The Value Run: Already Done or We've Only Just Begun?

2021 saw its fair share of rivalries:

The World vs. COVID

Reddit Traders vs. Ken Griffin

Elon Musk vs. Jeff Bezos

Britney Spears vs. Her Family

"Transitory" vs. Hyperinflation

Bored Apes vs. CryptoPunks

Michigan vs. Ohio State (Go Blue!)

And of course, a continuation of the age old feud between value and growth.

To many, it no longer felt like a meaningful rivalry after such a long stretch of underperformance for value (13 years). But much like the Wolverines finally turned the tide against the Buckeyes after failing to chalk up a victory every year since 2011, value finally showed some signs of life in the latter part of 2020. In fact, the six month period ending March 31st, 2021 saw the greatest string of outperformance by small cap value over large cap growth since World War II.

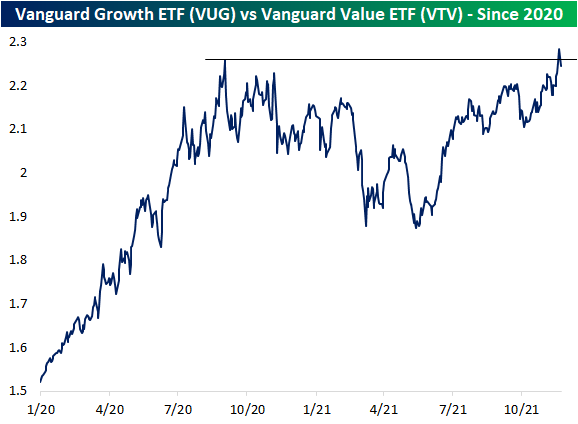

Some point to "Vaccine Monday" on November 9th, 2020 as the catalyst for value finally grabbing the baton, but the reality is that value's performance relative to growth had bottomed out several months earlier.

Source: Bespoke Investment Group

While large cap value has given up its relative gains since this Spring, small cap value is still hanging on to a sizable lead from Vaccine Monday until now.

The struggles of value investing from 2008-2020 are well-trodden. That horse is already dead - no need to beat it any further.

The past is past. It's future returns we care about. And there is much debate about whether the reversal in value's fortunes that began in 2020 has legs to it or is merely another head fake.

There are reasonable and compelling arguments to be made from both sides.

Value skeptics and growth-oriented investors will point to any or all of the following as reasons why value is dead and growth will continue to outperform:

- Flawed accounting methods have rendered traditional value metrics obsolete.

- Value investors are a broken record - they've been calling for a comeback for years now!

- Elevated profit margins for Big Tech should persist.

- The sector composition of value indices is not reflective of today's economy.

- Value stocks are "cheap for a reason."

- We live in a low growth world and when growth is hard to come by, growth stocks deservedly command a premium.

- Low interest rates are here to stay and value is simply a play on rising rates.

- Too much money chasing value strategies has arbitraged the return premium away.

The value advocates would counter with:

- There is inherent danger in the "this time is different" narrative.

- We are witnessing historically wide value spreads, i.e. the "value of value."

- Mean reversion in fundamentals should eventually occur.

- This recovery still has legs and that should bode well for value stocks.

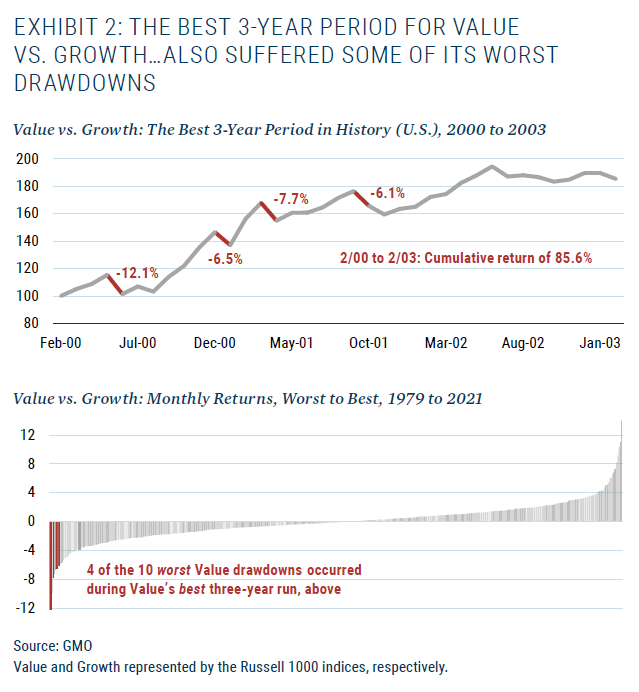

- Sharp reversals are common during extended value runs.

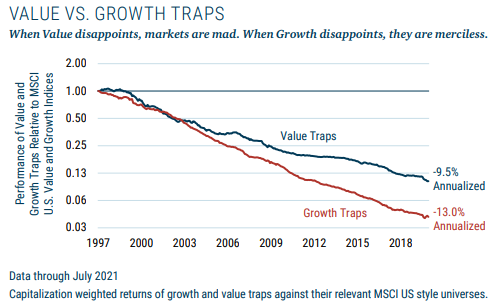

- Growth traps are worse than value traps.

- Inflationary environments have historically benefitted value over growth.

- Higher dividend yields should be additive to total returns.

- There are too many insanely expensive growth stocks today.

They say a picture is worth a thousand words. So rather than type a thousand words, I thought I'd share a handful of "pictures" (with some brief color commentary) to help paint a clearer picture of the debate at hand.

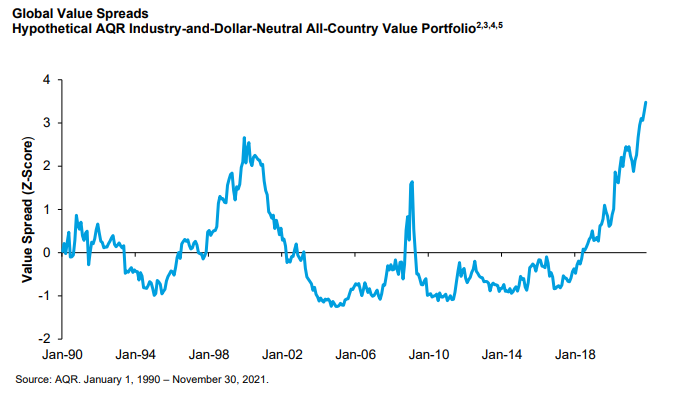

Speaking of pictures worth a thousand words, the chart below was so valuable to AQR's Cliff Asness that he penned what might be the shortest blog post of all-time titled "That’s It, That’s the Blog". Outside of a few footnotes, it's literally just this chart, which essentially depicts how "cheap" value stocks are relative to history using a composite of value metrics. For the novices out there, the higher the blue line, the cheaper value stocks are. Notice a) it's as high as it has ever been and b) the timing of the prior peak at the apex of the Tech Bubble.

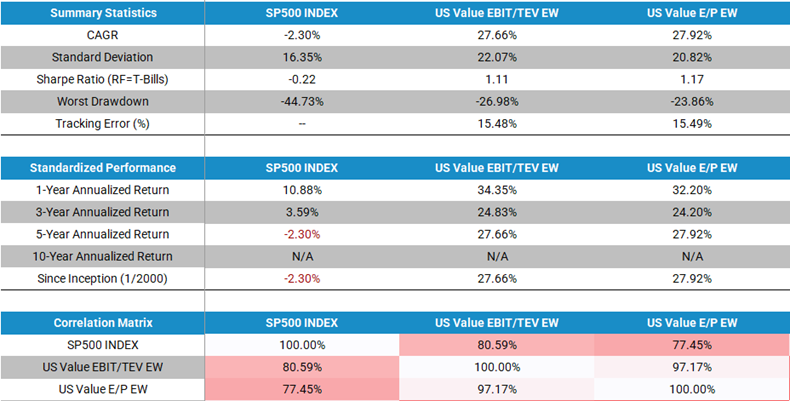

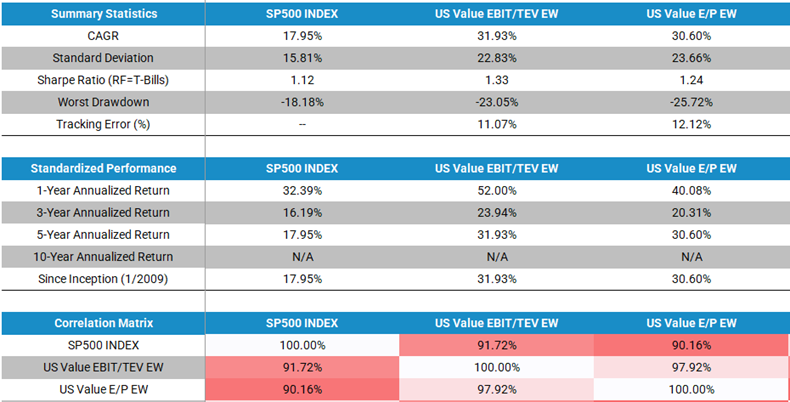

Why is this important, you ask? Because the other (rare) instances of extreme value spreads have preceded pretty meaningful value outperformance over the subsequent ~5 years or so. The folks at Alpha Architect examined the two most recent occurrences - the period following the bursting of the Tech Bubble and the aftermath of the GFC. Below is what they found for U.S. stocks...

First, the period from 1/1/2000-12/31/2004:

Source: Alpha Architect

Source: Alpha Architect

Then, the period from 1/1/2009-12/31/2013:

Source: Alpha Architect

Results from Developed International stock markets had similar results.

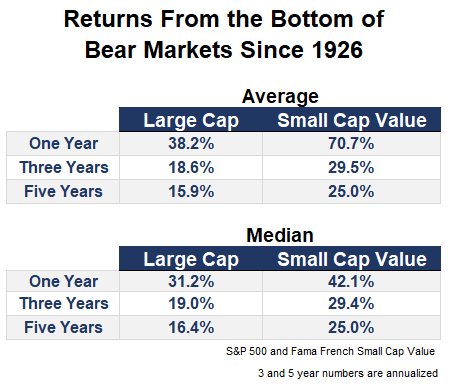

This jibes with Ben Carlson's blog post supporting the historical outperformance of small cap value stocks following the bottom of bear markets going back to 1926. On average, small cap value has done exceedingly better than large caps in the 1-, 3-, and 5-year periods post-bottom.

Source: A Wealth of Common Sense

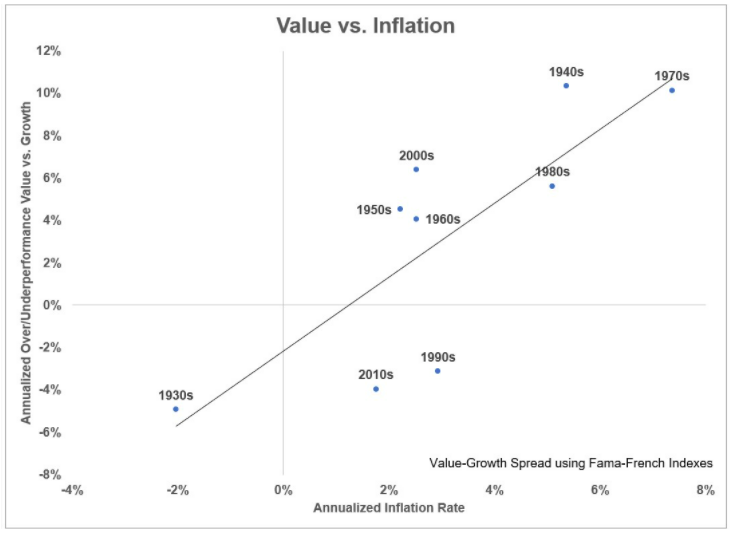

Another common narrative in the value/growth debate is the impact of interest rate movements and inflation dynamics on the performance of each style. With inflation being a key component in the discount rate used to value equities, higher inflation should correspond to a higher discount rate which in theory should place a premium on near-term cash flows that are typical of value stocks. Additional data from Ben supports that decades of higher inflation have seen a positive relationship with the outperformance of value.

Source: A Wealth of Common Sense

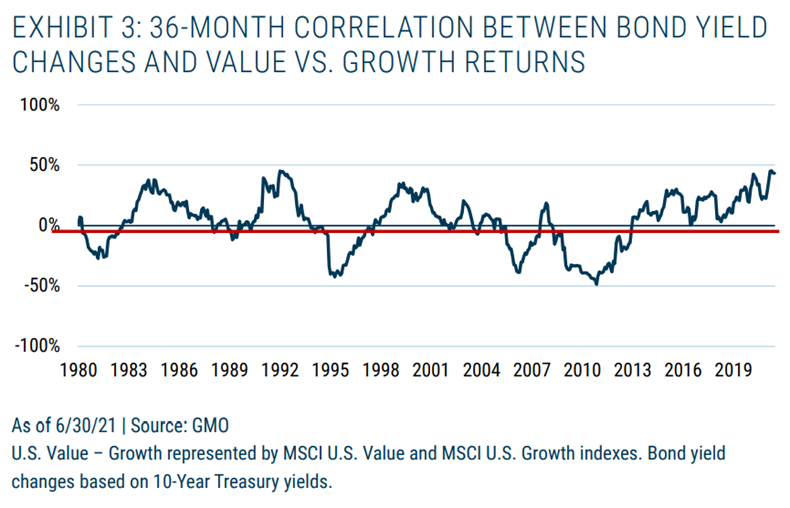

The correlation between changes in bond yields and the performance of value vs. growth is a bit more nuanced. As GMO notes in a recent research piece:

"Changing bond yields even over the last 36 months have explained only 20% of the variance of returns between value and growth. While a continuation of that pattern would mean a slight headwind for value given falling yields and a tailwind given rising yields, it’s hard to make an argument as to why it is inevitable that rates should fall from here, or why anyone would want to structure an equity portfolio around that assumption."

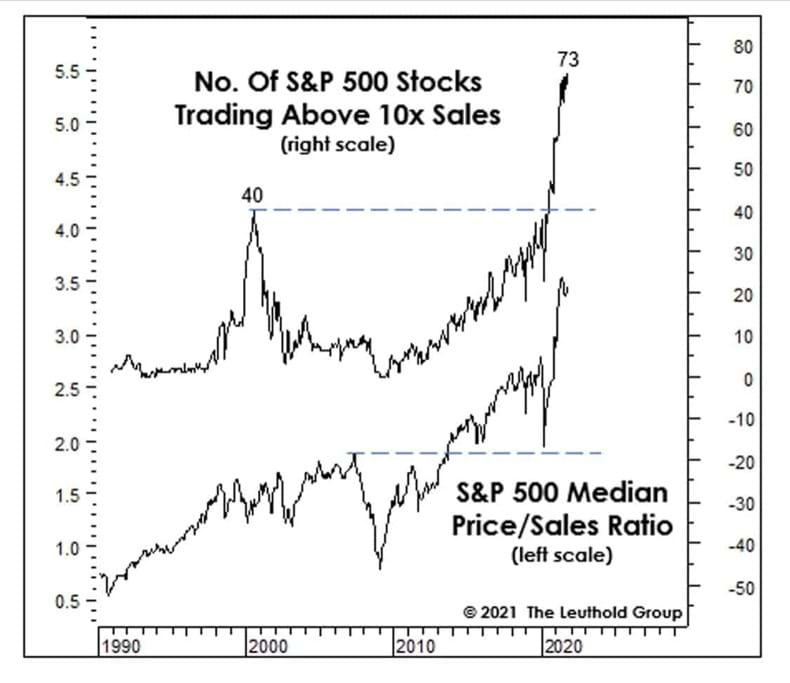

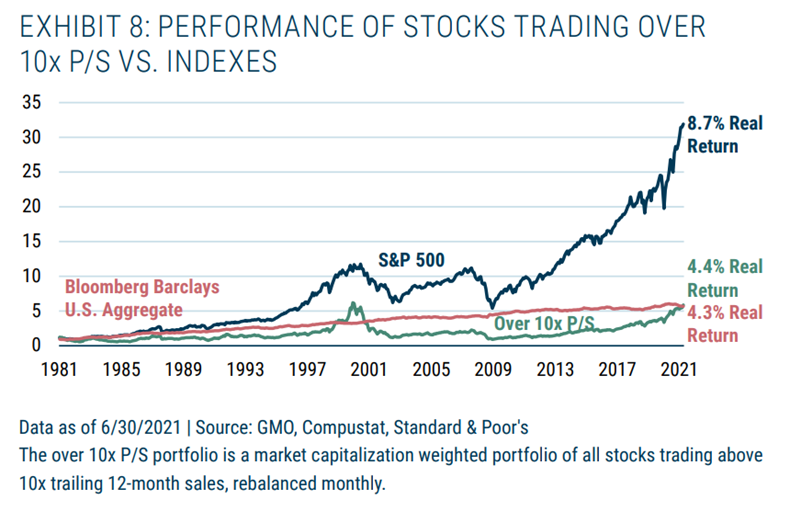

It's important to note that there are two ways for value stocks to "win" in the decade ahead - beat growth stocks or allow them to beat themselves. Nosebleed valuations across a subset of growth stocks have created an environment where any disappointment in revenue, earnings, and/or guidance can be punished swiftly by Mr. Market. Currently, the number of S&P 500 stocks trading at Price-to-Sales multiples greater than 10x is at an all-time high.

We care about this because we know from history that the average performance of stocks trading at such lofty valuations is dirt poor. Sure, there are a handful of exceptions to the rule, but most high-priced growth stocks don't end up becoming Amazon. Historically, per GMO, stocks trading above 10x P/S have basically performed like bonds on a real basis.

The phrase "value trap" gets tossed around quite frequently in the financial press, but rarely do you hear about "growth traps." In this instance, a trap in the stock market - be it growth or value - can be thought of as a company that disappointments in sales relative to forecasts and sees a drop in future sales estimates. As GMO notes below, markets get mad when value disappoints but are merciless when growth does. Anyone who has owned some of 2020's stay-at-home stocks in 2021 can attest.

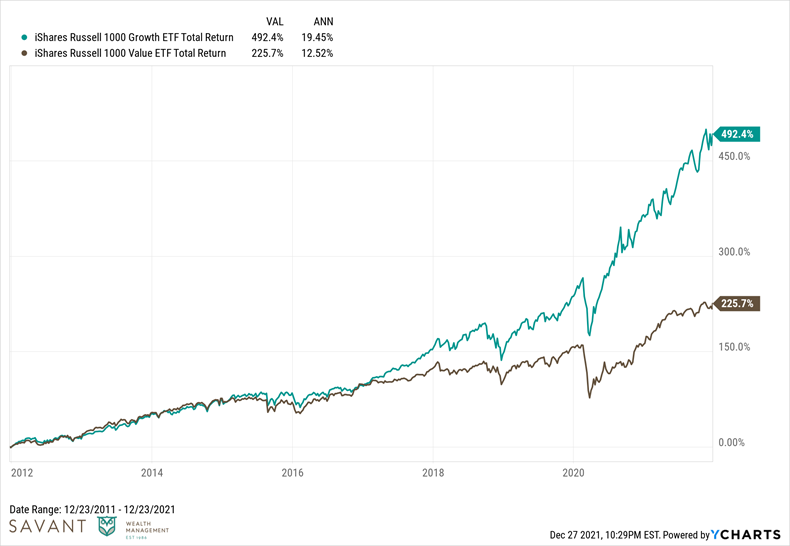

As painful as the last ten years have been on a relative basis for value, we must also frame that the absolute returns have been quite good, and pretty much in line with the long-term average. It's growth stocks that have outkicked their coverage over the prior ten years. On an annualized basis, growth stocks have earned over 19% per year going back to the end of 2011. Since 1979, the Russell 1000 Growth Index has returned an annualized 12.2%. Some mean reversion should be expected going forward.

With the current value run having taken a bit of a pause in the second half of 2021, some context is required. Meaningful short-term pullbacks are quite common during even the best periods for value. The best three-year period in value's history was from February 2000 through February 2003, but it saw some meaningful corrections along the way.

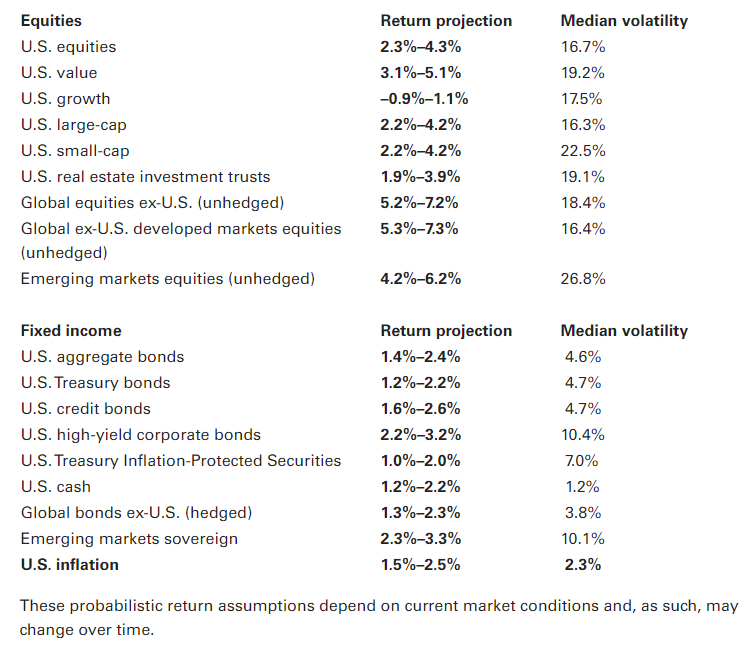

As we look towards the future, the long-term capital market assumptions of most asset managers that publish them are generally giving the nod to value over the next decade. Even Vanguard, who is not known for their bold market prognostications, is predicting a fairly large discrepancy in the expected range of returns between value (3.1%-5.1%) and growth (-0.9%-1.1%).

As we look towards the future, the long-term capital market assumptions of most asset managers that publish them are generally giving the nod to value over the next decade. Even Vanguard, who is not known for their bold market prognostications, is predicting a fairly large discrepancy in the expected range of returns between value (3.1%-5.1%) and growth (-0.9%-1.1%).

Source: Vanguard

I feel pretty good in saying that the odds are tilted in the favor of value stocks (particularly small cap value stocks) outperforming large cap growth over the next 5-10 years. Perhaps by a substantial margin.

Despite my strong conviction in value's resurgence, that doesn't equate to a portfolio that only owns value stocks. Diversification is still your buddy, and we always want to leave room in a portfolio for the unwanted answer to the question: what if I'm wrong?

There are no sure things in investing and having style diversification is one way to defend against the market's ability to humble us.

The experience of the last decade-plus has tested the faith of even the most dyed-in-the-wool value investors. And while it may sound like a broken record, if there was ever a time to "lean in" to value - that time seems to be now.

"Famous last words" you might say.

"Indeed, they are" I'd reply. "Second only to 'this time is different'."

Additional Resources:

That’s It, That’s the Blog (AQR)

Value investing: What history says about five-year periods after valuation peaks (Alpha Architect)

Value Traps vs. Growth Traps (GMO)

Dispelling Myths in the Value vs. Growth Debate (GMO)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.