What to Expect When You’re Expecting (Outperformance)

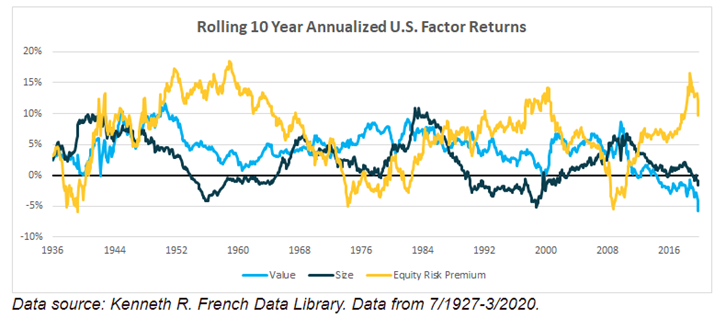

It’s easy to look at any factor return premium over a multi-decade period and get lulled into a false sense of being offered a free lunch. As value and small cap investors can attest this year – it is anything but. It has been a painful decade-plus for investors with tilts to these factors, particularly the acute experience of the last three years. If anything, this period has acted as a gut check on the risk of being different than the benchmark – even if those differences are by design. It has also served as a valuable reminder that all return premiums (even the basic equity risk premium) are earned, not handed out.

So what is an investor to do after a period like this? Abandon ship in favor of what’s “worked” recently? Or grin and bear it with confidence that this too shall pass?

My colleague and Senior Investment Research Analyst at Savant, Eamon Verdone, tackled this conundrum in a comprehensive post that is hot off the press over on our company blog:

What to Expect When You’re Expecting (Outperformance) (Savant Capital blog)

I encourage everyone to read the post in full, but if you’re looking for the punchline:

#1. No risk, no reward: These size and value factors are risk premia. If we expect long-term outperformance, it is in part explained by the underlying risk, which manifests itself in periods of underperformance.

#2. We have been here before: This is not the first time investors have proclaimed the death of the size or value premiums. The world has certainly changed and this crisis is much different than the last – no one is questioning that. But the truth is, it’s always different this time! It’s not about whether “this time is different,” but rather if it’s different enough to throw almost a century of data out the window.

#3. Opportunity’s knocking: No doubt, the recent stretch of underperformance for small and value stocks has been challenging. But the combination of attractive valuations and a history of outperformance coming out of bear markets may represent an ever-brightening light at the end of this tunnel of recent underperformance.

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.