Wow 20,000?

On Wednesday, the Dow Jones Industrial Average (“the Dow”) closed above 20,000 for the first time in history. The appropriate reaction is:

a) This is the top! Time to go to cash!

b) Maybe I should get more aggressive and bump up my allocation to stocks?

c) Bust out your Dow 20,000 gear and party like it’s 1999!

d) So what? The Dow is not my benchmark for personal financial success and does not resemble my portfolio whatsoever.

Give yourself a pat on the back if your answered D. Sensationalism of events like these has the ability to trigger our animal spirits or our worst fears if we don’t have a long-term investment plan to keep them in check.

Yesterday, almost every one of us came across some variation of the following statement via newspaper headlines, smart phone alerts or scrolling tickers on TV:

“The Dow closed above 20,000 for the first time in history!”

What you probably didn’t see was:

“On Wednesday, the Dow rose about 0.8%”

Both are accurate statements. Only one of them made for a great headline.

Milestones and large, round numbers are two things that human beings are predisposed to get really excited about. This applies to our personal lives as well as in markets. So it shouldn’t come as a surprise that when stock market indices like the Dow or the S&P 500 surpass big numbers with multiple zeros at the end that investors pause and wonder if there is something they should be doing with their portfolios in response.

There is nothing inherently wrong with celebrating milestones. A 40th birthday, a 25-year wedding anniversary, a child graduating college or 10 years with an employer are all wonderful opportunities to pause and enjoy something that is – and should be – meaningful to you. The Dow reaching 20,000, however, is hardly a cause for celebration. Let’s review a few of the reasons why this particular occasion belongs in the “interesting but not actionable” pile.

There is Much More to “the Market” Than the Dow

Let’s digress for a moment and remind ourselves what the Dow actually is. Financial television will interchangeably refer to the Dow and the S&P 500 as proxies for “the market.” They each represent different slices of large U.S. stocks. The S&P 500 is comprised of the (roughly) five hundred largest publicly traded companies in the U.S. And the Dow? Thirty subjectively chosen blue chip stocks. That’s right, thirty of the roughly 3,700 publicly traded companies in the United States.

And that’s just the domestic stock market! Roughly half of the investable universe of publicly traded stocks exists outside our borders in international stock markets. In addition to global stocks, most investors maintain exposure to other asset classes such as fixed income, real estate and other alternatives. Viewed in this context, the fluctuations of the Dow bear little resemblance to the experience and results of truly diversified portfolios.

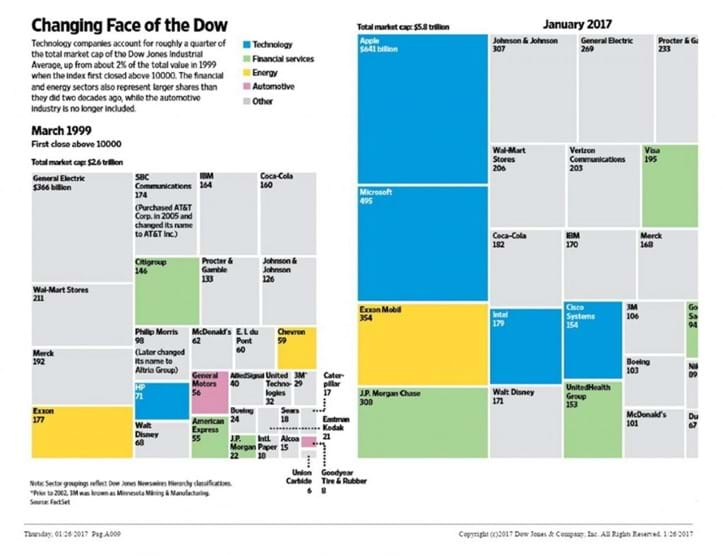

The Dow Today Looks Nothing Like the Dow of Old

The image above from The Wall Street Journal visually depicts the composition of the Dow today versus back in March 1999 when it first crossed 10,000. Many companies that were in the Dow in 1999 are no longer there and the sector representation is wildly different today than it was nearly twenty years ago.

The Dow for decades has been comprised of 30 stocks. Nevertheless, over its 120 year existence there have been 133 different companies on the list. The editors of the Wall Street Journal choose which companies are in the index and once a year, on average, add a new company to the list and drop an old one.

The Index Itself is Quite Flawed and Highly Antiquated

One of the reasons so much attention is paid to the Dow is the fact that it’s pretty much the oldest market proxy we have data on. But unlike a fine wine, the index has not gotten better with age.

From James Mackintosh at the Wall Street Journal:

The Dow was invented by a founder of this newspaper. My direct boss and his direct boss both sit on the committee that decides on the 30 companies which make up the average. And TV news has long since picked the Dow as its gauge of Wall Street activity.

But a columnist’s job isn’t to flatter. It is to present facts. And the fact is that the Dow is deeply flawed. It is not a good measure of the broad market—indeed it is not even designed to be. It is not a good guide to investing. It is not calculated in a sensible way. And it isn’t even right.

Furthermore:

The Dow is a share-price average, which was quick and easy to work out each day back when mechanical adding machines were state of the art for statistics. But share prices are arbitrary, as they depend on how many shares are issued; some companies have very high prices, which give them more influence on the Dow, even though they may be less valuable overall. Modern indexes are weighted by market value, often adjusted for the free float available, giving a better representation of the overall market or of the stocks which can be bought.

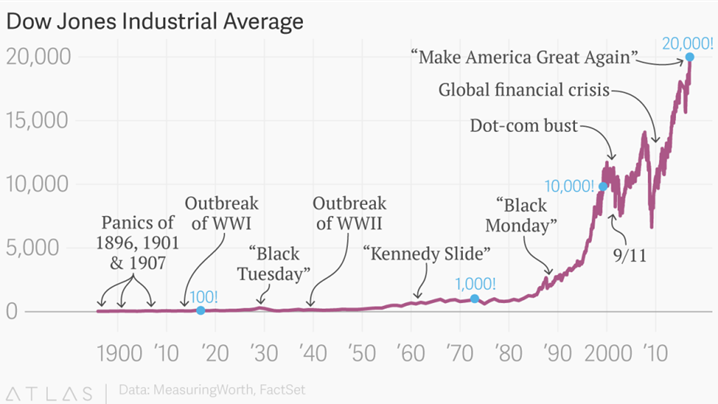

Get Used to Thousand Point Milestones and Hundred Point Daily Moves

The Dow took about twenty years to reach 100 and it wasn’t until more than a century after its inception that it reached the 10,000 mark in March of 1999. It only took another eighteen years from there to get to the 20,000 number we are at today. If you think that’s wild, only forty-two trading days elapsed since the last milestone at 19,000. While that may seem like a massive move in such a short period of time, in reality it was merely a roughly five percent gain.

As markets continue to march higher over time, it’s important to remember that 100 point daily moves and 1,000 point milestones will ultimately be non-events as they represent nothing more than noise around a much larger base.

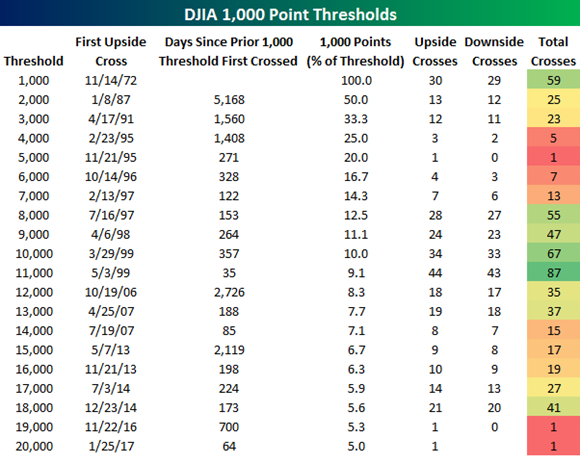

The Odds Heavily Favor Us Crossing 20,000 Several More Times

The table below from Bespoke Investment Group shows each 1,000 point milestone in the Dow’s history. You’ll notice a pretty consistent trend in the data. All but five of the thresholds were crossed at least ten times. In fact, eight of the twenty crossed over thirty times and four of them crossed over fifty times! Getting riled up each time a cross happens would likely leave most investors feeling “partied out.”

So while the media and the financial press pontificate on what might happen next, remember this:

It doesn’t matter, but it doesn’t not matter either.

As Josh Brown points out, “it is what it is.” As silly as it is to get excited over a proxy like the Dow crossing a big number, many people do and at the end of the day it’s people that drive markets. If Dow 20,000 is the spark that lights the fuse for a big rally driven by investor sentiment, then so be it. But if 2016 taught us anything, it’s that predicting future outcomes is hard and predicting human response to outcomes is multiples harder. The Dow could very well go back to 15,000 before getting to 25,000. That’s why prudent investors diversify to manage risk, periodically rebalance their portfolios, and keep their eyes focused on the long-term, which is where the only returns that matter reside.

There’s nothing wrong with feeling good when markets go up. It’s supposed to feel good! And people can and should take the opportunity to celebrate milestones. Just be sure to save the noisemakers and party favors for the ones you’ll fondly remember later in life and not the ones related to some arbitrary stock market index.

Additional Reading:

We’re Already at Dow 30000, You Just Don’t Know It (The Wall Street Journal)

This is my Dow 20,000 post (The Reformed Broker)

The Ins and Outs of the Dow Jones Industrial Average (The Wall Street Journal)

Dow 20,000 is arbitrary and pointless—just like the Dow itself (Quartz)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.