The Paper Trail: Secondary Interests

It's been a busy month since my last post!

For starters, I published my first paper since joining Cliffwater, titled "Private Equity's Second(ary) Act"

This paper explores two distinct yet related trends that have emerged as private equity has matured: the rise of the secondary market and the emergence of innovative evergreen structures designed for individual investors to access the growing segment.

These are important and timely topics as semi-liquid, perpetual funds continue to grow in popularity within RIA-guided portfolios. My hope is that readers come away with a better understanding of:

- The evolution of the secondary markets

- The portfolio benefits of secondaries

- The appeal of specialist secondary managers, and

- The necessary (but insufficient) role secondaries play in evergreen strategies.

But of course I have buried the lede...

On February 11th, my wife and I executed a "secondary investment" of our own by welcoming our son Owen Robert Huber into the world!

Mom and baby are doing great, and big sister Hannah (our "primary commitment" in PE-parlance) is over the moon with her new best friend.

Now, back to our regularly-scheduled investment programming.

In addition to sharing my own research - a first for The Paper Trail - February's roundup also features:

- The diversification, or lack thereof, of equity hedge funds

- Active hurricane seasons and cat bond returns

- Tokenization of private markets

- The "magnificent" concentration of the U.S. stock market

- Perspectives on private equity NAV loans

- Factor investing in crypto

- Passive investing in bonds

- A 50-year retrospective of the endowment model of investing

- Redefining "gateway markets" and "core property types" in real estate

- And much more!

“bps” (reading time < 10 minutes)

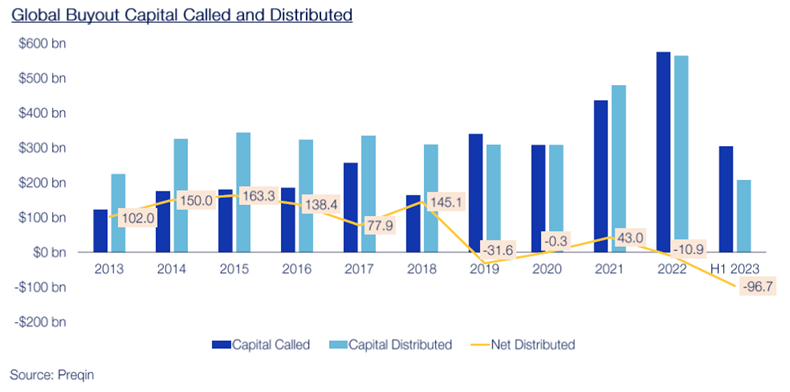

What role should secondaries play in evergreen private equity funds?

"For their investment merits, there’s a lot to like about secondaries. But, they are not a panacea. The strengths of secondaries can help offset the drawbacks of primary fund commitments and co-investments in perpetual fund vehicles, and vice versa. Instead of either/or, they should all work in harmony."

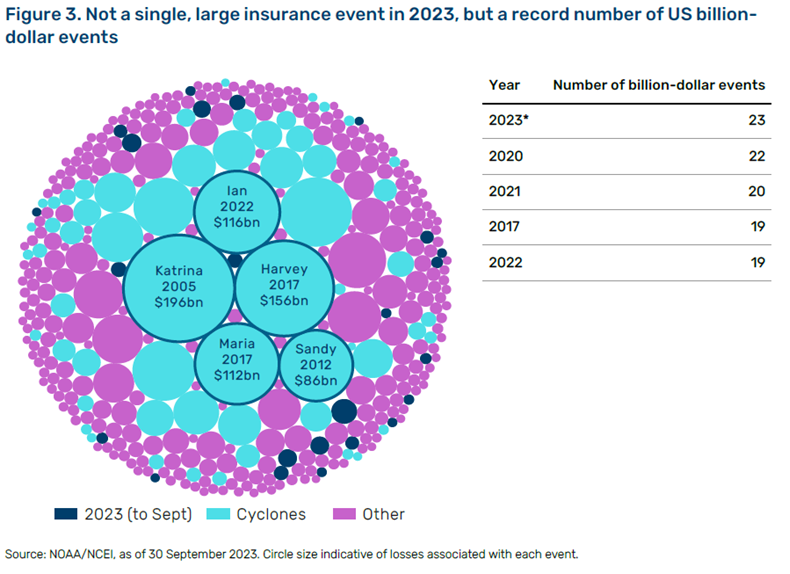

Is there a correlation between active hurricane seasons and catastrophe bond returns?

"It may seem somewhat counterintuitive that despite the record number of billion-dollar events, the cat bond industry did not incur material losses. Looking under the hood at the nature of these events reveals that the 2023 season was primarily comprised of lower-level tornadoes and linear wind scenarios, which cat bonds were broadly insulated from."

Cat Bonds: Does an Active Season Mean Larger Losses? (Man Group)

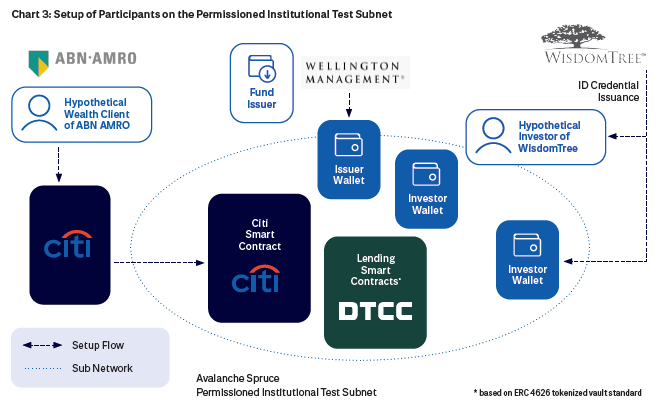

Will tokenization play a big role in the future of private markets investing?

"Tokenization unlocks the value in traditional markets to new use cases and digital distribution channels while enabling greater automation, more standardized data rails, and even improved overall operating models, such as those facilitated by digital identity and smart contracts. These are significant advantages over traditional models."

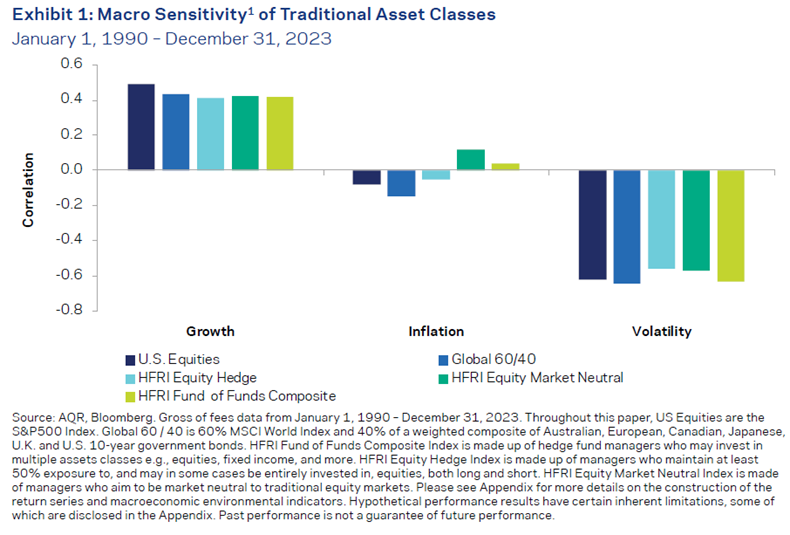

Do equity hedge funds actually provide meaningful diversification?

"While this is expected for traditional markets, it is noteworthy that hedge funds on average—even those classified as market neutral—have also exhibited broadly similar sensitivities. In particular, their return correlation to growth and volatility has been historically aligned to that of equity markets. In other words, the average hedge fund is unlikely to provide much-needed diversification to traditional portfolios during periods of macro uncertainty."

Is Your Equity Hedge Fund Portfolio Resilient Enough for Uncertain Times? (AQR)

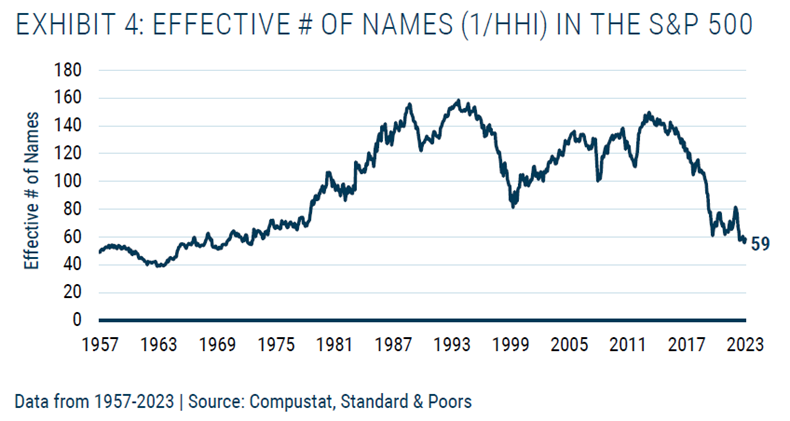

Is the current concentration in cap-weighted U.S. equity indices a cause for concern?

"The S&P 500’s total concentration, which we can measure using a Herfindahl-Hirschman Index (or HHI), is equivalent today to that of an equal-weighted, 59 stock portfolio. Ten years ago, the index was more than twice as diversified. We have never seen – over any 10-year period – a decline (or increase) in diversification of the magnitude we have just witnessed."

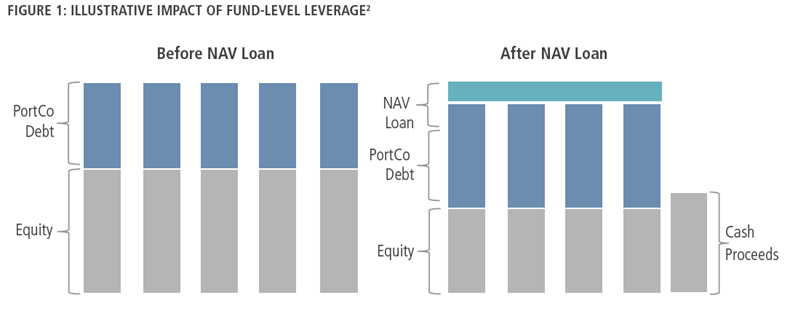

What are Net Asset Value ("NAV") loans and why are they controversial?

"While NAV loans are a multi-tool for achieving a wide range of investment objectives, they introduce a layer of systemic risk to a fund which is mitigated first and foremost by a substantial asset base of quality, performing companies. The terms and conditions of a NAV loan are also critically important factors for mitigating risk."

A Perspective on Private Equity NAV Loans (Neuberger Berman)

“pieces” (reading time > 10 minutes)

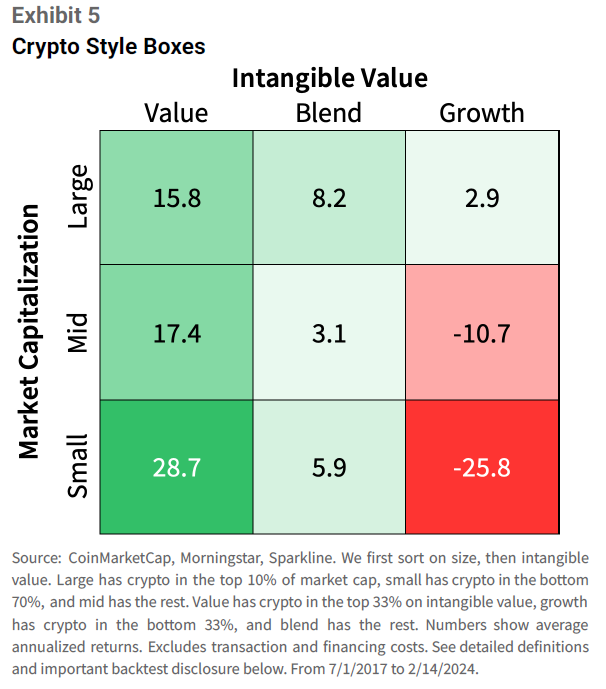

Can "factor investing" be applied to crypto?

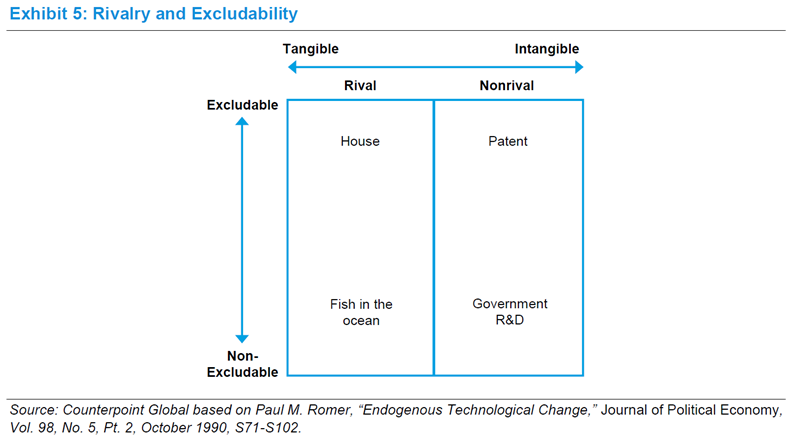

"We believe factor investing offers a useful tool for navigating the dynamic altcoin ecosystem. Intangible value can help filter out low-quality tokens, while homing in on those with under-appreciated adoption relative to their market caps. Momentum can help latch onto assets experiencing virtuous adoption cycles and sentiment- or flow-driven price trends."

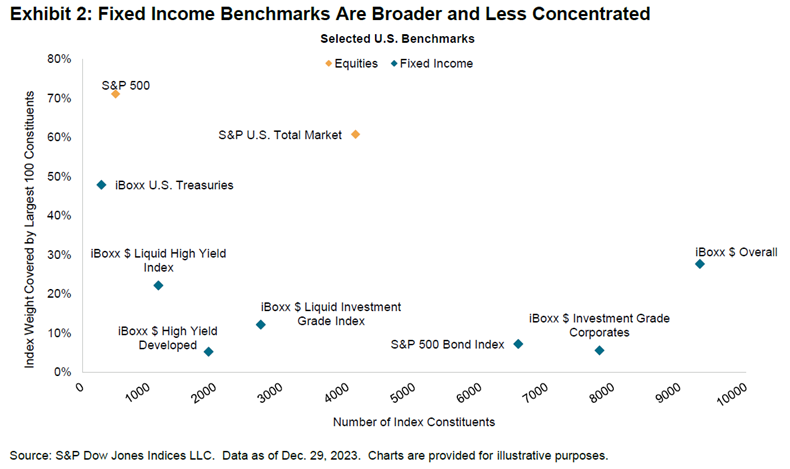

Why is passive investing in bonds not as widely adopted as passive investing in equities?

"Bond index funds came later for both practical and theoretical reasons. In practical terms, it generally was and remains harder to replicate a bond index than an equity index. Further, although there are many theoretical arguments that apply to both bonds and stocks, the case for active investing in the two asset classes has important differences, particularly—as we shall see—in the corporate credit markets."

The Hare and the Tortoise: Assessing Passive’s Potential in Bonds (S&P Dow Jones Indices)

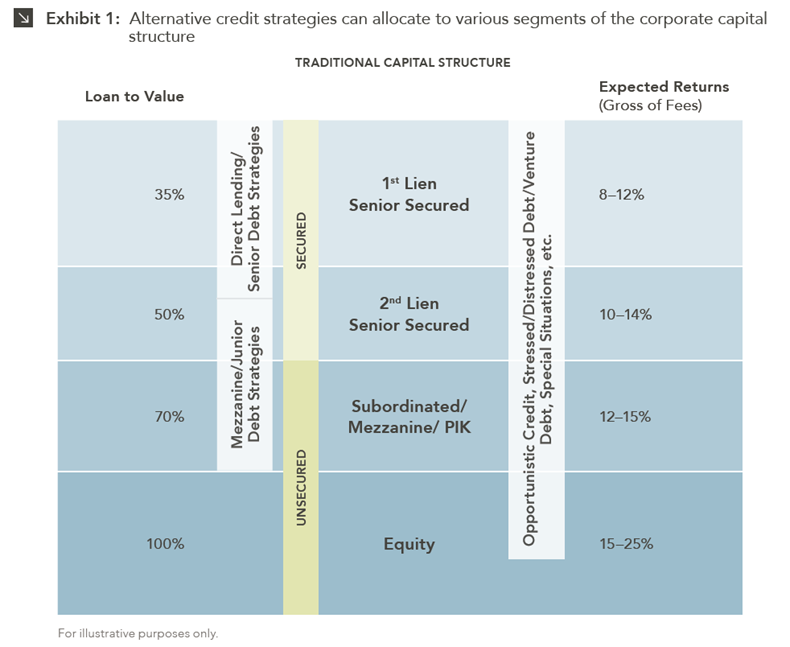

Is alternative credit still a misunderstood asset class despite its recent surge in popularity?

"Unlike traditional credit markets, alternative credit is often characterized by greater flexibility with regard to lender terms and underwriting standards, which can allow companies to gain access to capital to fund operations that would be otherwise inaccessible through traditional lending channels. Alternative credit covers a wide array of sub-strategies and can be either cashflow-based (i.e., repayment from cash flows generated by a corporate borrower) or asset-based (i.e., repayment from cash flows generated by some underlying pool of collateral)."

What characteristics are shared by businesses that experience increasing returns over time?

"The importance of most forms of increasing returns is deeply intertwined with the rise of intangible assets. Some of the characteristics of tangible and intangible assets are notably different. Intangible assets can scale faster than tangible ones but are also harder to protect. Intangible assets can lead to a faster rate of innovation but are subject to obsolescence."

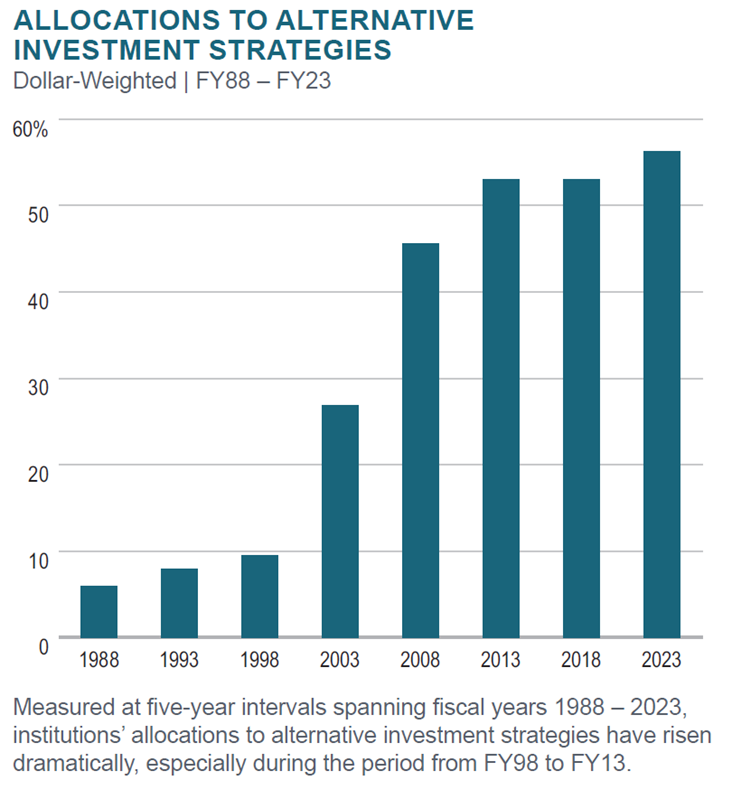

How has the endowment model of investing evolved over the past 50 years?

"What matters is that asset allocation “now” would be barely recognizable versus what it was “then.” Diversification that was once equities, fixed income and cash has been reconstituted as a mosaic of asset classes and strategies. This was enabled in the first place by two concepts—one, total return investing and, two, the greater diversification provided by private market strategies, both of which have been described earlier. Not every institution will include every asset class or alternative strategy in its portfolio, but the range of options and degree of finetuning to meet the return objectives and risk appetite of every institution continues to evolve."

How might LP-led secondaries fare in an environment of depressed levels of deal flow and activity?

"While the tailwinds present in the secondaries market are encouraging, buyers must proceed with caution when deploying capital and remain disciplined when pricing portfolios, as valuations may start contracting in 2024 and holding periods will continue to elongate. The extent to which these trends can be absorbed by the discounts paid for LP portfolios is the key dynamic that secondary buyers need to assess."

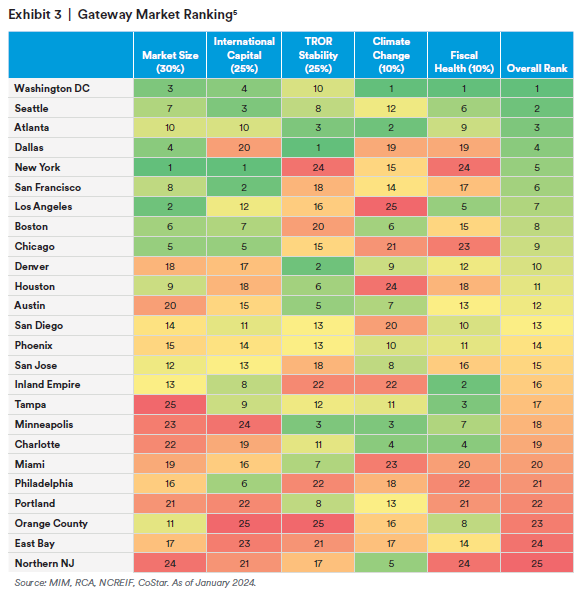

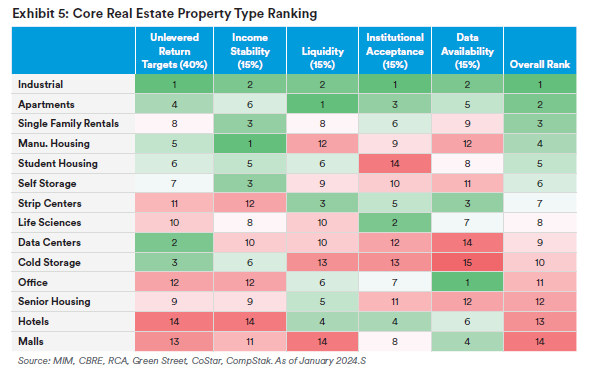

Have the current definitions of "gateway markets" and "core property types" in real estate become outdated?

"Based on our proposed methodology, as well as changes in market conditions in the last 40 years, Atlanta, Dallas and Seattle rank highly as gateway markets, while once “niche” alternative sectors like manufactured housing and single family rentals may exhibit traits of core property types."

Gateway Markets and Core Property Types: Not What They Used to Be (MetLife Investment Management)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.