The Paper Trail: Surprising Strength

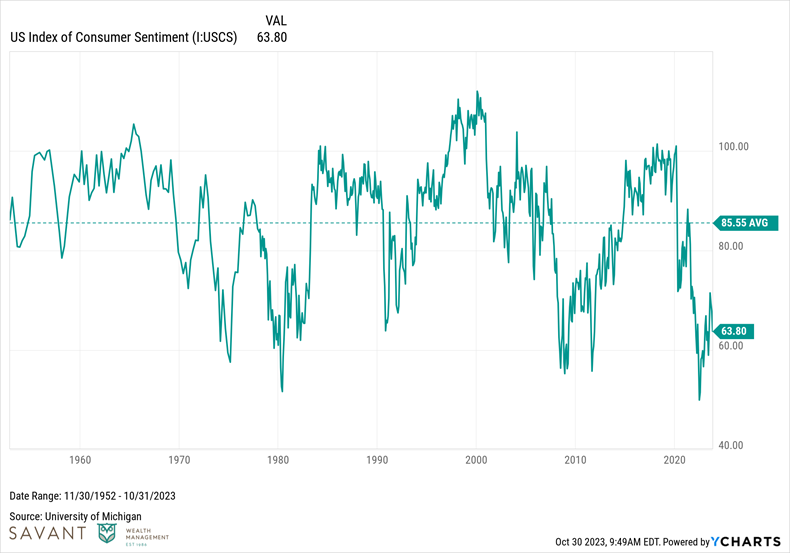

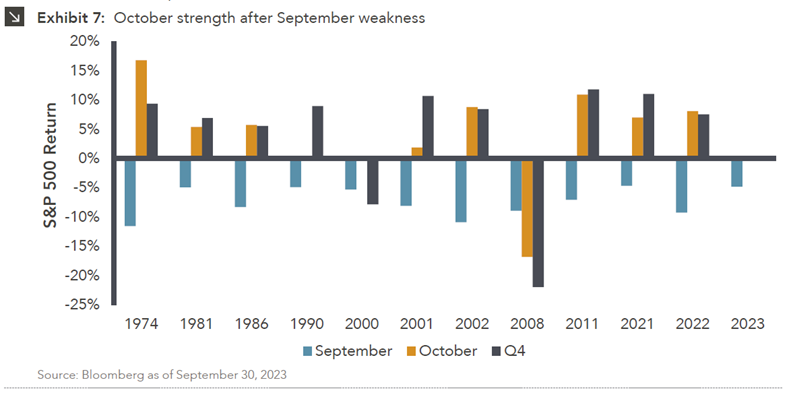

October has given investors more tricks than treats this year, with the 10-year Treasury yield flirting with 5%, and equity markets in the red across the globe. Despite the uptick in market volatility, the economy has remained surprisingly resilient - though you wouldn't know it looking at consumer sentiment.

Here's hoping that all the scaries disappear as quickly as the Spirit Halloween store from your local strip mall.

With that in mind, please enjoy this Spooktacular edition The Paper Trail! October's research roundup features:

- The outlook for U.S. stocks

- Asset location preferences for equities

- Emerging market fundamentals

- AI's impact on real estate beyond data center demand

- Opportunities in catastrophe bonds

- Asset-backed finance

- Rising profits in Japan

- Factor investing in corporate bonds

- Bitcoin vs. the rest of crypto

- Considerations for implementing alternative investments

- And much more

“bps” (reading time < 10 minutes)

Is the surprisingly strong U.S. stock market beginning to show signs of weakness?

"Although markets declined in the third quarter amid lingering consumer fears, geopolitical risks, and government woes, it is possible much of the volatility is in the rearview mirror as the rate hiking cycle nears to a close, inflation further abates, and companies show signs of earnings strength."

U.S. Equities: Surprising Strength Gives Way to Macro Risks (Marquette Associates)

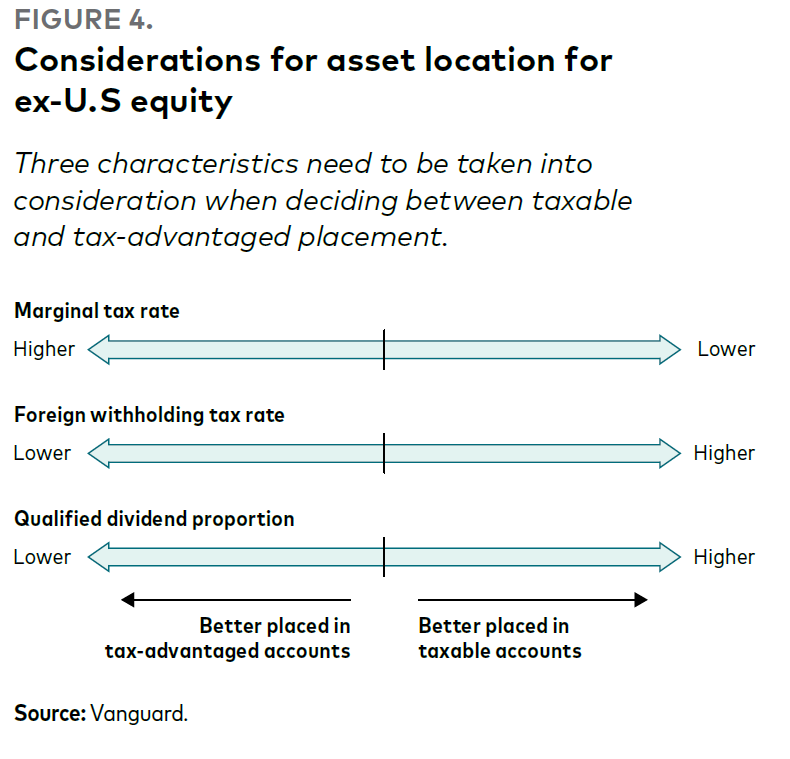

Should non-U.S. stocks be held in taxable or tax-deferred accounts?

"For most investors, preferentially placing ex-U.S. equity in a taxable account is the asset location strategy that maximizes after-tax return. The higher end of the added value is associated with portfolios that have both high levels of qualified dividend income and high foreign withholding rates. Only investors in the top tax bracket, who hold relatively tax-inefficient ex-U.S. equities, may find it beneficial to shield their ex-U.S. equity in a tax-advantaged account."

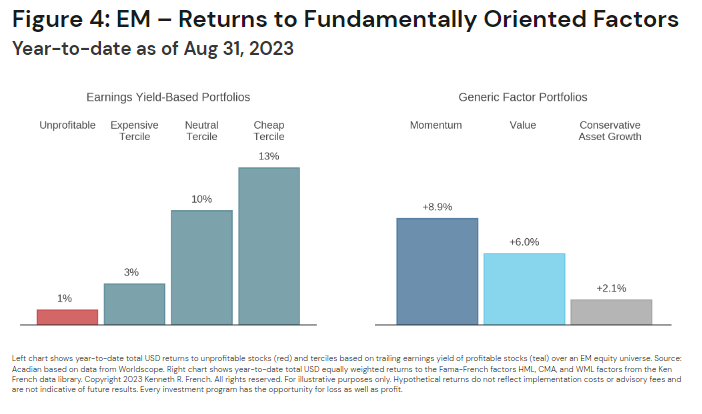

What is the bull case for investing in Emerging Markets relative to U.S. stocks?

"The U.S. has been caught up by thematic sentiment and thereby resembles a voting machine, while EM has been trading more soberly based on fundamentals, resembling a weighing machine."

Sentiment Versus Fundamentals: The Current Case for EM over U.S. Equity (Acadian)

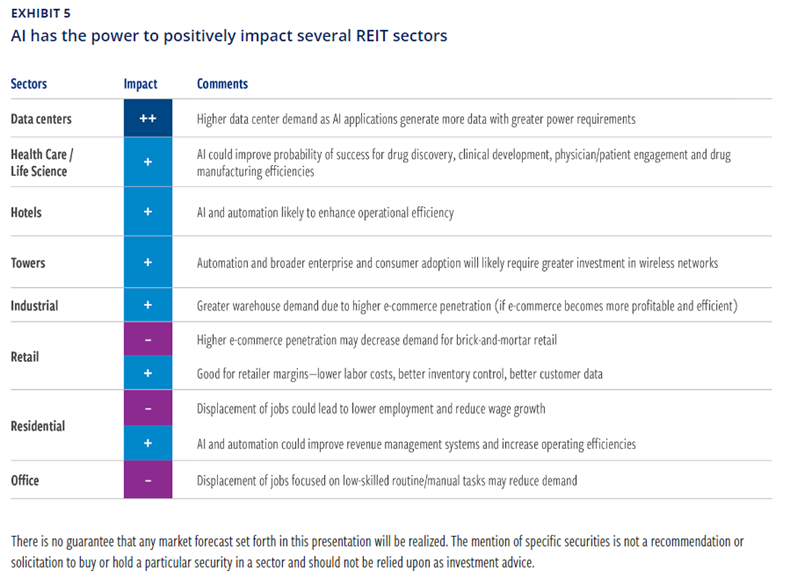

What will AI's impact on real estate be beyond data centers?

"AI and automation are likely to improve margins for operationally intensive businesses such as senior housing and hotels. AI is also likely to improve the success rate of new drug discovery, leading to increased research funding and demand for life science property."

How will AI shape the real estate investing landscape? (Cohen & Steers)

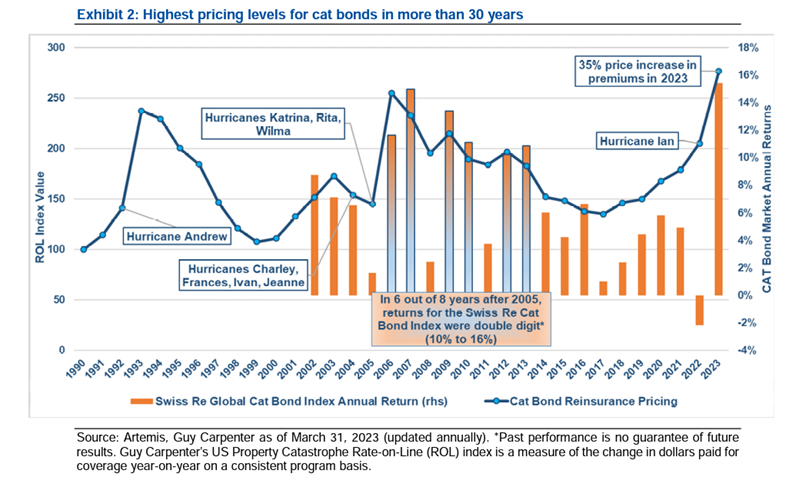

Are catastrophe bonds an attractive diversifier in the current environment?

"We believe the combination of supply/demand imbalances and recent substantial price increases may present an attractive investment opportunity throughout the remainder of 2023 and into 2024. "

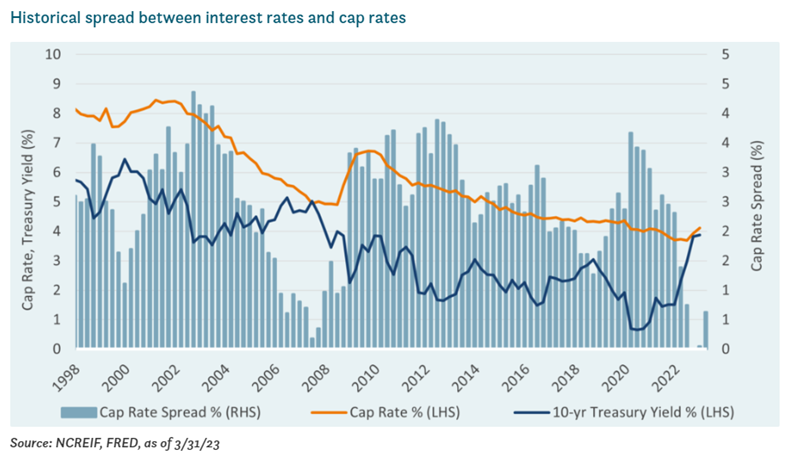

What is the relationship between interest rates and real estate cap rates?

"It is important to note that the relationship between interest rates and cap rates is not always linear or immediate. Real estate markets are influenced by various factors, including supply and demand, the local economy, investor sentiment, and market cycles. While interest rates can significantly determine cap rates, they are not the sole determinant."

The rising rate environment’s impact on real estate cap rates (Verus)

“pieces” (reading time > 10 minutes)

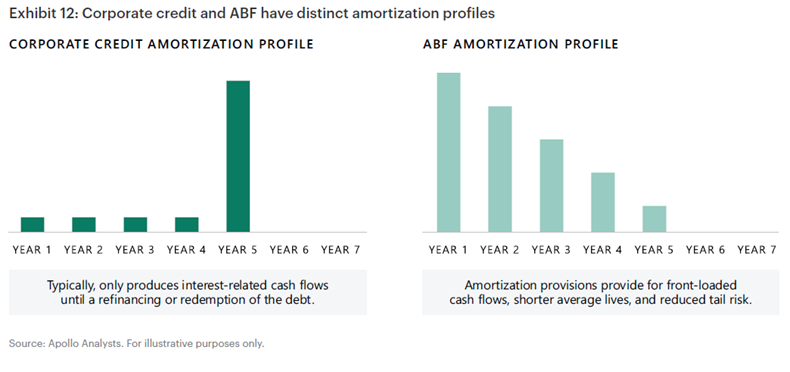

What features make Asset-Backed Finance (ABF) an attractive segment of the private credit asset class?

"In particular, ABF has historically experienced lower losses than corporates due to the nature of its underlying structures: a) diversified underlying assets that mitigate single points of failure, b) strong documentation with covenants and cash-flow waterfalls, and c) credit enhancement through bankruptcy remote and ring-fenced collateral."

Asset-Backed Finance: The Next Evolution of Private Credit (Apollo)

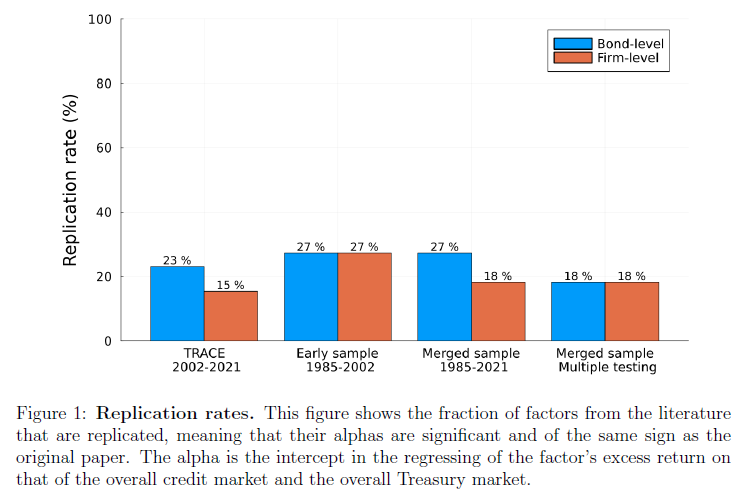

Does factor investing work in corporate bonds?

"Using this relatively clean data and robust methodology, we show that the majority of corporate bond factors from the literature fail to replicate, but a minority of factors remain significant. Further, analyzing corporate bond factors based on equity signals, we find a number of significant new factors."

Corporate Bond Factors: Replication Failures and a New Framework (AQR)

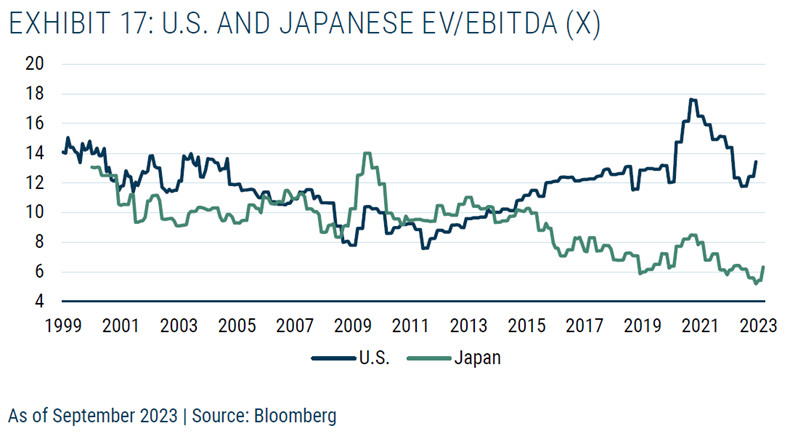

Is now the time to lean into Japanese stocks?

"The Japanese equity market has continued to de-rate despite the improved

fundamentals. To me, this creates a potentially very interesting opportunity."

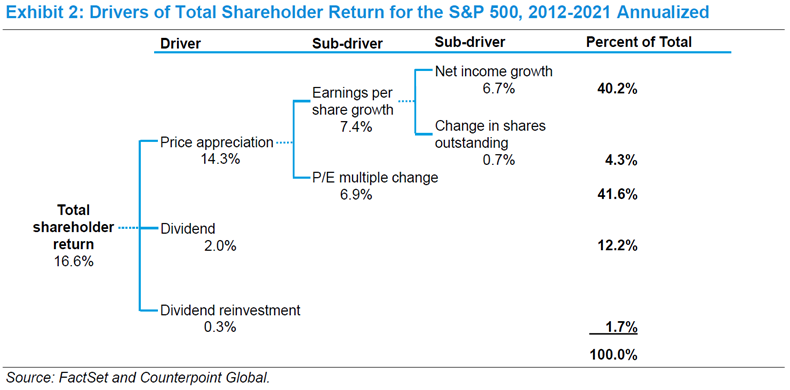

What are the long-term drivers of total returns to shareholders?

"Investors often consider dividends to be part of total returns. But for investors using TSR, price appreciation is the only source of investment return that contributes to accumulated capital. Indeed, dividends and share buybacks have the same result in a TSR calculation because they both increase the percentage ownership in a company."

Total Shareholder Return: Linking The Drivers of Total Returns to Fundamentals (Counterpoint Global)

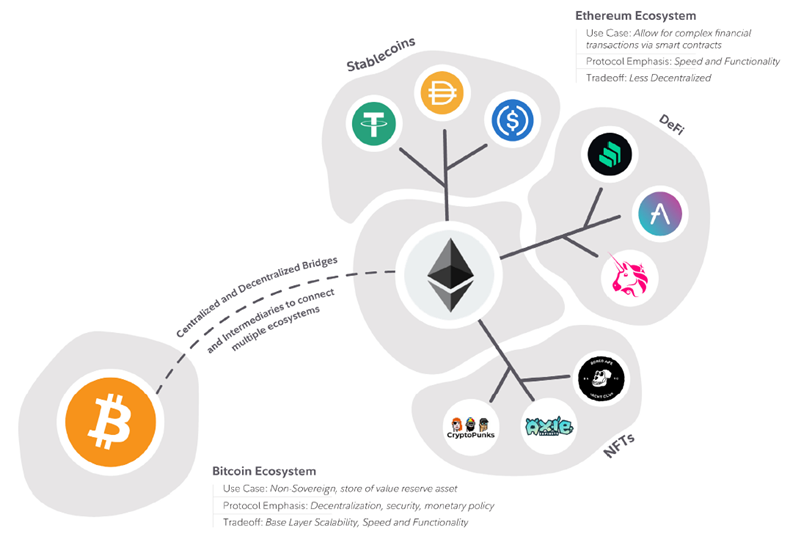

Is Bitcoin in a league of its own relative to other digital assets?

"Investors should hold two distinctly separate frameworks for considering investment in this digital asset ecosystem. The first framework examines the inclusion of bitcoin as an emerging monetary good, and the second considers the addition of other digital assets that exhibit venture capital-like properties."

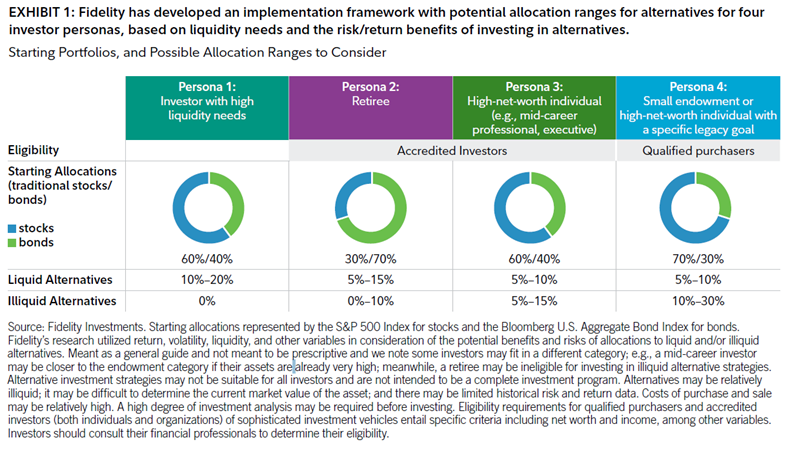

Which variables most influence the appropriate mix of alternatives in a portfolio for different investor personas?

"Institutions and advisors will also need to explore many important considerations for investing in alternatives, including eligibility, liquidity, costs, and risk."

Considerations When Implementing Alternative Investments in Multi-Asset Class Portfolios (Fidelity)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.