The Paper Trail: Sea Change

“An optimist stays up until midnight to see the New Year in. A pessimist stays up to make sure the old year leaves.” —William E. Vaughan

While I am not sure I'll stay up until midnight on New Year's Eve, I'm very much looking forward to waking up on January 1st with 2022 in the rearview. Not sure if that makes me an optimist or a pessimist...

It was very easy to be a pessimist this year, surrounded by a sea of negativity in the economy and markets.

While it may not seem like it, investors have much more to be optimistic about in 2023 - slowing inflation, higher yields in fixed income, better entry points in equities, and an end in sight to the Fed's rate hiking cycle.

We often place too much emphasis on one year ending and another beginning. The turn of the calendar need not precipitate a turnover of your portfolio. Incremental improvement in our lives and our investments should be a continuous exercise.

Too all my readers, I wish you a happy, healthy, and prosperous new year!

Now, onto the final installment of The Paper Trail for 2022. This month's research roundup features:

- Achieving Adequate Diversification in Stocks

- New "Gateway" Markets in U.S. Real Estate

- Opportunities in Insurance-Linked Securities

- Technology Exposure in the U.S. Stock Market

- Global Macro Strategies

- Implications of Positive Stock-Bond Correlations

- Portfolio Protection, Fast and Slow

- Market Sea Changes

- And much more!

“bps” (reading time < 10 minutes)

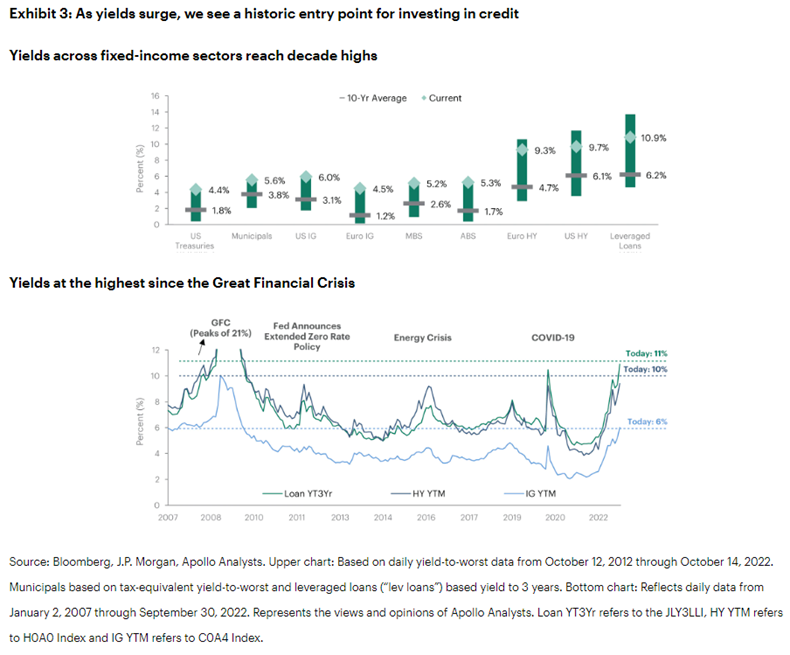

Is it time for investors to start leaning into credit?

"Through a historical lens, we believe today’s market environment offers a unique entry point for investors looking to allocate to credit. We expect this opportunity to unfold over the next 12 to 24 months, as the Fed tightens monetary policy, market volatility stays historically elevated, and liquidity remains challenged. In our view, this environment will continue to create periodic forced-selling dynamics that can, in turn, generate attractive opportunities for investors who can act as liquidity providers in times of market stress and distress."

A Case for Credit: Opportunity Reaches Historic Entry Point as Yields Surge (Apollo)

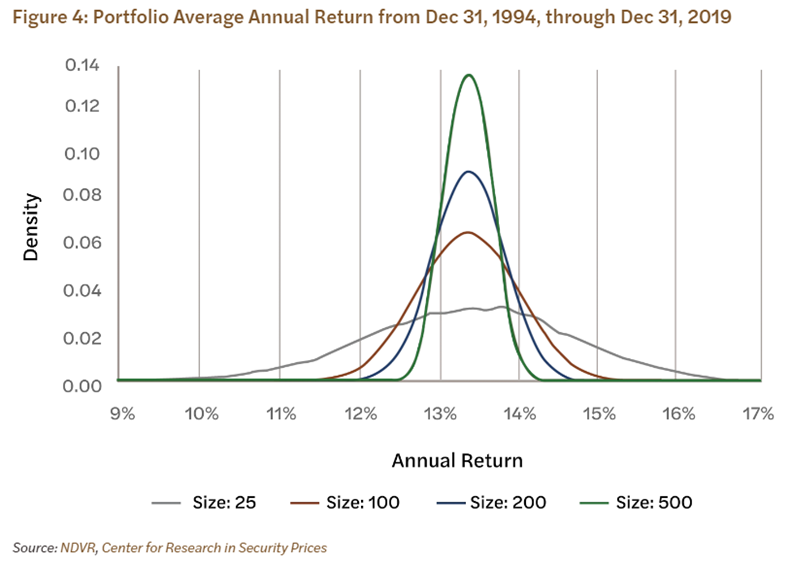

How many stocks are needed in a portfolio to achieve adequate diversification?

"From the portfolio diversification point of view, more should always be preferred. There might be other practical considerations that limit the number of stocks. However, our analysis demonstrates that investors would generally benefit from owning more than 20-30 stocks."

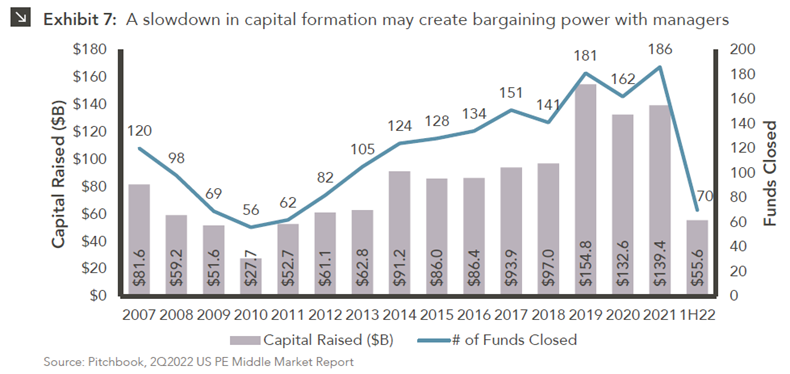

Is the balance of power in private equity shifting from GPs to LPs?

"From here, the bargaining pendulum may be swinging in investors’ favor. We have witnessed a steady increase in time to close since the 2018 trough of 11.1 months to a recent peak of 14.6 months in 2021, as well as a pullback in capital raised in the first half of 2022. Though there was an acceleration in time to close in the first half of 2022, anecdotally, we have seen both first and final close dates continue to push further out throughout the year. To the extent these are signs that allocators are growing skittish, there may be increased opportunities for investors to negotiate more favorable terms."

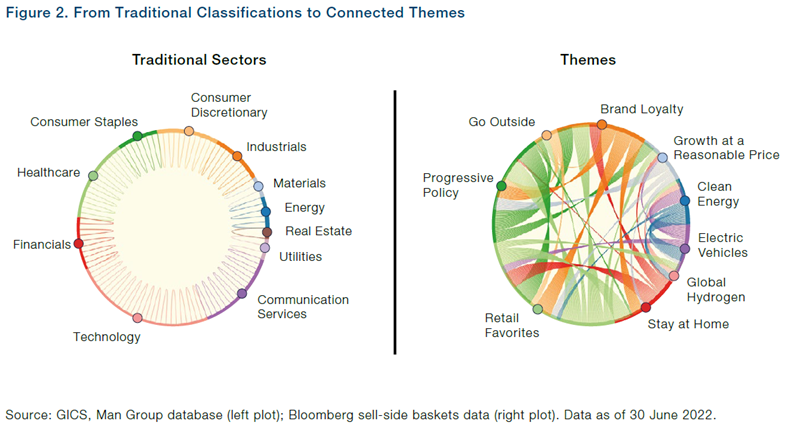

Can quantitative techniques improve thematic investing?

"Themes can capture a unique perspective on companies that traditional sector or other groupings may not. With themes transcending sector and industry boundaries, thematic investing can allow us to capture salient trends in areas in which we have conviction. With advancements in data and analytic techniques, we believe that there are rich opportunities in thematic investing that we can harvest – but also challenges."

Quantitative Solutions to Thematic Investment Challenges (Man Group)

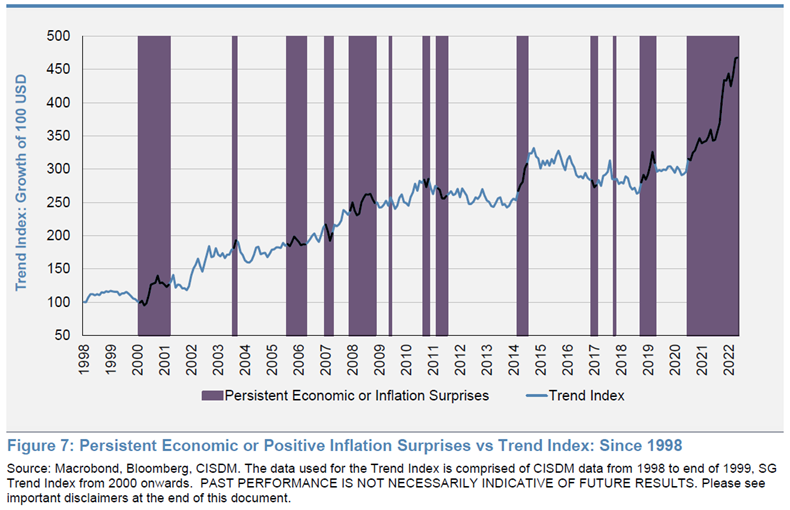

Why does trend following perform well when economic surprises happen?

"It is intuitive to understand why a trend in surprises can lead to a trend in asset prices. The health of the global economy and inflation are important inputs for pricing assets, and if either of these factors have been mis-estimated for an extended period of time, some form of repricing is likely. Where these trends emerge, however, is difficult to predict - thus diversification across a broad range of markets helps to increase your chances of capturing these trends"

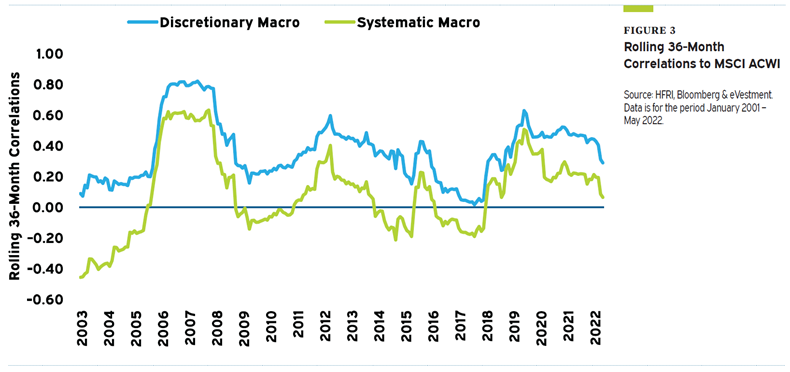

Are Global Macro strategies a worthy alternative investment?

"Generally, global macro strategies have produced modest absolute returns, but attractive risk-adjusted returns, low correlations relative to equities, and tend to exhibit positive skew. Global macro strategies tend to provide diversification benefits when they are most needed, such as during turbulent or volatile markets for traditional assets such as equities. All these characteristics are attractive to investors looking to diversify an institutional portfolio that typically derives most of its risk and return from equity-like strategies."

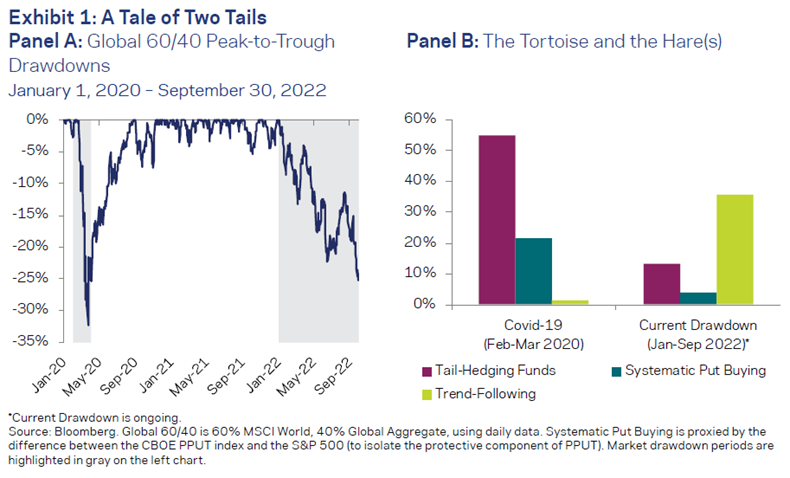

Should portfolio hedging strategies behave more like the Tortoise or the Hare?

"Tail-hedging funds—and to a lesser extent the “passive” options strategy—had strong returns during the shorter drawdown, but have been markedly less impressive during the current one. They were the proverbial hare— winning in the drawdown that resembled a sprint but losing in the one that has felt more like a marathon. In contrast, trend-following strategies had little to show for themselves during the Covid drawdown, but like the tortoise, have proven clear winners in the current, longer drawdown."

“pieces” (reading time > 10 minutes)

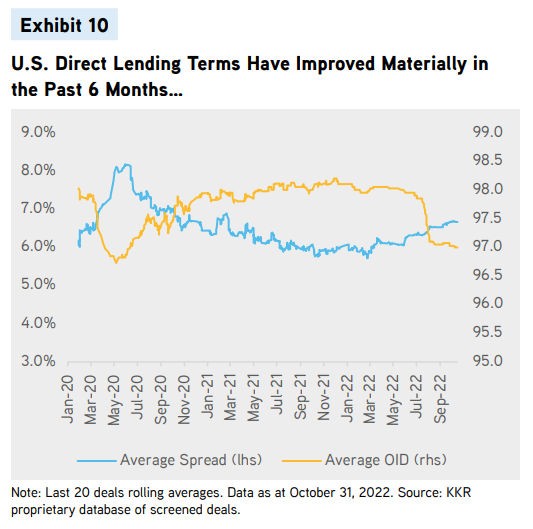

With improved yields in public markets, does an allocation to private credit still make sense?

"We certainly acknowledge that bonds are now offering a much more compelling value proposition than earlier in the year, with the U.S. 10-year yield around 3.5%-4% and a level of coupon that could better absorb potential price fluctuations from rates movements. So, we certainly agree that traditional liquid fixed income has its place in a balanced portfolio. That said, we still make the call to modify the 60/40 portfolio and include a 10% allocation to higher yielding, high quality Private Credit. Within Private Credit, we think optimal portfolio construction depends upon investor type, risk profile, and duration needs."

Regime Change: The Benefits of Private Credit in the ‘Traditional’ Portfolio (KKR)

Have we officially entered a new market regime?

"As I’ve written many times about the economy and markets, we never know where we’re going, but we ought to know where we are. The bottom line for me is that, in many ways, conditions at this moment are overwhelmingly different from – and mostly less favorable than – those of the post-GFC climate described above. These changes may be long-lasting, or they may wear off over time. But in my view, we’re unlikely to quickly see the same optimism and ease that marked the post-GFC period."

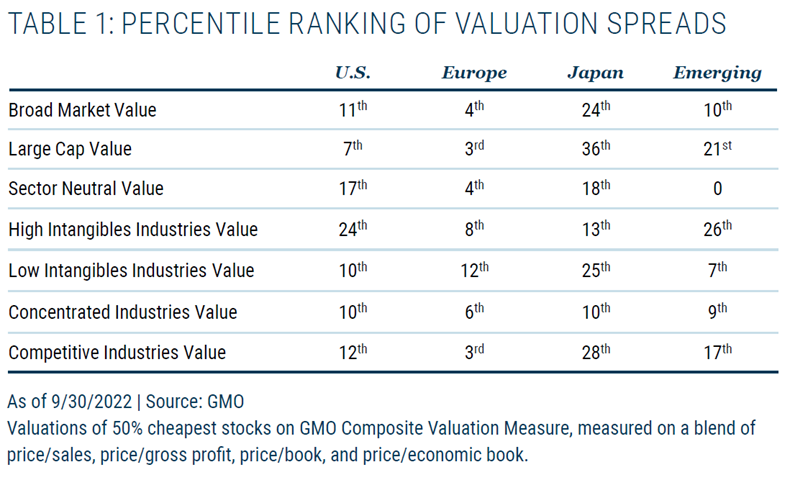

Is the recent good run for value stocks poised to continue?

"While Europe is a notable outlier as the most extreme value spread in the world, we see a wider than normal spread of value in every region and in every different way we know how to slice value versus growth. The willingness to pay extreme prices for [supposedly] long-duration growth assets that benefited from low rates led to a massive growth bubble. Given the valuation extremes reached across regions and sectors, value’s recent outperformance corrects only part of the dislocation. For this reason, long value/short growth remains our highest conviction position."

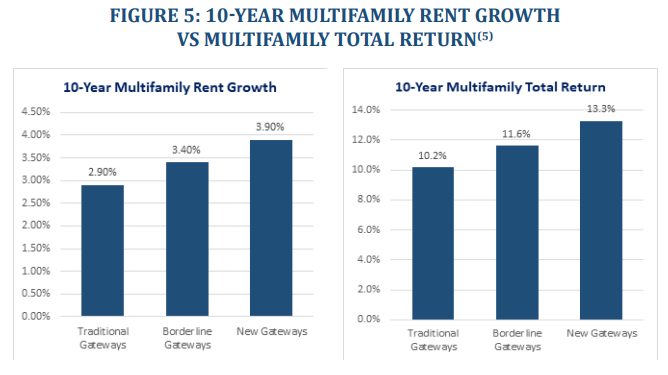

Have a new set of Gateway markets emerged in the U.S. Real Estate market?

"Headwind factors like corporate relocations and anemic population growth have displaced many former selling points of Gateway markets into growth market alternatives."

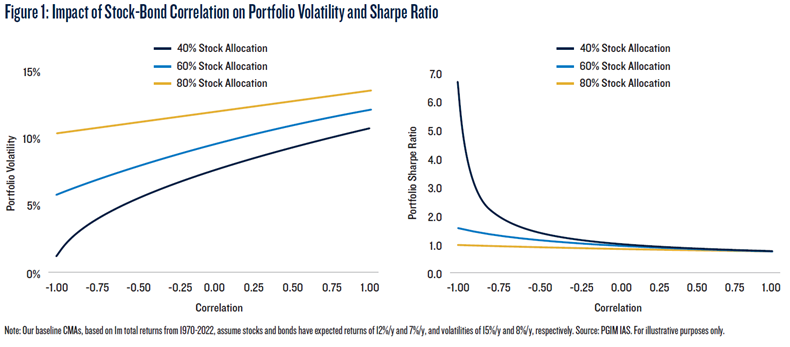

How does a positive correlation between stocks and bonds impact balanced portfolios?

"Shifting to a positive stock-bond correlation world will cause a balanced portfolio of stocks and bonds to deliver more volatile performance with a wider set of potential long-term outcomes – including more extreme tail events and deeper max drawdowns."

Portfolio Implications of a Positive Stock-Bond Correlation World (PGIM)

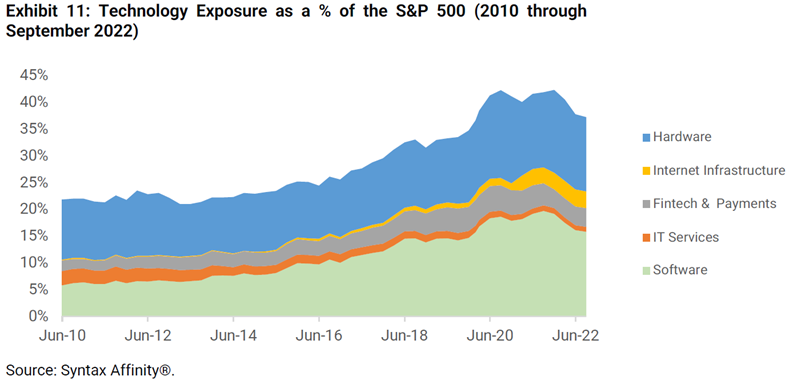

Is the S&P 500 still too concentrated in technology exposure?

"Passive investors in the S&P 500 have benefitted from this trend, but as history has shown, concentration risks can cut both ways and present levels of tech exposure that are still greater than those during the peak of the Tech Bubble."

Know What You Own: Revisiting S&P 500 Tech Exposure (Syntax Advisors)

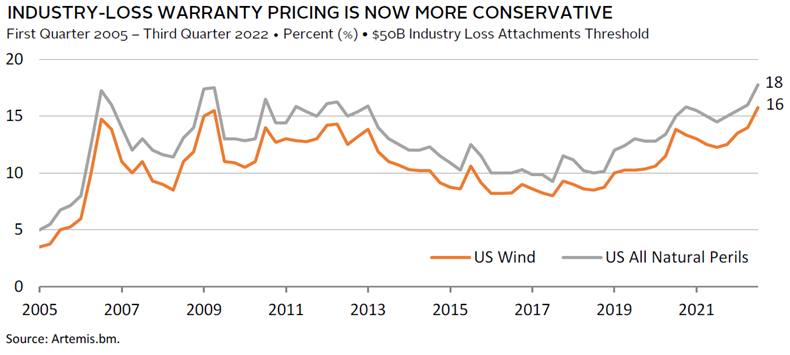

Do Insurance-Linked Securities (ILS) present an attractive risk-reward tradeoff in 2023?

"In short, 2023 represents a market dislocation and opportunity to invest in a diversifying asset on attractive historic yields."

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.