The Elements of Diversification

All ordinary matter in the universe is comprised of chemical elements. An investment portfolio is no different, with a tapestry of asset classes, factors, strategies, tools and techniques serving as the raw materials.

The science of chemistry has long struck me as wonderfully analogous to portfolio construction. So much so that a few years ago I decided to take a trip down memory lane and revisit high school chemistry class. I thought it would be cool to visualize the taxonomy of diversification by creating a different kind periodic table, one with investments as the elements. With the help of our summer intern at the time (shout-out to Lea!), I put it together, made it look all pretty and…let it sit dormant in a file folder on my computer for five years.

Fast forward to this summer as our firm began the process of documenting and codifying our investment philosophy. I thought it would be the perfect opportunity to dust of the old periodic table, make a few modifications, and include it in the piece.

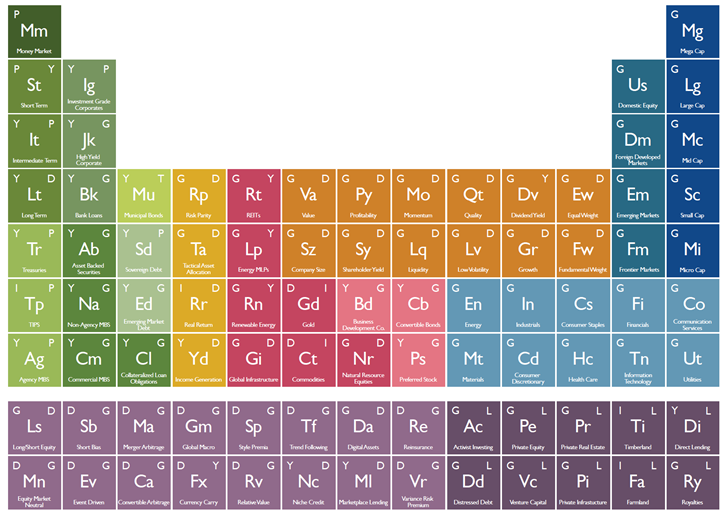

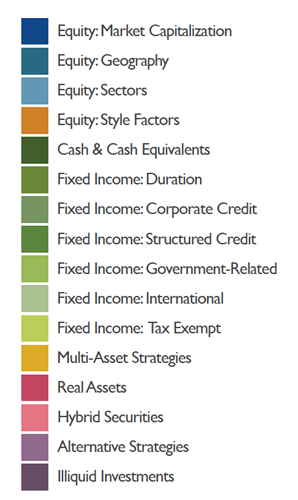

We started by bucketing each “element” into various color-coded categories.

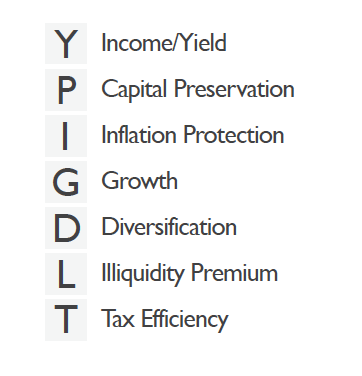

Each element was then assigned a primary objective and (in most cases) a secondary objective, using the seven options listed below:

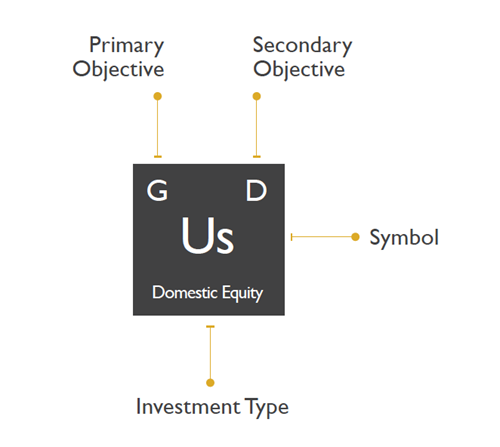

Here’s an example of how to interpret the boxes in the table:

And now, the pièce de résistance…

And now, the pièce de résistance…

(Click to enlarge)

I fully expect that there are a handful of omissions, or perhaps a few areas where one might flat-out disagree with how I’ve laid things out. This was not meant to be 100% exhaustive, nor was it meant to be indicative of what one of our portfolios looks like. What I hoped to accomplish was to:

- Demonstrate the breadth of the investable universe that exists. In an environment when many investors anchor to – and base expectations off of – U.S. stocks and bonds, it’s important to remember that the “market” extends well beyond the Dow or the S&P 500.

- Reinforce the principle that no investment is an island. The ways in which different investments influence and interact with one another matters more than the individual line items themselves. While chemical elements are essential to life on earth, it is only when they form compounds that the magic truly happens.

- Stress the importance of knowing what you own and why you own it. By assigning primary and secondary objectives to each investment, we can better understand the risk and return drivers of our portfolios. What works for one person might cause an explosion in the chemistry lab for another.

Compounds are the unique substances formed as the result of two or more chemical elements combining with each other. Compounding is the long-term result of finding an investment mix aligned with your goals, objectives and risk preferences – and sticking with it through good times and bad. (Terrible pun intended)

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.