The Ultimate 2020 Market Playbook

PSYCH – made ya look!

But now that I’ve lured you in with my clickbait, you might as well stick around, right?

In case you haven’t noticed, prediction season is in full swing and that can only mean one thing…

As I type this, financial advisor inboxes around the globe are being flooded with 2020 market forecasts, outlooks and playbooks from every Tom, Dick, and Macquarie in asset management. I’m not sure what it is about the ball dropping in Times Square that leads people to believe they need to abandon (supposedly) well thought out investment strategies in exchange for entirely new ones. So you liked it on December 31st but hate it on January 1st? Cool. Cool cool cool.

I hope and pray that no reasonable investor or allocator is actually making drastic changes to their portfolio based on the content of these outlooks, but who knows? I’d be lying if I said I never read or skimmed any of them. Occasionally you stumble upon a decent insight or interesting nugget here or there. But by and large, these publications are rarely actionable. It’s entertainment and should be treated as such.

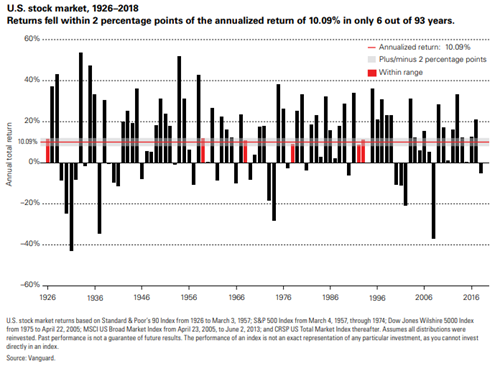

What’s most remarkable about these things, considering the amount of man-hours and resources that go into crafting them, is that they often end up predicting asset class returns for the next 12 months that are within spitting distance of their long-term averages. The irony, of course, being that market returns almost never come anywhere close to long-term averages in a given calendar year.

As much as I don’t care for the annual tradition of market outlooks, I would hate to leave my readers empty-handed – especially with two weeks left to go not just for the year, but for the decade. I don’t come bearing gifts of S&P 500 price targets, 10-year Treasury yield forecasts, or “cautiously optimistic” cop-outs. But I do have in my bag of toys a list of ten things I am fairly confident in, not for the next twelve months, but for the next ten years ahead…

1. Value will have a solid, multiyear run ahead of growth

There is no sugarcoating it – value stocks got absolutely trounced by their growth counterparts in the 2010s. Some have proclaimed that value is dead, and that we are in a new paradigm. Others will point out that while periods of such underperformance are rare, they are not unprecedented and this too shall pass.

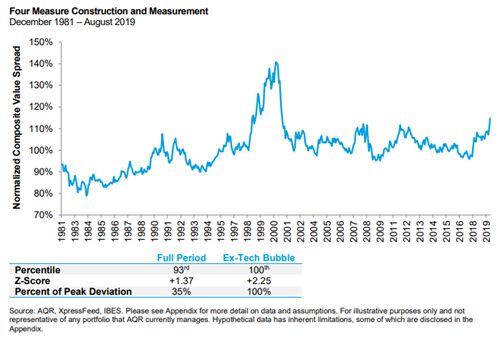

It is a tautology that value stocks are cheaper than their growth counterparts. Just how much cheaper though, varies over time. Regardless of your stance, there’s no denying that the “value of value” -i.e. the spread between cheap and expensive stocks – has gotten wider. So much so that AQR’s Cliff Asness, not typically one to endorse factor timing, is now advocating that investors “sin a little” by overweighting value stocks.

Source: AQR

Here’s Cliff:

Essentially, we think the evidence is strong that the first eight+ years of value losing was “rational” (for want of a better word). The expensive companies ex post more than justified their ex ante starting prices based on things like delivered earnings, sales, margins, cash flow, etc. In contrast the last almost two years have seen value lose for “irrational” reasons. Value fundamentals have not come in worse over this recent painful period, it’s just prices that have gone the wrong way

Conviction in value, or any factor, requires a belief in risk based compensation, behavioral mispricing, or some combination of the two. I think there’s still a strong case to be made that both are still reasonably valid at it pertains to the value premium. Here’s to hoping that today’s historically wide spreads bear fruit in the decade ahead.

2. We’ll have at least one recession in the U.S.

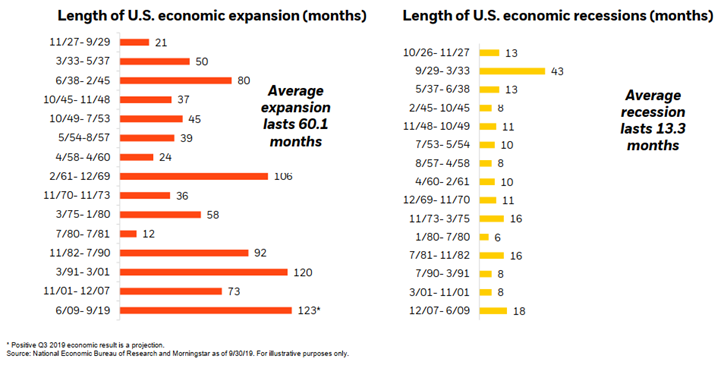

We’ve all heard the expression that “expansions don’t die of old age” and the last +10 years have been living proof. We’re currently in the longest expansion on record and are about to close out the first decade in U.S. history without a recession.

I’m not sure anyone could convince me that economic cycles as we know them have vanished and that somehow we have successfully conquered recessions for good. Inevitably, stability will breed instability and a Minsky Moment will emerge. It may not be next year, or even the year after that, but eventually it’s coming. Consider it my “stone cold lead pipe lock” for the decade ahead. Having a plan in place when, not if, it arrives is of greater importance than any ill-advised attempts to predict its timing and/or magnitude.

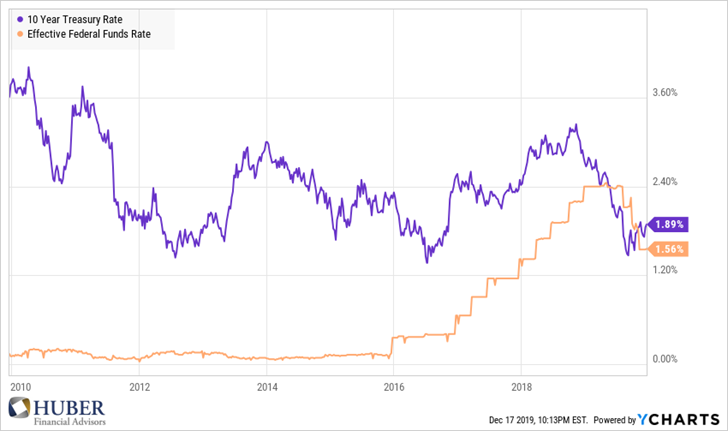

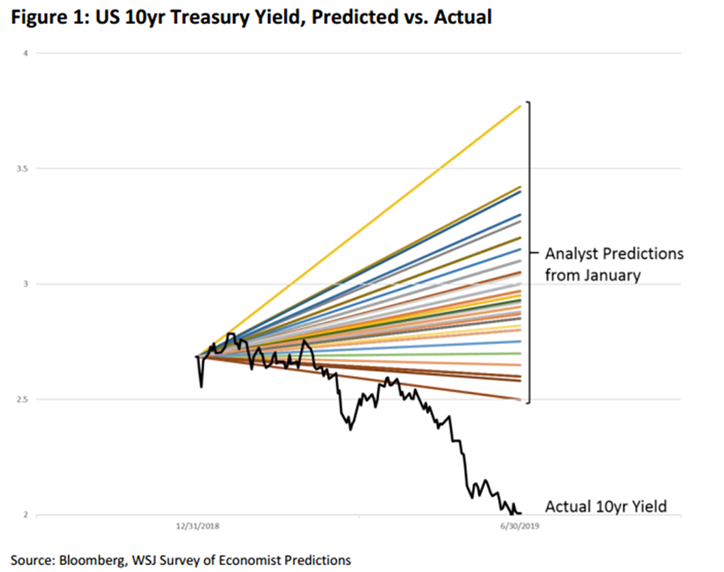

3. Interest rates will continue to confound us.

Pundits have been calling for the end of the bond bull market for what seems like an eternity now. The financial media has written ad nauseum about how to prepare for a “rising rate environment.” And for most of 2018, it appeared as if the omen was finally coming to fruition.

And then 2019 happened and caught absolutely everyone flat-footed.

Time and time again, we think we can predict interest rate movements and therefore, bond returns. And time and time again the market humbles us. I doubt the 2020s will be any different.

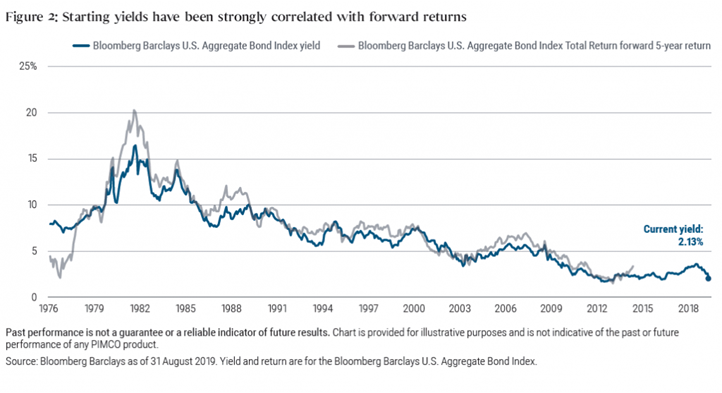

4. Bond returns will be…meh

As limited as we are in our ability to forecast interest rate fluctuations in the short-term, we do know that starting yields can give you a pretty good approximation of what forward returns over the next 5-10 years will look like for bonds.

I think it’s fairly safe to say that while traditional core fixed income can still provide a number of portfolio benefits – volatility reduction, consistent income, diversification in bad times – the returns from the asset class will be nothing to write home about.

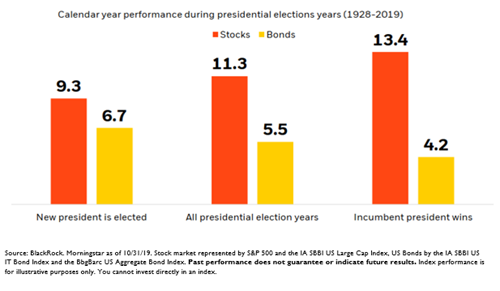

5. Politics will matter much less to your portfolio than you think they will.

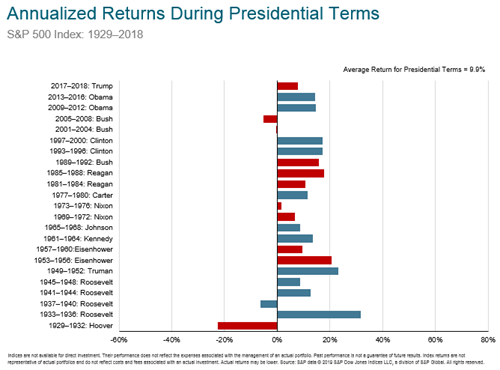

Election years can be quite polarizing in nature. Regardless of the outcome, some investors will be ecstatic and others terrified. Policy can have material short term implications for financial markets, but as time horizons expand that relationship becomes much more muted.

Source: BlackRock

Stock and bond markets have done well, on average, during election years. Historically, they’ve done better when the incumbent wins, but that is not an ironclad rule. Right, left, somewhere in between – markets have historically provided meaningful returns under political regimes of all stripes.

Source: Dimensional Fund Advisors

Many on the right missed out on a significant portion of this current bull market due to fears about the Obama administration. Similarly, many on the left thought it was a foregone conclusion that markets would tank after a Trump win. Market returns are ultimately driven by myriad other factors outside of who is sitting in the Oval Office. Best to keep your politics out of your portfolio.

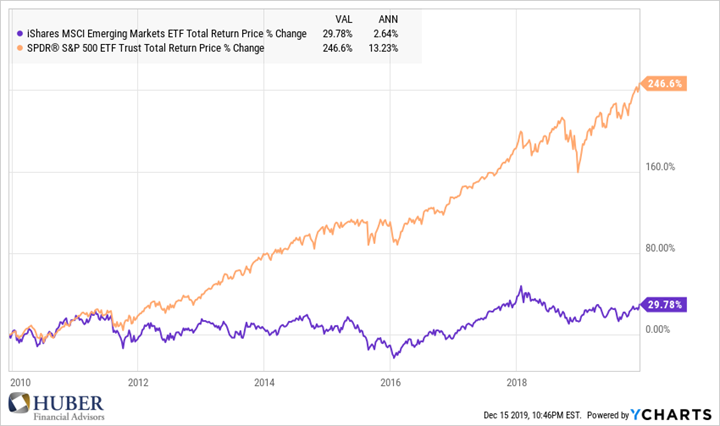

6. Emerging Markets will fare better.

If you invested in Emerging Markets at the start of the decade, you don’t have a lot to show for it – particularly when juxtaposed against the impressive returns of the S&P 500.

Yet much like abandoning U.S. Large Cap stocks in 2009 would have been a tremendous mistake, jettisoning Emerging Market stocks from your portfolio today will likely end in regret. While there’s no telling what will happen in the asset class over the next 12-24 months, starting valuations matter a great deal to long-term returns. And today’s prices in EM already reflect some pretty pessimistic assumptions. Some of the best returns in investing can come from things going from “awful” to “not so great.”

7. Something unprecedented will happen.

A decade without a recession, Trillions of dollars of debt with NEGATIVE yields, the emergence of cryptocurrencies, free trading everywhere, community-adjusted EBITDA (LOL), the election of Donald Trump – just a small sampling of happenings over the past ten years that were either unimaginable or would have gotten you laughed out of the room when the decade began. We would be silly to think that ten years hence there won’t be some crazy stuff that went down that seems impossible today.

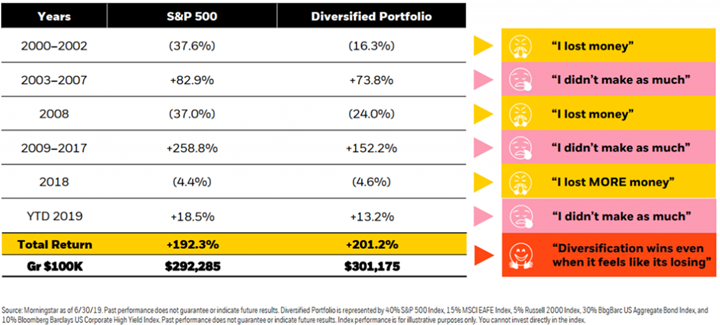

8. Diversification will frustrate, yet still be worth it.

Investors instinctively focus on relative returns during good times, and absolute returns during bad times.

Source: BlackRock

After a decade in which most diversifiers detracted from performance relative to just owning the S&P 500, it’s natural to wonder why you should even bother. But as the graphic above from BlackRock illustrates, diversification can still add value over a long horizon, even if it doesn’t always feel like it.

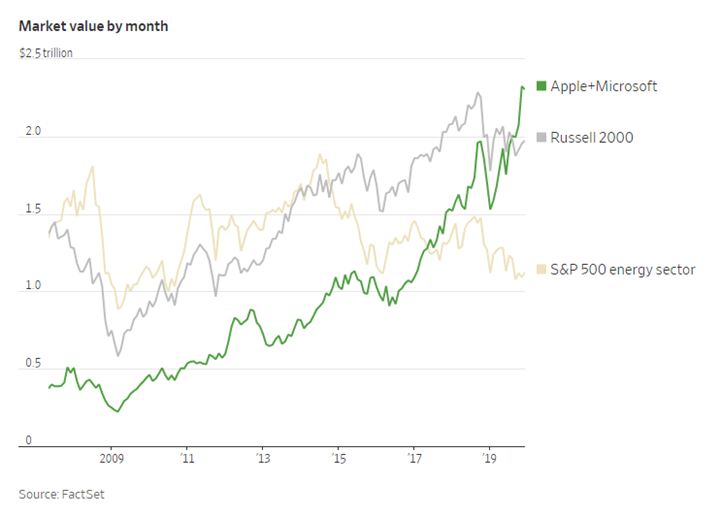

9. At least one of today’s juggernauts will lose steam.

Today’s largest companies are massive, to put it mildly. Microsoft and Apple each have market values over $1 Trillion. To put that in perspective, that is more than TWICE the value of the entire energy sector of the S&P 500 and more than the combined value of all +2,000 constituents of the Russell 2000 small cap index!

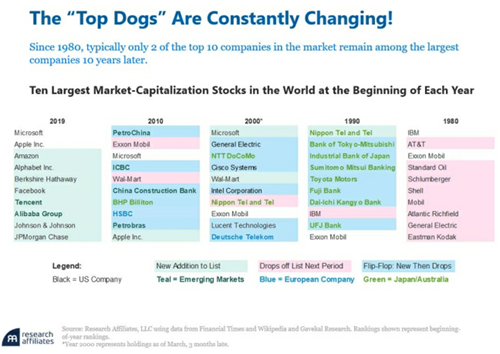

Today’s “Top Dogs” are household names that many of us use on a daily basis. They may seem like safe bets, particularly given the strong returns they’ve posted. But history has not been kind to the biggest companies in the world. It’s one thing to make it to the top – it’s another to stay there.

Source: Research Affiliates

The above graphic from Research Affiliates shows how few of the largest companies make it from one decade to the next still in the top 10. It’s hard to say who, but it seems likely AT LEAST one of these giants will stumble.

10. Whatever happens, it won’t look anything like this past decade.

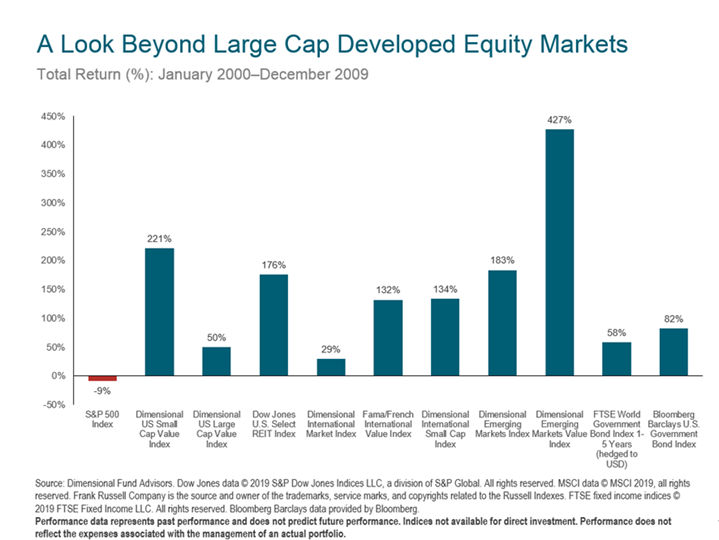

The 2000’s became known as the “lost decade” for investors, with the S&P 500 in the red after a ten year period that was book-ended by two massive bear markets that saw U.S. large cap stocks get cut in half. Ten years is a VERY long time to live through in the stock market and still be below water. But if you were a diversified investor in the aughts – owning bonds, foreign stocks, small caps, REITs, etc. – you actually did pretty OK.

Every decade will have at least one “loser” asset class. Something that you’ll look back and ask yourself “why did I own this piece of garbage?” The challenge, as always, is that we’ll only know what those assets are with the benefit of hindsight. Michael Batnick and Nick Maggiulli put together this awesome GIF that shows just how different the last four decades have been across an assortment of asset classes.

Source: The Irrelevant Investor

New Year’s Resolutions almost never work. Conversely, small incremental changes can create sustainable habits that lead to dramatic improvement in results over time. Investing is no different. Turning over your portfolio to coincide with the turning of the calendar is a recipe for disappointment and disaster. Instead of poring over short term investment outlooks, redirect that time towards establishing a thoughtful, evidence-based investment philosophy and building processes that allow you to stay out of your own way. That, my friends, is the ultimate playbook – and it will work just as well in 2030 and 2040 as it will in 2020!

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.