Is Innovation Investable?

If you're a regular reader of The Paper Trail, you know by now that I am Kai Wu's #1 fanboy. Kai is the founder & Chief Investment Officer for Sparkline Capital and his papers are a staple in my monthly research compendium. He is prolific when it comes to applying novel approaches (unique data sets, machine learning) to classic investment frameworks (i.e. value investing) in areas where the old rules may no longer apply. Think intangible assets and crypto/Web3.

His latest published work is titled Investing in Innovation and it was so good I just couldn't wait until the end of the month to highlight it.

The obvious (and cosmetic) answer to the question posed in my blog post's title is yes. Today, there are dozens of funds dedicated to INNOVATION or THEMATIC INVESTING or DISRUPTION or some other sexy sounding buzzword. The fund company marketing machines know exactly what they're doing.

This stuff sells (for now at least) because there is a certain level of intuition behind it that attracts the average investor. After all, who wouldn't want to invest in innovation? As Kai notes:

"We love innovation. Technology lifted the human species from millennia of subsistence to the dominant form of life on earth. And it is the principal driver of economic growth on a long timescale."

But back to the question at hand: is innovation investable?

As Nobel prize-winning physicist Richard Feynman would note, there is a difference between knowing the name of something and knowing something. And while there are no shortages of well-marketed funds with that label in their moniker, I'll be the first to admit I would roll my eyes anytime I saw innovation touted as an asset class.

Like many others, my natural assumption was that innovation, disruption - whatever you want to call it - was just slapping lipstick on expensive, junky, non-profitable growth stocks. For evidence-based investors, that type of investing is anathema to the tried-and-true factors of owning cheap, profitable companies for the long-term. It's a movie we all knew would end badly, and the credits indeed seem to now be rolling.

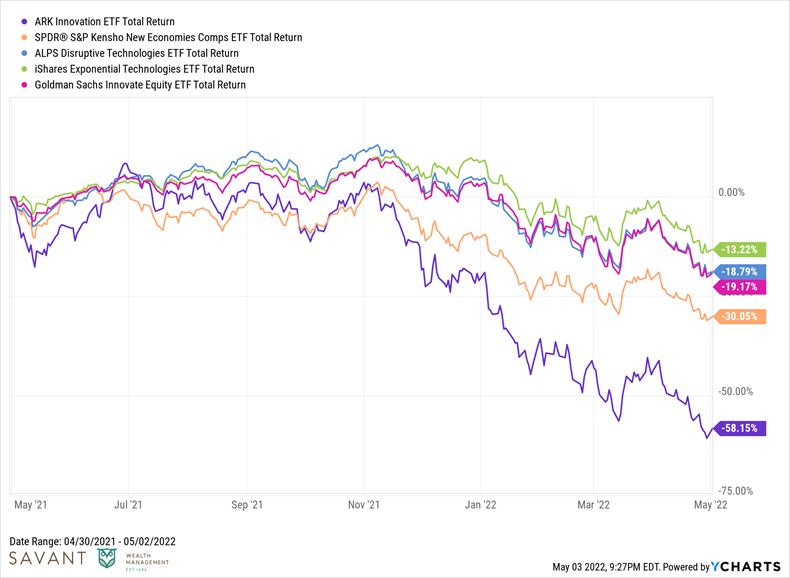

The last twelve months have not been kind to innovation-focused ETFs.

The posterchild of this group - ARKK - has had a particularly rough go of it as of late. The ETF is up a mere 11.89% over the last three years, significantly trailing the S&P 500 and the [insert obligatory "tech-heavy"] Nasdaq. The amazing part is that over this same stretch, ARKK was at one point up nearly 250%. A spectacular elevator ride up and equally spectacular ride down.

So, is my own perception of innovation investing correct in that it is merely a proxy for expensive, junky growth? According to Kai, it's not so cut and dry... (hey, that rhymes!)

As polarizing as this topic is, Kai points out that "not a single rigorous empirical study exists on the long-term performance of innovation investing." One reason being the simple fact that it is a very abstract concept that is incredibly challenging to define and measure. Enter the U.S. Patent and Trademark Office (USPTO).

U.S. patent data goes back to the 1800's and the structure of the patents themselves is highly standardized which lends itself well to Natural Language Processing (NLP). I won't get too into the weeds here - I know about as much (or as little) as the next guy about machine learning - but essentially Kai was able to classify related patents into various technology clusters and use that as a reliable proxy to run a back-tested simulation.

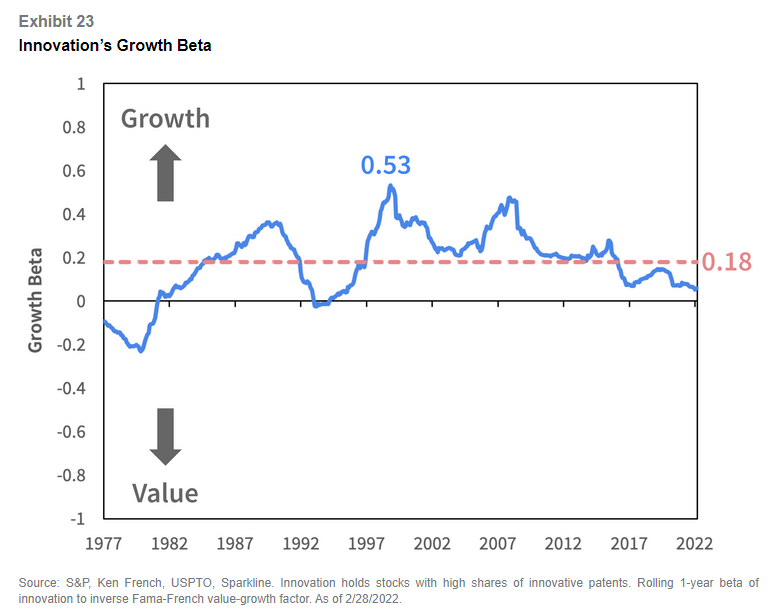

His findings were quite interesting. First, the innovation factor (as Kai defines it) had a much lower beta to growth than I would have expected.

Kai notes:

"Innovation and growth are distinct concepts. Value and growth are merely synonyms for cheap and expensive. Innovation, like any other group of stocks, can be cheap or expensive depending on the fashion of the day. While the market tends to assign higher multiples to innovative firms on average, the correlation is weak and unstable."

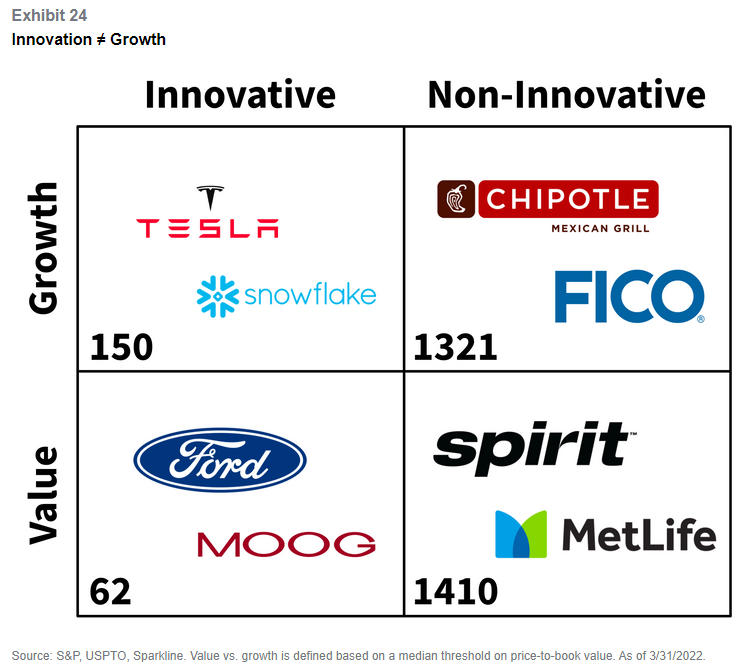

The image below breaks down that point even further - dividing the 2x2 matrix into value/growth on the y-axis and innovative/non-innovative on the x-axis. The numbers on the bottom left of each quadrant represent the total number of stocks in each. A couple of things stick out. First, there are A LOT of non-innovative growth companies. Second, there are surprisingly a decent number of innovative traditional value companies.

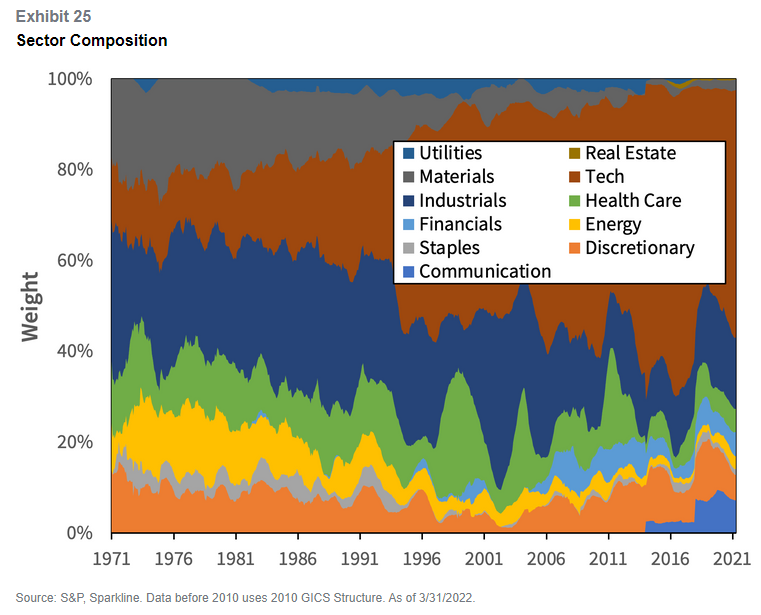

Also worth noting is that innovation is more than just a tech story. Sure, the sector exposure to tech below has drifted higher over time, but so has that of the overall market.

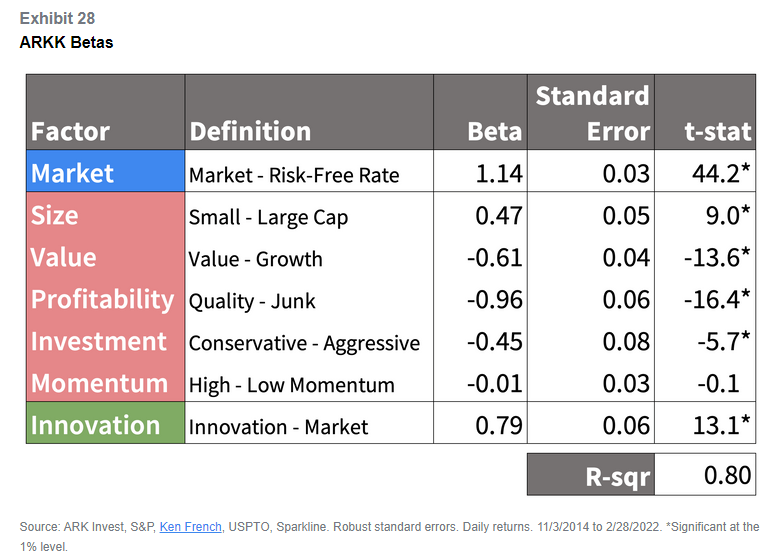

Kai also found that his innovation factor was not subsumed by the classic Fama-French factors. That said, he stressed the importance of neutralizing negative exposure to factors that are likely to be rewarded over time, i.e., value and profitability. Using ARKK as an example, Kai highlighted that ETF's massive negative loadings to those two factors. Those are big bets to be making, and bets that are unlikely to be rewarded over time.

After reading this paper, I am certainly more openminded to the idea that innovation can be investable. But being investable doesn't have to necessitate going all-in. Diversification is still your buddy. Even if innovation (done right and reasonably priced) can be an additional arrow in an investor's quiver, we should think of it as just that: one arrow of many.

One more quote from Kai:

"The analysis in this paper supports the idea of allocating some capital to “innovation as an asset class.” But investors should not stop there. We believe that investors can do even better in a strategy that finds value not just in innovation but also in the other intangible pillars – brand, human capital, and network effects."

I'll pause there and direct you to the full piece for your reading pleasure. I promise you won't regret it!

Full Paper Here:

Get on the List!

Sign up to receive the latest insights from Phil Huber directly to your inbox.