The Paper Trail: Trending, Fast and Slow

Well that was a fun month to start the year, huh?

There's an old Wall Street adage that says “as goes January, so goes the year.”

Like most market aphorisms, it sounds clever in theory but the results are mixed at best in practice. But if it does happen to ring true this year, we are in for one wild ride. All the more reason to seek ways to diversify and build durable portfolios!

With that in mind, I present 2022's first installment of The Paper Trail!

“bps” (reading time < 10 minutes)

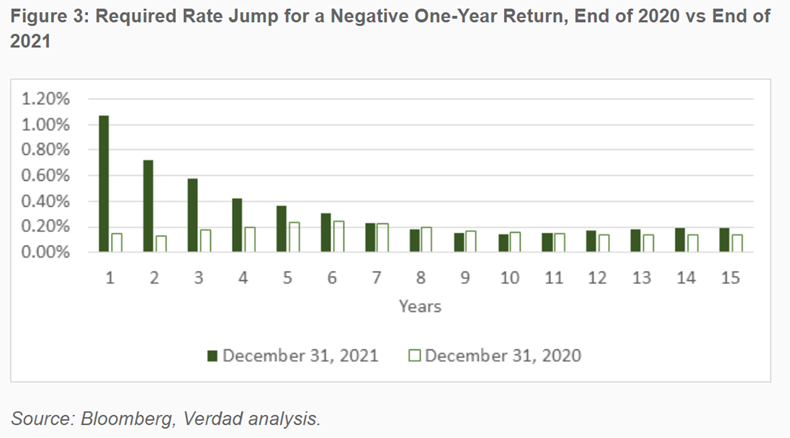

How worried should investors be about interest rate risk today?

"The most recent negative returns came when the hurdle rate for negative returns was very low. It is higher now. If you are going to worry about rates, at least worry correctly. Use the current coupons and steepness of the yield curve to understand at least intuitively how much rates must rise to deliver a negative return."

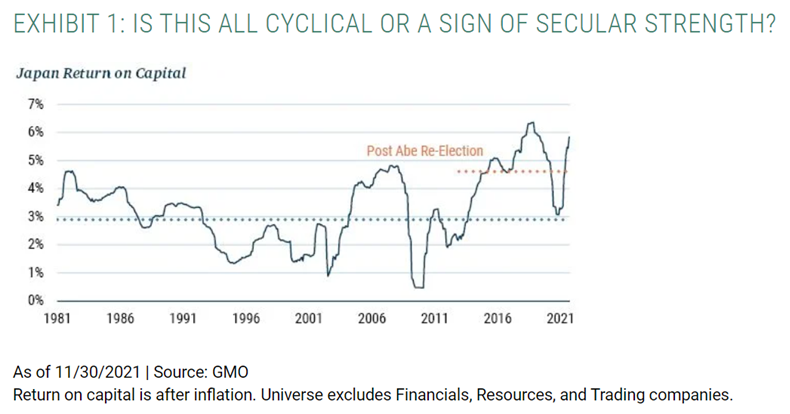

Are investors ignoring Japanese equities to their own detriment?

"Secular operational and profit improvements have led to better fundamental outcomes for shareholders. While the U.S. has increased earnings per share (EPS) by 66% since late 2012, Japan has done even better. Surprisingly to many, Japanese EPS has grown more than 160% since Abe’s re-election in late 2012."

Japan Equities: Entrenched Perceptions Ignore Improving Reality (GMO)

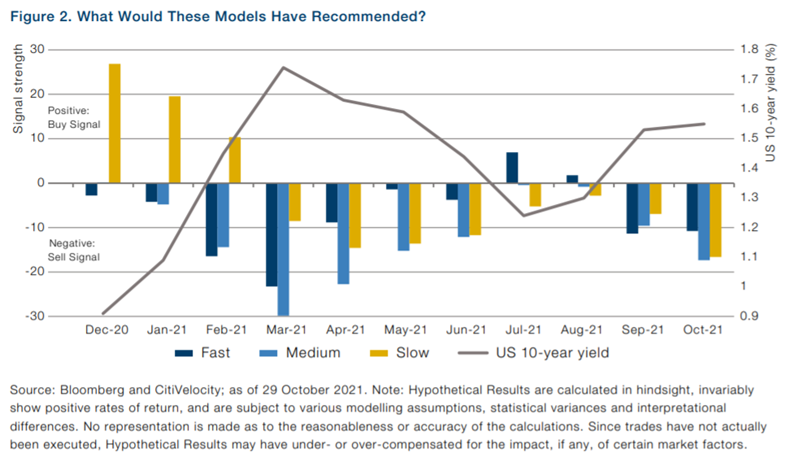

What is the "right" timeframe, if any, to determine a trend?

"Methodologies that account for a longer time window tend to outperform in slowly trending markets. However, when volatility is elevated, having a ‘faster’ model that is more responsive to shifts in market directions can be better."

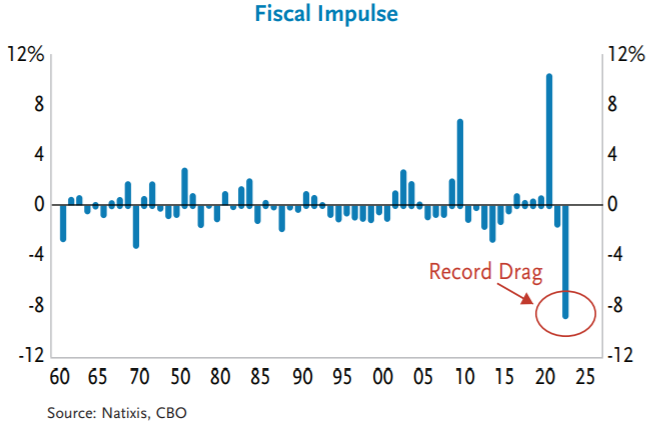

Can the Fed deliver monetary tightening that is neither too hot nor too cold?

"Truth is, while we believe odds favor a long-term reversion back toward 2%, we can’t tell you with certainty who will win the long game of this inflationary tug-of war between the secular disinflationary tailwinds on one side and supply chain and labor power headwinds on the other. What we can say with conviction is that we have the biggest inflationary tail risk in 40 years creating the most significant challenge for central banks in a generation."

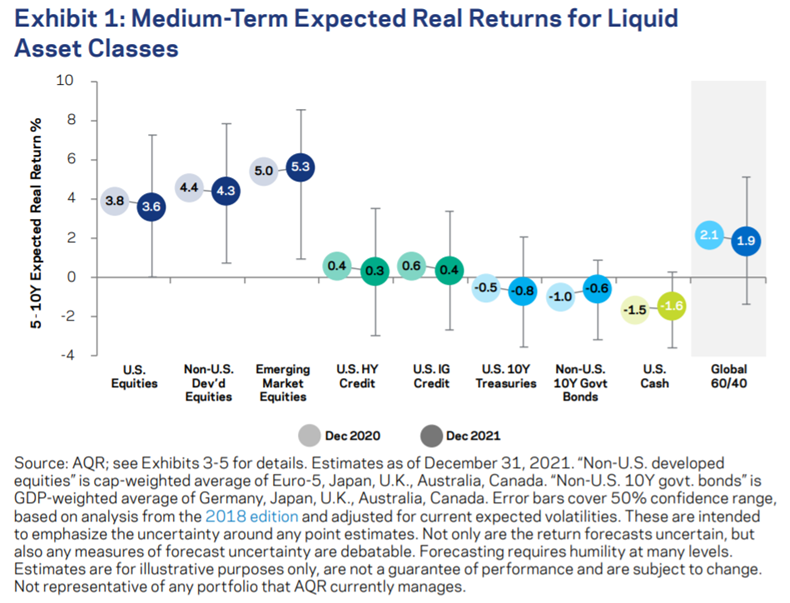

What returns can we expect from liquid asset classes over the next 5-10 years?

"Maybe the next 10 years will see a continuation of the recent golden era for traditional portfolios, with all the inputs to our return estimates once again surprising on the upside, and we’ll be writing another mea culpa in 2032. But we wouldn’t bet on it."

2022 Capital Market Assumptions for Major Asset Classes (AQR)

“pieces” (reading time > 10 minutes)

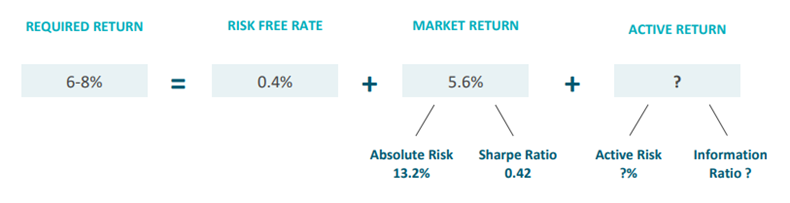

How should the expected results from active management be integrated into the asset allocation process?

"Many approaches have been developed over the years which might be used to forecast active return. These approaches range from highly complex and time intensive to very simple and intuitive. As we believe is often the case, simple is not necessarily inferior and may be preferable, especially in a portfolio-wide context when an investor is developing active return forecasts for multiple asset classes."

Integrating Active Return into Asset Allocation Modeling (Verus Investments)

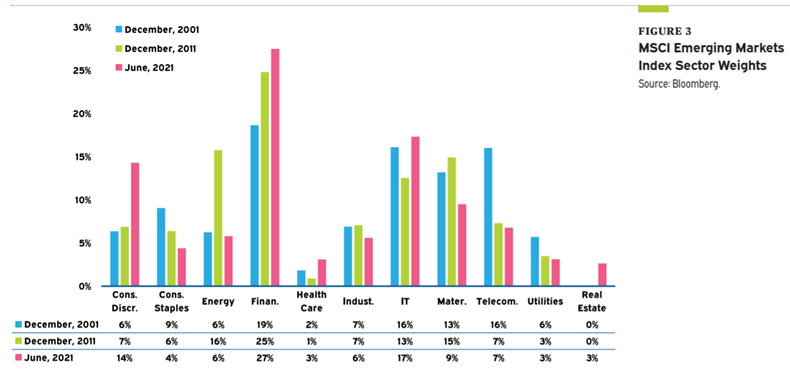

Should Emerging Markets equities still play a strategic role in a diversified portfolio?

"The strong performance of risk assets since the GFC has coupled with declining interest rates to lower forward return expectations for most asset classes. And while emerging market equities have undergone a somewhat similar process, we believe they are one of few public market asset classes that can help an investor achieve a return over 6% or 7%. Hence, any investor building a diversified portfolio and hoping for a higher rate of return should consider a dedicated allocation to emerging market equities."

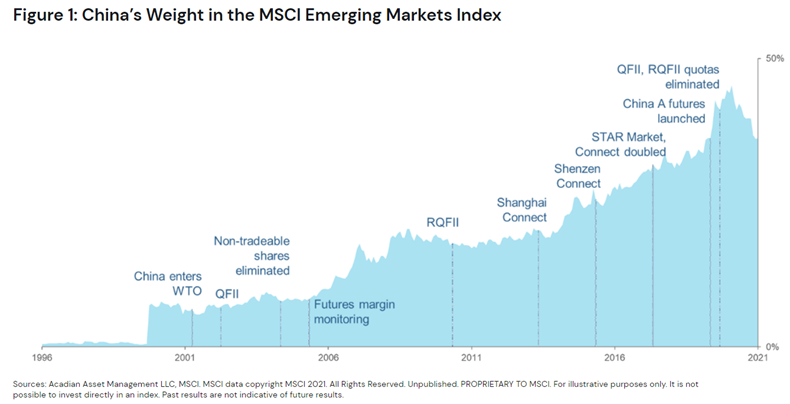

Within EM, should allocators be strategically overweight or underweight Chinese stocks?

"Naturally, many investors approach EM allocation decisions from the starting point of established benchmarks. As we have highlighted in this note, however, EM benchmarks are highly active constructs, representing an amalgamation of judgment calls and interests. In reassessing EM allocations in view of China’s rise, therefore, asset owners should start from the presumption that their particular EM objectives and geopolitical views will call for a material benchmark relative overweight or underweight to China, as a whole."

Polarizing Views: China’s Impact on EM Investing (Acadian Asset Management)

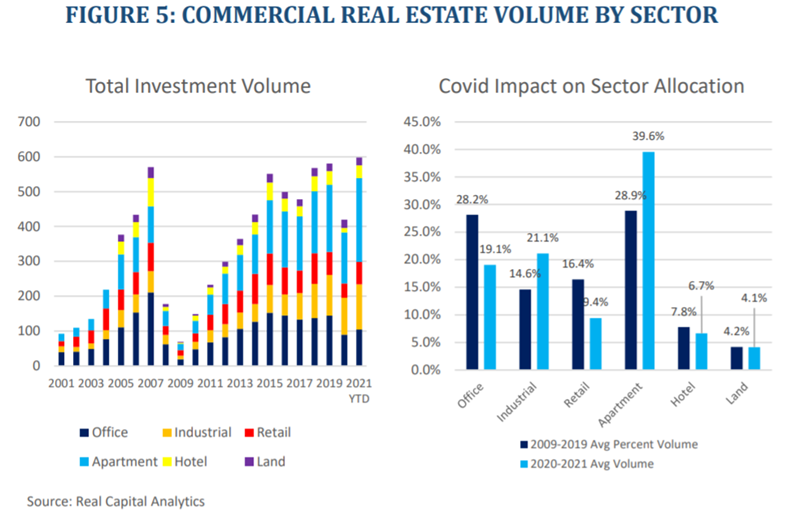

What is the outlook for U.S. real estate in a post-Covid world?

"Nearly all alternative real estate sectors will continue experiencing rising or unabated investment demand, at least in the short-term until newer investors experience some of the idiosyncratic risks of these categories. As such, these “safe havens” are even more crowded than in prior years, so careful participants need to be judicious about substrategies, even if their macro sector allocation is promising."

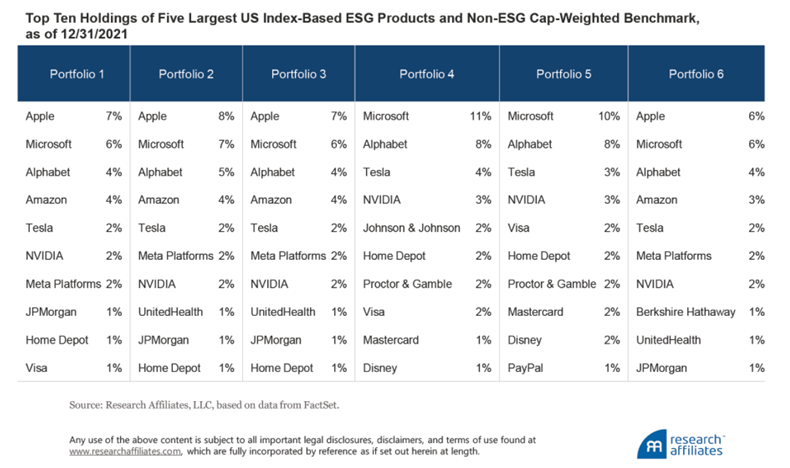

Do ESG preferences actually have an impact on performance?

"The following table lists the top ten holdings for six portfolios: the five largest ESG vehicles and a cap-weighted benchmark. We intentionally omit labels. Can you tell which vehicle is the non-ESG portfolio? Johnson & Johnson, Berkshire Hathaway, and PayPal are the only companies that are unique to individual portfolios. Every other company is included in two or more strategies."

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.