporating IAI with other commonly used quality attributes, such as gross and operating profitability and change of net operating capital, our findings suggest that the new quality portfolio could be improved by the inclusion of companies with high intangibles investments. The new quality portfolio exhibits a better risk-return profile and a more desirable factor exposure."

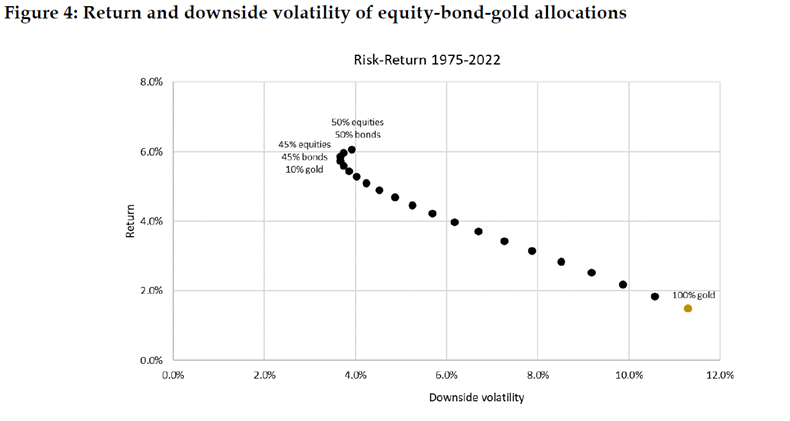

Does a strategic allocation to gold enhance he risk-adjusted returns of a multi-asset portfolio?

"A modest allocation to gold indeed helps to reduce downside risk of traditional stock-bond allocations, yet such risk reduction comes at the cost of return."

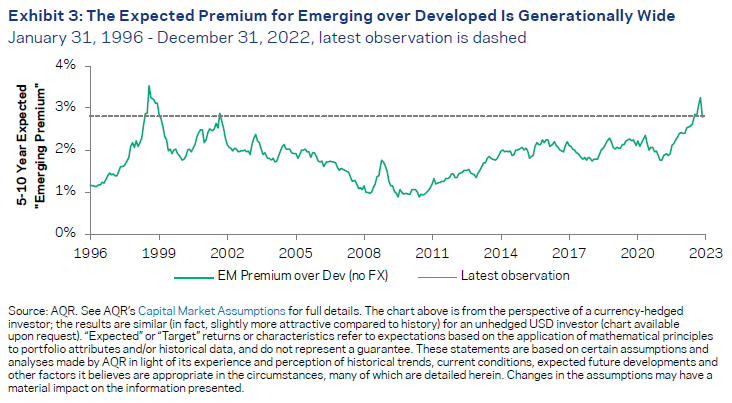

Is there a strong case for investors to "re-up" their allocations to emerging market equities?

"Bottom line: there are many reasons to believe that the relatively attractive valuations found in emerging markets represent a 5-10 year opportunity. In other words, the current expected premium is likely due to these markets being relatively underpriced, as opposed to representing compensation for assuming meaningfully greater portfolio risk."

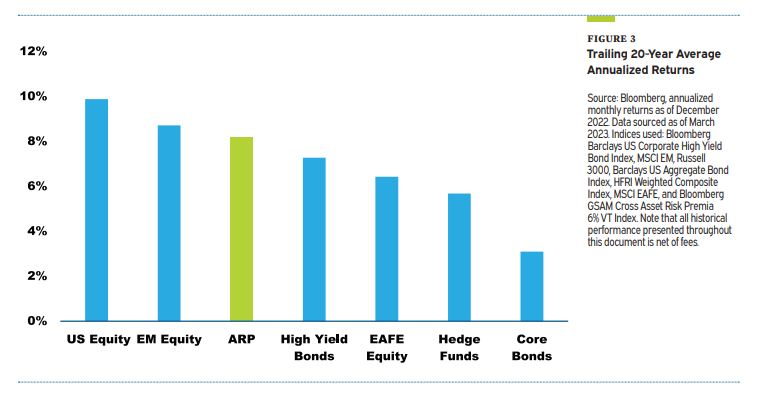

What are alternative risk premia (ARP) and how might they fit into a portfolio?

"Alternative Risk Premia are designed to harvest risk premiums across the global capital markets in a manner that avoids exposure to traditional risk premia and thus makes them uncorrelated with the major asset classes used by investors. ARP strategies invest in factors such as momentum, carry, value, defensive, and volatility, among others."

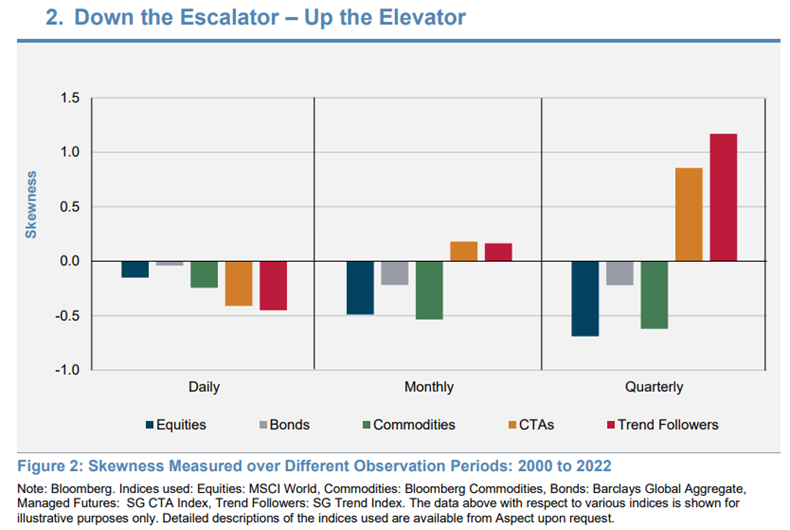

Why is the positive skewness of trend following strategies so valuable?

"At this stage it may well be worth emphasizing why positive skewness is such a desirable property in a strategy. Provided the strategy has a positive expected return then having positive skewness implies that the maximum expected upside is larger than the maximum expected downside. Conceptually this conforms to the old adage: ‘Run your winners and cut your losers’. From a risk management point of view this type of strategy profile is also desirable as the likelihood of outsized returns will tend to be on the upside rather than the downside"

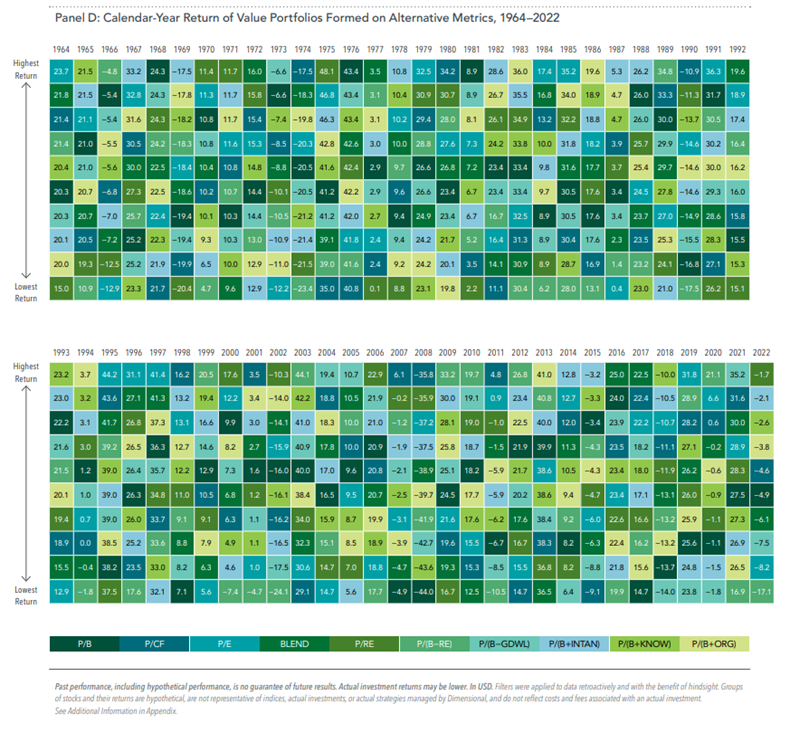

How does price-to-book (P/B) stack up against other valuation metrics?

"Investors should always keep an open mind and look for better ways to extract information about differences in expected returns between value and growth stocks. However, when evaluated based on conceptual, empirical, and practical considerations, price-to-book—one of the original value metrics (Stattman 1980; Rosenberg, Reid, and Lanstein 1985)—still offers several advantages over alternative metrics. Our analysis shows price-to-book can provide a similar expected return with lower turnover and more control over the exposures to multiple premiums in a systematic investment solution."

Assessing Alternative Value Metrics (Dimensional Fund Advisors)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.